Overview

Compliance Risk Management Platform

Organizations face a growing number of risks that span IT, regulatory compliance, third-party relationships, and more.

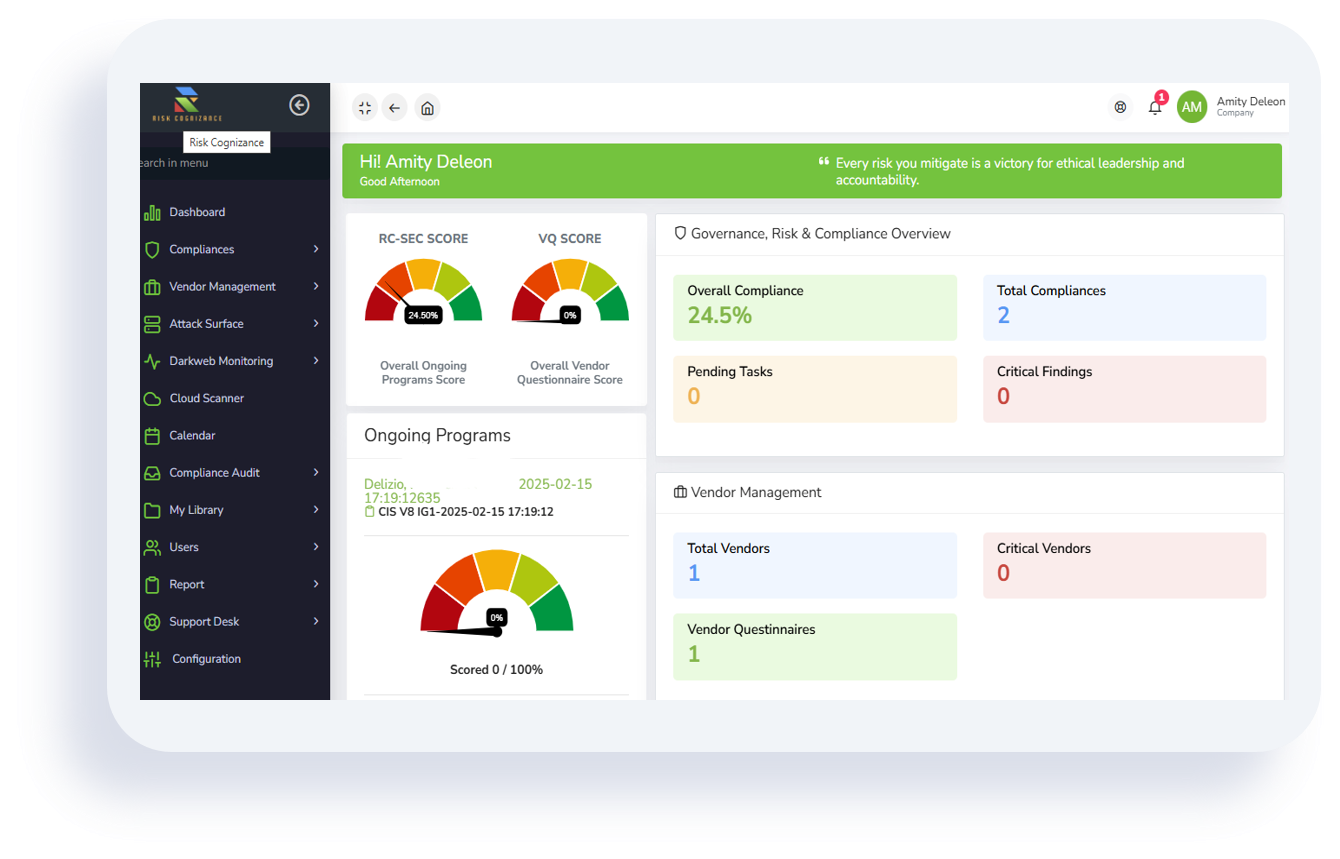

Risk Cognizance continuous, proactive awareness of all risks has become the cornerstone of modern risk management. A Centralized Risk Management Platform offers a comprehensive, real-time view of all risk-related data, enabling organizations to not only manage but also anticipate and mitigate risks before they escalate.

Our centralized platform that integrates risk, compliance, audit, and cyber risk functions, providing organizations with a holistic view of their governance landscape. A single tool that can streamline all your GRC processes, including Risk Management (Operational Risk, Enterprise Risk, Third-Party Risk), Compliance Management, Policy Management, Case Management, Audit Management, IT & Cybersecurity Risk Management and ESG.

Compliance Management Platform: Integrated Compliance Solution

Effectively manage a wide range of requirements with an efficient and integrated approach. Fully Automated Regulatory Compliance Management Leader.

Streamline compliance operations, mitigate risks, and build trust with customers and stakeholders in one centralized, AI-powered platform.

- Regulatory Compliance Management

- Cloud Compliance Management

- Connected Compliance Solution

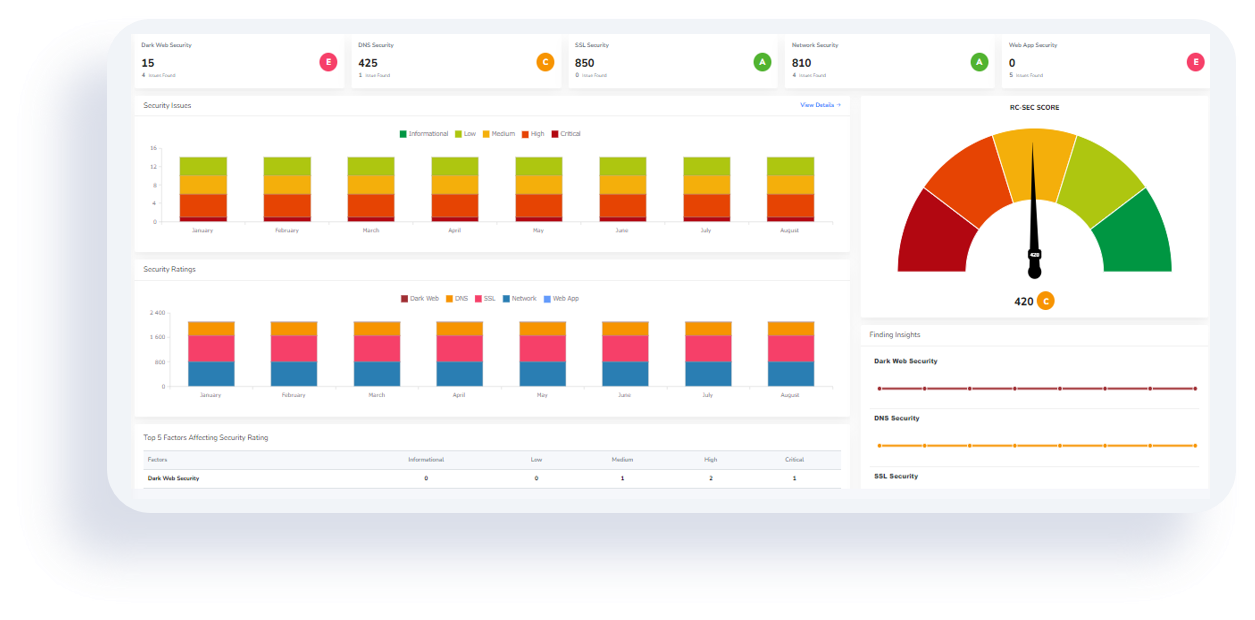

- Attack Surface Management

Regulatory Compliance Management solutions provide automated workflows, enhanced collaboration, and real-time reporting features, helping you save time, reduce costs, and optimize resources in managing compliance and regulatory obligations.

Our solutions create a centralized framework that ensures regulations, risks, controls, and issues are accurately mapped to relevant business functions, locations, and legal entities. We offer senior executives complete visibility into key processes and workflows, including policy management, regulatory compliance, change management, regulatory engagement, and case and incident handling, empowering proactive issue prevention while fostering trust and credibility.

What is a Centralized Risk Management Platform?

A Centralized Risk Management Platform is an integrated software solution that unifies an organization's approach to identifying, assessing, managing, and reporting risks (like IT, cyber, compliance, or enterprise risks) in one place, boosting visibility, automating workflows (like assessments, audits, remediation), and enabling data-driven decisions for better business resilience and governance

Risk Cognizance Centralized Risk Management Software connected GRC (Governance, Risk, & Compliance) suites, offer features like risk registers, asset tracking, compliance mapping, and dashboards to streamline processes across departments, moving from reactive to proactive risk management.

Why Organizations Need a Centralized Platform: Risk Management Tool

Organizations are operating in an increasingly complex, interconnected environment where risks are dynamic, diverse, and can emerge from multiple areas. Managing these risks efficiently and effectively requires a Centralized Risk Management Tool, which offers key advantages across the organization:

1. Fragmented Data Across Silos

Many businesses store risk, compliance, and governance data in isolated systems or departments, making it difficult to gain a holistic view of overall risk exposure. A Centralized Platform consolidates all these data sources into a single, unified hub, breaking down silos and providing a single source of truth for better decision-making.

- Improved Decision-Making: Real-time, centralized data ensures all stakeholders have access to accurate and up-to-date information.

- Data Consistency: Eliminate discrepancies and inconsistencies, ensuring all departments work from the same set of facts.

2. Proactive Risk Management and Continuous Risk Cognizance

With a Centralized Platform, organizations can shift from reactive risk management to proactive risk mitigation. Constantly monitoring and assessing risks ensures that potential threats are identified early and dealt with swiftly, preventing incidents before they disrupt operations.

- Early Detection & Alerts: Predict and identify emerging risks through advanced analytics, automated monitoring, and predictive modeling.

- Proactive Mitigation: Take corrective actions before risks escalate into larger issues, reducing the potential financial, operational, and reputational impact.

3. Streamlined Compliance Management

Staying compliant with constantly changing regulations is one of the biggest challenges businesses face. A Centralized Risk Management Tool simplifies compliance by automating monitoring, alerting, and reporting, ensuring that your organization stays ahead of regulatory changes.

- Automated Compliance Monitoring: Keep track of changes in laws, regulations, and internal policies without manual effort.

- Audit-Ready Data: Continuous evidence collection ensures your organization is always prepared for audits, reducing the time and stress involved in the audit process.

4. Holistic Risk Management Across Multiple Domains

Whether it’s IT risks, third-party relationships, operational challenges, or regulatory compliance, modern risks are multifaceted and interconnected. A Centralized Platform helps manage risks across all domains in one place.

- Comprehensive Risk View: Get a holistic understanding of your organization’s risk profile, seeing how various risks intersect and compound.

- Cross-Departmental Collaboration: Risk, compliance, IT, legal, and other departments can all collaborate seamlessly using a unified platform.

5. Incident Management & Workflow Automation

Efficient incident response is crucial for minimizing the impact of unexpected events. A Centralized Risk Management Platform enables organizations to respond to incidents swiftly, track resolution, and ensure continuous monitoring of the situation.

- Automated Workflow: Streamline incident management tasks and automate the assignment of responsibilities, reducing manual errors and delays.

- Real-Time Incident Tracking: Keep an eye on incident status and resolution in real time, ensuring nothing falls through the cracks.

6. Advanced Reporting and Real-Time Analytics for Data-Driven Decisions

With increasing data volumes, organizations need a way to make informed, data-driven decisions. A Centralized Risk Management Platform offers powerful reporting and analytics tools that provide real-time insights into all risk and compliance factors.

- Real-Time Dashboards: Visualize key performance indicators (KPIs), risk status, and compliance metrics in a single dashboard.

- Predictive Analytics: Utilize historical data and trends to forecast future risks and prepare for potential challenges.

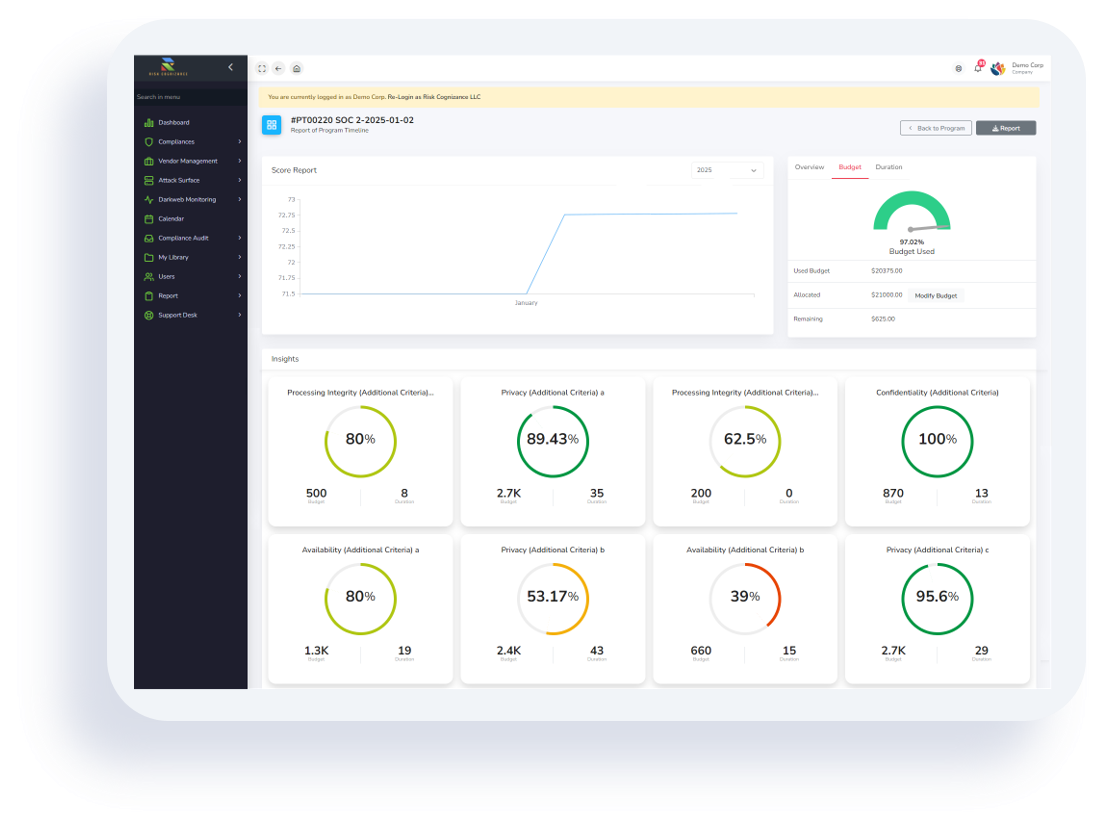

- Customizable Reports: Generate detailed, tailored reports for executives, auditors, or compliance teams.

7. Policy Management and Enforcement

Effective policy management is vital for controlling risk. The Centralized Platform allows for the creation, distribution, tracking, and enforcement of policies across the organization.

- Consistent Policy Execution: Ensure policies are consistently followed by all employees and departments, reducing risk exposure.

- Real-Time Policy Tracking: Monitor adherence to policies in real-time, making it easier to spot and address violations.

- Risk-Based Policy Adjustments: Modify and update policies based on emerging risks, ensuring your organization is always aligned with its risk management strategies.

8. Audit Management and Continuous Monitoring

Internal audits are critical for assessing compliance and identifying potential vulnerabilities. A Centralized Risk Management Platform streamlines audit management, making it easier to prepare for and execute audits efficiently.

- Automated Evidence Collection: Automatically collect audit data, making it easy to present during audits.

- Audit-Ready: With continuous risk monitoring, you can ensure your organization is always prepared for regulatory and internal audits.

- Audit Insights: Use real-time audit data to identify areas of risk and improve future audit processes.

9. Scalability and Flexibility for Growth

As your organization grows, so too do the risks and challenges it faces. A Centralized Risk Management Tool is scalable and adaptable, ensuring your platform evolves with your business needs.

- Adaptable to Changing Risks: The platform can scale to accommodate new risks, such as global expansion, new business units, or emerging threats.

- Flexible Configuration: Customize the platform’s settings and workflows to align with your organization’s unique needs and risk profile.

10. Cost Savings and Reduced Risk Exposure

A Centralized Risk Management Platform helps organizations avoid the high costs associated with managing risks inefficiently, such as penalties for non-compliance or the financial fallout of preventable incidents.

- Cost-Effective Risk Mitigation: By identifying risks early and acting swiftly, you can avoid costly disruptions and fines.

- Resource Efficiency: Automate manual risk management tasks, freeing up resources for more strategic activities.

The Strategic Imperative of a Centralized Risk Management Platform

A Centralized Risk Management Platform with a focus on Risk Cognizance is no longer a luxury—it’s a necessity. In an age where risks are growing more complex and interconnected, organizations need a unified approach that not only helps manage risks but also provides continuous awareness and actionable insights.

By consolidating data, streamlining workflows, automating compliance, and offering real-time reporting, this platform enables businesses to mitigate risks proactively and ensure they stay ahead of potential threats. With predictive analytics and continuous monitoring, organizations are better positioned to make data-driven decisions, improve governance, and maintain operational resilience.

Take Control of Your Risk Landscape

Is your organization ready to enhance its Risk Cognizance and gain full control over its risk management practices?

Contact us today to schedule a demo or learn how our Centralized Risk Management Software can help you stay ahead of risks, streamline compliance, and strengthen operational efficiency.

Recognized as a GRC Software Leader