Overview

The Compliance Challenge Businesses Face

Businesses struggle to keep up with ever-changing compliance requirements. The complexity of aligning with frameworks such as NIST, ISO 27001, CMMC, GDPR, HIPAA, SOC 2, and PCI DSS often overwhelms organizations, leading to increased risks, penalties, and inefficiencies. Risk Cognizance transforms compliance by offering a user-friendly, AI-automated compliance solution that streamlines governance, risk, and compliance (GRC) management.

Custom Frameworks Made Easy

Build custom compliance and privacy frameworks

Customizable compliance frameworks can be created by assessing risks, defining requirements, and implementing best practices. When creating a custom framework, it's important to balance compliance with business objectives.

Steps for creating a custom compliance framework:

- Assess risks: Consider potential dangers and uncertainties when working with third-party vendors.

- Define requirements: Outline how to implement and maintain the framework.

- Implement best practices: Follow best practices for cloud security, for example.

- Balance compliance with business objectives: Make sure compliance doesn't overshadow the organization's broader business goals.

- Enforce standards: Make sure employees know compliance expectations and consequences for non-compliance.

Why Businesses Need a Governance, Risk, and Compliance Software

Manual compliance management is no longer sustainable. Organizations face growing challenges such as:

- Constantly evolving regulatory requirements

- High risk of human errors in compliance tracking

- Time-consuming audits and reporting

- Difficulty in integrating security and compliance efforts

Custom Frameworks

Custom compliance frameworks are tailored approaches to meet specific mandates, which can be complex and diverse. Risk Cognizance stands out with its inherently agile and infinitely adaptive platform, making it effortless to support any mandates, including custom frameworks.

Seamless Customization

Embracing custom compliance frameworks can be daunting due to their intricate nature and the wide variety of controls involved. Risk Cognizance excels in handling this complexity with ease. Our platform’s inherent agility and adaptability enable seamless customization, ensuring your complex enterprise effortlessly navigates unique mandates while reducing resource strain.

Risk Cognizance eliminates these pain points by providing an intuitive platform that automates compliance processes, ensuring organizations stay ahead of regulatory changes while reducing risks and operational burdens.

The Difference Between GRC Tools and Manual Compliance Management

| Feature | Manual Compliance | Risk Cognizance GRC Platform |

|---|---|---|

| Compliance Tracking | Time-consuming and error-prone | AI-driven real-time monitoring |

| Risk Assessments | Reactive, post-incident | Proactive, automated detection |

| Regulatory Updates | Manually researched | Automated framework updates |

| Audit Preparation | Labor-intensive | Streamlined with evidence automation |

| Integration | Siloed and fragmented | Centralized compliance hub |

Risk Cognizance simplifies GRC by reducing inefficiencies, automating risk management, and enhancing security posture.

How an Integrated GRC Platform Helps CISOs and Security Teams

Security leaders require a unified compliance solution that integrates seamlessly with their existing cybersecurity infrastructure. Risk Cognizance provides:

- AI-powered risk analysis for faster decision-making

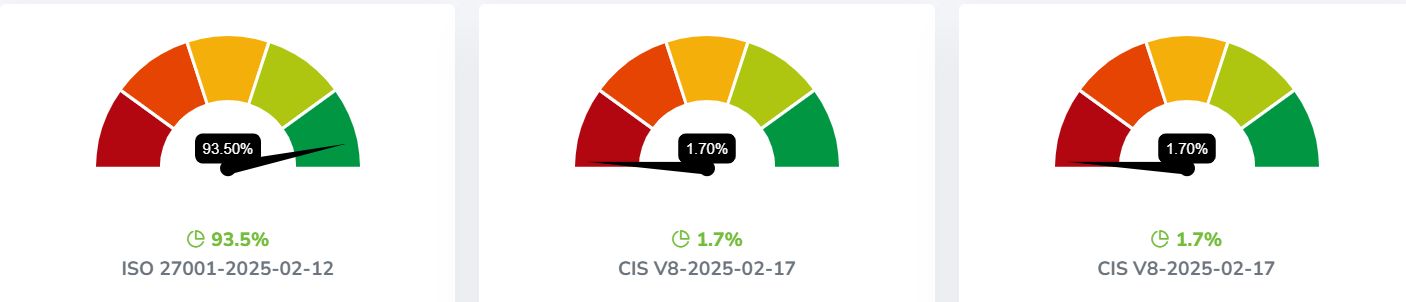

- Centralized dashboards for real-time compliance insights

- Seamless integration with SIEM, IAM, and enterprise security tools

- Custom compliance workflows tailored to business needs

By shifting from manual compliance to an automated framework, CISOs and security teams can proactively mitigate risks while ensuring compliance adherence.

Seamless Integration & User-Friendly Interface

- An intuitive dashboard requires minimal training.

- API integrations with SIEM, IAM, and enterprise security tools.

- Custom compliance workflows for industry-specific needs.

Over 250 Integrated Apps to and API access to all of our system.

Automating risk management, with workflow, and our AI compliance management tools.

Which Businesses Benefit Most from a GRC Platform?

While all industries benefit from compliance automation, businesses in highly regulated sectors experience the greatest impact:

- Financial Services: Compliance with GLBA, PCI DSS, SOX

- Healthcare: HIPAA and patient data security

- Defense Contractors: CMMC certification and DoD requirements

- Retail & E-Commerce: PCI DSS and data protection

Customizable Compliance Frameworks

Whether your business needs to comply with CMMC, ISO, NIST, SOC 2, HIPAA, GDPR, or other regulations, Risk Cognizance’s GRC Tools for Small Medium Sized Businesses and Startups provide tailored compliance solutions that grow with your business.

All your customized compliance needs in one platform

Customize and automate your compliance programs as you grow. You can set up controls and build upon our supported frameworks and annual cycles of work to align to any framework or standard.

Meet your unique compliance needs with custom frameworks

Risk Cognizance’s custom frameworks and custom controls help you efficiently customize and automate your compliance programs as you grow. Unlock revenue, strengthen your compliance and security posture, and save time and money.

Customize tasks and controls

You can easily create and customize tasks and controls in addition to the automated Risk Cognizance controls to accommodate any regulatory framework.

Risk Cognizance provides scalable and customizable compliance frameworks to meet the unique needs of various industries.

How Risk Cognizance’s 6-in-1 Solution Transforms Compliance

AI-Powered Automation for Seamless Compliance

- Automated risk assessments that proactively identify vulnerabilities

- Real-time compliance tracking supporting multiple regulatory frameworks

- Custom dashboards for instant governance, risk, and compliance insights

Proactive Risk Management & Threat Intelligence

- AI-driven risk quantification prioritizes mitigation efforts

- Automated alerts for compliance deviations and regulatory updates

- Integration with attack surface management and dark web monitoring tools

Continuous Regulatory Compliance

- Automated policy management ensuring adherence to industry standards

- Built-in compliance templates simplify regulatory alignment

- Real-time tracking of regulatory changes for proactive adaptation

Incident Response & Remediation Support

- Automated incident reporting for faster breach response

- Integrated threat intelligence to prevent cyberattacks

- Forensic audit trail for regulatory investigations

Vendor & Third-Party Risk Management

- Continuous monitoring of vendor compliance

- Automated assessments to mitigate supply chain risks

- Centralized vendor risk profiles for better decision-making

Use Cases: How Risk Cognizance Helps Businesses

Strengthening Compliance in Financial Institutions

A global financial firm faced challenges complying with GLBA, PCI DSS, and SOX. Risk Cognizance helped them:

- Automate compliance tracking, reducing audit preparation by 80%

- Achieve continuous compliance with evolving financial regulations

- Gain real-time cybersecurity insights and governance control

Ensuring HIPAA Compliance in Healthcare

A healthcare provider struggled with HIPAA compliance and patient data security. Risk Cognizance provided:

- AI-powered compliance monitoring for instant risk detection

- Automated documentation for audits and reporting

- Proactive security controls to prevent data breaches

Achieving CMMC Certification for Defense Contractors

A defense contractor needed CMMC Level 2 certification to maintain government contracts. Risk Cognizance enabled them to:

- Automate security control mapping for CMMC requirements

- Streamline evidence collection for audits

- Reduce compliance costs while accelerating certification timelines

Case Studies: Proven Success with Risk Cognizance

Enterprise-Wide GRC Transformation

A Fortune 500 company lacked a centralized compliance strategy, leading to inefficiencies and audit failures. With Risk Cognizance, they:

- Consolidated compliance into a single AI-powered platform

- Reduced compliance violations by 75%

- Improved cybersecurity resilience across multiple business units

Small Business Achieves Compliance Excellence

A growing e-commerce business sought a cost-effective compliance solution. Risk Cognizance helped them:

- Identify security gaps with automated regulatory mapping

- Cut manual compliance efforts by 65%

- Enhance audit readiness, enabling them to secure high-value contracts

How Your Organization Can Benefit from Risk Cognizance’s 6-in-1 Solution

Risk Cognizance is designed to simplify compliance, enhance security, and reduce operational burdens. Whether you’re a small business or a multinational enterprise, our user-friendly AI-automated compliance solution helps you:

- Automate regulatory compliance and risk management

- Streamline audits and reporting with AI-powered insights

- Proactively identify and mitigate security risks

- Ensure continuous compliance across multiple frameworks