Investment Trends from Governance, Risk & Compliance Leaders

Investment Trends from Governance, Risk & Compliance Leaders

We recently surveyed chief risk officers, chief compliance officers, and governance directors from multinational organisations to uncover urgent technology gaps and identify where senior leaders are focusing their budgets right now. The results have been compiled into a detailed report outlining the immediate investment priorities, emerging technology needs, and strategic objectives of the delegate group. If your solution aligns with these pressing needs, we want to hear from you immediately. Our final sponsorship packages for the fast-approaching October event are being finalised, and availability is extremely limited. Act fast to ensure your offering is front and centre when these decision-makers come together.

Technology-Driven Strategic Transformation

Across the GRC landscape, there is a strong shift toward leveraging emerging technologies such as artificial intelligence, automation, and advanced analytics. These tools are enabling functions to move beyond traditional compliance roles and contribute more strategically to business priorities. By embedding intelligent systems into daily operations, GRC leaders are driving smarter decision making, improving responsiveness, and aligning more closely with organisational goals.

Operational Efficiency Through Standardisation

Improving consistency and centralising processes has become a critical focus for GRC professionals. Organisations are working to streamline workflows, eliminate duplication, and apply a unified approach to risk and compliance management. This drive for operational coherence not only enhances internal visibility and control but also improves agility in responding to evolving regulatory and business demands.

Creating Value and Protecting Reputation Through Innovation

GRC functions are increasingly being positioned as partners in innovation. By advancing the use of technology to uncover opportunities and reinforce controls, organisations are enabling their risk and compliance teams to contribute to growth while safeguarding reputation. This evolving role reflects a wider commitment to long-term resilience, stakeholder trust, and value creation across the enterprise.

Engage With The Group

Job Title: Group Global Compliance & Business Integrity

Job Title:

- Director, Data Compliance and Assurance

- Group Chief Risk and Compliance

- Chief Risk and Compliance Officer

- Director, Compliance, Ethics & Regulatory Affairs

- Chief Finance and Risk Officer

- Risk SME Director Strategic Projects

- Vice President, Risk and Compliance

- Deputy Company Secretary

- Chief Finance and Risk Officer

GRC automation is critical because it transforms governance, risk, and compliance from a fragmented, reactive, and manual process into a proactive, strategic, and data-driven function. By automating repetitive tasks, organizations can enhance efficiency, reduce human error, and gain real-time visibility into their risk posture, which is essential for navigating the increasingly complex regulatory and threat landscape. This shift allows GRC teams to move beyond mere compliance and become strategic partners that drive business value and protect the company's reputation.

Why Automate GRC?

- Reduces Costs and Increases Efficiency: Manually managing GRC is a monumental and resource-intensive undertaking. Automation handles repetitive, time-consuming tasks like evidence collection, policy enforcement, and reporting, freeing up your team for more strategic work and reducing the need for costly manual labor.

- Ensures Continuous Compliance: Manual processes often result in a "snapshot" view of compliance, where checks are done periodically. Automation provides continuous monitoring, ensuring your organization is always in a state of readiness for audits and can address issues in real-time.

- Minimizes Human Error: Human-driven processes are prone to mistakes in data entry, policy application, and evidence collection. Automated systems ensure consistency and accuracy, which is vital for preventing non-compliance penalties and security breaches.

- Enhances Proactive Risk Management: With real-time data and advanced analytics, GRC automation can identify and predict emerging risks before they become a significant problem. This allows organizations to move from a reactive to a proactive risk management model, improving their overall security posture and operational resilience.

- Improves Decision-Making: Automation provides a centralized, single source of truth for all GRC data. This real-time visibility and consolidated reporting empower leaders to make smarter, data-driven decisions that are closely aligned with organizational goals.

Key Statistics and Trends

Recent surveys and market analyses highlight the increasing importance and growing investment in GRC technologies. Here are some key statistics and trends from the industry:

- Market Growth: The global GRC market size was valued at approximately $50.5 billion in 2024 and is projected to grow significantly to over $104.5 billion by 2031, demonstrating a robust compound annual growth rate (CAGR) of over 15%. This growth is driven by increasing regulatory complexity, rising cybersecurity risks, and a greater emphasis on data privacy.

- Widespread Challenges: Over half of GRC professionals (51%) cited navigating the complex regulatory landscape as a top challenge, with nearly half (48%) struggling to keep up with increasingly sophisticated cyber threats.

- AI Adoption is Gaining Momentum: While a majority of GRC professionals recognize the value of AI, a significant gap remains between awareness and implementation. According to one survey, only 14% of organizations have fully integrated AI into their GRC frameworks. However, this is changing quickly, with over 40% of organizations actively evaluating AI solutions.

- AI for Proactive Risk Management: The most mature GRC programs are not just using AI for efficiency. They are leveraging it for strategic purposes: 72% of advanced organizations use AI to track risk proactively, and over half use it for predictive risk modeling.

- Digital Transformation is Key: 71% of compliance leaders expect to undertake digital transformation initiatives in the next three years that require support from their compliance functions.

- Persistent Reliance on Manual Processes: Despite the push for automation, a significant number of organizations are still operating with outdated methods. 60% of GRC users still manage compliance manually with spreadsheets. This highlights the substantial opportunity for technology adoption.

- Budget Outlook: The majority of GRC professionals (77%) expect their budgets to either increase or stay the same, indicating that GRC is viewed as a valuable and essential function that warrants continued investment.

- Focus on Business Value: The perception of GRC is shifting. 80% of corporate risk and compliance professionals agree that their organization views risk and compliance as valuable business advisory functions, and 74% believe that GRC requirements enable, support, and enhance business activity.

5 Case Studies in GRC Automation

Simplifying Regulatory Compliance for a Global SaaS Provider: A leading provider of AI-powered SaaS solutions faced challenges with complex, manual compliance processes. By implementing a GRC automation platform, they streamlined workflows and automatically assigned tasks and reminders to employees for documentation. The platform also provided a centralized repository for evidence, significantly reducing the time and manual follow-up required for audits.

- Enhancing Governance for a Payment Solutions Company: A company dealing with sensitive payment data needed to improve governance for its PCI 4.0 compliance. They used a GRC platform to build a custom application for their asset inventory. This app provided a structured, repeatable approach to risk analysis, documenting assets, risks, and mitigation strategies in a centralized location. The automation features then streamlined the workflow by sending automatic notifications to stakeholders upon task completion, creating a transparent and auditable trail.

- Microsoft GRC Team Projects: Microsoft's GRC team has partnered with developers to create automated tools to solve internal GRC challenges. For example, they developed a web-based tool to generate network architecture diagrams for their O365 environments, which previously was a time-consuming manual process. This automation improved diagram quality and efficiency. They also created an "AutoDoc" tool to automatically generate a System Security Plan (SSP) document from collaborative input, saving countless hours on manual data collection and review.

- American Family Insurance: This primary insurance provider had a decentralized GRC framework, with data scattered across multiple systems, leading to conflicting information and redundant efforts. They adopted a GRC automation platform to consolidate data and processes into a single source of truth. The platform's automated workflows and centralized reporting solved their data fragmentation problem, allowing them to gain a holistic view of IT risk and better manage vulnerabilities across their enterprise.

- Managing Third-Party Risk: A large corporation struggled to manage the compliance of its vast network of third-party vendors. They implemented an automated GRC system that conducted continuous risk assessments and monitoring of their vendors. The system automatically flagged high-risk vendors and non-compliant activities, streamlining the due diligence process and ensuring their supply chain remained secure and aligned with regulatory standards.

10 FAQs About GRC Automation

- What is GRC automation? It's the use of software to streamline and automate processes related to governance, risk management, and compliance, such as risk assessments, policy management, and evidence collection.

- What are the primary benefits? The key benefits are increased efficiency, reduced costs, minimized human error, real-time visibility, and a stronger, more proactive security posture.

- Can GRC automation replace human GRC professionals? No. Automation is a tool that augments human expertise. It handles repetitive tasks, allowing professionals to focus on strategic analysis, complex problem-solving, and providing crucial guidance.

- What types of compliance can be automated? Automation can assist with all levels of compliance, but it is especially effective for frameworks with extensive control requirements, such as SOC 2, ISO 27001, HIPAA, and GDPR.

- How long does it take to implement? The timeline varies based on the organization's complexity, but it can range from a few weeks to several months. The key is to start with a clear plan and a phased approach.

- Can automation integrate with my existing tools? Yes, most modern GRC platforms are designed with robust integration capabilities to connect with your existing technology stack, including cloud services, ticketing systems, and HR software.

- Is GRC automation only for large corporations? No, organizations of all sizes can benefit. For smaller businesses, it can be a cost-effective way to manage compliance without a large, dedicated GRC team.

- How does it handle regulatory changes? Automated GRC platforms can be updated to reflect new or changing regulations, and many can even send alerts to relevant teams when an update affects their compliance obligations.

- What is a "single source of truth"? A "single source of truth" is a centralized repository where all GRC-related data, documents, and evidence are stored and maintained. Automation helps create this by pulling data from disparate systems into one unified location.

- What is the future of GRC automation? The future involves a shift toward predictive analytics, integrated platforms that unify different risk functions, and "human-in-the-loop" systems where AI acts as a strategic assistant.

How Risk Cognizance Solves These Problems

Risk Cognizance is an AI-driven GRC platform designed to address the challenges of manual, fragmented, and reactive GRC processes. It solves these problems by providing a unified, intelligent, and automated solution that empowers organizations to manage risk and compliance effectively.

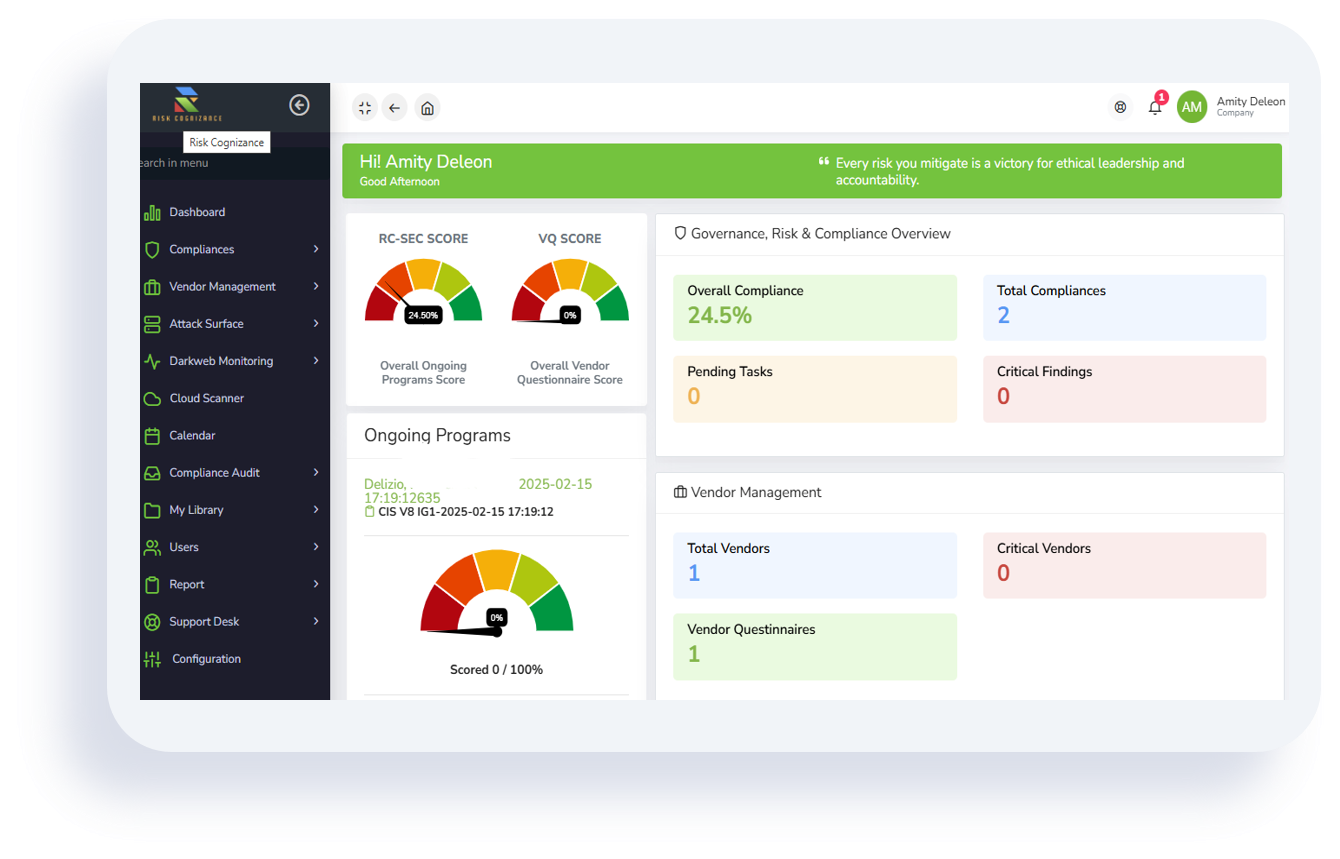

- Integrated Risk Management: Risk Cognizance eliminates data silos by providing a single data model for the entire enterprise. This creates a unified, real-time view of risk and compliance, allowing for better communication and a more holistic understanding of the organization's risk posture.

- AI-Driven Analytics and Predictive Assessments: Instead of just reacting to past events, the platform uses AI-driven analytics to identify emerging risks and forecast potential compliance gaps. This allows teams to be proactive in their risk management, addressing issues before they escalate.

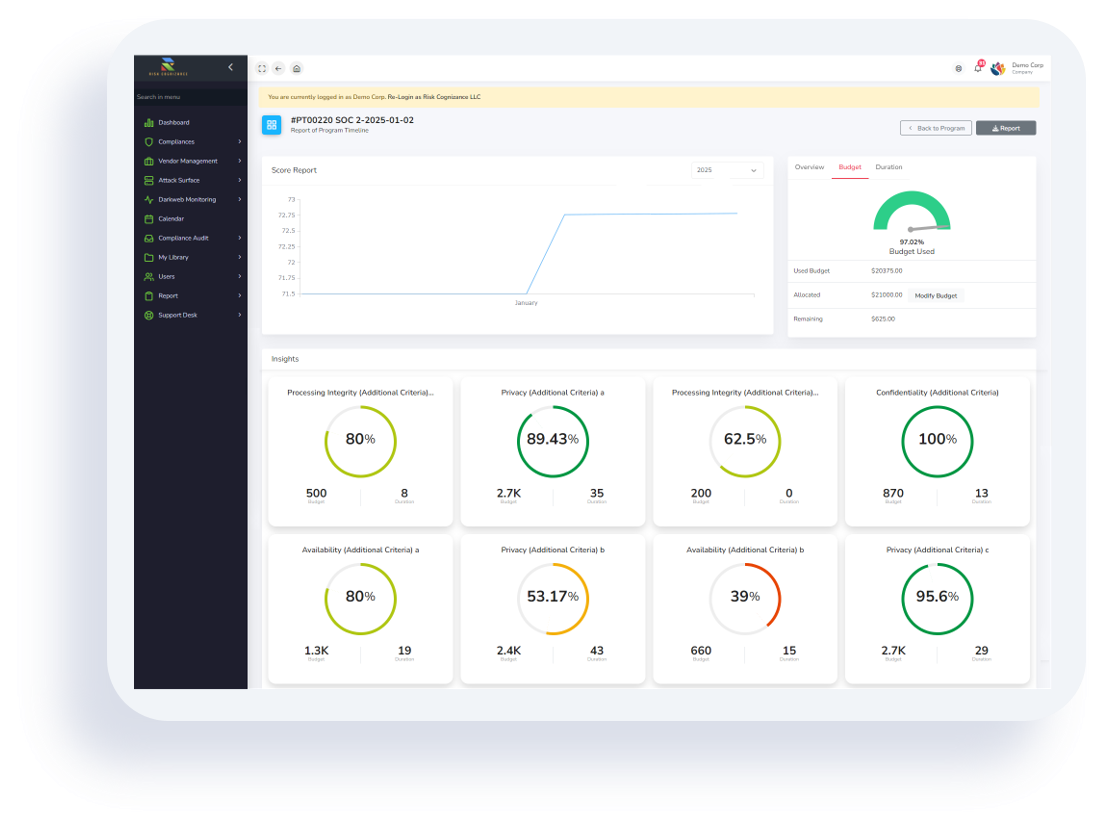

- Automated Workflows and Evidence Collection: The platform automates repetitive and time-consuming tasks. It connects to your existing systems to automatically collect, tag, and organize evidence, reducing manual effort, minimizing human error, and streamlining the audit process significantly.

- Centralized Reporting and Actionable Insights: Risk Cognizance provides centralized, customizable dashboards and reports. This gives leaders real-time visibility into their compliance status and risk exposure, enabling them to make smarter, data-driven decisions that protect the business and its reputation.

- Comprehensive Threat Monitoring: The platform extends beyond traditional GRC by including features like vendor and third-party risk management, attack surface management, and dark web monitoring. This provides a multi-faceted approach to security, helping organizations prepare for and mitigate a wider range of modern threats.