Beyond Compliance: How GRC and AI Drive Business Resilience

The GRC Imperative: Why Risk Management is Non-Negotiable

Simply reacting to threats is no longer enough. Organizations must proactively build resilience. This is where governance, risk and compliance software comes in, providing a structured and automated approach to managing an organization's most critical vulnerabilities. From protecting data to ensuring regulatory adherence, these solutions are the digital foundation of modern business security.

Key Statistics You Can't Afford to Ignore

The numbers speak for themselves. The cost of non-compliance and unmanaged risk is staggering and rising.

GRC Software Market

The global GRC software market is a rapidly expanding industry, valued at approximately $50 billion in 2024 and projected to reach over $100 billion by 2031, with a compound annual growth rate (CAGR) of around 15%.

The average global cost of a data breach reached $4.76 million in 2025. This figure can soar to over $9.5 million in highly regulated sectors like finance and healthcare.

The U.S. Securities and Exchange Commission (SEC) issued over $600 million in fines in 2024 for messaging compliance failures alone, demonstrating the high price of inadequate record-keeping.

These statistics underscore a clear message: investing in a proactive GRC strategy is not an expense—it's a critical investment in your organization's longevity and stability.

_1756037949.jpeg)

What Is Governance, Risk, and Compliance (GRC)?

At its core, GRC is an integrated system of capabilities that enables an organization to achieve its objectives reliably while managing uncertainty and acting with integrity.

- Governance: The framework of rules, policies, and processes that ensures the organization's activities are aligned with its goals and values. It defines who has authority and what they are accountable for.

- Risk: The practice of identifying, assessing, and mitigating potential threats to an organization's capital and earnings. This includes financial, operational, strategic, and reputational risks.

- Compliance: The discipline of ensuring that the organization adheres to all relevant laws, regulations, standards, and internal policies.

When combined, these three pillars form a powerful, unified approach to corporate resilience, ensuring that an organization can confidently navigate an unpredictable future.

The Digital Backbone: Essential GRC Solutions

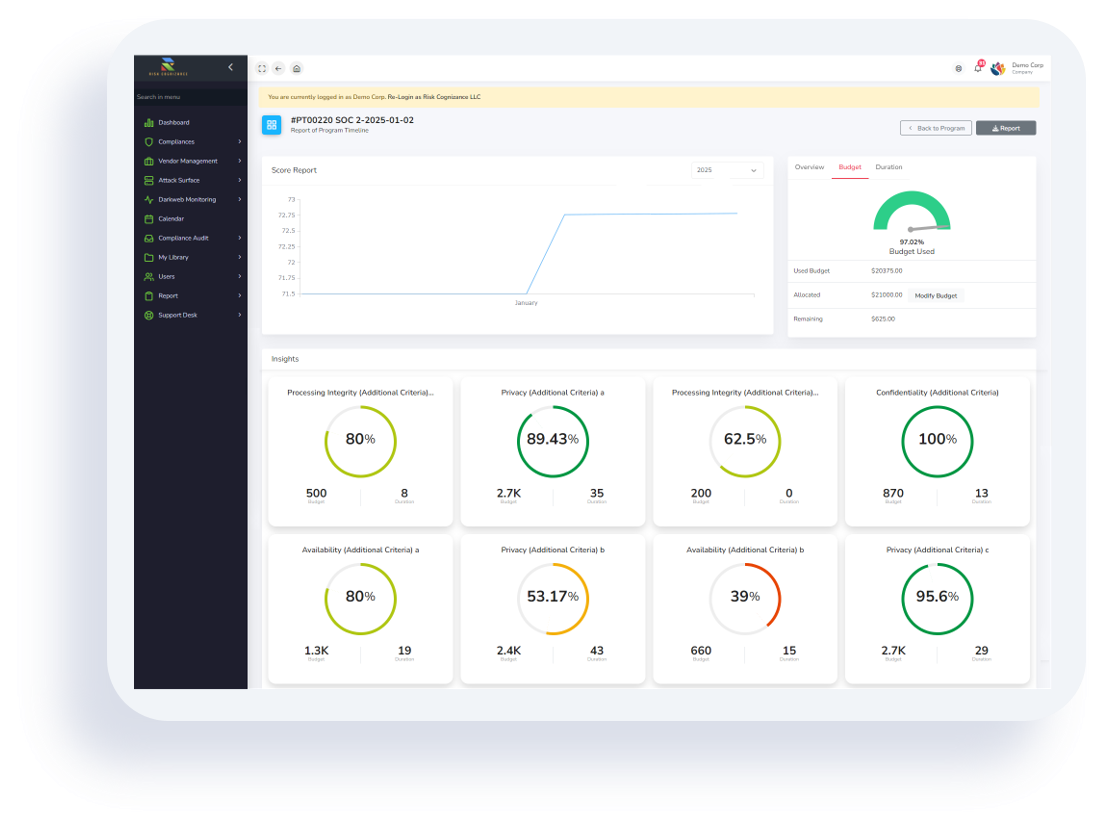

At the core of a resilient organization is a comprehensive grc software platform. This powerful technology provides a single source of truth for all risk-related data, enabling a holistic view of potential threats. The right enterprise risk management software goes beyond simple checklists, helping to identify, assess, and mitigate risks across the entire company. The right set of grc tools empowers teams to not only identify risks but also to act on them decisively.

A key component of this is compliance management software, which ensures that organizations adhere to a myriad of regulations and standards. This is complemented by governance risk and compliance software, which integrates these three pillars into a single, comprehensive solution. For businesses operating in complex supply chains, third-party risk management software is crucial for mitigating the risks associated with external vendors and partners. The right erm software (enterprise risk management) helps organizations identify, assess, and prepare for potential risks across the entire enterprise.

For those looking for comprehensive solutions, grc solutions offer a tailored approach to meet specific business needs. This can be supported by robust risk and compliance software that provides a clear picture of an organization's risk exposure. For large enterprises, enterprise risk management software solutions are essential for managing complex risk portfolios. Even the singular grc tool can make a significant difference in a team's efficiency. A strong grc platform serves as the foundation for all risk-related activities. For a more streamlined approach, a single grc solution can often provide the necessary functionality for smaller businesses.

Strategic Practices and Expert Guidance

Technology is only one part of the equation. To truly succeed, businesses must combine great tools with smart practices. A compliance audit is a fundamental step, a systematic review that confirms all policies and regulations are being followed. However, the manual effort involved can be reduced significantly with compliance automation, a game-changer that streamlines repetitive tasks and reduces the margin for error. Implementing compliance automation software is a powerful step in this direction.

Some organizations are even turning to a fractional ciso, a part-time Chief Information Security Officer, to gain expert guidance without the cost of a full-time executive. The implementation of risk compliance software is a vital step in this journey, alongside the use of various risk and compliance tools. A comprehensive compliance audit software can further streamline the auditing process, providing detailed reports and insights. The integration of governance risk and compliance tools into a unified system creates a powerful defense against potential threats. Finally, an integrated risk management software provides a holistic view, while compliance and risk management software ensures that these two functions work in synergy. This includes grc software solutions and robust third party vendor risk management to protect the entire business ecosystem.

5 Critical GRC Use Cases

Organizations across all sectors are leveraging GRC to tackle complex challenges. Here are five examples of GRC in action:

- Financial Services: A bank uses enterprise risk management software to comply with stringent regulations like Basel III and SOX. The software provides real-time monitoring of transactions, helping to detect fraud and manage credit risk, while ensuring every audit is handled efficiently.

- Healthcare: A hospital system uses compliance management software to manage HIPAA and HITECH Act requirements. This ensures patient data privacy, automates compliance audits, and provides a centralized platform for tracking and reporting on security controls.

- Manufacturing: A global manufacturer uses third-party risk management software to vet its complex supply chain. It assesses the financial stability, cybersecurity protocols, and labor practices of its hundreds of suppliers, mitigating the risk of operational disruptions and reputational damage.

- Information Technology: A tech startup scales its operations using a unified grc platform. It combines compliance automation for frameworks like SOC 2 with a central grc solution to manage security policies and track IT risks, allowing the company to attract enterprise clients more quickly.

- Small Business: A growing e-commerce company engages a fractional ciso to establish a proper GRC framework. They implement a single grc tool to manage data privacy (GDPR/CCPA) and payment card industry (PCI) compliance, ensuring they can grow without exposure to significant legal and financial risks

How AI Plays a Part in Modern GRC

Artificial Intelligence is not just a buzzword; it's a transformative force in the GRC space. AI-powered grc solutions are moving risk management from a reactive exercise to a predictive science.

- Predictive Risk Analytics: AI models can analyze vast datasets—from market trends to news feeds—to identify emerging threats and predict potential risks before they materialize. This allows an integrated risk management software to provide early warnings and proactive mitigation strategies.

- Automated Compliance Checks: Using natural language processing (NLP), AI can instantly scan regulatory updates, identify changes, and automatically assess their impact on an organization's policies. Compliance automation software can then trigger automated workflows to update controls and notify relevant stakeholders.

- Real-Time Monitoring: AI-driven systems continuously monitor network activity and data access, automatically flagging anomalies that could indicate a security breach or compliance violation. This instant detection is a significant upgrade from periodic manual checks.

- Streamlined Auditing: Compliance audit software powered by AI can automatically collect evidence, cross-reference data points, and generate comprehensive reports, drastically reducing the time and resources required for an audit and minimizing human error.

Beyond Compliance: Leveraging Integrated GRC for Strategic Advantage and Long-Term Success

Beyond Compliance: Leveraging Integrated GRC for Strategic Advantage and Long-Term Success

For too long, Governance, Risk, and Compliance (GRC) has been relegated to the realm of necessity—a cost center focused on ticking regulatory boxes and avoiding penalties. While essential, this narrow view fails to capture the immense strategic potential inherent in a well-integrated GRC framework.

In today’s volatile and interconnected business environment, organizations that move beyond this traditional mindset and embrace GRC as a strategic lever are discovering a powerful edge, enhancing decision-making, fostering innovation, and building sustainable, long-term success.

The Evolution from Checkbox to Strategy

The landscape has fundamentally shifted. Digital transformation, the explosion of data, increasingly complex global regulations, sophisticated cyber threats, and heightened stakeholder expectations demand a more holistic approach. GRC can no longer effectively operate in isolated pockets within an organization. Its evolution demands integration and a shift in perspective—from a reactive, compliance-driven function to a proactive, value-adding strategic partner.

The Silo Problem: A Barrier to Resilience and Insight

One of the biggest impediments to realizing GRC’s strategic potential is the prevalence of organizational silos. When risk management, legal, compliance, IT, security, privacy, finance, and operations function independently, critical information gets lost, efforts are duplicated, and a comprehensive understanding of the organization’s true risk exposure is impossible. Consider these common scenarios:

IT implements new AI technology without fully consulting privacy and legal on data usage implications.

Finance assesses market risk without a deep understanding of potential operational or supply chain vulnerabilities identified by the risk team.

Compliance develops policies without adequate input from the teams responsible for implementing them on the ground.

These disconnects create gaps in oversight, lead to inefficient resource allocation, hinder effective decision-making, and ultimately, make the organization more vulnerable to disruption and non-compliance.

Connected GRC: The Power of Collaboration

The solution lies in breaking down these silos and fostering genuine cross-functional collaboration, using GRC as the unifying framework. An integrated GRC approach ensures that:

Information Flows Freely: Relevant data and insights are shared across departments, creating a single source of truth and a holistic view of risk.

Shared Understanding Develops: Different functions gain appreciation for each other’s priorities, challenges, and how their work impacts the broader risk landscape.

Controls are Integrated: Security, privacy, compliance, and operational controls are designed and implemented cohesively, reducing redundancy and improving overall effectiveness.

Risk Appetite is Aligned: The organization develops a clearly defined and commonly understood risk appetite that informs strategic decisions across all departments.

Responsibility is Shared: A culture emerges where risk management and compliance are not just the job of specific departments, but an integral part of everyone’s role.

Leveraging GRC for Strategic Advantage

When GRC operates as an integrated, collaborative function, it unlocks significant strategic benefits:

Enhanced Decision-Making: Leaders gain access to comprehensive, real-time data on risks and compliance status across the enterprise. This enables more informed strategic planning, resource allocation, and risk-taking aligned with the organization’s objectives.

Fostering Responsible Innovation: Clear GRC frameworks and guardrails actually enable innovation. By understanding the risks and compliance requirements upfront, organizations can pursue new technologies (like AI) and business models more confidently and ethically, avoiding costly missteps.

Building Sustainable Growth and Resilience: Proactive risk management, strong governance, and a demonstrable commitment to ethical compliance build trust with investors, customers, regulators, and employees. This trust translates into enhanced brand reputation, improved access to capital, and greater organizational resilience against economic downturns, cyberattacks, or regulatory changes. Integrating ESG factors into the GRC framework further strengthens this long-term sustainability.

Why Risk Cognizance?

Risk Cognizance is more than just a name; it's our philosophy. We believe that true resilience comes from being acutely aware of your risk posture, understanding the threats, and proactively implementing the right solutions. We provide the insights, analysis, and strategic guidance you need to make informed decisions. We are a trusted partner in helping you build a culture where risk is not just managed but understood, empowering you to turn uncertainty into a competitive advantage.

Frequently Asked Questions

1. What is the difference between GRC and IT GRC?

IT GRC is a subset of the broader GRC discipline, focusing specifically on the risks and compliance requirements related to an organization's information technology assets and systems.

2. Is GRC software necessary for small businesses?

Yes. While GRC may seem complex, the right grc tool or grc solution for a small business can be a simple, scalable platform that helps manage foundational risks and compliance, protecting the business as it grows.

3. What is a "fractional CISO"?

A fractional CISO is a Chief Information Security Officer who works for a company on a part-time or contract basis. This allows organizations to access high-level cybersecurity expertise without the cost of a full-time executive.

4. What is the biggest risk for an organization without GRC?

The most significant risk is a lack of foresight. Without an integrated GRC framework, organizations operate in silos, unable to see how one risk (e.g., a cybersecurity threat) can have a cascading effect on compliance and business operations, leading to major financial and reputational damage.

5. How does third-party vendor risk management differ from traditional risk management?

It focuses specifically on the risks posed by external vendors and suppliers, which are often overlooked but can be a major source of data breaches and business disruptions.

6. What is the role of risk and compliance tools?

These tools provide the specific functions needed to manage risk and compliance, such as risk assessment matrices, policy management systems, and audit trails.

7. Can compliance automation replace a compliance team?

No. Automation is a tool that enhances a team's efficiency, taking over repetitive tasks so that human experts can focus on strategic decision-making, complex problem-solving, and relationship management.

8. What is the difference between grc solutions and grc software solutions?

These terms are often used interchangeably. "Solutions" may imply a broader offering that includes services, while "software solutions" specifically refers to the technological platform.

9. What is a grc platform?

A GRC platform is a centralized, integrated software system that manages all aspects of an organization's governance, risk, and compliance activities in a single location.

10. How can I justify the cost of GRC to my leadership?

Frame it as an investment in resilience. The cost of a GRC program is a fraction of the potential fines, litigation, lost revenue, and reputational damage that can result from a single security breach or compliance failure.

The GRC Imperative

The message is clear: GRC is no longer a back-office function focused solely on avoiding trouble. It is a dynamic, strategic capability essential for navigating complexity, building trust, and achieving sustainable success in the modern business world. Organizations that embrace an integrated, collaborative, and forward-looking approach to GRC will undoubtedly gain a significant competitive edge.