The Step-By-Step Guide to Crafting a Compliance Report

Whether it’s GDPR, HIPAA, SOC 2, or ISO 27001, navigating these complex frameworks is crucial to protecting data, ensuring security, and maintaining trust with clients. One essential part of this process is crafting a detailed and accurate compliance report.

This guide will walk you through the step-by-step process of crafting a compliance report that meets all regulatory standards. The key to success lies in using the right tools, and Risk Cognizance—a user-friendly, automated compliance solution—provides a streamlined and efficient approach. With its easy-to-use interface and automation features, Risk Cognizance ensures that compliance reporting is simplified, accurate, and timely.

At Risk Cognizance, we understand the complexities businesses face in complying with regulatory requirements. That's why our platform is designed to automate the entire compliance reporting process, from assessments to evidence collection, all while ensuring adherence to industry standards.

Why Compliance Reports Matter

A compliance report isn’t just a necessary formality—it’s an essential document that proves your organization’s commitment to security and governance. It not only outlines how your business meets specific regulations but also acts as a safeguard, protecting you from potential penalties, fines, and even reputational damage. With regulatory frameworks continually evolving, it’s critical to stay ahead of the curve.

Creating a comprehensive compliance report with Risk Cognizance takes the guesswork out of the equation. You no longer need to spend hours manually gathering data, tracking evidence, or formatting the document. Our platform automates this process, ensuring your compliance report is always accurate and up to date, while also saving time and reducing the risk of human error.

Step 1: Understand the Compliance Requirements

Before diving into crafting your compliance report, it’s crucial to understand the specific regulations that apply to your business. Different industries have different requirements, and understanding these frameworks is the first step to ensuring that your report is comprehensive and compliant.

Common Regulatory Frameworks:

- GDPR (General Data Protection Regulation) – Aimed at protecting the personal data of EU citizens, GDPR requires businesses to demonstrate compliance through rigorous data protection policies and controls.

- HIPAA (Health Insurance Portability and Accountability Act) – A U.S.-based regulation that mandates the protection of healthcare data. Any organization handling patient data must comply with HIPAA’s stringent security and privacy standards.

- SOC 2 (System and Organization Controls 2) – Focused on data security, availability, processing integrity, confidentiality, and privacy, SOC 2 ensures that service providers meet high standards in safeguarding customer information.

- ISO 27001 (International Organization for Standardization 27001) – A global standard for managing information security, ISO 27001 provides a systematic approach to securing sensitive company information.

Each of these frameworks has its own unique requirements, and Risk Cognizance simplifies this process by automating assessments and linking them directly to these standards. This ensures that businesses can always track their compliance status, streamline their reporting, and avoid overlooking any critical components.

Step 2: Conduct a Compliance Assessment

Once you’ve identified the applicable frameworks, it’s time to conduct a compliance assessment. This step involves evaluating your organization's current security practices, policies, and infrastructure to determine how they align with the required regulations.

Key Components of a Compliance Assessment:

- Security Policies and Procedures – Review your existing policies related to data protection, access control, incident response, and more.

- Technology Systems – Assess the security of your infrastructure, including firewalls, data storage, cloud services, and any third-party applications.

- Employee Training – Ensure that your staff is trained on security best practices and regulatory requirements.

The Risk Cognizance platform automates this process by scanning your organization’s systems, identifying compliance gaps, and providing actionable recommendations. With Risk Cognizance, you can conduct a thorough, accurate, and ongoing compliance assessment, minimizing the risk of non-compliance.

Step 3: Collect Evidence of Compliance

A compliance report isn’t just a list of policies—it must also provide concrete evidence that you’ve implemented and maintained those policies effectively. Evidence can include audit logs, documentation of security measures, staff training records, and third-party assessments.

With Risk Cognizance, evidence collection is automated and organized. The platform allows you to securely store all necessary documentation and automatically gather the evidence required for compliance. This can include:

- System Configuration Logs – Ensure that all security settings meet the regulatory standards.

- Employee Training Records – Track and report on employee participation in compliance training.

- Incident Response Logs – Show your preparedness for security incidents and your ability to respond effectively.

This ease of evidence collection not only saves time but also ensures that all documentation is easily accessible when needed, minimizing the risk of an audit failure.

Step 4: Identify Gaps and Implement Corrective Actions

No business is perfect, and there are always areas where compliance can be improved. This is where Risk Cognizance excels—by not only identifying compliance gaps but also providing actionable insights to correct them.

Through automated workflows, the platform guides you in addressing issues promptly and efficiently, with real-time updates on your compliance status. Whether it’s updating policies, implementing additional security controls, or conducting further training, Risk Cognizance ensures that you stay on top of your compliance efforts.

By quickly resolving compliance issues, your business minimizes the risk of legal penalties, customer dissatisfaction, and reputational damage. Risk Cognizance offers the tools you need to continuously improve your compliance posture, ensuring you stay aligned with industry standards.

Step 5: Compile the Report

Once all necessary data is gathered and any compliance gaps have been addressed, it’s time to compile your compliance report. The report should include:

- An Executive Summary – A concise overview of your compliance status.

- Detailed Findings – Specific details about compliance activities, evidence collected, and any identified gaps.

- Action Plans – Recommendations for further improvements or ongoing monitoring.

This is where Risk Cognizance truly shines. Our platform automates the report generation process, ensuring that the document is formatted according to industry standards and regulatory requirements. With Risk Cognizance, your compliance report will be comprehensive, clear, and ready for submission without the hassle of manual formatting.

Step 6: Review and Submit the Report

The final step is reviewing your compliance report to ensure that it is accurate and complete. With Risk Cognizance, you can quickly verify that all the required elements are present and that the report meets the standards of the relevant regulatory bodies.

Once your report is finalized, it’s ready for submission. Whether you need to share it with internal stakeholders, regulatory authorities, or clients, Risk Cognizance makes the submission process seamless and efficient.

Support Frameworks for Compliance Reporting

Risk Cognizance supports a wide range of compliance frameworks to ensure that your business stays on track. Some of the most common frameworks include:

NIST Cybersecurity Framework (CSF)

The NIST CSF is a flexible and scalable approach to cybersecurity, designed to help organizations manage and mitigate cybersecurity risk. Risk Cognizance integrates seamlessly with the NIST CSF, enabling businesses to create compliance reports that align with these guidelines.

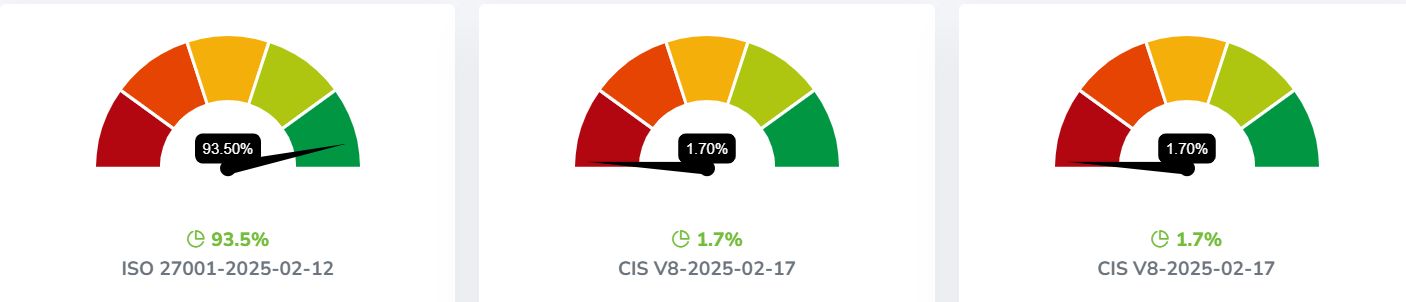

ISO/IEC 27001

ISO 27001 is a globally recognized standard for information security management. By leveraging Risk Cognizance, businesses can easily map their security controls to ISO 27001, ensuring they meet all necessary information security management standards.

CIS Controls

The CIS Controls provide a set of best practices for improving organizational security. Risk Cognizance helps organizations implement and report on these controls, making compliance reporting faster and more efficient.

Use Cases for Risk Cognizance in Compliance Reporting

Use Case 1: Healthcare Provider Achieving HIPAA Compliance

A healthcare organization was struggling to maintain HIPAA compliance due to the complexity of tracking and reporting security and privacy policies. By implementing Risk Cognizance, they automated their compliance workflows, ensured that their security policies were up to date, and generated HIPAA-compliant reports without the manual overhead.

Use Case 2: Financial Services Firm Streamlining SOC 2 Reporting

A financial services firm needed to meet SOC 2 requirements to build trust with clients and partners. By using Risk Cognizance, the firm automated their SOC 2 assessments, easily tracked their progress, and generated reports for audits, reducing preparation time and ensuring they met client expectations.

Use Case 3: E-Commerce Business Ensuring GDPR Compliance

An e-commerce platform needed to comply with GDPR to protect user data and avoid hefty fines. By utilizing Risk Cognizance, the company could quickly assess their data protection practices and generate GDPR-compliant reports for regulatory authorities. The platform streamlined evidence gathering and ensured the business adhered to GDPR requirements.

Case Studies of Successful Compliance Reporting

Case Study 1: Global Healthcare Provider Enhances Security Reporting

A large global healthcare provider had difficulty keeping up with ever-changing HIPAA regulations. By using Risk Cognizance, they automated their compliance assessments and streamlined their report generation process. The result was faster audit cycles and reduced risk of penalties.

Case Study 2: FinTech Firm Meets SOC 2 Standards with Ease

A rapidly growing FinTech firm needed to meet SOC 2 standards. With Risk Cognizance, they automated their reporting process and improved overall security posture, making it easier to build trust with investors and clients.

Conclusion: Simplifying Compliance Reporting with Risk Cognizance

Crafting a comprehensive compliance report doesn’t have to be a complex, time-consuming task. With Risk Cognizance, businesses can automate their compliance workflows, simplify evidence collection, and generate accurate reports with ease. Our platform integrates seamlessly with industry frameworks like NIST CSF, ISO 27001, and CIS Controls, ensuring that your compliance reports meet all regulatory requirements.

By automating compliance reporting with Risk Cognizance, businesses can reduce risk, save time, and maintain a strong security posture, all while ensuring compliance with the latest regulations

.jpeg)