AI GRC: AI in Governance, Risk, and Compliance

AI in GRC (Governance, Risk, and Compliance) offers a powerful solution, streamlining processes and enhancing resilience. Risk Cognizance, a user-friendly and easy-to-use AI automated compliance solution, empowers organizations to navigate this landscape effectively. This blog explores the transformative potential of AI in GRC, delving into use cases, team structures, and the benefits of integrated GRC platforms.

Why Businesses Need a Governance, Risk, and Compliance Software

Imagine trying to manage a vast network of regulations and internal policies manually. The sheer volume of data and the complexity of compliance requirements can overwhelm even the most diligent teams. This is where a robust GRC software like Risk Cognizance becomes invaluable. By automating key processes, Risk Cognizance minimizes human error, reduces manual workload, and ensures consistent adherence to regulatory standards.

GRC Software Solutions Build For Security Team

What Is the Difference Between Having a Governance, Risk, and Compliance Tool and Doing the Task Manually?

Manual GRC processes are time-consuming and prone to inaccuracies. They often rely on spreadsheets and disparate systems, making it difficult to gain a holistic view of risks and compliance status. In contrast, Risk Cognizance provides a centralized platform for managing all aspects of GRC. This allows for real-time monitoring, automated reporting, and proactive risk mitigation. Risk Cognizance, a user-friendly and easy-to-use AI automated compliance solution, allows for better transparency.

How Does an Integrated Governance, Risk, and Compliance Help the CISO and the Security Team?

For CISOs and security teams, integrated GRC platforms like Risk Cognizance are essential. They provide a comprehensive view of security risks, compliance gaps, and potential vulnerabilities. This enables them to prioritize resources, implement effective security controls, and demonstrate compliance to auditors. Risk Cognizance facilitates seamless integration with existing security systems, enhancing overall security posture.

What Type of Business Benefits More From a Governance, Risk, and Compliance Platform?

Businesses in highly regulated industries, such as finance, healthcare, and technology, benefit significantly from GRC platforms. However, any organization that handles sensitive data or operates in a complex regulatory environment can gain from implementing a GRC solution. Risk Cognizance is designed to be scalable and adaptable, catering to the needs of organizations of all sizes.

The Potential AI Use Cases in Governance, Risk, and Compliance

AI offers a wealth of opportunities to enhance GRC functions within organizations. Some key use cases include:

Risk Identification and Assessment

AI-powered systems can analyze vast amounts of data to identify emerging risks and trends, providing real-time risk intelligence to inform strategic decision-making. Risk Cognizance utilizes AI to continuously monitor internal and external data sources, detecting potential risks before they escalate.

Compliance Monitoring and Reporting

AI can automate the monitoring of regulatory changes, policies, and procedures, flagging potential breaches and generating compliance reports with greater speed and accuracy. Risk Cognizance simplifies compliance management by automating reporting and providing real-time insights into compliance status.

Fraud Detection and Prevention

AI models can detect anomalies and patterns indicative of fraudulent activity, enabling organizations to proactively mitigate financial and reputational risks. Risk Cognizance employs advanced AI algorithms to identify and prevent fraudulent activities, safeguarding your organization's assets.

Audit Automation

AI can be leveraged to automate certain audit tasks, such as sampling, testing, and documentation, freeing up human auditors to focus on more complex, value-added activities. Risk Cognizance automates audit processes, reducing the time and resources required for compliance audits.

Predictive Analytics

By harnessing AI’s predictive capabilities, organizations can forecast potential scenarios, stress-test strategies, and make more informed, data-driven decisions. Risk Cognizance provides predictive analytics to help organizations anticipate future risks and make proactive decisions.

The New Frontier for AI in GRC: The Good, the Bad

AI in GRC offers significant benefits, but it also presents challenges. The "good" includes increased efficiency, accuracy, and proactive risk management. The "bad" involves potential biases in AI algorithms and the need for robust data governance. Risk Cognizance addresses these challenges by implementing ethical AI practices and ensuring data privacy.

Elements of an Effective AI GRC Team: Key Roles and Best Practices

An Artificial Intelligence (AI) Governance, Risk, Compliance (GRC) team ensures AI governance, risk management, and compliance are seamlessly integrated into daily operations. This article explores the roles within an AI GRC team and the best practices they follow for effective risk management.

Key Takeaways

An AI GRC team integrates AI governance, AI risk management, and AI compliance into daily operations to align with strategic objectives and ensure regulatory adherence.

Key Roles in an AI GRC Team

- Chief AI Risk Officer: Oversees AI risk management strategies.

- Data Protection Officer: Ensures data privacy and compliance.

- AI Project Manager: Manages AI projects and ensures alignment with GRC requirements.

- AI Governance Committee: Provides oversight and guidance on AI governance.

Building an Effective AI GRC Team

Building an effective AI GRC team requires clearly defined roles, securing executive support, and ensuring continuous training to adapt to evolving regulations and maintain compliance.

Understanding an AI GRC Team

An AI GRC team acts as the internal authority on AI governance, AI risk management, and AI compliance programs, ensuring they run smoothly and effectively. The main aim is to weave AI governance, AI risk, and AI compliance policies into daily operations, managing AI risks efficiently. This integration offers a holistic view of AI risks, streamlines decision-making, and aligns operations with strategic AI objectives, with our AI GRC system, and AI GRC tools.

Support Frameworks

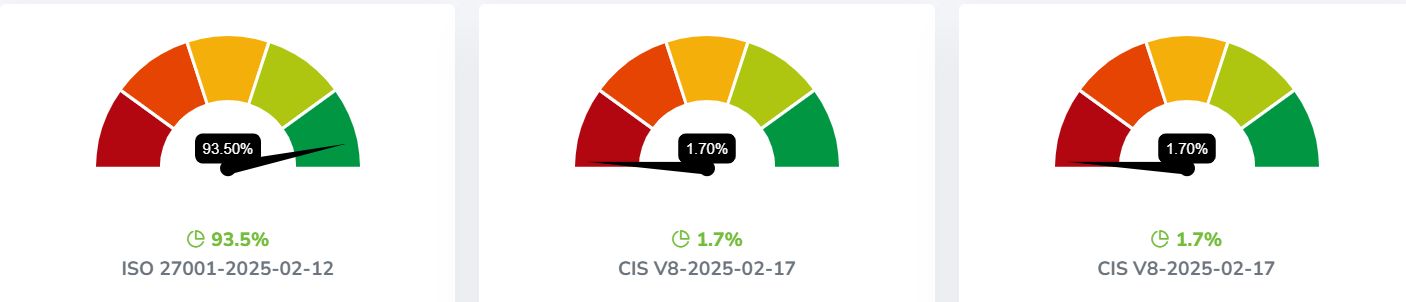

Risk Cognizance supports various industry-standard frameworks, including ISO 27001, NIST, GDPR, and HIPAA.

Customizable Compliance Frameworks

Whether your business needs to comply with CMMC, ISO, NIST, SOC 2, HIPAA, GDPR, or other regulations, Risk Cognizance’s GRC Tools for Small Medium Sized Businesses and Startups provide tailored compliance solutions that grow with your business.

Use Cases

- Financial institutions using Risk Cognizance to automate anti-money laundering (AML) compliance.

- Healthcare providers leveraging Risk Cognizance to ensure HIPAA compliance and protect patient data.

- Manufacturing companies using Risk Cognizance to manage supply chain risks and ensure regulatory compliance.

Case Studies

- A global financial institution reduced compliance costs by 30% using Risk Cognizance's automated reporting and risk assessment capabilities.

- A healthcare provider improved patient data security and reduced compliance audit time by 50% with Risk Cognizance's integrated compliance management features.

How Can Your Organization Benefit From Risk Cognizance 6 in One Solution?

Risk Cognizance offers a comprehensive 6-in-1 solution, including:

- Automated risk assessments.

- Real-time compliance monitoring.

- Automated reporting and audit trails.

- Fraud detection and prevention.

- Predictive risk analytics.

- Integrated policy management.

Embrace the future of GRC with Risk Cognizance, a user-friendly and easy-to-use AI automated compliance solution, and transform your organization's approach to risk and compliance.