Overview

AI-Powered Compliance Management for Modern Business

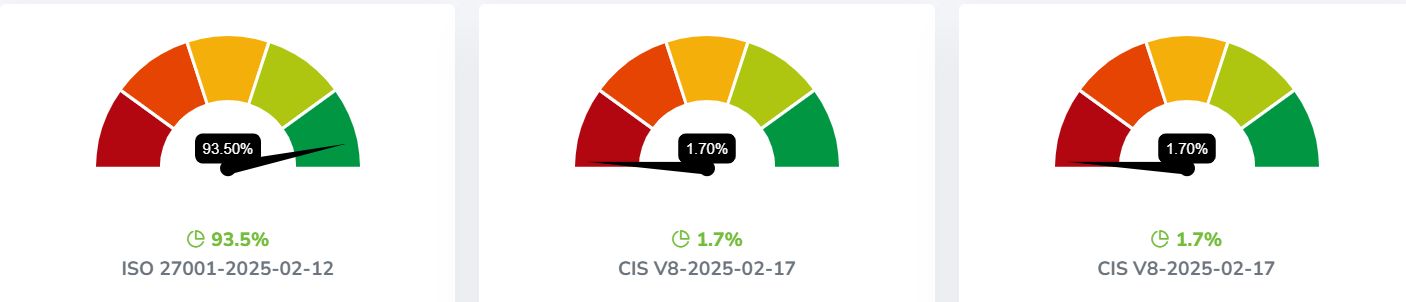

Compliance pine management is more complex than ever. Organizations must adhere to multiple frameworks such as NIST, ISO 27001, HIPAA, SOC 2, PCI DSS, CIS, CMMC, DORA, and NIS2. Managing compliance manually is inefficient, costly, and prone to human error.

The Risk Cognizance Hybrid GRC Platform is an AI-driven governance, risk management, and compliance (GRC) software designed to simplify compliance management through automation, analytics, and centralized oversight. This all-in-one solution is ideal for CISOs and compliance management teams, offering an intelligent approach to regulatory compliance, risk mitigation, and security governance.

Compliance Challenges and How AI Solves Them

Organizations face several compliance challenges, including:

Regulatory complexity – Staying up to date with changing regulations requires continuous monitoring.

Manual processes – Traditional compliance management is time-consuming and increases the risk of errors.

Siloed data – Lack of centralized compliance data leads to inefficiencies in reporting and audits.

High compliance costs – Maintaining compliance can be expensive without automation.

- AI-powered automation within Risk Cognizance addresses these challenges by:

- Automating risk assessments and compliance reporting

- Enhancing regulatory tracking with AI-powered analytics

- Providing real-time compliance insights through a centralized dashboard

- Reducing manual efforts through automated workflows and AI-driven recommendations

Key Compliance Management Fundamentals

An effective vCISO compliance management platform and tools must support critical compliance functions, including:

Policy Enforcement

Risk Cognizance ensures consistent policy application by automating compliance enforcement across various frameworks. The AI-powered cybersecurity compliance software continuously monitors for deviations and alerts teams to potential risks.

Risk Assessment

The enterprise risk management and third-party risk management tools identify, assess, and mitigate cyber and operational risks, providing organizations with an early warning system for regulatory breaches.

Regulatory Reporting

With compliance assessments and audit manager software, organizations can streamline compliance audits and reporting, ensuring they meet regulatory deadlines while minimizing administrative burdens.

CISO compliance Software Solutions Build For Security Team

Risk Cognizance Hybrid GRC Platform

Risk Cognizance integrates AI-driven automation with user-friendly functionalities, offering:

GRC software for compliance – A unified platform to manage compliance requirements.

Multi-tenant GRC platform– Ideal for MSSPs and enterprises managing multiple entities.

Attack surface platform – Identifies and mitigates external vulnerabilities.

Ticket management software – Tracks and resolves compliance-related incidents.

Dark web monitoring tool – Alerts organizations to credential leaks and data exposure.

Enterprise risk management – Automates risk identification and mitigation strategies.

Cloud assessment software – Ensures compliance across cloud environments.

IT and cyber risk management software – Monitors security posture and regulatory alignment.

Cyber program software –– Manages cybersecurity initiatives with compliance in mind.

Automated compliance management software –– Reduces manual compliance workload with AI-powered workflows.

Over 250 Integrated Apps and API access to all of our system.

Automating risk management, with workflow, and our AI compliance management tools.

Built-In AI Capabilities for Smarter Compliance

Risk Cognizance stands out as an AI-powered compliance management platform with:

- AI-powered analytics – Detects patterns and predicts compliance risks before they escalate.

- Automated workflows – Reduces the manual burden on compliance teams.

- Centralized reporting – Offers real-time compliance insights to key stakeholders.

Industry-Specific Use Cases

Finance and Banking

A global financial institution leveraged Risk Cognizance to automate PCI DSS and SOC 2 compliance, reducing compliance audit time by 60% while improving reporting accuracy.

Healthcare

A healthcare provider streamlined HIPAA compliance using the cyber tools and compliance assessments features, achieving full compliance with minimal manual intervention.

Enterprise IT Risk Management

A multinational IT company integrated Risk Cognizance’s AI-powered cyber risk management software to enhance ISO 27001 and NIST compliance, reducing security incidents by 40%.

Case Studies: How Companies Improved Compliance Efficiency

Case Study 1: Reducing Compliance Costs with Automation

A Fortune 500 company using Risk Cognizance’s automated compliance management software reduced compliance-related costs by 35% by replacing manual processes with AI-driven automation.

Case Study 2: Achieving Continuous Compliance with AI-Powered Insights

An MSSP deployed Risk Cognizance’s multi-tenant GRC platform to manage compliance for multiple clients, reducing compliance gaps and increasing operational efficiency.

Why Businesses Choose Risk Cognizance

Organizations trust Risk Cognizance because of its:

- All-in-one compliance management capabilities

- AI-driven automation for compliance and risk management

Recognition on Gartner Peer Insights as a top 3 GRC tool for assurance leaders

The Future of Compliance: Why Automation is Essential

With increasing regulatory demands and evolving cyber threats, automated compliance management is no longer optional—it’s a necessity. Risk Cognizance Hybrid GRC Platform provides CISOs and compliance management teams with the tools needed to ensure regulatory compliance while optimizing efficiency, security, and cost-effectiveness.

Recognized as a

Cybersecurity Leader

Ready to transform your compliance management? Contact Risk Cognizance today.

Book a Demo