Resilience Cyber Insurance Solutions

Cyber threats are evolving at an unprecedented rate, placing businesses of all sizes at risk of financial and reputational damage. Risk Cognizance provides an AI-driven, user-friendly compliance solution that simplifies cyber risk management while ensuring businesses maintain resilience against threats. Through automated governance, risk, and compliance (GRC) processes, organizations can proactively manage risks, streamline compliance efforts, and optimize cyber insurance policies.

The Growing Importance of Cyber Insurance

Organizations with cyber insurance are better positioned to detect, respond, and recover from cyberattacks. A Forrester report highlights that businesses leveraging cyber insurance and comprehensive attack surface management, like Risk Cognizance, experience reduced risk exposure and improved security posture.

Identity Compromises Driving Policy Changes

Insurance providers are adapting their policies due to the rise in identity-related breaches. Research shows that 47% of cyber insurance claims stem from identity and privilege compromises. Insurers now emphasize robust identity and access management strategies, making compliance frameworks and automated solutions essential for businesses seeking coverage at competitive rates.

How to Effectively Manage Cyber Risk to Reduce Cyber Liability Insurance Costs

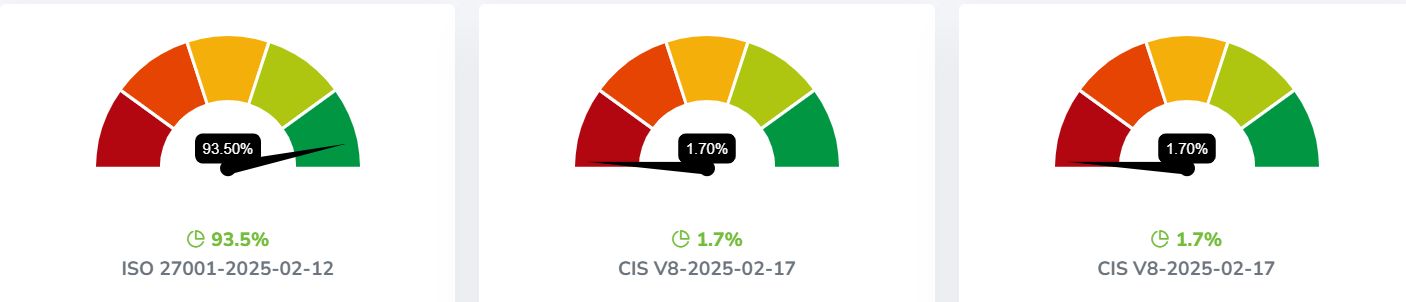

As cyber threats escalate, businesses must adopt proactive security measures to secure cyber insurance policies at optimal rates. Risk Cognizance integrates key frameworks, including NIST, CIS, ISO 27001, and GDPR compliance, to ensure organizations meet insurer requirements while strengthening security posture.

GRC Software Solutions Build For Security Team

Key Strategies to Reduce Cyber Insurance Costs

- Strong Cybersecurity Framework Implementation: Adopting and adhering to recognized cybersecurity frameworks such as NIST, ISO 27001, or CIS Controls demonstrates a commitment to comprehensive security practices.

- Advanced Threat Detection and Response Capabilities: Implementing SIEM (Security Information and Event Management), EDR (Endpoint Detection and Response), SOAR (Security Orchestration, Automation, and Response) systems, and ransomware protection software enhances threat identification and mitigation.

- Regular Vulnerability Assessments and Penetration Testing: Conducting ongoing vulnerability scans and periodic penetration tests to uncover and remediate security weaknesses before exploitation.

- Effective Incident Response Plan: Maintaining a well-documented and regularly tested incident response plan reduces damage and recovery time in the event of cyber incidents.

- Employee Training and Awareness Programs: Educating employees on phishing, social engineering, and cyber threats significantly reduces the likelihood of successful attacks.

- Data Encryption and Protection Measures: Utilizing strong encryption for data at rest and in transit, coupled with robust access controls, protects sensitive information from unauthorized access.

- Multi-Factor Authentication (MFA): Enforcing MFA for accessing critical systems and data adds an extra layer of security, preventing unauthorized access.

- Regular Software and System Updates: Keeping all systems, applications, and infrastructure up to date with security patches protects against known vulnerabilities.

- Zero Trust Architecture Implementation: Ensuring continuous verification of every access request strengthens the overall security posture.

- Compliance with Industry Standards and Regulations: Demonstrating compliance with GDPR, HIPAA, PCI DSS, and other relevant regulations reinforces organizational security and privacy standards.

- Business Continuity and Disaster Recovery Plans: Establishing effective business continuity and disaster recovery strategies ensures rapid recovery from cyberattacks and reduces financial impact.

- Cybersecurity Insurance History: Maintaining a history of few or no claims signals lower risk to insurers, potentially leading to reduced premiums.

- Third-Party Vendor Risk Management: Implementing stringent security measures and conducting regular audits for third-party vendors ensures adherence to high cybersecurity standards.

By addressing these key security factors, organizations can enhance their overall cybersecurity posture and potentially lower cybersecurity insurance premiums by demonstrating a reduced risk profile to insurers.

Customizable Compliance Frameworks

Whether your business needs to comply with CMMC, ISO, NIST, SOC 2, HIPAA, GDPR, or other regulations, Risk Cognizance’s GRC Tools for Small Medium Sized Businesses and Startups provide tailored compliance solutions that grow with your business.

Reducing Cybersecurity Insurance Costs as a Call for Funding

Investing in cybersecurity fortifies an organization’s defense against cyber threats while presenting a compelling case for increased organizational funding. Organizations can significantly lower their cybersecurity premiums by meeting or exceeding insurer requirements through robust security measures—such as implementing advanced threat detection systems, conducting regular security assessments, and adhering to industry compliance standards. This reduction in insurance costs can offset the initial cybersecurity investment, showcasing a clear return on investment (cybersecurity ROI).

Additionally, a strong cybersecurity posture minimizes the risk of costly data breaches and operational disruptions, reinforcing the strategic value of cybersecurity funding. Strategic investments in cybersecurity not only safeguard an organization’s digital assets but also optimize financial expenditures related to risk management, making a strong case for allocating further annual budget toward cybersecurity initiatives.

The Role of Cybersecurity Insurance

From small businesses recovering from ransomware attacks to large corporations navigating data breaches, cyber insurance plays a pivotal role in helping organizations bounce back.

In today’s business environment, cyber insurance is an essential risk management tool for CISOs. By understanding cyber insurance fundamentals, evaluating organizational needs, and integrating coverage into a comprehensive cybersecurity strategy, CISOs can enhance their organization’s resilience against cyber threats while reducing insurance costs.

Use Cases for AI-Powered Cyber Risk and Compliance Management

- Financial Institutions: Banks and insurance companies require robust security measures to safeguard sensitive customer data and prevent fraud. Risk Cognizance automates compliance audits and real-time risk assessments, reducing financial liabilities.

- Healthcare Sector: Ensuring HIPAA compliance and protecting patient data are critical challenges. With AI-driven compliance tracking, healthcare organizations minimize the risk of breaches while meeting regulatory requirements.

- Retail and E-Commerce: Online businesses are prime targets for cyberattacks. Risk Cognizance provides proactive monitoring of supply chain vulnerabilities, protecting customer information from exposure.

Case Studies

Case Study 1: Financial Institution Strengthens Security Posture

A multinational bank faced challenges in meeting evolving regulatory standards and securing an affordable cyber insurance policy. By implementing Risk Cognizance, the institution automated compliance workflows, improved identity security, and successfully reduced its insurance premium by 30%.

Case Study 2: Healthcare Provider Achieves Compliance Efficiency

A healthcare network struggled with manual compliance tracking, leading to increased regulatory scrutiny. After adopting Risk Cognizance, the organization automated compliance assessments, reduced audit preparation time by 70%, and strengthened its overall security resilience.

Why Businesses Need Governance, Risk, and Compliance Software

Managing cyber risks manually is inefficient and error-prone. A dedicated GRC solution like Risk Cognizance automates risk assessments, policy management, and compliance tracking, ensuring businesses stay ahead of evolving threats.

How Your Organization Can Benefit from Risk Cognizance's 6-in-1 Solution

Risk Cognizance offers a fully integrated AI-powered platform covering:

- Risk Management – Automated risk identification and mitigation

- Compliance Tracking – Continuous monitoring of regulatory changes

- Incident Response – AI-driven threat detection and response

- Audit Management – Streamlined reporting and policy management

- Vendor Risk Management – Monitoring third-party vulnerabilities

- Security Posture Assessment – Real-time insights into organizational risks

By implementing Risk Cognizance, businesses can enhance their security resilience, secure cost-effective cyber insurance, and achieve long-term regulatory compliance with ease.