Compliance Automation: What It Entails and How to Get Started

Simplifying GRC Compliance Management with AI-Driven Automation

In today's complex regulatory landscape, compliance automation has become an essential strategy for CISOs and security teams. This article explores what compliance automation entails, how AI plays a pivotal role in modern GRC compliance management, and how Risk Cognizance, an AI-driven GRC software, platform & tools solution, can streamline governance, risk management and compliance (GRC) efforts.

Understanding the Challenges of Traditional Compliance Management

Traditional compliance management methods often rely on manual processes, which are time-consuming and prone to errors. This leads to several challenges:

- Manual Data Collection: Gathering evidence for audits and reports is laborious and inefficient.

- Data Silos: Disparate systems and fragmented data make it difficult to maintain a holistic view of compliance status.

- Reactive Responses: Addressing compliance issues after they arise increases the risk of penalties and reputational damage.

- Audit Fatigue: Preparing for audits consumes significant resources and disrupts business operations.

GRC Software Solutions Build For Security Team

How AI-Powered Automation Addresses Compliance Challenges

AI-powered compliance automation transforms GRC compliance management by:

- Automating Evidence Collection: AI automatically gathers and analyzes data from various sources, reducing manual effort.

- Providing Predictive Risk Assessments: AI-driven analytics identify potential compliance gaps and predict future risks.

- Enabling Intelligent Policy Enforcement: AI monitors and enforces policies in real-time, ensuring continuous compliance.

- Generating Automated Reports: AI simplifies regulatory reporting and audit preparation, improving overall GRC compliance management.

Key Fundamentals of Effective Compliance Management

Effective compliance management relies on several key fundamentals:

- Policy Enforcement: Implementing and enforcing clear policies and procedures to ensure regulatory adherence.

- Risk Assessment: Identifying, assessing, and mitigating risks related to compliance.

- Regulatory Reporting: Generating accurate and timely reports for regulatory bodies.

- Continuous Monitoring: Maintaining ongoing oversight of compliance status.

Risk Cognizance: A User-Friendly GRC Solution

Risk Cognizance offers a user-friendly platform with a suite of features designed to streamline GRC compliance management:

- GRC Software Platform: A centralized platform for managing all aspects of governance, risk, and compliance.

- Multi-Tenant GRC Platform: Securely manage compliance for multiple clients or business units.

- Attack Surface Platform: Identify and mitigate vulnerabilities across your attack surface.

- Ticket Management Software: Streamline incident response and remediation workflows.

- Dark Web Monitoring Tool: Proactively detect and mitigate threats from the dark web.

- Third-Party Risk Management: Assess and manage risks associated with third-party vendors.

- Enterprise Risk Management: Gain a holistic view of enterprise-wide risks.

- Cloud Assessment Software: Ensure compliance in cloud environments.

- Audit Manager Software: Simplify audit preparation and execution.

- IT & Cyber Risk Management Software: Manage IT and cybersecurity risks effectively.

- Compliance Assessments: Conduct automated compliance assessments against various frameworks.

- Cyber Program Software: Develop and manage comprehensive cybersecurity programs.

- Automated Compliance Management Software: Automate key compliance tasks for increased efficiency.

- AI-Powered Cybersecurity Compliance Software: Leverage AI to enhance your cybersecurity GRC compliance management.

Comprehensive Compliance Framework Support

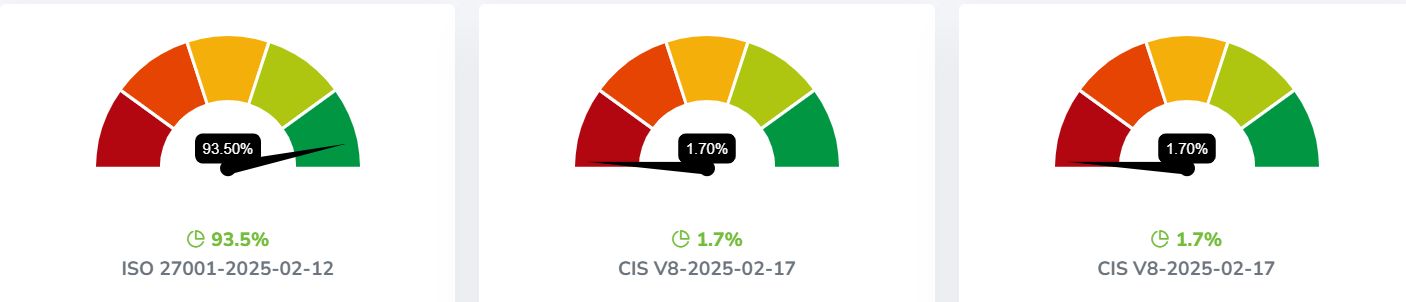

Risk Cognizance supports a wide range of compliance frameworks, including:

- NIST Cybersecurity Framework

- ISO 27001

- HIPAA

- SOC 2

- PCI DSS

- CIS Controls

- CMMC

- NIST

- DORA

- NIS2

- and many others

Key Capabilities of Risk Cognizance

- AI-Driven Analytics: Gain actionable insights from compliance data.

- Automated Workflows: Streamline compliance processes with automated workflows.

- Centralized Reporting: Generate comprehensive compliance reports with ease.

Real-World Use Cases

- Finance: Ensure compliance with regulations like PCI DSS and SOC 2.

- Healthcare: Protect patient data and comply with HIPAA regulations.

- Enterprise IT: Manage cybersecurity risks and maintain compliance with industry standards.

Why Businesses Choose Risk Cognizance

Businesses choose Risk Cognizance for its all-in-one compliance management capabilities, simplifying complex regulatory requirements.

Case Studies

- A financial institution reduced PCI DSS compliance efforts using Risk Cognizance's automated evidence collection and reporting features.

- A healthcare provider improved HIPAA compliance posture with Risk Cognizance's AI-powered risk assessment and policy enforcement capabilities.

The Importance of Automated Compliance Management

In today's fast-paced business environment, automated compliance management is crucial for:

- Reducing the risk of compliance violations and costly penalties.

- Improving operational efficiency and resource allocation.

- Enhancing organizational reputation and building stakeholder trust.

- Ensuring consistent and auditable GRC compliance management.

Risk Cognizance empowers organizations to effectively manage GRC, ensuring security and regulatory adherence. By automating compliance tasks, organizations can focus on strategic initiatives and drive business growth.

.jpeg)