Overview

Transforming Compliance with Intelligent Automation

In an era of evolving regulations, businesses face increasing challenges in maintaining compliance. Traditional manual processes lead to inefficiencies, human error, and potential non-compliance penalties. Risk Cognizance, a user-friendly and AI-driven compliance management solution, revolutionizes governance, risk, and compliance (GRC) by automating workflows, streamlining audits, and delivering real-time regulatory insights.

Why Businesses Need a Governance, Risk, and Compliance Software

Regulatory requirements change rapidly, making compliance a complex and resource-intensive process. Risk Cognizance simplifies this by offering an automated solution that eliminates the need for manual compliance tracking. With AI-driven insights, organizations can proactively identify and mitigate risks, ensuring continuous adherence to regulatory standards.

What Is the Difference Between Using a Governance, Risk, and Compliance Tool and Doing the Task Manually?

| Feature | Manual Compliance | Risk Cognizance GRC Platform |

|---|---|---|

| Compliance Tracking | Time-consuming spreadsheets | Real-time automated monitoring |

| Risk Assessments | Reactive, after incidents | Proactive, AI-driven detection |

| Regulatory Updates | Manually researched | Automatic regulatory alerts |

| Audit Preparation | Requires extensive effort | Streamlined evidence collection |

| Integration | Fragmented across teams | Centralized and automated platform |

How Does an Integrated Governance, Risk, and Compliance Solution Help the CISO and the Security Team?

CISOs and security teams are under growing pressure to manage compliance while mitigating cyber threats. Risk Cognizance provides:

- Automated compliance tracking to reduce manual workload

- AI-powered risk assessments for proactive security management

- Seamless integration with existing security tools for comprehensive oversight

- Customizable reporting to support audits and regulatory adherence

What Type of Business Benefits Most from a Governance, Risk, and Compliance Platform?

Organizations that handle sensitive data or operate in highly regulated industries benefit significantly from Risk Cognizance, including:

- Financial Services: Ensuring PCI DSS compliance and fraud prevention

- Healthcare: Maintaining HIPAA compliance and securing patient data

- Defense Contractors: Achieving and maintaining CMMC certification

- Retail & E-Commerce: Strengthening PCI compliance and protecting customer transactions

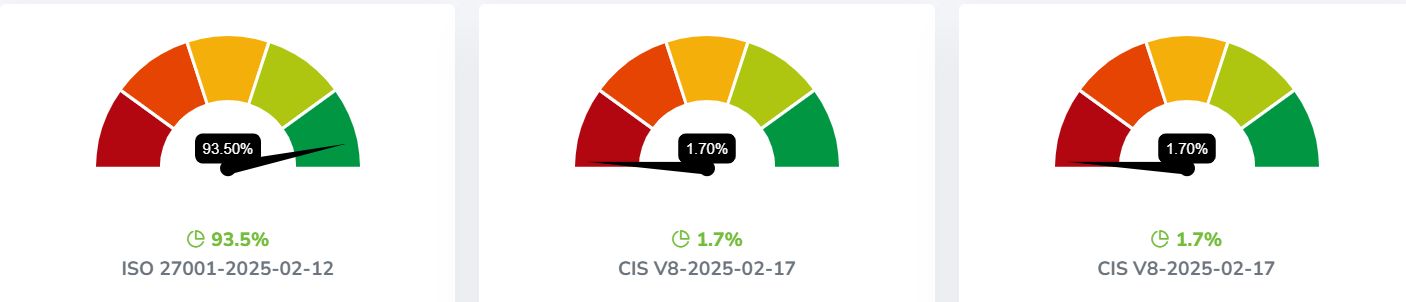

Customizable Compliance Frameworks

Whether your business needs to comply with CMMC, ISO, NIST, SOC 2, HIPAA, GDPR, or other regulations, Risk Cognizance’s GRC Tools for Small Medium Sized Businesses and Startups provide tailored compliance solutions that grow with your business.

How Can Your Organization Benefit from Risk Cognizance’s 6-in-1 Solution?

Risk Cognizance provides a comprehensive GRC platform designed to automate compliance, enhance risk management, and streamline governance. Key features include:

- AI-powered risk assessments for proactive security

- Real-time compliance monitoring with automated alerts

- Effortless audit preparation and documentation

- Integrated third-party risk management capabilities

- Automated incident response to enhance security operations

- Continuous regulatory updates to maintain compliance readiness

Seamless Integration & User-Friendly Interface

- An intuitive dashboard requires minimal training.

- API integrations with SIEM, IAM, and enterprise security tools.

- Custom compliance workflows for industry-specific needs.

Over 250 Integrated Apps to and API access to all of our system.

Automating risk management, with workflow, and our AI compliance management tools.

Use Cases: How Risk Cognizance Transforms Businesses

Financial Institutions: Achieving Seamless Compliance

A leading financial firm struggled with fragmented compliance processes and increasing regulatory fines. By implementing Risk Cognizance, they automated audits, reduced compliance violations, and ensured real-time tracking of industry regulations, significantly improving operational efficiency.

Healthcare Providers: Protecting Patient Data and Ensuring HIPAA Compliance

A hospital network faced challenges in securing patient data while maintaining HIPAA compliance. Risk Cognizance automated security assessments, minimized data breaches, and simplified compliance reporting, strengthening their data protection framework.

Defense Contractors: Ensuring CMMC Certification

A defense contractor required CMMC certification to continue working with government agencies. Risk Cognizance helped them map security controls, automate evidence collection, and achieve certification in a shorter timeframe, enhancing their compliance posture.

Case Studies: Proven Success with Risk Cognizance

Case Study 1: Enterprise-Wide GRC Transformation

A Fortune 500 company lacked a centralized GRC strategy, leading to inefficiencies and compliance gaps. Risk Cognizance provided an AI-driven platform to integrate compliance management, reducing violations by 75% and improving security resilience.

Case Study 2: Small Business Achieves Compliance Excellence

A growing e-commerce company required a scalable compliance solution to support expansion. Risk Cognizance automated workflows, streamlined regulatory mapping, and cut manual effort by 65%, accelerating audit readiness and ensuring compliance continuity.

The Future of Compliance with Risk Cognizance

As regulatory landscapes continue to evolve, businesses need an intelligent and scalable compliance solution. Risk Cognizance provides an AI-driven, automated approach that simplifies compliance, mitigates risks, and ensures organizations stay ahead of regulatory changes.

Book a Demo