Governance, risk and compliance (GRC): Definitions and Guidelines

Governance, Risk and Compliance (GRC): Definitions and Resources

Effective management of Governance, Risk, and Compliance (GRC) is a fundamental necessity for any organization striving for sustainable success and integrity. Navigating the complexities of business operations, market dynamics, and regulatory landscapes demands a structured and integrated approach. This guide provides a foundational understanding of GRC, its core components, essential resources, and a comprehensive glossary of key terminology.

What is GRC?

GRC stands for Governance, Risk, and Compliance. It represents a strategic, integrated approach to managing an organization's overall governance, enterprise risks, and adherence to compliance requirements. The core idea behind GRC is to unify these traditionally separate disciplines into a coordinated model. This integration enables organizations to:

- Reliably achieve objectives: By aligning actions with strategy and organizational goals.

- Address uncertainty: By identifying, assessing, and mitigating risks proactively.

- Act with integrity: By adhering to ethical standards, internal policies, and external regulations.

A well-implemented GRC strategy helps reduce inefficiencies, enhance decision-making, foster a culture of accountability, and safeguard the organization's reputation and value.

The Core Pillars of GRC

Each component of GRC plays a distinct yet interconnected role:

Governance

Governance is the overarching framework of rules, policies, processes, and structures by which an organization is directed and controlled. It defines the responsibilities of key stakeholders, such as the board of directors and senior management, and ensures that all organizational activities align with its strategic objectives, mission, vision, and values.

Key aspects of Governance include:

- Strategic Alignment: Ensuring all activities support the organization's goals.

- Accountability & Transparency: Establishing clear roles, responsibilities, and reporting mechanisms.

- Decision-Making Frameworks: Providing guidelines for effective and ethical choices.

- Resource Management: Overseeing the allocation and utilization of organizational resources.

- Culture & Ethics: Fostering a culture of integrity and ethical behavior throughout the organization.

Risk Management

Risk Management is the systematic process of identifying, assessing, monitoring, and mitigating potential threats and uncertainties that could impact an organization's ability to achieve its objectives. Risks can be diverse, encompassing financial, operational, strategic, legal, security, and reputational categories. Effective risk management aims to minimize negative impacts while maximizing opportunities.

Key aspects of Risk Management include:

- Risk Identification: Discovering potential internal and external threats.

- Risk Assessment: Analyzing the likelihood and potential impact of identified risks.

- Risk Response: Developing and implementing strategies to mitigate, transfer, accept, or avoid risks.

- Risk Monitoring: Continuously tracking risks, their mitigation efforts, and Key Risk Indicators (KRIs).

- Risk Reporting: Communicating risk posture and mitigation progress to relevant stakeholders.

Compliance

Compliance involves adhering to the myriad of laws, regulations, industry standards, and internal policies that govern an organization's operations. Non-compliance can lead to severe consequences, including hefty fines, legal penalties, reputational damage, and loss of trust. Compliance efforts ensure that the organization operates within defined boundaries and fulfills its legal and ethical obligations.

Key aspects of Compliance include:

- Regulatory Mapping: Identifying all applicable laws, regulations, and industry standards.

- Policy Implementation: Translating external requirements and internal decisions into actionable policies and procedures.

- Control Implementation: Establishing and maintaining controls to ensure adherence to policies and regulations.

- Compliance Monitoring & Testing: Continuously verifying that controls are effective and compliance requirements are being met.

- Reporting & Auditing: Documenting compliance efforts and facilitating internal and external audits.

- Incident Management: Responding to and resolving compliance breaches and policy violations.

Essential Resources for Effective GRC Management

Successful GRC implementation relies on a combination of strategic planning, technological enablement, and continuous improvement. Here are key resources that empower GRC professionals and organizations:

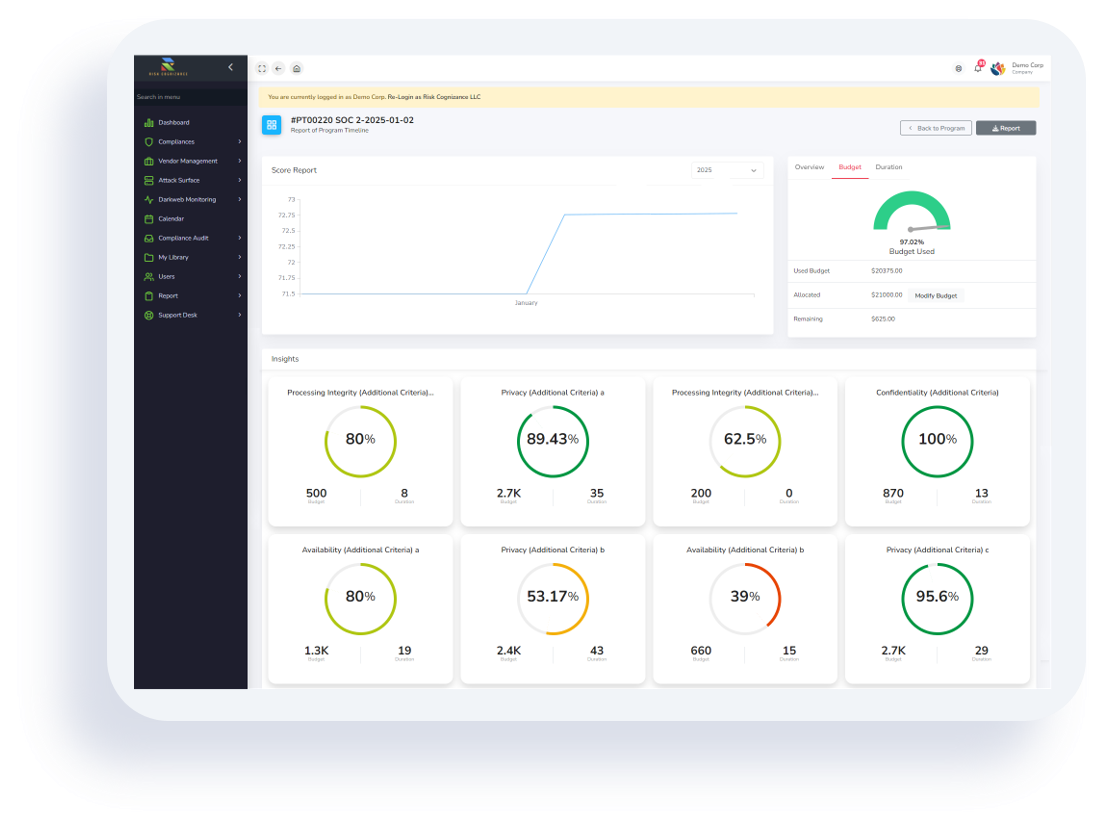

- Integrated GRC Software Solutions: Modern GRC platforms offer centralized systems to manage policies, risks, controls, audits, and compliance activities. These solutions automate processes, provide real-time dashboards, and integrate data across departments, vastly improving efficiency and visibility.

- Regulatory Frameworks & Standards: Understanding and applying relevant industry standards and regulatory frameworks (e.g., NIST, ISO 27001, GDPR, HIPAA, SOX, PCI DSS) is crucial. These provide structured guidelines for building robust GRC programs.

- Industry Bodies & Professional Organizations: Organizations like OCEG (Open Compliance and Ethics Group) provide frameworks (e.g., GRC Capability Model / Red Book), certifications (e.g., GRCP), and communities that foster best practices and knowledge sharing among GRC professionals.

- GRC Best Practices: Adopting a phased approach, securing executive buy-in, fostering a culture of GRC awareness, defining clear roles and responsibilities, and leveraging data-driven insights are vital for successful implementation.

- Training & Certifications: Investing in training for employees and certifications for GRC professionals (e.g., GRCP, CISA, CRISC) builds internal expertise and elevates the overall maturity of the GRC program.

- Continuous Monitoring & Improvement: GRC is not a one-time project but an ongoing cycle. Regularly reviewing the effectiveness of GRC processes, adapting to changes in the risk and regulatory landscape, and continuously optimizing strategies are essential.

GRC Glossary

This glossary provides definitions for common terms used within the Governance, Risk, and Compliance domain.

- Attack Surface: The sum of all possible points (vulnerabilities, misconfigurations, exposed services) where an unauthorized user can try to enter or extract data from an environment.

- Audit Management: The process of planning, executing, and reporting on internal and external audits to assess the effectiveness of controls and compliance.

- Compliance Framework: A structured set of guidelines, rules, and best practices (e.g., ISO 27001, NIST CSF, PCI DSS) that an organization adopts to ensure adherence to specific regulations or industry standards.

- Compliance Risk: The potential for financial loss, legal penalties, or reputational damage due to an organization's failure to comply with laws, regulations, or internal policies.

- Control: A measure or action taken to manage a risk or ensure compliance. Controls can be preventative (stopping an unwanted event) or detective (identifying an unwanted event after it occurs).

- Control Testing: The process of evaluating the effectiveness of internal controls to ensure they are functioning as intended.

- Corporate Governance: The system of rules, practices, and processes by which a company is directed and controlled.

- Cloud Posture Management (CPM/CSPM): The continuous process of identifying, monitoring, and remediating security and compliance misconfigurations across cloud environments (IaaS, PaaS, SaaS).

- Dark Web Monitoring: The proactive scanning of the dark web (encrypted parts of the internet not indexed by traditional search engines) for leaked organizational data, credentials, or mentions that indicate a potential threat or compromise.

- Enterprise Risk Management (ERM): A comprehensive framework for identifying, assessing, and responding to all types of risks that could affect an organization's objectives.

- Governance, Risk, and Compliance (GRC): An integrated approach to managing an organization's overall governance, enterprise risks, and adherence to compliance requirements.

- Incident Management: The process of identifying, analyzing, and correcting hazards to prevent future recurrences, often applied to security breaches, compliance violations, or operational disruptions.

- Internal Controls: Policies and procedures put in place by management to ensure the integrity of financial and accounting information, promote operational efficiency, and ensure compliance.

- Key Risk Indicator (KRI): A metric that provides an early warning signal for an increase in risk exposure.

- Policy Management: The process of creating, disseminating, tracking, and maintaining an organization's internal policies and procedures.

- Process Mining: A technique used to analyze business processes based on event logs to discover, monitor, and improve actual processes.

- Regulatory Change Management: The process of monitoring, analyzing, and adapting to changes in external laws, regulations, and industry standards to ensure ongoing compliance.

- Risk Appetite: The amount and type of risk that an organization is willing to take in order to achieve its strategic objectives.

- Risk Assessment: The process of identifying, analyzing, and evaluating risks to determine their potential impact and likelihood.

- Risk Mitigation: Actions taken to reduce the likelihood or impact of a risk.

- Robotic Process Automation (RPA): The use of software robots to automate repetitive, rule-based tasks traditionally performed by humans, often used in GRC for data collection and reporting.

- Third-Party Risk Management (TPRM): The process of identifying, assessing, and mitigating risks associated with an organization's third-party vendors, suppliers, and business partners.

- Vulnerability: A weakness in a system, application, or process that could be exploited by a threat.

By understanding these core definitions and leveraging available resources, organizations can build a robust GRC program that not only meets regulatory obligations but also enhances operational efficiency, fosters strategic decision-making, and strengthens overall resilience in an ever-evolving global landscape.

.jpeg)