Overview

Managing compliance manually is an overwhelming task for businesses facing increasing regulatory pressures. A Compliance Management System (CMS) powered by AI, such as Risk Cognizance, simplifies compliance tracking, automates risk assessments, and ensures organizations remain aligned with regulatory requirements.

With built-in automation, continuous monitoring, and real-time reporting, Risk Cognizance provides a user-friendly CMS platform that eliminates manual compliance challenges and enhances security governance.

What is a Compliance Management System (CMS)?

A Compliance Management System (CMS) is a structured framework that helps organizations track, manage, and ensure compliance with industry regulations, legal requirements, and internal policies. It integrates processes, AI automation, and reporting to mitigate risks and prevent non-compliance.

Traditional compliance methods rely on manual tracking, increasing the likelihood of errors and missed regulatory updates. Risk Cognizance automates compliance workflows, ensuring businesses stay ahead of evolving regulations effortlessly.

Built-in Capabilities of Risk Cognizance’s CMS

Key Features

- Automated regulatory tracking for seamless compliance updates

- AI-powered risk assessment and mitigation

- Real-time monitoring and audit-ready reporting

- Centralized policy management and enforcement

- Third-party risk evaluation and vendor compliance oversight

- Incident response automation and threat intelligence integration

_1740909233.png)

Supported Frameworks

Risk Cognizance’s Compliance Management System (CMS) ensures compliance with leading industry frameworks, including:

- Financial & Data Security: SOX, PCI-DSS, SOC 2, Basel II, FFIEC

- Healthcare & Privacy Regulations: HIPAA, GDPR, CCPA, CMS, HITRUST

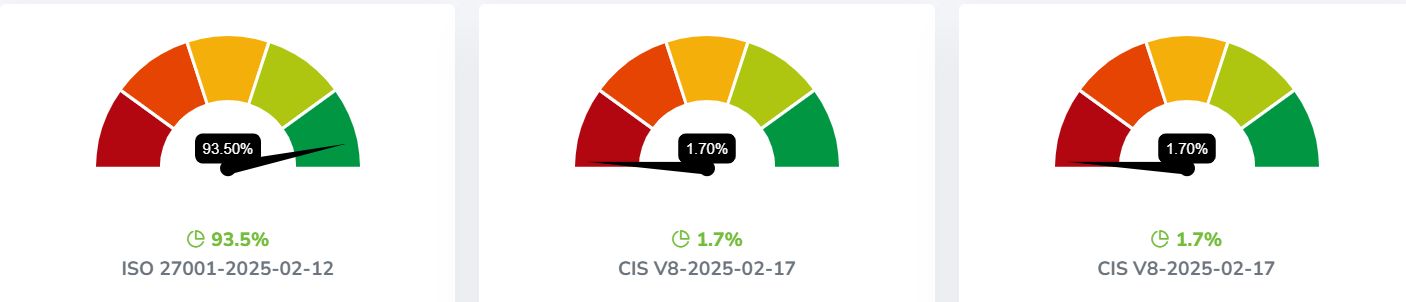

- Cybersecurity & Risk Management: NIST 800-53, NIST CSF, CIS Controls, ISO 27001

- Government & Defense Compliance: FedRAMP, CMMC, COBIT

Customizable Compliance Frameworks

Whether your business needs to comply with CMMC, ISO, NIST, SOC 2, HIPAA, GDPR, or other regulations, Our GRC Tools for Small Medium Sized Businesses and Startups provide tailored compliance solutions that grow with your business.

These built-in frameworks ensure businesses can automate compliance tasks and reduce regulatory burdens effortlessly.

Use Cases for Compliance Management System (CMS)

1. Healthcare Regulatory Compliance (HIPAA & CMS)

A major hospital system struggled with HIPAA compliance due to manual processes. Risk Cognizance automated regulatory tracking and risk assessments, reducing non-compliance incidents by 75%.

2. Financial Institutions & SOX Compliance

A global bank needed to improve its SOX compliance tracking. Risk Cognizance streamlined compliance reporting and automated audits, minimizing regulatory fines.

3. E-commerce & GDPR Compliance

An international online retailer faced challenges meeting GDPR requirements. Risk Cognizance’s automated data protection workflows ensured full compliance, preventing data breaches and customer trust issues.

Case Studies: Real-World Impact of a Compliance Management System (CMS)

Case Study 1: A Leading Healthcare Provider’s CMS Implementation

A healthcare organization facing compliance challenges adopted Risk Cognizance’s CMS to manage HIPAA and CMS regulatory requirements. Within six months, compliance efficiency increased by 90%, reducing audit preparation time from weeks to hours.

Case Study 2: Financial Firm’s Transition to Automated Compliance

A Fortune 500 financial firm replaced its manual compliance tracking with Risk Cognizance. Automated risk assessments and AI-powered analytics helped the firm achieve 98% compliance adherence while reducing regulatory costs.

Why Businesses Need a Compliance Management System (CMS)

Manual compliance tracking is inefficient, leaving organizations exposed to:

- Regulatory fines and penalties for non-compliance

- Time-consuming manual audits with high operational costs

- Increased security risks due to lack of proactive compliance management

A Compliance Management System (CMS) helps organizations:

- Streamline compliance workflows and eliminate manual tracking

- Automate regulatory updates for real-time compliance adaptation

- Enhance security governance through AI-powered risk assessments

GRC Software Solutions Build For Security Team

What Is the Difference Between Having a Compliance Management System (CMS) and Doing the Task Manually?

Manual Compliance Management:

- Requires spreadsheet tracking and manual data entry

- Prone to errors, delays, and outdated information

- Involves time-consuming audits and compliance checks

Automated Compliance Management System (CMS) with Risk Cognizance:

- AI-driven regulatory updates ensure real-time compliance

- Automated workflows reduce compliance burdens by 80%

- Centralized dashboards provide clear compliance insights

How Does an Integrated Compliance Management System (CMS) Help the CISO and the Security Team?

CISOs and security teams need a centralized solution to manage compliance risk efficiently. Risk Cognizance’s CMS provides:

- Continuous compliance monitoring to prevent regulatory gaps

- AI-powered security risk assessments for proactive threat mitigation

- Automated compliance documentation to streamline audits

- Vendor and third-party compliance tracking for supply chain security

With an AI-driven CMS, security leaders can focus on strengthening cybersecurity postures while ensuring full compliance.

What Type of Business Benefits More from a Compliance Management System (CMS)?

Industries with complex regulatory requirements benefit the most from CMS automation, including:

- Healthcare & Life Sciences: HIPAA, CMS, and GDPR compliance for patient data security

- Financial Services: SOX, PCI-DSS, and SOC 2 adherence for financial transparency

- Government & Defense: CMMC and FedRAMP compliance for national security standards

- Retail & E-commerce: GDPR and CCPA compliance for data privacy protection

Businesses in these sectors face high compliance demands and require AI-powered solutions to stay ahead.

How Can Your Organization Benefit from a Compliance Management System (CMS)?

Risk Cognizance’s Compliance Management System (CMS) empowers organizations with:

- Automated compliance tracking, reducing manual workloads

- AI-powered risk detection, enhancing security governance

- Centralized policy management, ensuring seamless regulatory alignment

- Real-time reporting and insights, simplifying audits and compliance reviews

By adopting a CMS platform like Risk Cognizance, businesses achieve greater efficiency, lower compliance risks, and enhanced regulatory adherence.

Organizations can no longer rely on manual compliance processes to meet regulatory demands. With Risk Cognizance’s AI-driven Compliance Management System (CMS), businesses automate compliance tracking, reduce risk exposure, and ensure seamless regulatory adherence.

By integrating AI, automation, and real-time monitoring, organizations improve compliance efficiency while enhancing security governance and reducing operational costs.

Book a Demo