What is compliance management, and how to implement it

What Is Compliance Management? Meaning & Examples

In an era of accelerating digital transformation and intensifying regulatory scrutiny, effective compliance management has transitioned from a mere operational necessity to a strategic imperative. Compliance management is about aligning company processes with legal regulations and industry standards to protect data from emerging cyber threats. It is the structured approach an organization takes to ensure it adheres to the vast landscape of laws, internal policies, and ethical guidelines that govern its operations.

Beyond simply avoiding fines and legal repercussions, robust compliance management builds trust, enhances reputation, and fortifies an organization's resilience against an increasingly complex threat environment. It is the bedrock upon which sustainable business operations and enduring stakeholder confidence are built.

What is Compliance Management? Core Principles and Strategic Value

Compliance management encompasses the systematic processes, controls, and oversight mechanisms designed to ensure that an organization operates within the boundaries of applicable legal, regulatory, and ethical requirements. Its core principles are:

- Identification: Proactively identifying all relevant laws, regulations, industry standards, and internal policies.

- Assessment: Evaluating the organization's current adherence to these requirements and identifying potential compliance gaps and risks.

- Control Implementation: Designing and implementing policies, procedures, and technological controls to mitigate identified risks and ensure adherence.

- Monitoring & Reporting: Continuously monitoring compliance status, tracking changes in regulations, and reporting on performance to relevant stakeholders.

- Response & Remediation: Establishing clear processes for addressing non-compliance, managing incidents, and implementing corrective actions.

Strategically, compliance management protects against:

- Legal and Financial Penalties: Avoiding hefty fines, sanctions, and litigation.

- Reputational Damage: Preserving brand integrity and public trust.

- Operational Disruptions: Ensuring business continuity by preventing compliance-related shutdowns.

- Cyber Risks: Directly contributing to cybersecurity posture by mandating data protection, access controls, and incident response protocols.

Examples of Compliance Management in Action

Compliance management is pervasive, touching every aspect of an organization's operations. Here are a few examples:

- Financial Services: Adhering to anti-money laundering (AML) regulations, Sarbanes-Oxley (SOX) Act requirements, and data privacy laws like GDPR when handling customer financial data.

- Healthcare: Ensuring HIPAA compliance for patient data privacy and security, as well as managing pharmaceutical regulations and medical device safety standards.

- Technology & SaaS: Achieving SOC 2 certification for cloud service security, maintaining ISO 27001 for information security management, and adhering to global data privacy laws like GDPR and CCPA.

- Manufacturing: Complying with environmental protection regulations, worker safety standards (OSHA), and supply chain ethics.

- Human Resources: Adhering to labor laws, anti-discrimination policies, and workplace safety regulations.

Why a Compliance Management System (CMS) is Imperative

In today's dynamic regulatory landscape, managing compliance manually with spreadsheets and disparate documents is not only inefficient but highly risky. A modern Compliance Management System (CMS) centralizes, streamlines, and automates compliance processes, offering critical advantages:

- Centralized Repository: A single source of truth for all regulations, policies, and control evidence.

- Automated Workflows: Streamlining tasks such as policy review, risk assessments, control testing, and evidence collection.

- Real-time Visibility: Providing continuous insight into compliance posture, identifying gaps, and enabling proactive remediation.

- Reduced Risk & Cost: Minimizing the likelihood of non-compliance, reducing fines, and lowering the operational costs associated with manual processes.

- Enhanced Audit Readiness: Significantly simplifying the preparation and execution of internal and external audits.

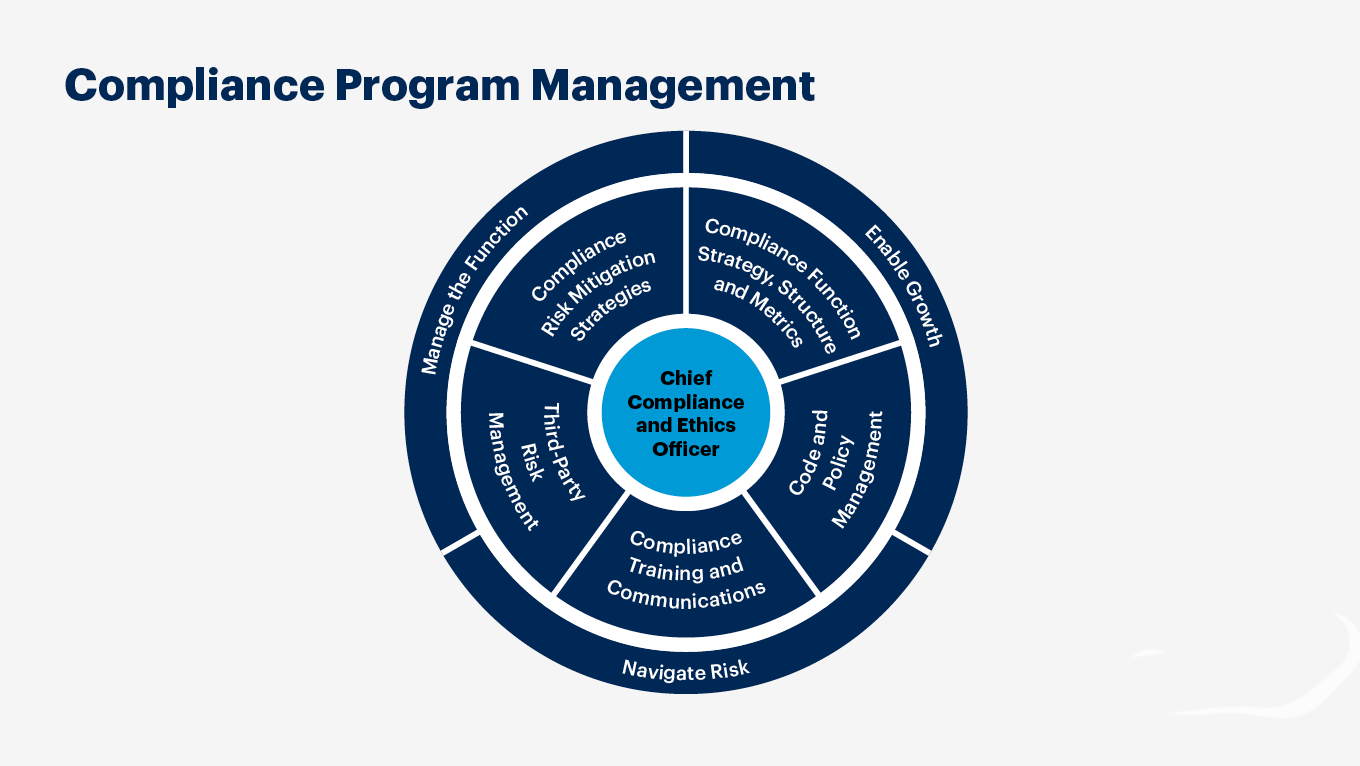

Key Roles in an Organization that Utilize a Compliance Management System (CMS)

A CMS serves as a critical tool across various functions within an organization, fostering cross-departmental collaboration on compliance initiatives:

- Compliance Officers: The primary users, responsible for overseeing the entire compliance program, tracking regulatory changes, and ensuring adherence.

- Legal Counsel: Advising on legal interpretations, reviewing policies, and managing regulatory interactions.

- Chief Information Security Officers (CISOs) & IT Managers: Ensuring IT systems and data processes meet security and privacy compliance requirements (e.g., SOC 2, ISO 27001, HIPAA).

- Internal Auditors: Leveraging the CMS to plan, execute, and report on audit findings, verifying control effectiveness.

- Risk Managers: Integrating compliance risks into broader enterprise risk management frameworks.

- HR Professionals: Managing compliance with labor laws, employee privacy regulations, and workplace safety standards.

- Business Unit Leaders: Ensuring their specific operations align with relevant policies and regulations.

Compliance Management, Audit, & Due Diligence: A Synergistic Relationship

These three pillars are intrinsically linked, forming a holistic approach to governance and risk mitigation:

- Compliance Management: This is the ongoing, proactive process of aligning operations with requirements. It's the "doing" of adherence, enabled by a robust CMS.

- Audit: This is the independent verification process. Internal and external audits assess the effectiveness of compliance controls and procedures, using the data and processes managed within the CMS to validate adherence. Our Internal Audit Management Software supports this seamlessly.

- Due Diligence: This is the investigative process, particularly critical when engaging with third parties. It involves a thorough assessment of a third party's compliance, security, financial, and operational posture before a partnership is established. A CMS, particularly one with strong vendor management capabilities, supports the collection and analysis of due diligence information.

Choosing the Right Compliance Management Tool

Selecting a CMS is a strategic decision that can significantly impact your organization's resilience and efficiency. When evaluating solutions, consider platforms that offer:

- Rapid Deployment: Time to value is critical. For instance, Risk Cognizance is designed for quick setup, allowing you to have foundational compliance frameworks up and running within 30 minutes, accelerating your time to demonstrable compliance.

- Scalability for Diverse Use Cases: The best solutions are not narrowly focused but offer a large number of use cases, adapting to your growing regulatory landscape and expanding operational needs. Risk Cognizance's Integrated Connected GRC Software provides this inherent scalability across various domains including Compliance, Risk, Audit, and Policy.

- Comprehensive Requirement Support: The platform should actively support current and evolving regulatory requirements, offering updated content and mapping tools. Risk Cognizance's Regulatory Compliance Management Software and Regulatory Change Management Software ensure you stay ahead of mandates.

- Seamless Integration and Support: A strong CMS offers easy integration with your existing IT ecosystem (e.g., HRIS, cloud platforms, ticketing systems) and comprehensive vendor support to ensure smooth adoption and ongoing optimal performance. Risk Cognizance offers POC (Proof of Concept) solutions to ensure seamless support and integration with your specific environment, demonstrating value from day one.

- IT & Cyber Compliance Focus: Given the increasing overlap between compliance and cybersecurity, the solution should provide robust IT & Cyber Compliance Management Software features to manage controls related to data security and privacy standards (like SOC 2, HIPAA, ISO).

- Vendor Due Diligence Support: For comprehensive risk management, look for how the CMS can integrate with or provide Vendor Risk Management Software to streamline the due diligence audit process for third parties, ensuring your extended enterprise remains compliant.

Elevate Your Compliance. Build Enduring Trust.

Effective compliance management is no longer merely about checking boxes; it's about embedding a culture of integrity and resilience into your organizational DNA. By leveraging a modern, integrated Compliance Management System, you can transform a complex challenge into a strategic advantage. This protects your organization from legal and financial pitfalls, strengthens its reputation, and empowers it to navigate the complexities of the digital age with confidence. Choose a solution that not only streamlines your compliance efforts but actively contributes to the enduring trust your stakeholders place in you.