Overview

Regulatory Centralized Compliance software

Navigating this intricate web manually, with disparate tools or scattered spreadsheets, is not merely inefficient—it poses significant risk. This fragmented approach often leads to overlooked obligations, missed deadlines, and severe financial and reputational penalties. The solution lies in Centralized Compliance software, a unified platform that transforms fragmented efforts into a cohesive and manageable program. It consolidates all compliance-related functions, enabling superior oversight, seamless automation, and comprehensive reporting on adherence.

Embracing a centralized compliance strategy moves your organization from a reactive stance to a proactive one. It clarifies complex requirements, significantly reduces operational burden, and fosters a robust foundation of trust with regulators, auditors, and stakeholders.

The Imperative for a Unified Compliance View

Modern compliance extends far beyond simply checking boxes; it's about embedding regulatory adherence into the fabric of your operations. The challenge lies in connecting the dots across various departments, data sources, and regulatory frameworks. Without a unified view, organizations struggle to:

- See the Big Picture: Understand how different regulations overlap or conflict.

- Track Evolving Requirements: Keep pace with new laws and updates across jurisdictions.

- Prove Adherence: Consolidate evidence and demonstrate control effectiveness for audits.

- Identify Compliance Risks: Proactively spot vulnerabilities before they become critical issues.

A fragmented approach inevitably leads to inefficiencies, potential non-compliance, and a drain on valuable resources.

Key Capabilities for Streamlined Compliance

Effective Regulatory Centralized Compliance software offers a suite of integrated capabilities designed to streamline your entire compliance lifecycle. These features work in harmony to ensure continuous adherence and foster an audit-ready posture:

- Consolidated Information Hub: Provides a single point of access for all compliance-related data. This includes your policies, procedures, risk assessments, and audit findings, creating a comprehensive and real-time dashboard of your compliance status.

- Intelligent Automation: Drastically reduces manual effort by automating routine compliance tasks. This includes policy distribution, training assignments, evidence collection, and workflow management for reviews and approvals. Automation minimizes human error and ensures consistency.

- Integrated Risk Management: Compliance is intrinsically a function of risk mitigation. The software facilitates the identification, assessment, and mitigation of compliance-specific risks by connecting directly to broader risk management frameworks. This allows you to prioritize efforts where they matter most.

- Robust Reporting and Analytics: Generates clear, customizable reports and dashboards that offer deep insights into your compliance status. These tools identify areas of non-compliance, highlight emerging risks, and provide irrefutable evidence of adherence for internal and external stakeholders.

- Seamless System Integration: Ensures that compliance data flows effortlessly across your organization. It integrates with existing business systems (e.g., ERP, CRM, HR), eliminating data silos and enhancing efficiency across departments.

- Comprehensive Audit Support: Simplifies the entire audit preparation and execution process. By providing centralized access to all relevant documentation, automated audit trails, and control evidence, the software significantly reduces the time and stress associated with compliance audits.

Scalability for Growth: The platform is designed to grow with your organization. Whether you're a startup or a large enterprise, it scales to meet the needs of expanding operations, new regulations, and evolving business units without requiring a complete system overhaul.

Risk Cognizance: Your Foundation for Regulatory Excellence

At Risk Cognizance, we understand that navigating the regulatory labyrinth demands more than just a tool—it requires an intelligent, integrated partner.

Our Integrated Connected GRC Software delivers a robust Regulatory Centralized Compliance software solution, empowering organizations to manage their obligations effectively, efficiently, and with complete confidence.

Here is how Risk Cognizance consolidates and elevates your compliance journey:

Unified Regulatory Oversight: Our Regulatory Compliance Management Software acts as your central command center for all compliance information. This includes dynamic Regulatory Change Management Software that continuously monitors and updates you on new or revised regulations, ensuring your controls are always current.

Automated Compliance Workflows: From automated evidence collection to streamlined policy acknowledgments, our platform drastically reduces manual workload. Our Policy Management Software automates the entire lifecycle of your internal policies, ensuring they are always current and effectively communicated.

Over 250 Integrated Apps and API access to all of our system.

Automating risk management, with workflow, and our AI compliance management tools.

Integrated Risk-Based Compliance

Compliance cannot operate in isolation. Our platform is deeply integrated with our broader Risk capabilities, encompassing Enterprise Risk Management Software, Operational Risk Management Software, and IT & Cyber Risk Management Software.

This ensures compliance risks are identified, assessed, and mitigated as a fundamental part of your overall risk strategy. We also leverage Attack Surface Management, Cloud Posture Scanner, and Dark Web Monitoring to address digital risks that could impact compliance posture.

Streamlined Audit and Reporting: Our Internal Audit Management Software and Audit & Controls module simplify audit preparation by providing centralized access to all required documentation and audit trails. Our Case and Incident Management Software and Regulatory Engagement Management Software ensure that any compliance-related issues or interactions with regulators are managed effectively and documented for transparency.

Cyber Resilience through Hybrid GRC: Our Cyber Hybrid GRC Software brings cybersecurity and compliance together, providing a holistic view of your digital risk posture and ensuring your controls meet stringent standards. This integrated approach not only helps with compliance but also enhances your overall security resilience.

Scalability for Future Growth: As your organization expands, our platform is built to scale seamlessly, adapting to new regulations, jurisdictions, and business units without requiring a complete system overhaul. Our ESG Risk Management Software also ensures your sustainability and social responsibilities are part of this integrated approach.

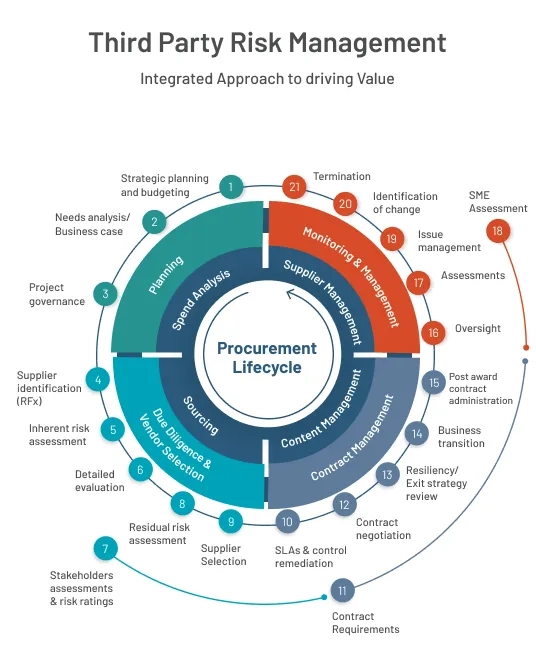

Comprehensive Third-Party Compliance

Your vendors are an extension of your compliance footprint. Our Vendor Risk Management Software integrates third-party compliance assessments into your centralized framework, ensuring their adherence to your security and regulatory standards.

One GRC Software Platform for Complete Confidence

Our platform provides a singular source of truth for all your GRC activities, eliminating data silos and fostering seamless collaboration across every department. From the strategic foresight offered by Enterprise Risk Management to the meticulous detail of Regulatory Compliance Management, every aspect is harmonized. This means your data is consistent, your insights are real-time, and your decisions are fully informed.

With Risk Cognizance, you gain the profound peace of mind that comes from knowing your organization is not just compliant, but genuinely resilient, prepared for whatever challenges the future may hold.

Achieving Compliance with Confidence

The story of modern compliance is one of profound transformation—from a fragmented, reactive burden to a centralized, proactive, and strategic advantage.

By leveraging Regulatory Centralized Compliance software like that offered by Risk Cognizance, organizations gain unparalleled oversight, achieve significant efficiencies through automation, and build a stronger, more trustworthy reputation. This integrated approach ensures continuous adherence to regulations, fostering peace of mind and enabling sustainable growth in an ever-complex world. Embrace a centralized compliance strategy, and confidently navigate your regulatory journey.

Recognized as a

GRC Software Leader