Overview

Integrated Risk Management (IRM) Software Solutions

Integrated Risk Management Software Solutions for Compliance & Risk Automation

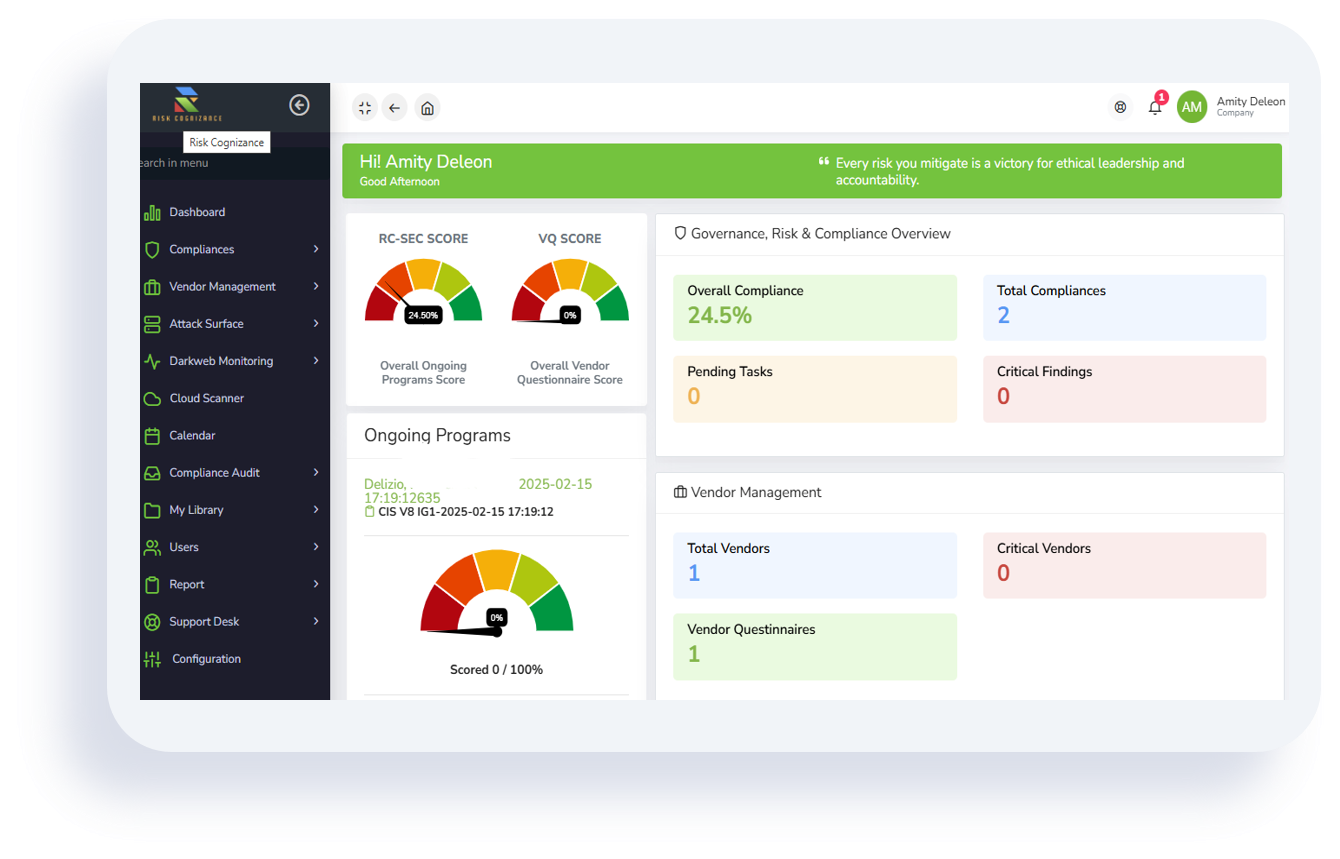

Risk Cognizance's AI-driven Integrated Risk Management (IRM) Software for automating compliance, risk, and audit management. Optimize governance, reduce risks, and stay compliant with our cloud-based GRC platform.

Why Choose Risk Cognizance’s GRC Software?

Risk Cognizance offers an AI-powered Integrated Risk Management (IRM) platform designed to streamline and automate governance, risk management, and compliance (GRC) processes. Whether you're in finance, healthcare, or any other industry, our comprehensive GRC software helps mitigate risk, ensure compliance, and simplify audit management—all in one easy-to-use platform.

Our GRC platform supports businesses in navigating complex regulatory landscapes, enabling them to stay audit-ready, manage compliance tracking, and foster operational resilience. With our cloud-based GRC solutions, you can enhance your organization's efficiency, security, and compliance management processes.

Comprehensive GRC Solutions to Drive Business Success

Risk Cognizance’s GRC suite offers a robust set of tools to empower organizations with proactive compliance management and risk mitigation. Key features of our GRC software include:

- Risk Management Software: Automate risk assessments, mitigation workflows, and evidence collection, providing enterprise-wide visibility.

- Compliance Automation Software: Streamline compliance tasks, helping your business stay compliant with regulatory requirements such as ISO 27001, SOC 2, and HIPAA.

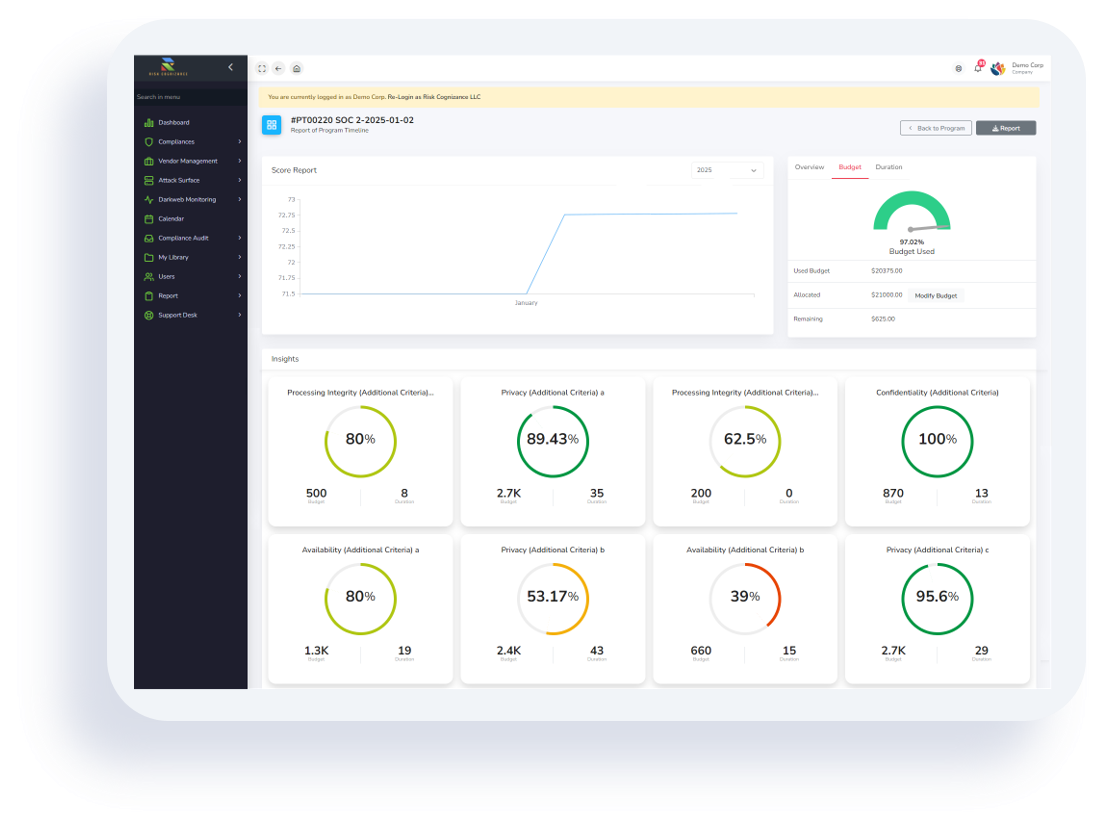

- Audit Management Software: Effortlessly track and manage internal and external audits, ensuring audit readiness at all times.

- Third-Party Risk Management Software: Safeguard your organization from third-party vulnerabilities by evaluating and managing supplier risks.

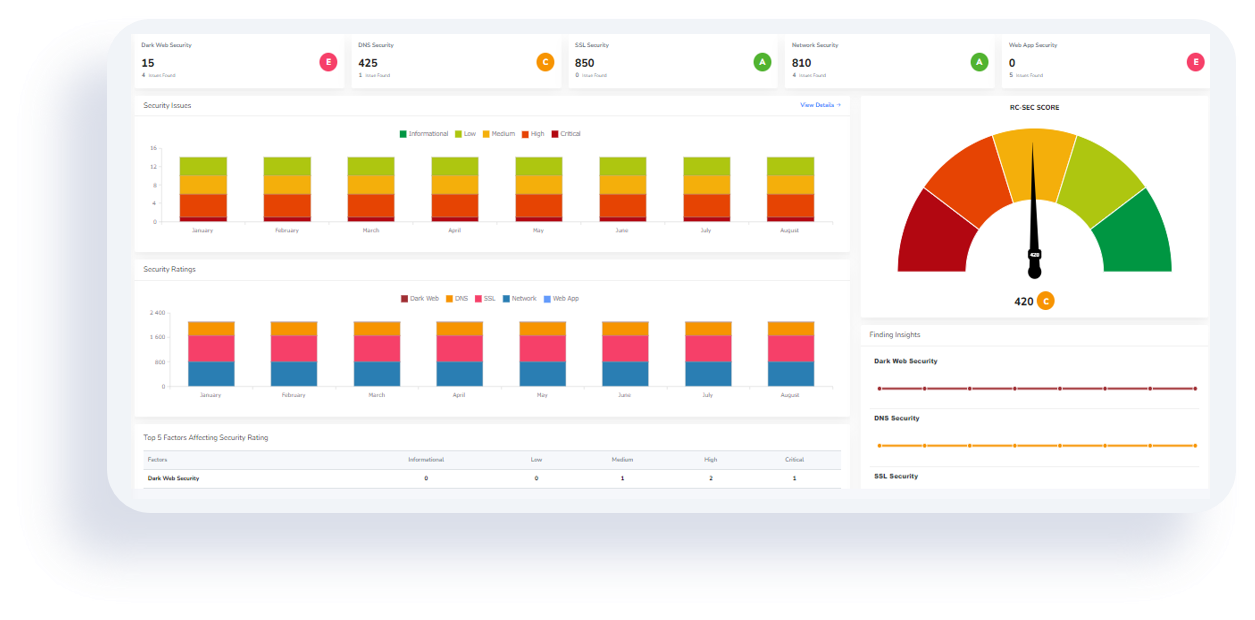

- Cyber Risk Management Software: Protect your organization from evolving cyber threats and comply with cybersecurity regulations.

- With Risk Cognizance's GRC software solutions, businesses can automate key compliance and audit management processes, reduce manual work, and enhance overall security posture.

AI-Driven Risk and Compliance Management

The future of GRC lies in AI. Risk Cognizance leverages cutting-edge AI capabilities to analyze risks, automate compliance reporting, and proactively detect potential threats. Our cloud-based GRC software platforms are designed to scale with your business needs and offer:

- Proactive Risk Mitigation: Predict and prevent emerging risks with our AI-powered risk management tools.

- Automated Compliance Reporting: Generate real-time compliance reports to ensure you meet regulatory standards effortlessly.

- Data Privacy Compliance: Protect sensitive information and maintain compliance with global data privacy regulations like GDPR.

- By integrating AI into our GRC solutions, we help organizations stay ahead of regulatory changes, streamline internal audits, and ensure continuous compliance across all departments.

Key Benefits of Our GRC Platform

Our Integrated Risk Management (IRM) software is specifically designed to help enterprises thrive in an increasingly complex regulatory environment. Key benefits include:

- Simplified Compliance Management: Automate compliance tasks and track progress in real-time to stay aligned with regulatory changes.

- Improved Audit Readiness: Keep your organization audit-ready with comprehensive audit management and tracking features.

- Comprehensive Risk Insight: Gain full visibility into organizational risks with an integrated risk management system, enabling quicker decision-making and risk response.

- Faster Decision-Making: Empower teams with the right tools for better and faster risk assessments, compliance checks, and audits.

- Risk Cognizance's GRC software platform provides the flexibility and scalability needed for businesses of all sizes, ensuring that your organization remains compliant, resilient, and audit-ready.

Who Can Benefit from Risk Cognizance’s GRC Software?

Risk Cognizance’s GRC suite is ideal for organizations across a wide range of industries. Our platform supports key decision-makers such as:

- CISOs & vCISOs: Easily manage and mitigate cyber and IT risks, track compliance, and monitor overall organizational risk.

- Compliance Officers: Streamline regulatory reporting, automate compliance tracking, and ensure all legal requirements are met.

- Risk Managers: Proactively identify risks, implement mitigation strategies, and track progress on risk reduction efforts.

- Internal Auditors: Simplify audit processes, ensuring that your organization is always audit-ready and compliant.

Key Features of Risk Cognizance’s GRC Software:

- Governance & Policy: Establish policies and structures to ensure ethical conduct, transparency, and accountability within your organization.

- Risk Assessment Tools: Automate and streamline risk assessments across the enterprise, gaining real-time insights into potential risks.

- Compliance Tracking Software: Simplify tracking and reporting of compliance across different regulatory frameworks, including ISO 27001 and SOC 2.

- Operational Resilience: Strengthen your organization’s operational resilience by identifying and managing operational risks proactively.

Integrated Risk Management (IRM) for MSPs (Managed Service Providers) and MSSPs

Integrated Risk Management (IRM) for MSPs (Managed Service Providers) and MSSPs (Managed Security Service Providers) enables both service models to deliver holistic, proactive security and compliance through a unified governance, risk, and compliance (GRC) platform. IRM centralizes client compliance management, security risk assessments, governance workflows, and continuous monitoring within a single multi-tenant environment.

For MSPs, IRM strengthens traditional IT services by adding advanced security capabilities such as automated compliance (NIST, ISO, GDPR), vulnerability tracking, third-party risk management, and integrated assessment tools—often enhanced by AI.

For MSSPs, IRM streamlines security operations by consolidating threat management, audit automation, attack surface monitoring, incident response, and reporting into a cohesive system that improves efficiency and client transparency.

By bridging general IT management (MSP focus) and deep security operations (MSSP focus), IRM empowers providers to:

- Deliver MDR, vCISO, and continuous security oversight

- Automate audits and compliance evidence collection

- Manage risks across clients through centralized, multi-tenant dashboards

- Align security initiatives with business goals

- Provide higher-value, strategic, and proactive security outcomes

In short, IRM unifies IT, security, and compliance to help MSPs and MSSPs reduce risk continuously while improving operational efficiency and client value.

What is Integrated Risk Management?

1. What is Integrated Risk Management (IRM)?

Integrated Risk Management (IRM) is an approach to managing and coordinating all aspects of risk within an organization. It combines risk identification, assessment, mitigation, and monitoring into a unified strategy. IRM integrates both operational and strategic risk management across the organization to provide a holistic view of risks and how they can impact business objectives.

2. Why Do Organizations Need Integrated Risk Management?

Organizations need IRM to efficiently manage and mitigate various risks—financial, operational, cybersecurity, and regulatory—that may arise in today's complex business environment. By taking an integrated approach, businesses can reduce silos, improve risk visibility, enhance decision-making, and ensure compliance with regulations, ultimately driving more informed business outcomes.

3. What are the Benefits of Integrated Risk Management?

The main benefits of IRM include:

- Improved Risk Visibility: A comprehensive view of all risks across the organization.

- Better Decision-Making: With centralized risk data, executives can make more informed decisions.

- Enhanced Efficiency: Streamlined risk management processes across departments.

- Increased Compliance: Helps ensure compliance with laws, regulations, and industry standards.

- Proactive Risk Mitigation: Identifies potential risks early, enabling preventative actions.

4. What are the Challenges of Implementing an Integrated Risk Management Approach?

Implementing IRM can be challenging due to:

- Resistance to Change: Employees and departments may be hesitant to adopt new processes.

- Lack of Expertise: A shortage of skilled professionals can hinder implementation.

- Data Silos: Difficulties in integrating data from different departments or systems.

- Cost: Initial investment in technology and training can be significant.

- Complexity: The need to manage multiple types of risks (financial, operational, cybersecurity, etc.) in one framework can be overwhelming.

5. How to Build an Effective IRM Framework?

Building an effective IRM framework involves:

- Risk Identification: Understanding and cataloging all potential risks.

- Risk Assessment: Evaluating the likelihood and impact of each risk.

- Risk Mitigation: Creating action plans to reduce or control risks.

- Integration: Combining risk management processes across departments into a unified framework.

- Technology: Implementing tools, such as GRC software, to automate and streamline risk management.

- Continuous Improvement: Regularly reviewing and updating the IRM strategy to adapt to changing business needs.

6. How Do I Pick the Right IRM Solution for My Business?

To choose the right IRM solution, consider:

- Scalability: Ensure the solution can grow with your organization.

- Ease of Use: Look for an intuitive, user-friendly interface.

- Customization: Choose a solution that can be tailored to your organization’s specific needs.

- Integration: The solution should seamlessly integrate with existing systems (ERP, CRM, etc.).

- Support and Training: Consider vendors offering strong customer support and training resources.

- Compliance Features: Ensure the solution helps manage industry-specific regulations.

7. What is the Difference Between ERM and IRM?

Enterprise Risk Management (ERM) focuses on identifying and managing risks at the organizational level, encompassing all types of risks across departments. Integrated Risk Management (IRM), on the other hand, is a more comprehensive and collaborative approach that integrates risk management into business processes and systems, focusing on aligning risk strategies with organizational goals for a more holistic view.

8. What is an Integrated Risk Management Framework?

An IRM framework is a structured approach to managing all risks within an organization. It includes policies, processes, tools, and technologies that help identify, assess, and mitigate risks in a coordinated and aligned manner. The framework integrates various risk management functions into one cohesive strategy that aligns with business objectives, ensuring that risks are managed proactively.

9. How Can the Integrated Risk Management Process Be Successfully Implemented?

Successful implementation of IRM involves:

- Clear Vision and Leadership: A strong executive team that drives the IRM strategy.

- Collaboration Across Departments: Cross-functional collaboration is key to breaking down silos.

- Technology Integration: Use of tools like GRC platforms to automate processes and improve efficiency.

- Regular Training: Ensuring teams are well-trained on IRM policies and tools.

- Continuous Monitoring and Reporting: Implement real-time monitoring and reporting systems to stay ahead of emerging risks.

10. What are the Top-listed Risk Management Certifications Available?

Some of the most recognized risk management certifications include:

- Certified Risk Management Professional (CRMP): Focuses on comprehensive risk management practices.

- Certified in Risk and Information Systems Control (CRISC): Specializes in IT and cybersecurity risk management.

- Risk Management Professional (RMP): Offered by PMI, focused on project risk management.

- ISO 31000 Risk Manager Certification: Based on the ISO 31000 standard for risk management.

- Certified Information Systems Security Professional (CISSP): Focuses on cybersecurity risk management and is widely recognized in the IT industry.

Final Thoughts: Optimizing Risk and Compliance with Risk Cognizance

In today’s dynamic business environment, having the right governance, risk, and compliance software is crucial for maintaining a strong security posture and regulatory compliance. Risk Cognizance’s Integrated Risk Management (IRM) software simplifies GRC processes, empowers organizations with AI-driven insights, and reduces the complexity of compliance, risk, and audit management.

With Risk Cognizance, you gain access to a comprehensive GRC platform that streamlines your compliance workflows, enhances risk visibility, and ensures continuous audit readiness—all in one solution. Experience the power of automated governance, risk management, and compliance today and drive your business towards greater resilience.

By aligning with these industry-leading features and capabilities, Risk Cognizance ensures that you’re always ahead in managing risks, staying compliant, and optimizing audit readiness across your organization.

Recognized as a GRC Software Leader