GRC Tools Are Software Applications

GRC tools have become indispensable for organizations navigating compliance requirements. Risk Cognizance stands at the forefront of innovative software applications designed to streamline Governance, Risk, and Compliance processes through automation and intuitive design.

The Challenge of Modern Compliance

James, a Compliance Director at a multinational corporation, recalls the struggles before implementing modern GRC tools: "We were drowning in spreadsheets, disconnected systems, and manual processes. Each regulatory change meant weeks of work updating documentation and controls. We needed a software application that could automate these processes while maintaining accuracy."

This scenario plays out in organizations worldwide as compliance teams struggle with fragmented approaches to governance and risk management. Traditional methods simply cannot scale with today's expanding regulatory demands, creating an urgent need for integrated GRC tools that streamline compliance activities.

How Risk Cognizance Transforms GRC

Risk Cognizance delivers a comprehensive software application that unifies all aspects of governance, risk, and compliance in a single, user-friendly platform. Unlike typical GRC tools that require extensive configuration and technical expertise, Risk Cognizance offers an intuitive experience that enables rapid adoption across the organization.

The easy-to-use interface transforms complex compliance requirements into manageable workflows, while powerful automation capabilities eliminate repetitive tasks. What sets Risk Cognizance apart from other GRC tools is its ability to adapt to your organization's specific needs without requiring custom coding or extensive consulting engagements.

Core Capabilities:

- Centralized policy and document management with automated version control

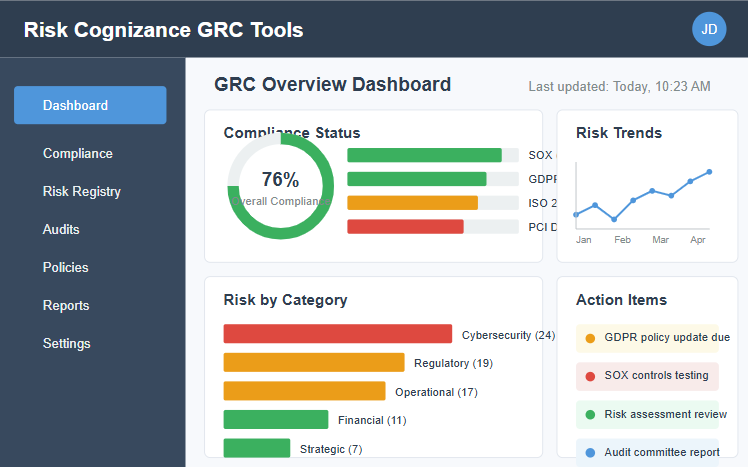

- Continuous compliance monitoring with real-time dashboards

- Automated risk assessments with configurable risk scoring

- Streamlined audit management and evidence collection

- Comprehensive regulatory change tracking and impact analysis

- Custom workflow creation through an intuitive drag-and-drop interface

- Robust reporting and analytics with executive-friendly visualizations

Supported Frameworks

Risk Cognizance offers built-in support for critical regulatory frameworks, eliminating the need for separate software applications for different compliance requirements:

- SOX/ICFR: Simplify financial controls management and testing

- GDPR/CCPA/CPRA: Streamline data privacy compliance and subject rights management

- ISO 27001/27701: Integrate information security and privacy management

- NIST CSF/800-53/800-171: Implement cybersecurity best practices with automated controls mapping

- Industry-Specific Regulations: Configure the GRC tools for healthcare (HIPAA), financial services (GLBA, PCI DSS), manufacturing (FDA, EHS), and more

The User Experience Advantage

"What impressed us most about Risk Cognizance was how quickly our team adopted it," explains Michelle, a Risk Manager at a financial institution. "Other GRC tools we evaluated required weeks of training. With Risk Cognizance, our team was productive within days."

This user-friendly approach extends throughout the software application, from initial setup to daily operations. The intuitive interface guides users through compliance activities with clear instructions and contextual help, while automated workflows ensure consistent execution of critical processes.

Use Cases

Case 1: Automated Regulatory Change Management

A global bank implemented Risk Cognizance to address the challenge of managing regulatory changes across multiple jurisdictions. Before adopting these GRC tools, their compliance team spent approximately 40 hours weekly reviewing regulatory updates and manually updating policies and controls.

After implementing the Risk Cognizance software application:

- Regulatory change review time decreased by 85%

- Policy updates became automated based on regulatory changes

- Impact assessments were streamlined through the easy-to-use workflow engine

- Compliance gaps were identified proactively rather than during audits

- Cross-departmental collaboration improved through centralized communication

"The automation capabilities transformed how we manage regulatory changes," their Compliance Officer reports. "What once consumed most of our week now takes just a few hours, allowing us to focus on strategic compliance initiatives."

Case 2: Integrated Risk Assessment

A healthcare system with facilities across three states struggled with inconsistent risk assessment methodologies and limited visibility into enterprise risk. Their previous approach involved multiple software applications that created data silos and prevented comprehensive risk analysis.

With Risk Cognizance's integrated GRC tools:

- Risk assessments were standardized across all facilities

- Risk data was consolidated into real-time dashboards

- Automated alerts notified stakeholders when risks exceeded thresholds

- Control testing became linked directly to risk mitigation

- The user-friendly interface enabled clinical directors to participate in risk management

"For the first time, we have a holistic view of risk across our organization," their Chief Risk Officer explains. "The easy-to-use nature of Risk Cognizance means we're getting input from stakeholders who previously avoided our risk management processes."

Case 3: Streamlined Audit Management

A manufacturing company with global operations faced recurring challenges with audit management, including scattered evidence, inconsistent findings remediation, and limited visibility into audit status. Previous GRC tools they tried either proved too complex or lacked the necessary functionality.

After implementing Risk Cognizance:

- Audit preparation time decreased by 70%

- Evidence collection became automated and centralized

- Finding remediation rates improved from 65% to 97%

- Audit status became visible through real-time dashboards

- The user-friendly interface simplified auditor interactions

"Our last regulatory audit was remarkably different," notes their Audit Director. "Instead of frantically searching for documentation, we simply logged into Risk Cognizance and had everything at our fingertips. The auditors were impressed with our level of organization."

Case Studies

Financial Services Leader Achieves Compliance Transformation

Alpine Banking Group struggled with fragmented GRC tools that created inconsistent compliance practices across their organization:

Before Risk Cognizance:

- 8 different compliance systems requiring manual data consolidation

- 45+ days to prepare for regulatory examinations

- Limited visibility into compliance status across business units

- Significant compliance gaps identified during audits

- Excessive staff time dedicated to manual compliance activities

After Implementation:

- Consolidated all compliance activities into a single software application

- Reduced examination preparation to 15 days

- Achieved real-time visibility into compliance status

- Proactively identified and remediated 93% of potential findings before audits

- Reduced compliance management time by 68%

- Successfully navigated three regulatory examinations with zero significant findings

"Risk Cognizance hasn't just simplified our compliance processes—it's transformed our entire approach to governance and risk management," reports their Chief Compliance Officer. "The user-friendly platform has democratized compliance throughout our organization."

Healthcare Network Optimizes Regulatory Compliance

Midwest Medical Center faced challenging compliance requirements across five hospitals and numerous outpatient facilities:

Before Risk Cognizance:

- Disjointed compliance approaches across facilities

- Manual tracking of 2,000+ regulatory requirements

- Inconsistent policy management and attestation

- Limited resources for compliance oversight

- Recurring audit findings due to documentation gaps

After Implementation:

- Unified compliance approach across all facilities through a single software application

- Automated tracking and alerting for regulatory requirements

- Standardized policy management with 99.7% attestation rates

- Optimized resource allocation through risk-based prioritization

- Reduced regulatory findings by 87% in first year

"What makes Risk Cognizance different from other GRC tools we evaluated is how intuitive it is for our clinical staff," explains their Director of Compliance. "The easy-to-use interface means we don't have to be compliance experts to maintain compliance."

Transform Your Approach to GRC

In today's complex regulatory environment, effective GRC tools aren't just about maintaining compliance—they're about transforming how your organization approaches governance, risk, and compliance. Risk Cognizance delivers the rare combination of comprehensive functionality and user-friendly design.

Unlike other software applications that require extensive customization and specialized expertise, Risk Cognizance provides immediate value with out-of-the-box capabilities designed for rapid deployment and adoption.

Experience the difference that truly integrated GRC tools can make. Request a demonstration today and discover how Risk Cognizance can transform your approach to governance, risk, and compliance.

Meta Description: Risk Cognizance offers intuitive GRC tools as a comprehensive software application that simplifies governance, risk, and compliance processes with automation, real-time monitoring, and user-friendly interfaces.

Keywords: GRC tools, software application, governance risk compliance, Risk Cognizance, compliance automation, user-friendly GRC, regulatory compliance, integrated risk management, audit management, policy management, compliance software, risk assessment tools