Case Study: Risk Cognizance Replacing Archer Risk Management Software

The Challenge: A Fragmented GRC Ecosystem

Our client, a global financial services firm, was struggling to manage its governance, risk, and compliance (GRC) program. Their existing setup was a legacy system centered on Archer, supplemented by a patchwork of disconnected tools, spreadsheets, and manual processes. This fragmented ecosystem created significant inefficiencies and heightened risk across the organization.

The primary pain points were:

- Monolithic Architecture: The on-premise, server-centric nature of the legacy system made it rigid and difficult to update. A simple new feature or regulatory change could take months, requiring extensive IT involvement and costly professional services.

- Siloed Data and Workflows: Information was trapped in different departments—risk management, internal audit, and compliance all had their own separate spreadsheets and reporting methods. This made it impossible to get a real-time, unified view of the firm's risk posture.

- Manual and Repetitive Tasks: Teams spent an inordinate amount of time on manual data entry, evidence collection, and report generation. The process was prone to human error and prevented staff from focusing on high-value, strategic work.

- Poor User Experience: The outdated user interface and steep learning curve led to low user adoption. Many employees bypassed the system entirely, opting for familiar spreadsheets, which only worsened the data silo problem.

A clear illustration of this was the response to a new data privacy regulation. The compliance team spent three months manually updating documents, emailing stakeholders for approvals, and painstakingly cross-referencing controls across different frameworks—all while the business was exposed to potential fines. The fragmented system was not just inefficient; it was a liability.

The Solution: A Unified, Cloud-Native Platform

Recognizing the need for a fundamental change, the firm began a search for a modern GRC solution. They chose Risk Cognizance, a cloud-native platform designed to unify all GRC functions in a single, intuitive environment.

The key features of Risk Cognizance that addressed the firm's challenges were:

- Microservices Architecture: Built from the ground up for the cloud, Risk Cognizance is modular and flexible. This architecture enables rapid updates, seamless integration with other business tools via APIs, and effortless scalability as the firm grows.

- Centralized Risk and Control Libraries: All GRC data is stored in a single source of truth. The platform provides a powerful cross-walk capability, allowing the firm to map controls to multiple regulatory frameworks simultaneously.

- No-Code Automation: Risk Cognizance's no-code workflow automation transformed tedious manual processes. The platform automatically assigns tasks, sends reminders, and collects evidence, drastically reducing administrative overhead.

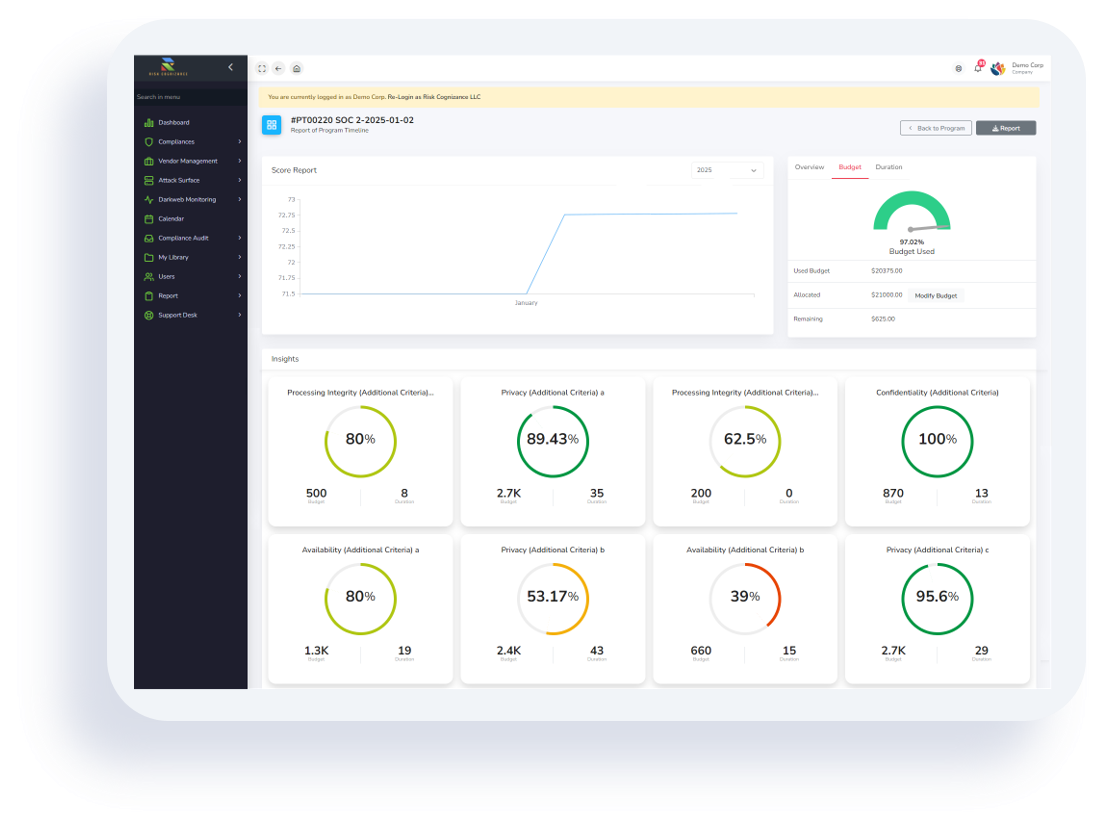

- Intuitive User Interface: With a modern, clean, and user-friendly design, the platform required minimal training. The role-based dashboards and personalized views made it easy for employees at all levels to engage with the GRC program.

The Results: A More Agile and Resilient Organization

The transition to Risk Cognizance delivered immediate and quantifiable results, moving the firm from a reactive, compliance-centric posture to a proactive, risk-aware culture.

- Enhanced Regulatory Agility: The firm’s response to the next regulatory change was a stark contrast to the first. Using Risk Cognizance, the team updated the new framework, and the system automatically identified all relevant controls and assigned tasks to stakeholders. The entire process was completed in just two weeks, with real-time dashboards providing a clear view of compliance status throughout.

- Significant Cost Reduction: Beyond the initial lower cost of ownership, the firm realized a 30% reduction in manual processes within the first six months, leading to substantial labor cost savings. The elimination of expensive professional services for system updates further contributed to a strong ROI.

- Improved Decision-Making: With a unified, real-time view of risk, senior leadership could now make informed, data-driven decisions. The platform's dynamic reporting and heatmaps replaced static, out-of-date spreadsheets, giving the board a continuous pulse on the firm's risk landscape.

- Increased Productivity and User Satisfaction: By automating rote tasks, Risk Cognizance empowered GRC teams to shift their focus from administration to strategic risk mitigation. The intuitive interface led to a high adoption rate and a 40% increase in user satisfaction, turning the GRC program from a burden into a valued business enabler.

What is GRC Software?

GRC stands for Governance, Risk, and Compliance. GRC software is a comprehensive platform that integrates and manages these three interconnected disciplines within an organization. Its primary purpose is to provide a unified, holistic view of an organization's performance, risk exposure, and compliance with rules and regulations.

A GRC platform acts as a central hub, bringing together data and processes that would otherwise be siloed in different departments.

- Governance: The GRC software helps define and enforce the policies, frameworks, and decision-making structures that an organization uses to achieve its business goals.

- Risk Management: It provides tools to identify, assess, prioritize, and mitigate various risks (e.g., financial, operational, cybersecurity, reputational) that could affect the organization.

- Compliance: The software automates the process of adhering to internal policies, industry standards, and external laws and regulations.

Who uses GRC software?

GRC software is typically used by a wide range of professionals, including:

- C-suite executives and board members: They use it to get a high-level, data-driven view of the organization's risk profile to make strategic decisions.

- Chief Risk Officers (CROs) and Chief Compliance Officers (CCOs): They are the primary owners and users, managing the day-to-day GRC activities.

- Internal auditors: The software simplifies the audit process by providing a centralized repository of controls, policies, and evidence.

- IT security and legal departments: These teams use it to manage their specific compliance and risk-related tasks.

What is Risk Management Software?

Risk management software is a specialized application focused entirely on the "Risk" component of GRC. Its sole purpose is to help an organization systematically identify, analyze, evaluate, and treat risks. The software provides tools for creating risk registers, performing risk assessments, and monitoring the effectiveness of risk mitigation strategies.

Key features often include:

- Risk registers: A centralized database to document all identified risks.

- Risk assessment tools: Features for scoring risks based on their likelihood and impact, often visualized with heat maps.

- Mitigation and control tracking: The ability to assign ownership and track the progress of plans to reduce or eliminate risks.

- Real-time dashboards: Dashboards that give a clear view of the organization's current risk posture.

- Who uses Risk Management software? While many people across an organization are involved in risk management, the software is most often used by:

- Risk managers and analysts: The primary users who are responsible for running the risk management program.

- Department heads and business unit leaders: They use it to manage risks specific to their operations.

- Internal audit teams: They verify the effectiveness of risk management processes.

What is Compliance Management Software?

Compliance management software is a specialized tool that focuses on the "Compliance" component of GRC. Its main goal is to ensure an organization adheres to all applicable laws, regulations, standards, and internal policies. The software helps automate the often-manual and complex tasks associated with compliance.

Key features typically include:

- Policy and procedure management: A central repository for all policies and procedures.

- Regulatory change tracking: Alerts and updates on new or changing regulations that affect the organization.

- Compliance testing and monitoring: Tools to regularly check if controls are operating effectively.

- Reporting and audit trail: Features that simplify preparing for audits by automatically collecting and documenting evidence of compliance.

Who uses Compliance Management software?

Chief Compliance Officers (CCOs) and compliance managers: The main users who are responsible for implementing and overseeing the compliance program.

- Legal departments: They use it to ensure the organization meets its legal and regulatory obligations.

- Human Resources: They can use it to track compliance with labor laws and company policies.

- Internal auditors: They use the software to conduct compliance-focused audits.

How are they different?

The key difference lies in their scope and focus.

| Feature | GRC Software | Risk Management Software | Compliance Management Software |

|---|---|---|---|

| Scope | Broad and Integrated: Covers all three areas of Governance, Risk, and Compliance in a single, unified platform. | Narrow and Focused: Concentrates specifically on identifying, assessing, and mitigating risks. | Narrow and Focused: Concentrates specifically on adhering to laws, regulations, and policies. |

| Purpose | To align business strategy with risk and compliance, providing a holistic view for strategic decision-making. | To protect the organization from potential threats by proactively managing uncertainty. | To avoid penalties, fines, and reputational damage by ensuring adherence to rules. |

| Approach | Proactive and Strategic | Proactive and Strategic | Reactive and Tactical |

| Primary User | Senior executives, Chief Risk Officers, Chief Compliance Officers, and internal auditors. | Risk managers, department heads, and business unit leaders. | Compliance officers, legal teams, and internal auditors. |

| Relationship | The "umbrella" that integrates the other two functions. | A critical component within a broader GRC framework. | A critical component within a broader GRC framework. |

In short, you can think of it like this: GRC is the comprehensive strategy, while Risk Management and Compliance Management are specialized, yet crucial, components of that strategy. A company might start with separate risk and compliance software and eventually evolve to a single, integrated GRC platform to streamline operations and get a better view of their enterprise-wide posture.

By replacing their legacy system with Risk Cognizance, the firm not only solved its immediate GRC challenges but also built a resilient, agile, and forward-looking foundation for sustainable growth in an ever-changing regulatory environment.