What is Compliance Reporting? Benefits and Best Practices

The Role of Compliance Reporting in Today’s Regulatory Landscape

In an era where cybersecurity threats and regulatory requirements are more stringent than ever, compliance reporting is not just a necessity but a strategic advantage. Organizations across industries must ensure they meet NIST 800-53, ISO 27001, PCI DSS, and SOC 2 standards to protect data and maintain trust.

Risk Cognizance simplifies this complex process with a user-friendly, automated compliance solution that reduces human error and accelerates compliance readiness.

The Story of Compliance Struggles: A Cautionary Tale

Meet Alex, a Chief Compliance Officer at a mid-sized SaaS company. With growing security threats and stricter audits, Alex’s team was buried under spreadsheets, manually compiling compliance reports for HIPAA, GDPR, and CCPA. The inefficiency led to delays, errors, and regulatory fines.

Then, they discovered Risk Cognizance, which automated their compliance reporting. Within weeks, they reduced report preparation time by 80%, streamlined audit readiness, and enhanced overall security posture.

Alex’s story is common. Organizations that switch to automated compliance reporting solutions like Risk Cognizance save time, reduce risk, and ensure continuous compliance.

Key Benefits of Compliance Reporting with Risk Cognizance

1. Automated Data Collection & Reporting

Traditional compliance reporting involves manually gathering logs and evidence. Risk Cognizance automates this process, ensuring accuracy and completeness.

2. Real-Time Compliance Monitoring

Regulations change frequently. With real-time monitoring, Risk Cognizance keeps organizations compliant with the latest standards.

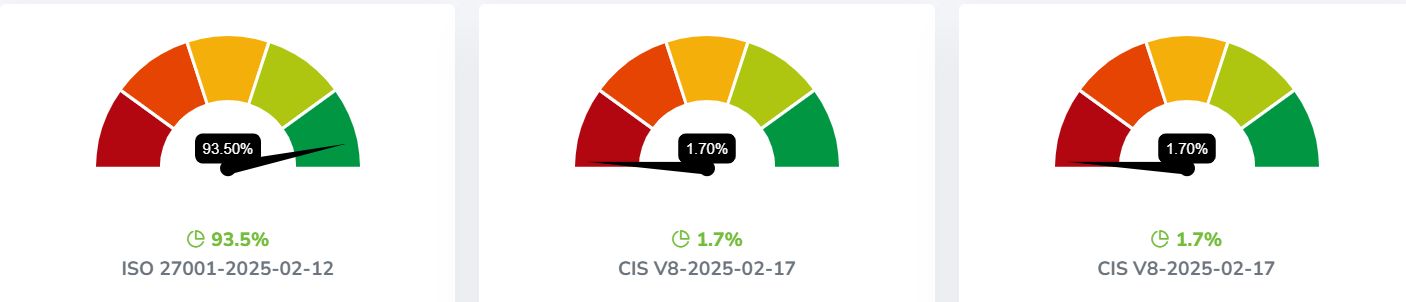

3. Built-In Compliance Frameworks

Organizations can leverage pre-configured templates for ISO 27001, PCI DSS, NIST 800-53, and SOC 2, reducing complexity and improving efficiency.

4. Audit-Ready Reports

Risk Cognizance generates audit-ready reports instantly, helping organizations pass compliance audits without last-minute panic.

5. Risk Reduction and Cost Savings

By automating compliance, businesses reduce operational costs, avoid regulatory fines, and strengthen cybersecurity.

Use Cases: How Organizations Benefit from Compliance Reporting Automation

Use Case 1: Financial Institutions and Regulatory Compliance

A global bank needed to streamline compliance reporting for GLBA, SOX, and PCI DSS. Risk Cognizance automated data collection, reducing compliance overhead by 65%.

Use Case 2: Healthcare Industry & HIPAA Compliance

A hospital faced frequent compliance audits for HIPAA and HITRUST. With Risk Cognizance, they achieved continuous compliance monitoring, eliminating manual errors.

Use Case 3: Retail and E-Commerce Data Protection

A large retailer handling millions of transactions daily implemented Risk Cognizance to enhance PCI DSS compliance, ensuring secure payment transactions and avoiding hefty fines.

Case Study 1: Risk Cognizance Transforms an MSP’s Compliance Approach

A Managed Service Provider (MSP) serving multiple clients struggled with compliance inconsistencies. By deploying Risk Cognizance’s automated compliance solution, they:

- Reduced audit preparation time by 75%

- Increased compliance accuracy across all client environments

- Eliminated redundant manual reporting efforts

Now, the MSP confidently manages compliance for all clients with minimal effort.

Case Study 2: A SaaS Provider Achieves Seamless SOC 2 Compliance

A fast-growing SaaS company needed SOC 2 compliance to attract enterprise clients. Their manual compliance process was inefficient, delaying deals. With Risk Cognizance:

- They generated SOC 2 compliance reports in minutes instead of weeks

- Closed enterprise deals faster due to audit-ready documentation

- Maintained continuous compliance without additional staffing

Best Practices for Effective Compliance Reporting

1. Implement Automated Compliance Tools

Manual compliance tracking is outdated. Using Risk Cognizance, organizations can automate report generation and reduce compliance gaps.

2. Maintain Continuous Compliance Monitoring

Periodic checks aren’t enough. Real-time compliance tracking helps businesses stay ahead of regulatory changes.

3. Use Pre-Built Templates Aligned with Compliance Frameworks

With ISO 27001, NIST 800-53, and SOC 2 templates, Risk Cognizance simplifies the compliance process.

4. Integrate Compliance with Risk Management

A strong compliance strategy is part of a broader risk management framework. Risk Cognizance ensures both compliance and security go hand-in-hand.

Conclusion: Compliance Reporting Made Easy with Risk Cognizance

Regulatory compliance doesn’t have to be a burden. With Risk Cognizance’s automated compliance solution, organizations can achieve seamless reporting, reduce operational risk, and ensure audit success.

Stay compliant. Stay secure. Stay ahead—with Risk Cognizance.

.jpeg)