Case Study: Of A Fictional Tech Startup & Small Business

Case Study: SyncFlow, a Fictional Tech Startup

The Challenge:

SyncFlow, a rapidly growing tech startup with 75 employees, was struggling to manage its governance, risk, and compliance activities. As the company scaled, its manual and siloed processes became a significant liability, and a key strategic weakness was its lack of risk cognizance—the organization-wide awareness and understanding of its risk exposure.

- Fragmented Risk Management: The company lacked a centralized system for risk management. Department heads used disparate tools like spreadsheets and email to document risks, assign owners, and track mitigation efforts. This meant the leadership team had no "single source of truth" or real-time visibility into the company's risk exposure. They could not use a visual tool like a risk heat map to prioritize threats based on their likelihood and impact.

- Manual and Reactive Compliance: The Chief Compliance Officer, Jane, was overwhelmed by the manual work required for compliance. She spent weeks manually tracking new regulations like HIPAA and GDPR, updating internal policies, and gathering evidence from various departments to prove adherence. The process was reactive, with Jane often scrambling to meet deadlines or address compliance issues only after they were discovered.

Lack of Risk Cognizance: The company's culture was not risk-aware. Employees and middle management often saw risk and compliance as "Jane's problem" rather than a shared responsibility. They lacked a common language for discussing risks, a clear process for reporting potential issues, or an understanding of how their daily actions impacted the company's overall risk posture. This created a significant blind spot for management, as many emerging risks went unreported or were not escalated properly.

The Solution:

Recognizing that a fragmented approach was no longer sustainable, SyncFlow’s leadership decided to invest in an integrated GRC software solution. They sought a platform that was designed to be scalable for an SMB and would act as a central hub for all GRC activities, with a specific focus on building a more risk-cognizant organization.

The platform provided a unified system that enabled SyncFlow to:

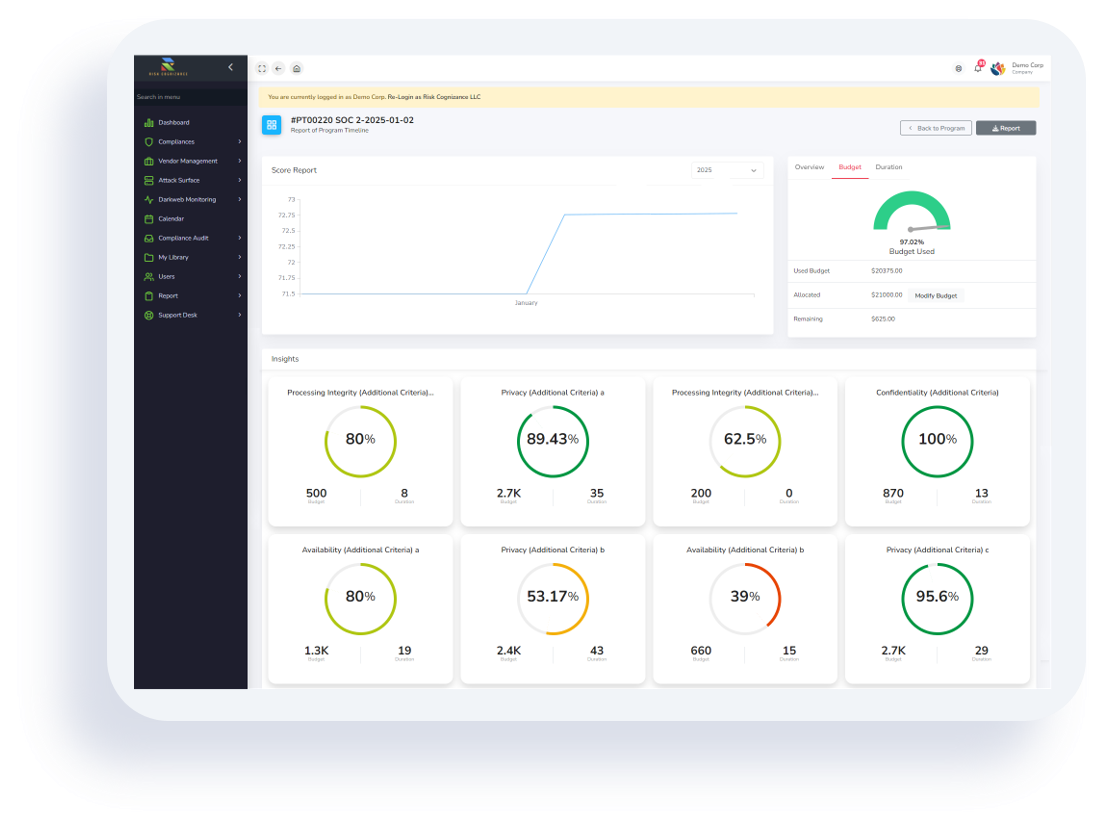

Establish a Centralized Risk Program: The GRC software allowed SyncFlow to create a comprehensive risk register where all risks—from cybersecurity vulnerabilities to operational disruptions—were logged, assessed, and tracked. The platform automatically generated interactive dashboards and heat maps, giving executives and risk managers a clear, real-time visualization of the company's most critical threats.

- Automate Compliance Management: The software streamlined the entire compliance lifecycle. It provided automated alerts for regulatory changes, a central repository for all policies and procedures, and workflows that assigned compliance tasks to specific employees with clear deadlines. This shifted Jane’s role from a manual tracker to a strategic overseer.

- Improve Risk Cognizance: The new GRC platform was the technical backbone for a cultural shift. The leadership team used the software to formalize a "risk language" and a clear reporting process. Employees at all levels were given access to a simplified interface to report potential risks, fostering a sense of shared responsibility. This continuous, real-time input enabled the company to identify and address issues much earlier than before.

- Enhance Audit Readiness and Transparency: The GRC platform served as a single source of truth for audit evidence and documentation. All policies, controls, and compliance monitoring results were stored in one place with a clear audit trail. This transformed audit preparation from a stressful, weeks-long effort into a few days of validation, ensuring the company was always audit-ready.

_1725822920.png)

The Result:

Within a year of implementing the GRC software, SyncFlow experienced significant benefits, directly linked to the new platform and its ability to foster risk cognizance:

- 45% Reduction in Compliance Workload: The automation of regulatory tracking, policy management, and evidence collection freed up Jane and her team to focus on higher-value, strategic work.

- Proactive Risk Mitigation: By using the real-time dashboards and risk heat maps, SyncFlow's leadership was able to identify and mitigate several emerging risks before they could cause significant financial or reputational damage.

- Enhanced Executive Visibility: C-suite executives and the board could now access a single dashboard for an integrated view of risk, compliance, and governance, leading to more informed and confident decision-making.

- A Culture of Accountability: The platform made everyone’s role in risk and compliance clear, fostering a company-wide culture of accountability and proactive management. By making risk cognizance a core part of its operations, SyncFlow became a more resilient and secure organization, better equipped to navigate challenges and seize opportunities.

This expanded case study illustrates how GRC software goes beyond simple risk or compliance tools by providing a unified, strategic framework that is essential for sustainable growth in today's complex business environment.

.jpeg)