Financial Enterprise Risk Management Software for the Banking Industry: A Case Study

The Challenge: A Disjointed Approach to Risk in Banking

A leading multinational bank, operating across multiple continents, was facing a significant challenge: a fragmented and inefficient approach to enterprise risk management. The bank’s various departments—including retail banking, wealth management, and commercial lending—were using disparate, legacy systems to manage different risk types.

This siloed environment led to several critical problems:

- Lack of Holistic Visibility: It was nearly impossible to get a single, real-time view of the bank's overall risk posture.

- Manual Reporting: The process of aggregating data for board and regulatory reports was manual, time-consuming, and prone to error.

- Slow Response to Market Changes: The inability to quickly analyze and correlate market risk data with operational and credit risks hindered timely strategic decision-making.

- Regulatory Scrutiny: With increasing pressure from financial regulators, the bank needed a more auditable and streamlined way to demonstrate compliance.

The Chief Risk Officer (CRO) recognized that this disjointed system was a significant operational and strategic liability, hindering the bank’s ability to confidently navigate an uncertain financial landscape.

The Solution: A Unified, AI-Powered Platform

The bank chose to implement Risk Cognizance's Financial Enterprise Risk Management Software. The solution's primary objective was to serve as a unified, central command center for all risk-related activities.

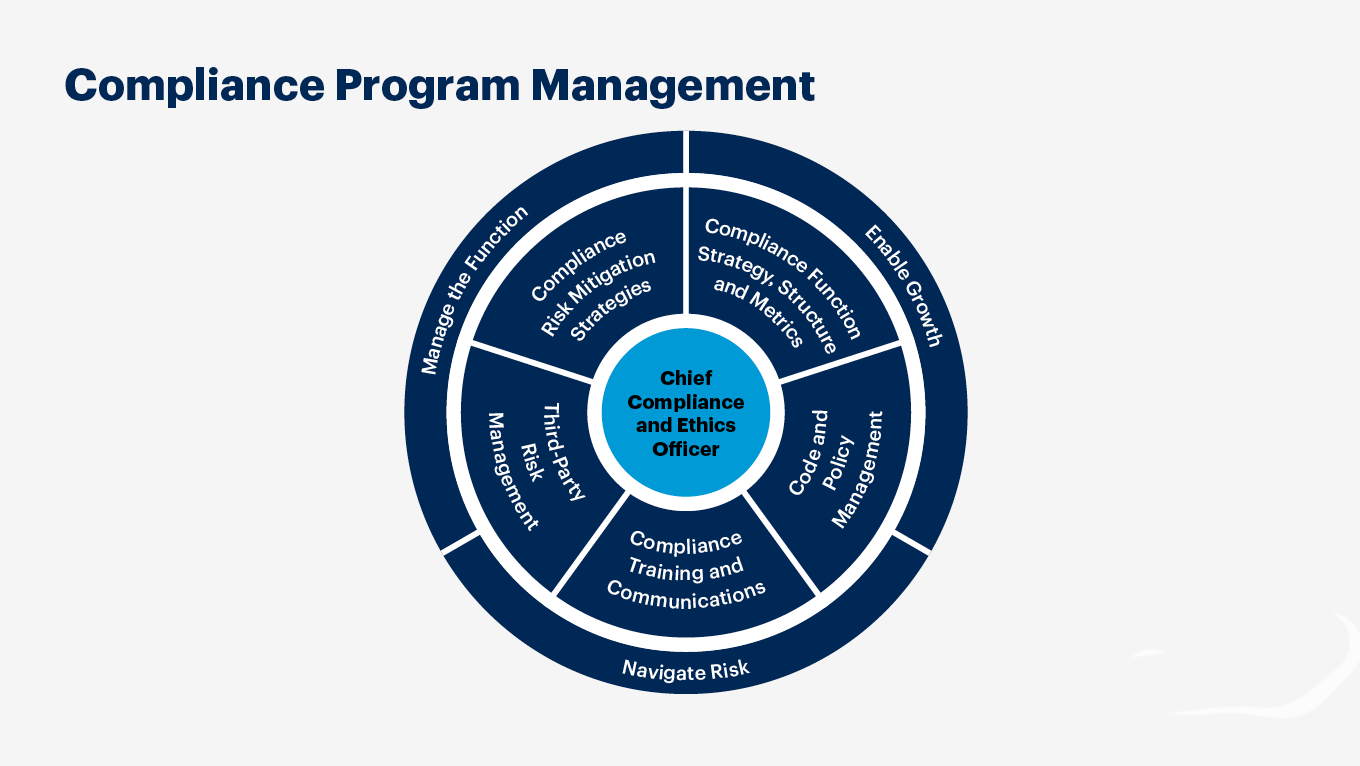

The implementation focused on key areas:

- Centralized Risk Data Hub: The platform was configured to ingest and normalize data from all of the bank's existing systems, creating a single source of truth for market, credit, and operational risk data.

- AI-Driven Automation: Advanced AI was deployed to automate the aggregation of data for quarterly reporting, significantly reducing the manual workload.

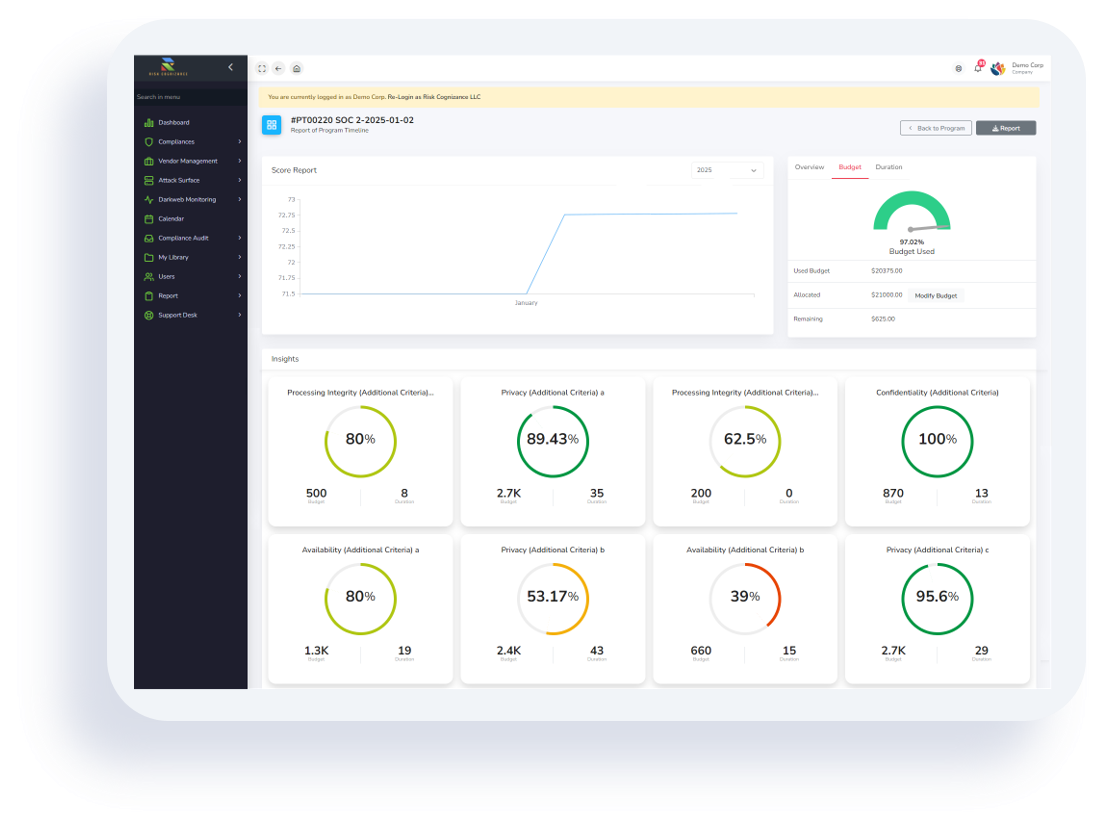

- Real-time Risk Dashboards: Customized dashboards were built to provide executive leadership and risk teams with a live, holistic view of the bank’s risk exposure, with the ability to drill down into specific risk types.

- Integrated Compliance Workflows: The software's compliance management features were used to map internal controls to a variety of regulatory frameworks, creating an automated and auditable process.

The Results: Enhanced Agility, Efficiency, and Confidence

The deployment of the Risk Cognizance platform delivered tangible, measurable results for the bank:

- 90% Reduction in Reporting Time: The time required to generate comprehensive enterprise-wide risk reports for the board and regulators was reduced from several weeks to just a few days.

- Improved Risk Visibility: For the first time, leadership had a holistic, real-time view of the bank’s interconnected risk posture, enabling proactive management of emerging threats.

- Stronger Compliance Posture: The automated, auditable workflows ensured consistent adherence to regulatory requirements, boosting confidence during audits.

- Empowered Risk Teams: The automation of manual tasks freed up the bank’s risk professionals to focus on strategic analysis and mitigation, rather than data collection.

Conclusion: A Strategic Partner in the Future of Banking

The multinational bank successfully transitioned from a fragmented, reactive risk management approach to a unified, proactive, and intelligent strategy.

"Risk Cognizance’s platform transformed how we view and manage risk," stated the bank's Chief Risk Officer. "It’s not just a software solution; it’s a strategic partner that gives us the clarity and confidence we need to thrive in a highly regulated and dynamic market. The efficiency and visibility we’ve gained are now core to our business operations."

This case study demonstrates how a unified, AI-powered Financial Enterprise Risk Management solution can be a game-changer for the banking industry, turning a critical operational challenge into a source of enduring competitive advantage.