Overview

Cybersecurity threats, regulatory pressures, and financial risks are more complex than ever. To stay ahead, organizations need a proactive and integrated approach to Enterprise Risk Management (ERM). Risk Cognizance offers an AI-driven ERM software solution that simplifies risk assessment, enhances compliance, and improves decision-making.

Customizable Compliance Frameworks

Whether your business needs to comply with CMMC, ISO, NIST, SOC 2, HIPAA, GDPR, or other regulations, Our GRC Tools for Small Medium Sized Businesses and Startups provide tailored compliance solutions that grow with your business.

The Role of Cybersecurity in Enterprise Risk Management (ERM)

Cyber threats are constantly evolving, cybersecurity must be at the forefront of any ERM strategy. Traditional risk management methods fail to keep pace with sophisticated cyberattacks, making automation and AI-driven solutions essential. Risk Cognizance helps organizations identify vulnerabilities, assess threats in real time, and align cybersecurity strategies with overall business objectives.

By integrating cybersecurity into ERM, businesses can:

- Detect and mitigate cyber risks before they escalate

- Ensure compliance with industry regulations

- Safeguard sensitive data and protect customer trust

- Reduce financial losses associated with security breaches

ERM Software Solutions Build For Security Team

The Ultimate Guide to Enterprise Risk Management Strategy

A successful ERM strategy requires a holistic approach that considers financial, operational, regulatory, and cybersecurity risks. Risk Cognizance simplifies ERM by offering:

- Automated risk assessments

- Real-time compliance tracking

- AI-powered decision support

- Centralized dashboards for risk visibility

- Integration with existing security and compliance tools

By leveraging AI and automation, organizations can shift from reactive risk management to a proactive, strategic approach that supports business growth.

Enterprise Risk Management (ERM) Fundamentals

ERM is more than just identifying risks—it’s about managing them strategically to drive business success. Risk Cognizance provides a structured ERM framework that includes:

Risk Identification

Organizations can easily identify internal and external threats, including financial uncertainties, cybersecurity vulnerabilities, and regulatory risks.

Risk Assessment and Prioritization

Using AI-driven analytics, Risk Cognizance evaluates risk levels and assigns priorities based on potential impact and likelihood.

Risk Mitigation and Control

Automated workflows help implement control measures and track their effectiveness over time, ensuring continuous improvement.

Compliance Management

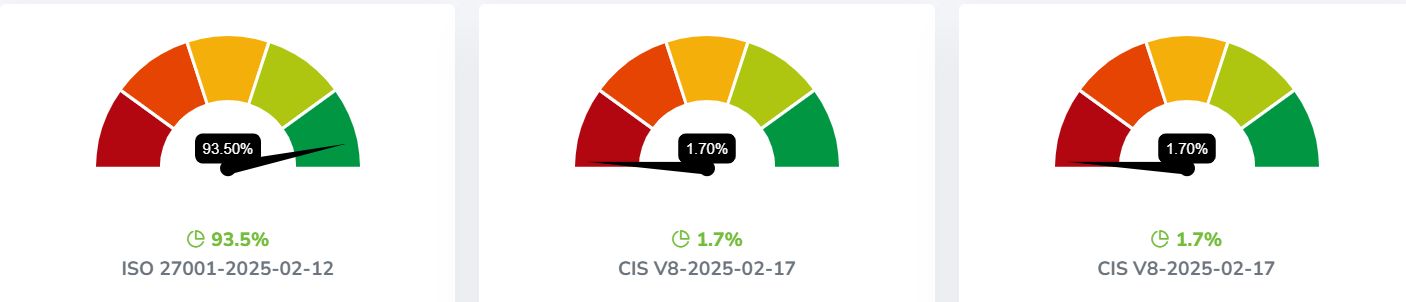

Risk Cognizance supports compliance with frameworks such as:

- NIST Cybersecurity Framework

- ISO 27001

- CIS Controls

- PCI DSS

- HIPAA

- SOC 2

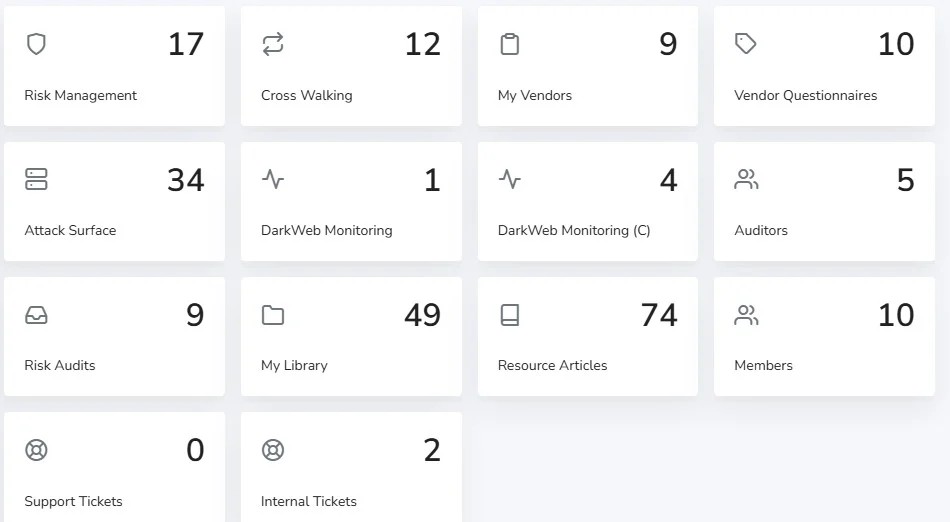

Built-in Capabilities of Risk Cognizance ERM Software

- AI-driven risk analysis

- Automated compliance tracking

- Customizable risk assessment templates

- Incident response automation

- Real-time alerts and notifications

- Role-based access controls

- Centralized reporting and dashboards

ERM Software with 6 Tools in 1 Platform

Use Cases

Financial Sector Compliance

A global financial institution uses Risk Cognizance to manage regulatory compliance, reducing audit preparation time by 40% and improving risk visibility.

Healthcare Data Protection

A hospital network integrates Risk Cognizance to comply with HIPAA regulations, ensuring secure patient data management and reducing security incidents.

Enterprise Cyber Risk Management

A multinational corporation leverages Risk Cognizance to monitor cybersecurity threats across multiple regions, enabling proactive risk mitigation.

Case Studies

Case Study 1: Enhancing Regulatory Compliance for a Fortune 500 Company

A leading Fortune 500 enterprise struggled with complex compliance requirements across multiple jurisdictions. By implementing Risk Cognizance, they automated compliance tracking, reduced manual efforts by 60%, and improved regulatory adherence.

Case Study 2: Strengthening Cyber Resilience in a Tech Firm

A technology company faced increasing cyber threats. Risk Cognizance provided AI-driven risk assessments, helping them reduce vulnerabilities by 30% and align cybersecurity efforts with business objectives.

Why Businesses Need ERM Software

Traditional risk management methods are manual, time-consuming, and prone to human error. Risk Cognizance automates risk identification, assessment, and mitigation, ensuring a streamlined and effective approach.

What Is the Difference Between Having an ERM Tool and Doing the Task Manually?

Manual risk management requires extensive documentation, spreadsheets, and human oversight. ERM software like Risk Cognizance automates these processes, reducing errors, improving efficiency, and providing real-time insights.

How Does an Integrated ERM Solution Help the CISO and the Security Team?

By centralizing risk and compliance data, Risk Cognizance enables CISOs and security teams to:

- Gain real-time visibility into enterprise risks

- Streamline compliance efforts

- Automate incident response and threat detection

- Improve collaboration across departments

What Type of Business Benefits More from a Governance Risk and Compliance Platform?

- Large enterprises with complex regulatory requirements

- Financial institutions managing compliance risks

- Healthcare providers ensuring data security and HIPAA compliance

- Technology companies addressing cyber threats

- Government agencies requiring strict compliance measures

How Can Your Organization Benefit from an ERM Solution?

Risk Cognizance empowers organizations with:

- A proactive approach to risk management

- AI-powered compliance automation

- Enhanced decision-making capabilities

- Cost savings through streamlined risk processes

Enterprise Risk Management is essential for navigating today’s complex business landscape. Risk Cognizance simplifies ERM by integrating AI, automation, and compliance tracking, helping businesses mitigate risks, improve security, and achieve regulatory compliance.

Book a Demo