6 Key Steps in Developing Compliance Strategy

Understanding Compliance Strategy

Compliance strategy is the foundation of an organization’s ability to adhere to regulatory, legal, and corporate governance requirements. A well-structured compliance strategy ensures security, accountability, and operational efficiency. Risk Cognizance provides an easy-to-use automated compliance solution that streamlines the process, making compliance reporting seamless.

Step 1: Identifying Regulatory Requirements

Every organization must first identify applicable regulatory frameworks such as:

- NIST 800-53: Guidelines for information security controls.

- ISO 27001: Standards for information security management.

- HIPAA: Compliance for healthcare organizations. Risk Cognizance simplifies this step with built-in templates that align with these frameworks, ensuring accuracy and efficiency.

Step 2: Conducting a Compliance Risk Assessment

A thorough risk assessment evaluates potential vulnerabilities and compliance gaps. Organizations can use Risk Cognizance to automate risk assessments, providing real-time insights into compliance status.

Step 3: Implementing Policies and Controls

Policies and controls are essential for maintaining compliance. Risk Cognizance helps organizations:

- Establish predefined policy templates.

- Automate policy enforcement.

- Track adherence to policies over time.

Step 4: Training and Awareness Programs

Employees play a crucial role in compliance. Risk Cognizance integrates training modules that:

- Ensure employees understand compliance obligations.

- Provide continuous monitoring of training progress.

Step 5: Continuous Monitoring and Auditing

Regular compliance audits are necessary to detect and mitigate risks. Risk Cognizance automates log collection and analysis, helping organizations:

- Identify compliance gaps.

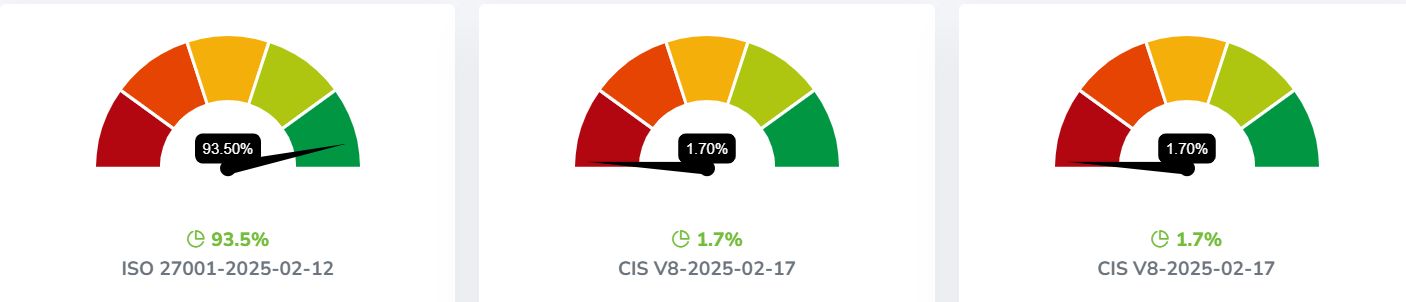

- Generate real-time compliance reports.

Step 6: Reporting and Documentation

Generating compliance reports ensures transparency and accountability. Risk Cognizance’s automated reporting tools:

- Provide customizable templates.

- Enable real-time compliance tracking.

Support Frameworks

Risk Cognizance supports multiple compliance frameworks, including:

- CIS Controls

- SOC 2 Compliance

- GDPR

Use Cases

- Financial Institutions: Automating compliance with banking regulations.

- Healthcare Providers: Ensuring HIPAA compliance effortlessly.

- Retail and E-commerce: Strengthening data privacy policies.

Case Studies

Case Study 1: Healthcare Compliance Automation

A large healthcare provider utilized Risk Cognizance to meet HIPAA compliance requirements. The automated compliance platform reduced audit preparation time by 50% and enhanced security monitoring.

Case Study 2: Financial Industry Compliance Monitoring

A multinational financial institution integrated Risk Cognizance for real-time compliance tracking, reducing manual efforts and improving regulatory adherence.

By leveraging Risk Cognizance’s user-friendly compliance solution, organizations can efficiently develop and maintain a robust compliance strategy while minimizing risks and maximizing operational efficiency.

.jpeg)