The Board’s Role in GRC: Leading Governance, Risk, and Compliance

Governance, Risk, and Compliance (GRC) has evolved far beyond a back-office function. Today, it sits at the core of enterprise resilience and strategic success. As cyber threats grow more sophisticated, regulations expand, and stakeholder expectations rise, boards are increasingly expected to provide informed oversight, strategic direction, and leadership in GRC.

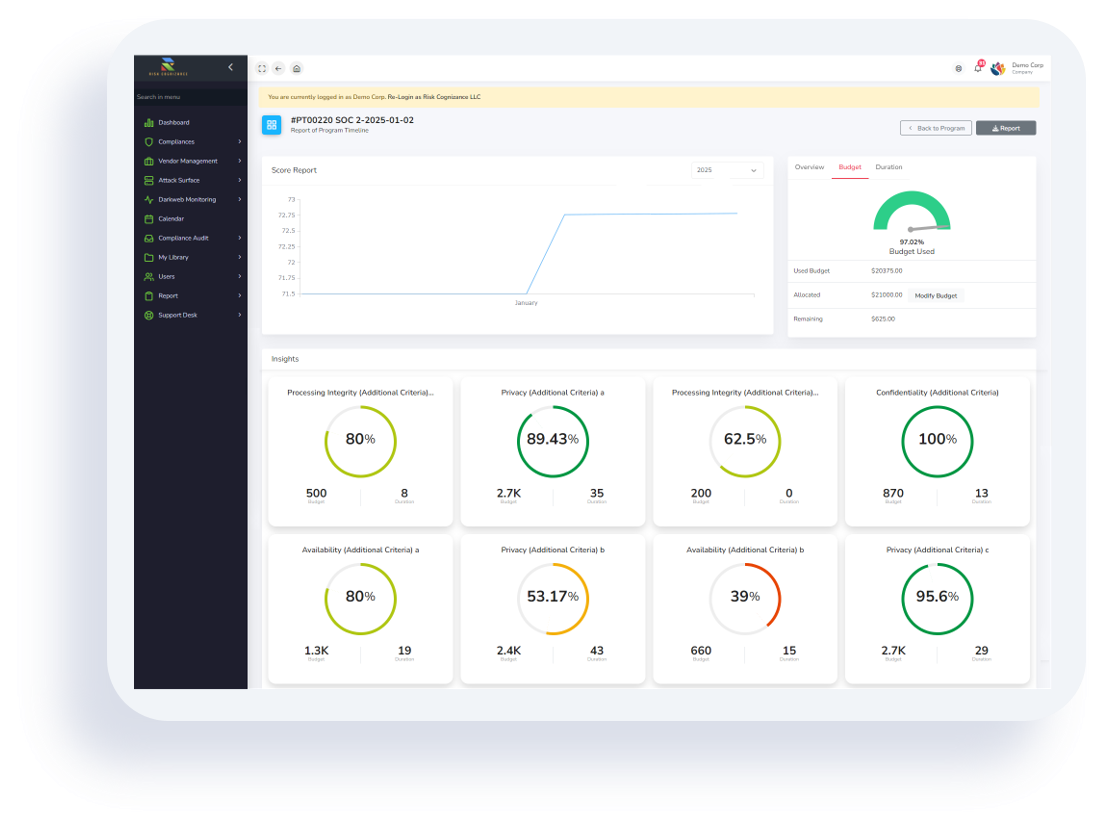

Below, we explore what it takes for board members and executives to lead effectively in GRC—and how modern GRC software, including AI-powered solutions like Risk Cognizance, empowers organizations to meet these expectations.

1. What It Takes to Be a Leader in Governance, Risk, and Compliance

High-performing GRC leaders share a common set of traits and responsibilities:

• Strategic Awareness

Boards must understand how governance, risk, and compliance influence the organization’s long-term objectives—not just operational details.

• A Culture of Accountability

Leaders must set the tone for ethical behavior, transparency, and compliance as nonnegotiable standards.

• Engagement, Not Delegation

Boards can no longer treat GRC as a “check-the-box” responsibility. GRC oversight must be active, continuous, and strategic.

• Data-Driven Insight Interpretation

Boards must be able to interpret real-time dashboards and risk analytics to make informed decisions.

2. Modern GRC Leadership: How High-Performing Compliance Programs Earn Executive Trust

• Credibility Through Transparency

Executives value GRC programs that provide accurate, real-time visibility into risk exposure and compliance status.

• Proactive Risk Management

Top programs anticipate issues before they escalate.

• Enterprise-Wide Integration

High-performance GRC programs unify IT, legal, HR, compliance, operations, and security.

• Measurable Outcomes

Metrics such as risk reduction and audit readiness demonstrate maturity and reliability.

3. Key Principles of Successful GRC Management

• Alignment With Strategy

GRC must support business objectives and risk appetite.

• Continuous Monitoring and Improvement

Static programs quickly become outdated; ongoing adaptation is critical.

• Cross-Functional Collaboration

Shared ownership of risk strengthens preparedness and responsiveness.

• Technology-Driven Efficiency

Automation reduces errors, eliminates manual tracking, and accelerates compliance workflows.

4. Governance, Risk & Compliance (GRC) Software

Modern GRC platforms provide centralized visibility, automated workflows, and data-driven insights that strengthen oversight and decision-making. Boards increasingly rely on these tools to ensure accountability, readiness, and resilience.

Risk Cognizance: AI-Powered GRC for Modern Board Oversight

Risk Cognizance is an AI-driven GRC platform that automates IT risk and compliance across multiple industry frameworks, including:

- SOC 2

- PCI DSS

- NIST

- CMMC

- ISO 27001, ISO 27002, ISO 27003

- HIPAA

- CCPA

- And more

By unifying these frameworks into a single automated system, Risk Cognizance enables organizations to strengthen compliance maturity, reduce overhead, and enhance board-level visibility.

Top Best GRC Tools and Solutions

Modern enterprises operate in increasingly complex environments—managing cyber threats, regulatory requirements, third-party risks, and governance challenges. The best GRC tools provide integrated, automated solutions that simplify oversight and improve resilience. Below are key solution categories essential for today’s organizations:

• Enterprise Risk Management (ERM)

Comprehensive tools that identify, assess, and monitor enterprise-level risks across operations, IT, finance, and strategic initiatives.

• Third-Party Risk Management (TPRM)

Solutions that evaluate vendor and supplier risks, automate due diligence, monitor vendor security postures, and ensure compliance across the supply chain.

• Policy Management

Platforms that streamline policy creation, approval, distribution, acknowledgment tracking, and version control to maintain organization-wide compliance.

• Attack Surface Management (ASM)

Tools that continuously assess external-facing assets, identify vulnerabilities, and reduce exposure to cyber threats.

• Crosswalking Frameworks

Capabilities that map controls across multiple regulatory and security frameworks—reducing duplication, saving time, and simplifying audit readiness.

• AI Document Management

AI-powered systems that extract, classify, and organize compliance and risk documents automatically—accelerating audit readiness and evidence collection.

• Cloud Posture Management

Solutions that monitor cloud environments for misconfigurations, policy violations, and compliance gaps across multi-cloud infrastructures.

• And Much More

GRC technology continues to evolve, expanding into areas such as automated testing, control scoring, workflow orchestration, insider risk, operational resilience, and predictive analytics.

These capabilities empower boards and executives with deeper insight, improved assurance, and real-time visibility into organizational risk.

Conclusion

The board’s role in GRC is foundational to organizational resilience and long-term success. Modern leaders must embrace data-driven oversight, promote cross-functional accountability, and leverage intelligent automation to meet rising governance and compliance expectations.

Platforms like Risk Cognizance serve as a critical enabler automating controls, managing frameworks, and delivering real-time insights that empower boards to lead confidently in today’s rapidly evolving risk landscape.