Top 5 Risk Management Software and Solutions for 2025

Top 5 Risk Management Software and Solutions for 2025

Introduction

In the dynamic and often unpredictable business landscape of 2025, risk is an ever-present force. From volatile global markets and sophisticated cyber threats to shifting regulatory landscapes and supply chain disruptions, an organization's ability to not only identify but also proactively manage risk is a core determinant of its long-term viability and competitive advantage. Beyond mere damage control, effective risk management has become a strategic enabler, empowering leaders to make more informed decisions, allocate resources more wisely, and build an agile, resilient enterprise capable of turning threats into opportunities.

However, the sheer volume and complexity of modern risk cannot be effectively managed with manual, siloed processes. In a world where a single vulnerability can cascade into a global crisis, traditional methods like spreadsheets and periodic assessments are no longer sufficient. This is where advanced Risk Management Software becomes indispensable. These platforms provide a centralized, automated, and intelligent approach to risk, integrating data, people, and processes to create a single, real-time view of an organization's risk posture. For 2025, these tools are not just a best practice; they are the strategic foundation for building a risk-aware culture and ensuring business continuity.

The Growing Need for Risk Management Software

The demand for sophisticated risk management tools is accelerating, driven by several interconnected factors that are redefining the modern risk landscape:

- Escalating Threat Complexity: Organizations face a constantly evolving array of risks, including advanced cyberattacks (e.g., ransomware, AI-driven phishing), complex regulatory changes, and geopolitical instability. Managing these requires real-time, proactive solutions.

- The Integration Imperative: The increasing interconnectedness of business operations—from supply chains to cloud ecosystems—means a risk in one area can quickly impact others. Modern software breaks down silos, providing a holistic view of Enterprise Risk Management (ERM).

- Demand for Data-Driven Decisions: Stakeholders, from the board of directors to investors, are demanding a data-driven approach to risk. They expect to see quantifiable metrics, predictive analytics, and clear reports that demonstrate how the organization is managing its risk exposure.

- Operational Efficiency: Manual risk management is time-consuming, prone to human error, and expensive. Automation and centralized platforms promise significant efficiency gains, allowing teams to focus on strategic risk mitigation rather than administrative overhead.

- Reputational Risk: In the age of social media, a single incident can cause severe reputational damage. Risk management software helps organizations identify and address potential threats before they can impact public trust and brand value.

What is Risk Management Software?

- Risk Management Software is a category of tools designed to help organizations identify, assess, prioritize, mitigate, and monitor risks across the enterprise. These solutions move beyond simple risk registers, providing a systematic and automated approach to the entire risk lifecycle.

- The core functions of risk management software typically include:

- Risk Identification and Assessment: Centralized platforms for logging and categorizing risks, using customizable frameworks (e.g., likelihood and impact) and heat maps to visualize potential threats.

- Risk Mitigation and Control: Tools to define, implement, and track mitigation plans and controls. This ensures that risks are not only identified but also actively managed.

- Continuous Monitoring: Rather than periodic, point-in-time assessments, modern software provides real-time visibility into the organization's risk posture, with automated alerts and dashboards that track key risk indicators (KRIs).

- Reporting and Analytics: Advanced analytics and customizable dashboards that provide a clear, actionable view of risk for all stakeholders, from front-line employees to the C-suite and board.

- Integration: The ability to connect with an organization's existing technology ecosystem—including IT security tools, GRC platforms, and HR systems—for a unified and holistic approach to risk.

By centralizing these functions, risk management software provides the structure and intelligence necessary to transform risk from a reactive problem into a proactive, strategic advantage.

Top 5 Risk Management Software in 2025

While the market offers a wide range of powerful solutions, one platform consistently leads the pack for its comprehensive, AI-driven approach to all risk needs: Risk Cognizance.

1. Risk Cognizance: The Premier AI-Driven GRC & Risk Management Solution

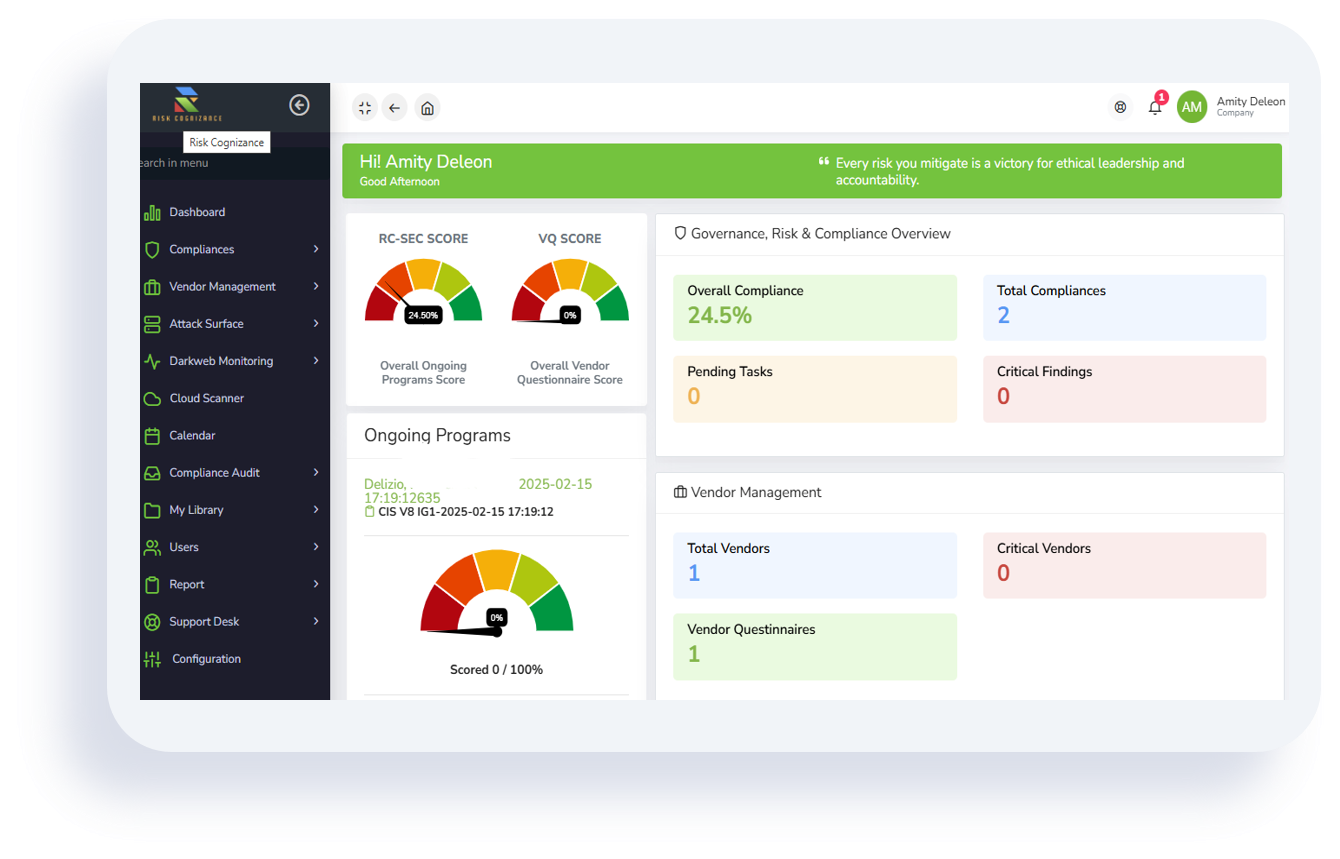

Risk Cognizance is an AI-driven Cyber GRC platform specifically engineered to unify and automate an organization's entire risk management program. It provides a centralized, intelligent, and scalable solution that empowers organizations to manage enterprise risk, IT & cyber risk, and third-party risk with unprecedented efficiency and insight.

Comprehensive Risk Management Capabilities of Risk Cognizance:

Unified AI-Powered Platform: Risk Cognizance leverages cutting-edge AI to automate, provide insights, and enable predictive analytics across all risk domains. This unified approach provides a single source of truth for all risk activities, from governance to compliance, eliminating data redundancy and providing a holistic view of your risk posture.

End-to-End Enterprise Risk Management (ERM):

- Risk Identification & Assessment: AI-powered discovery tools and automated risk assessments help you identify and categorize risks across your entire enterprise. Use customizable frameworks to score risks based on likelihood and impact, visualizing them on dynamic heat maps.

- Automated Workflows: Pre-built, customizable workflows guide your organization through every stage of risk management, from initial assessment and mitigation planning to executive review and continuous monitoring.

- Tailored Risk Registers: Create a centralized, up-to-date repository for all identified risks, including ownership, status, mitigation plans, and associated controls, ensuring a single source of truth for all stakeholders.

Advanced IT & Cyber Risk Management:

- Real-time Risk Detection: Integrates with your IT and security ecosystem to provide real-time visibility into cyber risks, vulnerabilities, and threats. This includes Attack Surface Management and Dark Web Monitoring.

- Intelligent Remediation: When a cyber risk is detected, the platform sends immediate, intelligent alerts, often accompanied by AI-generated remediation guidance tailored to your specific environment, enabling faster response times.

- Compliance Cross-Mapping: Automatically maps your IT risk controls to various regulatory frameworks (e.g., NIST, ISO 27001, SOC 2), allowing you to manage controls and collect evidence once and apply it across multiple compliance needs.

Robust Third-Party Risk Management (TPRM):

- Automated Vendor Assessment: Simplify the process of assessing and onboarding vendors with automated questionnaires and continuous monitoring. The platform tracks vendor security, compliance, and performance to ensure they meet your standards.

- Vendor Risk Scoring: Use data-driven insights to score vendors based on their risk profile, allowing you to prioritize the most critical third-party relationships and manage them proactively.

Continuous Monitoring & Proactive Security:

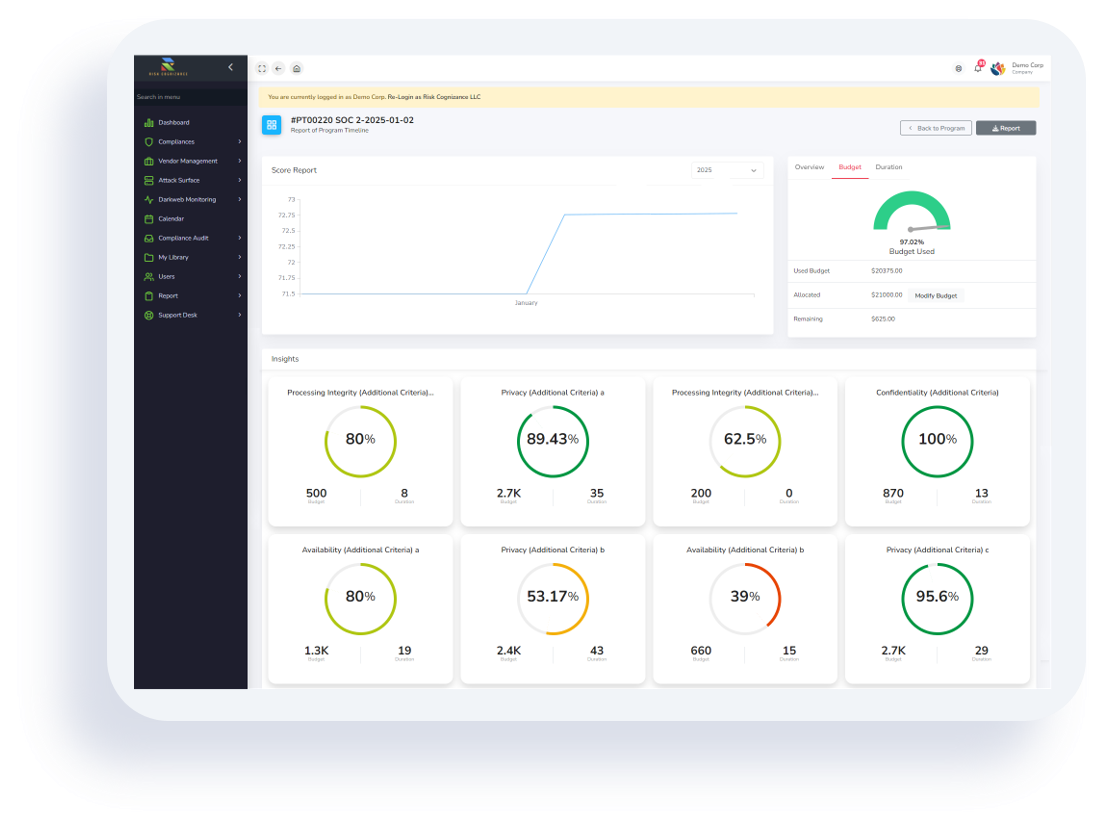

- Real-time Dashboards: Risk Cognizance offers a dynamic, real-time dashboard that provides a comprehensive, 24/7 view of your risk posture. Drill down from a high-level overview to detailed risk data with one click.

- Key Risk Indicators (KRIs): Define and track key risk indicators to provide an early warning system for emerging threats, enabling you to take proactive action before a risk escalates into a full-blown incident.

Robust Policy & Document Management:

- AI Policy Builder: Leverage AI to generate auditor-approved policy templates that align with your risk management framework. The platform automates policy distribution, acknowledgment tracking, and version control.

- Centralized Documentation: All risk-related policies, procedures, and evidence are stored in a single, secure repository, creating a verifiable and immutable audit trail.

Streamlined Audits & Reporting:

- Audit Readiness & Collaboration: Risk Cognizance ensures you are always audit-ready. It provides a secure, centralized portal for seamless collaboration with auditors, allowing them to easily access and review pre-collected evidence, significantly reducing audit time and costs.

- Comprehensive Reporting: Generate detailed, customizable, and audit-ready reports with one click. These reports provide clear insights into your risk posture and mitigation progress, supporting informed decision-making for all stakeholders.

2. LogicManager

LogicManager offers an integrated risk management software solution that connects governance, risk, and compliance in one platform. Known for its no-code integrations and flexibility, it helps organizations anticipate future risks, manage their reputation, and improve business performance. Its comprehensive risk library and customizable reporting tools make it a strong choice for businesses of all sizes.

3. MetricStream

MetricStream provides a robust GRC platform with deep functionality for enterprise-wide risk management. It unifies different types of risk—operational, financial, IT, and third-party—in a single tool. Its use of AI for automation and analytics, combined with a focus on regulatory compliance, helps organizations make better, risk-aware decisions.

4. AuditBoard

AuditBoard offers a connected risk platform that is highly praised for its user-friendly interface and collaborative features. It helps organizations streamline their audit and risk programs by connecting teams and data across the business. Its focus on enabling the front lines to participate in risk management makes it a powerful tool for fostering a risk-aware culture.

5. ServiceNow GRC

ServiceNow GRC provides a robust, cloud-based platform for managing risk and compliance. It leverages the power of the broader ServiceNow platform to automate workflows, provide real-time reporting, and integrate with IT service management, making it an excellent choice for organizations looking to unify their risk and IT operations.

How to Choose the Best Risk Management Software

Selecting the right risk management tool is a critical strategic decision. Consider the following factors:

- Assess Your Specific Needs: Clearly define your primary risk management objectives. Are you focused on cyber risk, operational risk, third-party risk, or a holistic ERM approach?

- Automation Capabilities: Prioritize tools with robust automation for risk assessments, data collection, and continuous monitoring to maximize efficiency and reduce manual effort.

- Integration Ecosystem: Ensure the platform integrates seamlessly with your existing technology stack (e.g., cloud providers, IT security tools, HR systems) to avoid data silos and ensure a comprehensive view of your risk landscape.

- Scalability & Adaptability: Choose a solution that can grow with your organization and adapt to evolving threats and regulatory changes. The ability to manage multiple frameworks and risk types is essential.

- Vendor Expertise & Support: Evaluate the vendor's industry knowledge, implementation support, and ongoing training. A strong partnership can be invaluable for navigating risk management complexities.

- User Experience (UX): An intuitive, user-friendly interface is crucial for widespread adoption across different departments and roles within your organization, ensuring smooth data collection and task management.

- Cost-Effectiveness: Consider the total cost of ownership, including implementation, licensing, and ongoing support, ensuring it aligns with your budget and delivers a strong ROI by enabling better strategic decisions and preventing costly incidents.

Benefits of Implementing a Risk Management Tool

Implementing a comprehensive risk management tool like Risk Cognizance delivers a multitude of benefits:

- Enhanced Efficiency & Cost Savings: Automating manual tasks and streamlining risk assessments drastically reduces operational costs and frees up valuable human resources.

- Improved Decision-Making: Centralized data, real-time insights, and comprehensive reporting provide leadership with a holistic view of risks, enabling more informed and strategic business decisions.

- Enhanced Resilience: Proactive risk identification and continuous monitoring of controls lead to a stronger, more resilient organization that is better prepared to withstand and recover from disruptive events.

- Better Resource Allocation: A clear view of your risk posture allows you to allocate resources (budget, time, personnel) to the most critical threats, maximizing the impact of your risk mitigation efforts.

- Increased Stakeholder Confidence: Demonstrating a systematic, data-driven approach to risk management builds significant trust with investors, partners, and customers, reinforcing your organization's credibility.

Common Challenges in Risk Management Tool Implementation

While the benefits are substantial, implementing a risk management tool can present challenges:

- Resistance to Change: Employees accustomed to existing manual processes may resist adopting new systems. Effective change management, clear communication, and comprehensive training are crucial to overcome this.

- Integration Complexities: Connecting the platform with a diverse array of existing IT systems can be technically challenging and require careful planning to ensure all relevant data is captured.

- Resource Constraints: Allocating sufficient time, budget, and personnel for initial setup, configuration, and ongoing management can be a hurdle, especially for smaller organizations.

- Defining Scope & Metrics: Clearly defining the scope of your risk management program and establishing measurable KPIs for its effectiveness can be complex without prior experience.

Steps for Successful Deployment and Integration of Risk Management Tools

To maximize the value of your risk management investment and ensure a smooth journey, follow a structured deployment approach:

Phase 1: Planning & Strategy: Define clear objectives for your risk management program and identify key stakeholders. Conduct a thorough gap analysis to understand your current risk posture.

Phase 2: Solution Selection: Rigorously evaluate platforms like Risk Cognizance, focusing on their specific features and capabilities. Conduct demos, review features, assess integration capabilities, and consider vendor support.

Phase 3: Implementation & Configuration: Integrate the risk management platform with your existing IT and business systems. Configure risk frameworks, controls, and workflows specifically tailored to your organization.

Phase 4: Training & Adoption: Provide comprehensive training to all users on how to effectively use the tool and understand their roles in the risk management process.

Phase 5: Monitor, Optimize & Evolve: Continuously monitor your risk landscape using the platform's dashboards and alerts. Regularly review performance metrics and identify areas for improvement.

Real-World Successes with Risk Management Tools

Organizations are already realizing significant benefits from implementing risk management tools. Financial institutions are using them to manage market volatility and regulatory risk, while technology companies are strengthening their cyber resilience and third-party oversight. Manufacturing firms are leveraging these platforms to mitigate supply chain disruptions and operational risks. These successes highlight how risk management tools enable businesses to move from a reactive posture to a proactive, strategic one, allowing them to focus on innovation and growth while maintaining a world-class security standard.

Conclusion

In the dynamic landscape of 2025, robust risk management is a fundamental requirement for business continuity and competitive advantage. By automating complex processes, providing real-time insights into threats, and fostering a culture of continuous improvement, these platforms empower organizations to navigate challenges and build a more resilient enterprise.

Risk Cognizance stands at the forefront of this transformation, offering an unparalleled AI-driven, comprehensive solution for Enterprise, IT, and Third-Party Risk Management. Its ability to unify risk management efforts into a single, intelligent platform makes it the premier choice for organizations committed to building resilience, fostering trust with their stakeholders, and driving sustainable growth in an increasingly complex world.

Other Top-Rated Compliance Software (GRC) Tools and Solutions

- Top 5 SOC 2 Compliance Software (GRC) Tools and Solutions for 2025

- Top 5 CMMC Compliance Software (GRC) Tools and Solutions for 2025

- Top 5 ISO 27001 Compliance Software (GRC) Tools and Solutions for 2025

Frequently Asked Questions (FAQs)

- Q: What is Enterprise Risk Management (ERM)? A: ERM is a comprehensive, organization-wide process for identifying, assessing, and preparing for any potential risks that could interfere with an organization's objectives. ERM software provides the framework and tools to manage this process holistically across all departments and business units.

- Q: What is the difference between risk management and compliance? A: Risk management is a proactive process of identifying and mitigating potential threats to an organization. Compliance, on the other hand, is about adhering to existing laws, regulations, and standards. While distinct, they are deeply interconnected, and GRC platforms often integrate both functions to provide a holistic view.

- Q: Can a risk management tool help with cyber threats? A: Yes, modern risk management software, especially platforms like Risk Cognizance, includes dedicated modules for IT and cyber risk management. These tools provide real-time threat monitoring, vulnerability management, and automated remediation guidance to help organizations proactively address cybersecurity risks.

- Q: What are Key Risk Indicators (KRIs)? A: KRIs are metrics used to provide an early signal of increasing risk exposure in a specific area of the business. By tracking KRIs through a risk management platform, organizations can move from reactive to proactive risk management, addressing potential issues before they become incidents.