GRC Compliance Software Solutions

Streamlining Compliance with AI

Governance, risk, and compliance (GRC) requirements is no longer a simple task. Businesses require robust strategies and tools to effectively manage risk, maintain compliance, and ensure strong governance. This is where Managed Service Providers (MSPs) and Virtual Chief Information Security Officers (vCISOs) play a crucial role, offering expert guidance and solutions. Furthermore, the integration of Artificial Intelligence (AI) into GRC platforms is revolutionizing how businesses approach compliance, offering unprecedented levels of automation and efficiency. This article explores the transformative role of AI in compliance management, outlines effective compliance strategies, and highlights the benefits of leveraging an AI-driven GRC platform as Risk Cognizance to achieve robust and streamlined compliance.

Traditional Compliance Challenges: A Manual Maze

Historically, compliance management has been a labor-intensive and often fragmented process. Relying on manual methods and spreadsheets leads to several critical challenges:

- Inconsistent Processes and Human Error: Manual processes are inherently prone to errors. Inconsistent application of policies and procedures across departments can create compliance gaps and increase the risk of violations. Human error is inevitable, leading to inaccuracies in data entry, reporting, and risk assessments.

- Keeping Up with Regulatory Changes: The regulatory landscape is constantly evolving, with new laws and standards emerging frequently. Manually tracking and interpreting these changes, and then updating policies and procedures accordingly, is a significant challenge.

- Data Silos and Inaccessibility of Information: Compliance data is often scattered across different departments and systems, making it difficult to gain a holistic view of an organization's compliance posture. Information silos hinder efficient communication, collaboration, and reporting.

- Time-Consuming and Resource-Intensive Audits: Preparing for audits manually is a stressful and time-consuming scramble. Gathering documentation from disparate sources, compiling reports, and ensuring all controls are in place can divert significant resources away from core business activities.

- Lack of Awareness and Training: Ensuring all employees are aware of and understand their compliance responsibilities is challenging with manual training methods. Inadequate training can lead to employees unknowingly violating policies and increasing compliance risks.

- Vendor Non-Compliance: Managing third-party vendor compliance manually is complex. Ensuring vendors adhere to the same security and compliance standards as the organization requires robust processes and continuous monitoring.

- Inadequate Risk Management Frameworks: Siloed risk management efforts across departments can lead to blind spots and missed risks. Inconsistent risk assessment methodologies can hinder effective risk prioritization and mitigation.

These traditional challenges highlight the need for a more efficient, accurate, and proactive approach to compliance management, especially for organizations seeking to optimize their MSP and vCISO service delivery.

GRC Software Solutions Build For Security Team

AI-Powered Automation: Transforming Compliance Management

Artificial intelligence is revolutionizing GRC, offering powerful solutions to overcome traditional compliance hurdles. AI-powered automation brings numerous benefits to compliance management, making it faster, more efficient, and significantly reducing manual workloads.

Key benefits of AI in compliance management include:

- Enhanced Efficiency and Speed: AI algorithms can process vast amounts of data at speeds impossible for manual processes. Automation of tasks as data collection, analysis, and reporting significantly accelerates compliance workflows.

- Improved Accuracy and Reduced Errors: AI minimizes human error in data analysis and reporting. Automated systems ensure consistent application of compliance rules and policies, leading to more accurate and reliable compliance outcomes.

- Proactive Risk Management and Prediction: Machine learning algorithms can analyze historical data to identify patterns and predict potential compliance risks. AI-powered predictive analytics enable organizations to proactively mitigate risks before they escalate.

- Streamlined Compliance Monitoring and Reporting: AI facilitates continuous monitoring of compliance controls and regulatory changes. Automated reporting tools generate comprehensive audit reports in minutes, significantly reducing the burden of manual reporting.

- Cost Optimization: Automation reduces operational costs associated with manual compliance tasks. By minimizing the risk of non-compliance and related penalties, AI-powered GRC platforms contribute to significant cost savings.

By leveraging AI, organizations can transform their compliance function from a reactive, resource-draining necessity to a proactive, efficient, and strategic business advantage. MSPs and vCISOs can utilize these AI-powered platforms to deliver enhanced GRC services to their clients, providing greater value and security.

Key Compliance Management Fundamentals

Effective compliance management rests on several fundamental pillars. These fundamentals, when implemented strategically and often enhanced by AI-driven tools, form the bedrock of a robust GRC program:

- Policy Enforcement:

- Clear and Accessible Policies: Well-defined, easily understandable, and readily accessible policies are crucial. Policies should translate complex regulations into actionable steps for employees.

- Regular Review and Updates: Policies must be living documents, regularly reviewed and updated to reflect changes in regulations, industry best practices, and organizational operations.

- Policy Communication and Acknowledgement Tracking: Effective communication of policies and procedures is essential. Tracking employee acknowledgement ensures that policies are not just accessible but also understood and accepted.

- Risk Assessment:

- Identify Relevant Laws and Regulations: The first step is to thoroughly understand the regulatory landscape applicable to the organization's industry and operations.

- Conduct Risk Analysis and Vulnerability Identification: A comprehensive risk analysis identifies potential vulnerabilities and threats to compliance. This involves gathering input from various departments to ensure a holistic view of risks.

- Risk Prioritization and Mitigation: Risks should be analyzed based on likelihood and impact. Prioritizing risks allows organizations to focus resources on the most critical areas and develop targeted mitigation strategies.

- Regulatory Reporting:

- Accurate and Timely Reporting: Compliance reports must be accurate, reliable, and delivered on time to relevant stakeholders, including regulators and internal management.

- Centralized Data and Audit Trails: Maintaining a centralized repository of compliance data with clear audit trails is crucial for demonstrating compliance and facilitating audits.

- Automated Report Generation: Automating report generation streamlines the reporting process, reduces manual effort, and ensures consistency and accuracy in compliance reporting.

These fundamental elements are essential for any organization aiming for robust compliance. MSPs and vCISOs can guide businesses in establishing and strengthening these fundamentals, often leveraging AI-powered GRC platforms to enhance their effectiveness.

Navigating the Compliance Framework Landscape

Organizations must adhere to various compliance frameworks depending on their industry, location, and the type of data they handle. Here are some key compliance frameworks that businesses frequently encounter:

- NIST Cybersecurity Framework: Developed by the National Institute of Standards and Technology (NIST), this framework provides a voluntary set of guidelines for organizations to manage and reduce cybersecurity risks. It outlines best practices across five key areas: Identify, Protect, Detect, Respond, and Recover. NIST compliance is particularly relevant for federal government agencies, contractors, and subcontractors.

- ISO 27001: This is an internationally recognized standard for information security management systems (ISMS). ISO 27001 provides a framework for establishing, implementing, maintaining, and continually improving an ISMS. Compliance with ISO 27001 demonstrates an organization's commitment to information security best practices.

- HIPAA (Health Insurance Portability and Accountability Act): HIPAA is a US law designed to protect the privacy and security of protected health information (PHI). HIPAA compliance is mandatory for healthcare providers, health plans, and healthcare clearinghouses. It includes rules for privacy, security, and breach notification.

- SOC 2 (System and Organization Controls 2): SOC 2 is a compliance standard developed by the American Institute of Certified Public Accountants (AICPA). It specifies how organizations should manage customer data to ensure security, availability, processing integrity, confidentiality, and privacy. SOC 2 is widely adopted by SaaS companies and service organizations, especially those with US-based customers.

- PCI DSS (Payment Card Industry Data Security Standard): PCI DSS is a set of security standards designed to protect cardholder data. Compliance is mandatory for organizations that handle credit card information, including merchants and payment processors. PCI DSS aims to prevent credit card fraud and data breaches.

- CIS Controls (Center for Internet Security Controls): CIS Controls provide a prioritized set of 18 critical security actions that organizations can implement to improve their cybersecurity posture. These controls are developed and supported by IT experts from various sectors and are designed to prevent the most common cyberattacks.

MSPs and vCISOs are instrumental in helping organizations understand, implement, and maintain compliance with these and other relevant frameworks. AI-powered GRC platforms further simplify this process by providing automated framework mapping, control implementation guidance, and compliance monitoring.

Risk Cognizance: An AI-Driven GRC Platform for Proactive Compliance

Risk Cognizance is an AI-powered GRC platform designed to streamline and strengthen cybersecurity and compliance efforts for businesses of all sizes, including MSPs and vCISOs offering GRC as a Service (GRCaaS). This comprehensive platform integrates six essential tools to provide an all-in-one solution for IT and security compliance management.

Key Built-in Capabilities of Risk Cognizance:

- AI-Driven Analytics and Risk Insights: Risk Cognizance leverages AI to analyze vast datasets, identify patterns, and provide predictive insights into potential risks. AI-driven analytics enhance risk assessments, enabling proactive risk management and informed decision-making.

- Automated Workflows: The platform automates repetitive and time-consuming compliance tasks, as policy updates, risk assessments, control evaluations, and evidence collection. Automated workflows streamline processes, reduce human error, and accelerate compliance efforts.

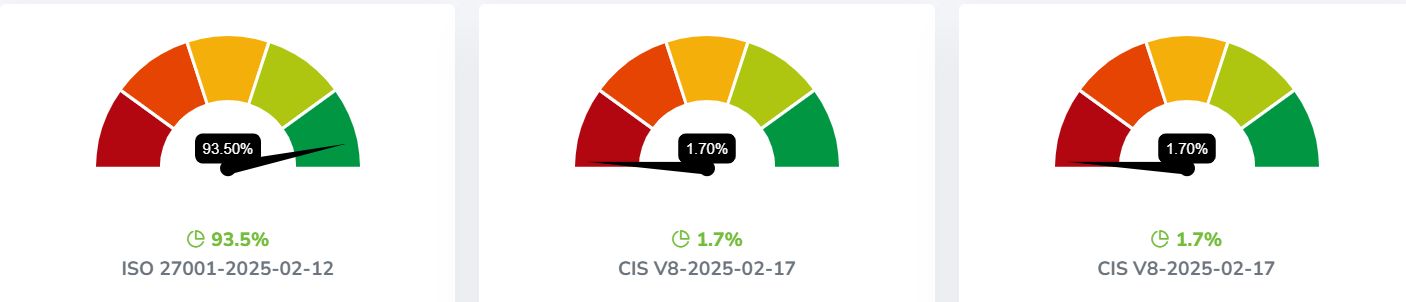

- Centralized Reporting and Dashboards: Risk Cognizance provides centralized dashboards and reporting tools that offer a real-time, comprehensive view of an organization's GRC posture. Customizable visualizations clearly communicate data insights to stakeholders, enhancing transparency and facilitating data-driven decision-making.

- Multi-Framework Compatibility: Risk Cognizance supports a wide range of industry-standard frameworks, including SOC 2, PCI DSS, NIST, CMMC, ISO 27001, HIPAA, GDPR, and more. This multi-framework compatibility provides flexibility and ensures alignment with diverse client compliance needs for MSPs and vCISOs.

- Vendor Risk Management: The platform includes robust tools for managing third-party vendor risks. It proactively identifies vendor non-compliance and helps organizations confidently manage vendor relationships based on criticality.

- Attack Surface Management: Risk Cognizance offers attack surface management capabilities to monitor and manage digital vulnerabilities, helping organizations proactively protect client environments.

These features make Risk Cognizance a powerful tool for MSPs and vCISOs to deliver exceptional GRC services, simplifying complex compliance management and providing clients with robust cybersecurity protection.

Real-World Use Cases Across Industries

AI-powered GRC platforms as Risk Cognizance are applicable across various industries, addressing specific compliance challenges and improving operational efficiency.

- Finance: In the finance industry, AI is crucial for fraud detection and prevention, real-time transaction monitoring, and risk assessment. AI-powered GRC platforms help financial institutions comply with regulations as PCI DSS and SOC 2, improve credit scoring accuracy, and enhance customer service through AI-driven chatbots.

- Healthcare: Healthcare organizations heavily rely on AI for HIPAA compliance, ensuring patient data privacy and security. AI assists in automating security controls, managing access to electronic health records (EHRs), and proactively preventing data breaches. AI-driven analytics can also streamline audits and improve overall operational efficiency in healthcare compliance.

- Enterprise IT: For enterprise IT, AI-powered GRC platforms streamline compliance with frameworks as NIST Cybersecurity Framework, ISO 27001, and CIS Controls. AI automates vulnerability management, security monitoring, and incident response, enhancing overall cybersecurity posture and reducing IT risks. MSPs and vCISOs can leverage these platforms to provide comprehensive cybersecurity and compliance services to enterprise IT clients.

Case Studies: Improved Compliance Efficiency with Risk Cognizance

While specific case studies for Risk Cognizance were not found in the provided search results, the general benefits of AI-powered GRC platforms and the features of Risk Cognizance suggest significant improvements in compliance efficiency. Here are two hypothetical case studies based on common challenges and AI-driven GRC solutions:

Case Study 1: Streamlining SOC 2 Audit for a SaaS Company

A rapidly growing SaaS company struggled with the manual processes required for SOC 2 compliance. Preparing for annual audits was time-consuming, requiring extensive manual data collection and report compilation. By implementing Risk Cognizance, the company automated its SOC 2 compliance efforts. The platform streamlined control implementation, automated evidence collection, and generated audit-ready reports. As a result, the company reduced audit preparation time by 50%, significantly lowered audit costs, and achieved continuous SOC 2 compliance monitoring, enhancing trust with their clients.

Case Study 2: Enhancing HIPAA Compliance and Data Security for a Healthcare Provider

A healthcare provider faced challenges in maintaining HIPAA compliance across its expanding network of clinics. Manual risk assessments and policy enforcement were proving inefficient and prone to errors, increasing the risk of HIPAA violations and data breaches. By adopting Risk Cognizance, the healthcare provider automated HIPAA risk assessments, policy management, and security control monitoring. The platform's AI-driven analytics helped identify potential vulnerabilities and proactively mitigate risks. The healthcare provider improved its HIPAA compliance score, strengthened patient data security, and reduced the administrative burden on its compliance team.

These case studies illustrate the potential of AI-powered GRC platforms as Risk Cognizance to significantly improve compliance efficiency, reduce costs, and enhance security across various industries. MSPs and vCISOs can leverage these benefits to offer compelling GRC services to their clients.

The Crucial Role of Automated Compliance Management in the Modern Business Landscape

Automated compliance management is no longer a luxury but a necessity for modern businesses. In an environment characterized by rapidly evolving regulations, increasing cyber threats, and complex data landscapes, manual compliance processes are simply unsustainable.

Automated compliance management is crucial because it:

- Reduces Compliance Risks: Continuous monitoring and proactive risk management minimize the likelihood of non-compliance and associated penalties.

- Enhances Operational Efficiency: Automation streamlines compliance workflows, freeing up valuable resources and allowing organizations to focus on strategic business initiatives.

- Improves Audit Readiness: Centralized data, automated reporting, and continuous monitoring ensure organizations are always audit-ready, reducing the stress and cost associated with audits.

- Enables Scalability and Growth: Automated GRC platforms allow businesses to scale their operations without compromising compliance. As organizations grow and regulations evolve, AI-powered solutions adapt and ensure continuous compliance.

- Facilitates Data-Driven Decision Making: AI-driven analytics provide valuable insights into risk landscapes and compliance posture, enabling informed, data-backed decisions.

The future of GRC is undoubtedly intertwined with AI. Organizations that embrace AI-powered automation will be better positioned to navigate the complexities of compliance, mitigate risks effectively, and achieve sustainable growth. MSPs and vCISOs who offer AI-driven GRC solutions are providing a critical service to businesses seeking to thrive in this evolving landscape.

Conclusion

In conclusion, the integration of AI into GRC platforms represents a paradigm shift in compliance management. Platforms as Risk Cognizance empower organizations to move beyond reactive, manual processes towards proactive, efficient, and data-driven compliance strategies. By leveraging AI-powered automation, businesses can overcome traditional compliance challenges, enhance their security posture, and achieve significant operational efficiencies. For MSPs and vCISOs, Risk Cognizance offers a powerful solution to deliver enhanced GRC services, enabling them to guide clients through the complexities of compliance and build resilient, secure, and trustworthy organizations. Explore how Risk Cognizance can transform your compliance management and empower your business today.

.jpeg)