GRC Solution Providers Complying with CMMC Requirements

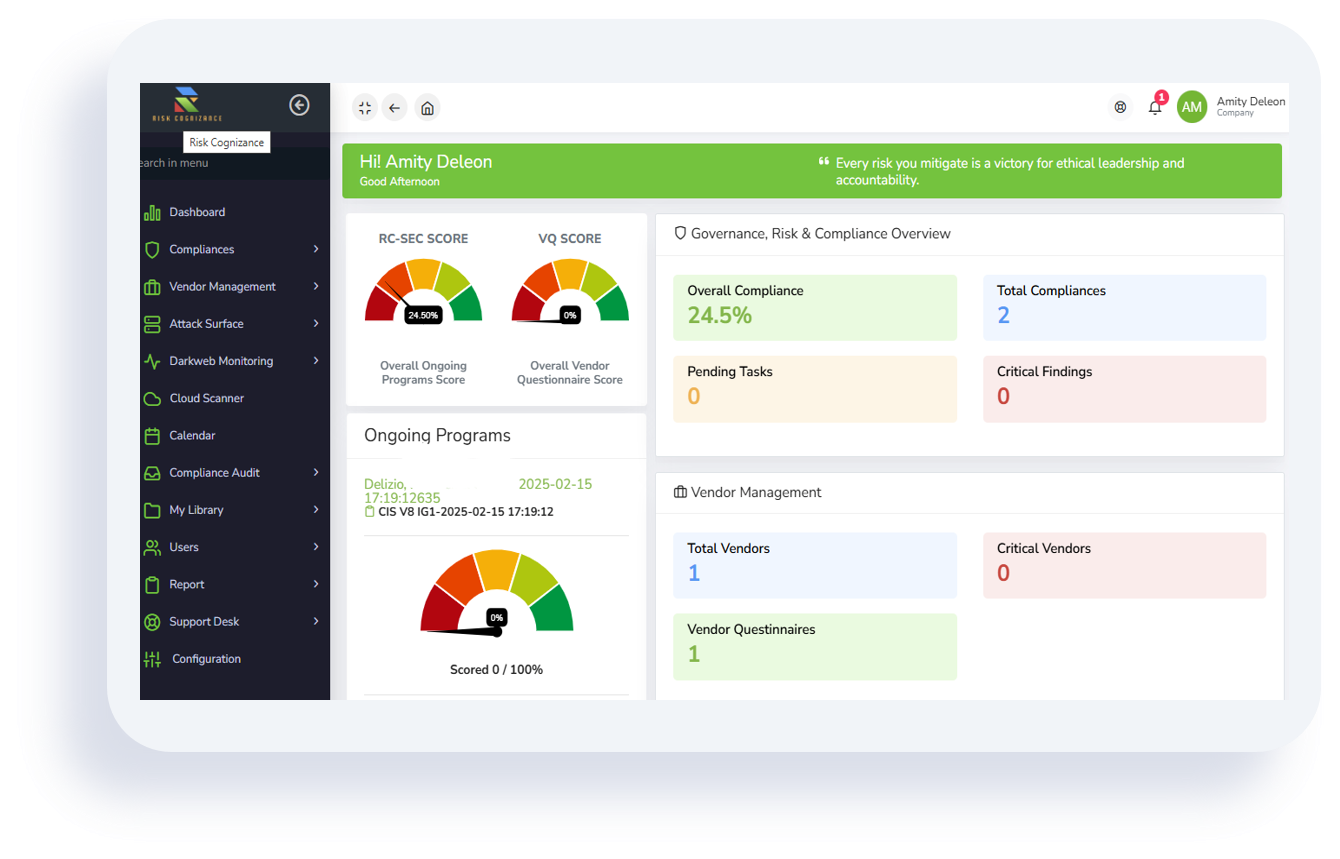

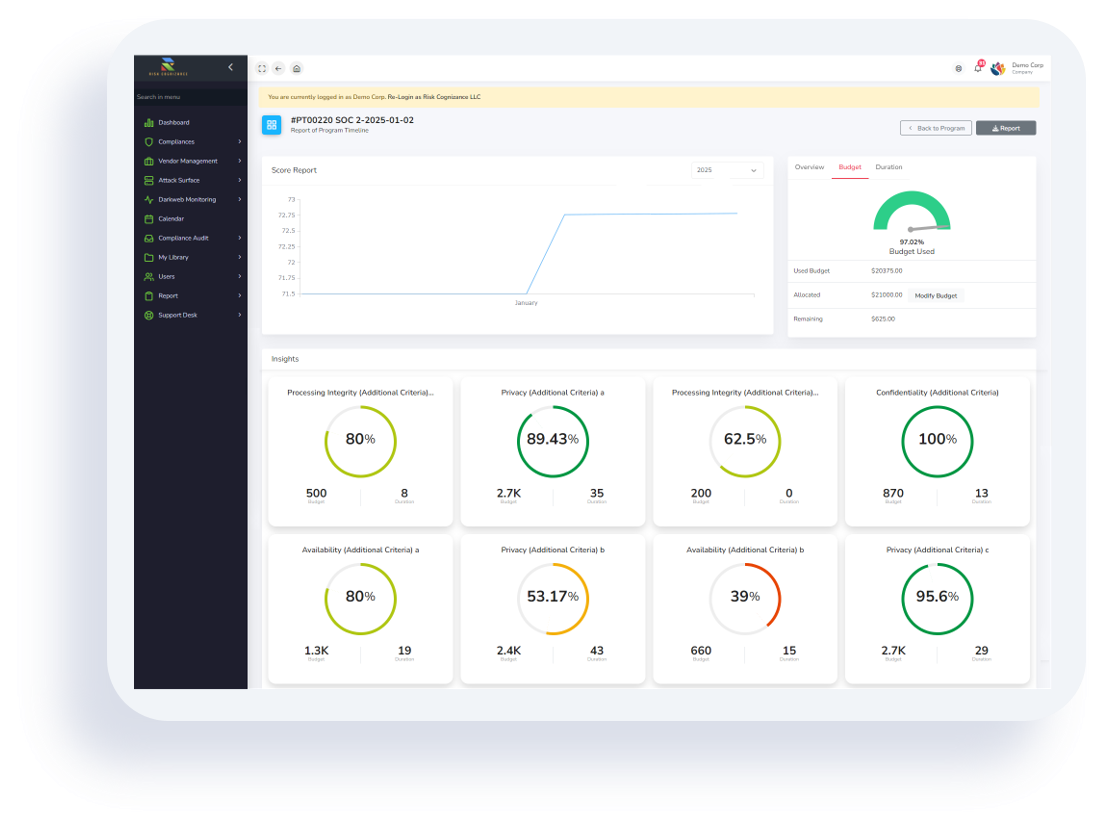

Risk Cognizance GRC software is an advanced, AI-driven, cloud-based Governance, Risk, and Compliance (GRC) platform designed for enterprises, MSSPs, MSPs, and security teams looking for comprehensive compliance and risk management solutions. Built with automation, scalability, and flexibility in mind, Risk Cognizance enables organizations to centralize risk management, streamline compliance processes, and proactively monitor operational and cyber risks from a single integrated platform.

In today’s complex regulatory and cyber risk landscape, enterprises require a GRC software platform that not only ensures compliance but also empowers executives and operational teams to make informed decisions in real-time. Risk Cognizance positions itself as a top-tier GRC provider, offering AI-driven workflows, intuitive dashboards, and cloud scalability tailored for modern business needs.

Why Enterprises Choose Risk Cognizance GRC

Modern enterprises face growing regulatory complexity, spanning ISO 27001, SOC 2, HIPAA, and CMMC. Risk Cognizance GRC simplifies compliance, reduces manual effort, and ensures accuracy while maintaining audit readiness. Key reasons organizations choose Risk Cognizance include:

- Automated Compliance Management: AI-powered automation reduces errors and accelerates compliance processes across multiple regulatory frameworks.

- Centralized Risk Management: Gain enterprise-wide visibility for operational, enterprise, cyber, and third-party risks within a single GRC platform.

- Operational Resilience: Plan for business continuity and disaster recovery proactively with real-time scenario analysis.

- Data-Driven Decision-Making: Consolidate all compliance, risk, and policy data for informed, timely executive decisions.

- Resource Optimization: Save time and reduce redundancies through intelligent, automated workflows and evidence collection.

- Flexible and Scalable Platform: Customize dashboards, reports, and workflows to fit your organization’s needs and industry requirements.

Comprehensive GRC Solutions Offered by Risk Cognizance

Governance & Policy Management

- Develop, distribute, and enforce policies across the organization.

- Establish clear accountability while fostering transparency and compliance culture.

- Automate version control, acknowledgment tracking, and policy updates for seamless management.

Enterprise Risk Management

- Conduct AI-driven risk assessments across all departments and projects.

- Prioritize risks and track mitigation strategies with dashboards and real-time reporting.

- Integrate operational, strategic, and enterprise risk assessments for a holistic view.

Cyber Risk Management

- Integrate cybersecurity threat intelligence directly into the GRC platform.

- Monitor IT systems continuously for vulnerabilities, compliance gaps, and threats.

- Enhance incident response and risk mitigation with proactive AI insights.

Third-Party Risk Management

- Assess and monitor vendors, suppliers, and partners for compliance and performance.

- Assign risk scores, automate assessments, and track remediation plans.

- Minimize supply chain exposure and improve third-party accountability.

Operational Resilience

- Build business continuity plans, disaster recovery protocols, and crisis management workflows.

- Run simulations to measure organizational preparedness and impact.

- Ensure sustainable operations and maintain stakeholder trust during disruptions.

Compliance & Audit Management

- Streamline regulatory compliance, internal audits, and reporting.

- Track evidence, findings, and corrective actions across all business functions.

- Automate alerts for compliance deviations and track resolution progress.

Data Privacy and Security Compliance

- Maintain adherence to regulations such as GDPR, CCPA, and HIPAA.

- Monitor data handling, privacy controls, and compliance reporting.

- Reduce exposure to legal and financial risks while protecting sensitive data.

Core Benefits of Risk Cognizance GRC Software

Data-Driven Decision-Making:

- Centralized dashboards provide a unified view of risks, compliance gaps, and policy adherence.

- Executives and teams can make informed decisions backed by accurate and timely data.

Proactive Compliance and Risk Management:

- Automated monitoring detects violations before they escalate.

- Continuous compliance and risk assessment ensure audit readiness at all times.

Enhanced Accountability and Transparency:

- Employees understand their responsibilities and compliance expectations.

- Automated workflows and reporting enhance visibility across departments.

Operational Efficiency:

- Streamlined GRC workflows reduce manual effort and eliminate redundancies.

- AI-driven tools accelerate assessments, audits, and compliance reviews.

Scalability and Customization:

- Tailor dashboards, reports, and workflows for your organization’s unique requirements.

- Scale with business growth and evolving regulatory frameworks.

Capturing Buyer Intent with Risk Cognizance GRC

Companies actively searching for GRC solutions often show strong intent to purchase. Risk Cognizance targets these signals effectively:

Searching for ISO 27001, SOC 2, HIPAA, or CMMC compliance frameworks.

- Evaluating software for audit management and internal controls.

- Exploring third-party risk management solutions for vendors and partners.

- Looking for tools to automate compliance processes and reduce manual workloads.

- Seeking platforms with AI capabilities for smarter risk assessment.

- Comparing cloud-based GRC platforms for scalability, efficiency, and ROI.

Engaging with reviews, case studies, whitepapers, and webinars about GRC software solutions.

Real-World Success Stories

Guidewire:

- Implemented Risk Cognizance GRC for IT GRC management.

- Achieved faster risk assessments, greater visibility, and better collaboration among stakeholders.

- Streamlined audits and compliance reporting, reducing manual tasks and errors.

Zurich Insurance:

- Adopted Risk Cognizance BusinessGRC for enterprise-wide compliance and risk management.

- Standardized workflows across departments, improving policy adherence and awareness.

- Gained real-time insights into compliance risks, allowing faster response to regulatory changes.

Steps for Successful Deployment

- Executive Support: Secure leadership buy-in to promote adoption and establish a risk-aware culture.

- Training Programs: Provide role-specific training to ensure optimal use of the GRC platform.

- Pilot Implementation: Start with a single business unit or function to validate processes and workflows.

- Continuous Improvement: Monitor platform usage, expand features, and optimize workflows consistently.

- Full Integration: Integrate Risk Cognizance GRC with other enterprise systems for seamless operations.

Conclusion

As regulatory requirements evolve and cyber risks increase, organizations need a robust, AI-powered GRC platform that adapts to change while driving operational efficiency. Risk Cognizance GRC software delivers a unified, cloud-based solution for governance, risk, and compliance, empowering enterprises to remain audit-ready, mitigate risks proactively, and optimize processes efficiently.

With AI-driven automation, integrated risk monitoring, and a user-friendly platform, Risk Cognizance is positioned as a top-tier GRC solution provider for enterprises seeking a scalable, future-proof compliance and risk management strategy.

.jpeg)