5 Best GRC (Governance, Risk & Compliance) Tools for 2025

The Growing Need for Automated Compliance Solutions

Governance, risk, and compliance (GRC) has become a critical component for organizations across all industries. Cyber threats are rising, regulatory frameworks are constantly shifting, and businesses must adapt quickly to avoid penalties, security breaches, and reputational damage.

Organizations that fail to implement a robust GRC strategy risk falling behind, facing non-compliance fines, and losing customer trust. The traditional, manual approach to compliance management is no longer sustainable.

This is where GRC software solutions step in—providing businesses with automated, AI-driven compliance tools to streamline operations, improve risk visibility, and ensure regulatory adherence.

In this blog, we explore the five best GRC tools for 2025 and why Risk Cognizance stands out as the most user-friendly, automated compliance solution on the market.

Why Organizations Need a GRC Tool

Businesses today operate in a high-risk environment, facing challenges such as:

- Stringent Regulatory Requirements – New laws like GDPR, CCPA, HIPAA, and SOC 2 demand strict compliance.

- Growing Cybersecurity Threats – Ransomware, phishing, and insider threats continue to increase.

- Third-Party & Vendor Risks – Companies rely on multiple vendors, creating supply chain vulnerabilities.

- Manual Compliance is Inefficient – Traditional compliance management is slow, error-prone, and resource-intensive.

- Reputational & Financial Risk – Compliance failures lead to fines, lawsuits, and damaged brand trust.

A GRC tool like Risk Cognizance enables businesses to stay compliant effortlessly while automating risk detection and policy enforcement.

Top 5 GRC Tools for 2025

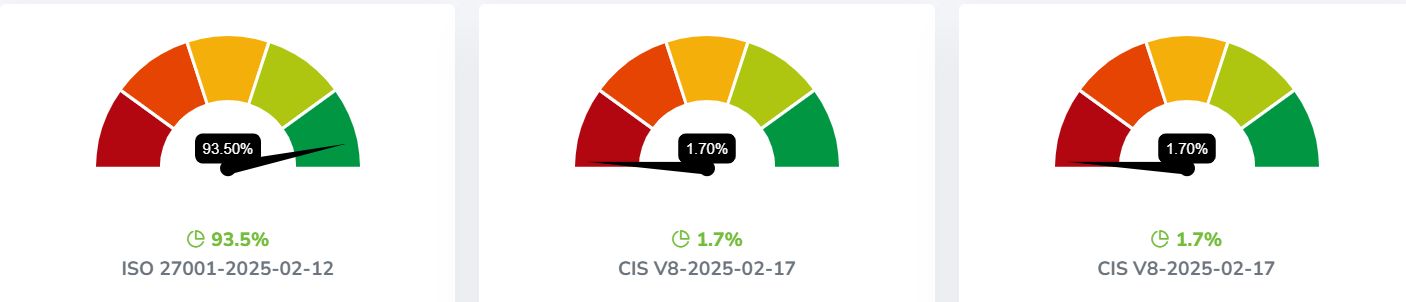

1. Risk Cognizance – Best for Automated Compliance & AI-Powered Risk Management

Risk Cognizance is the leading AI-driven compliance platform, designed to make GRC effortless with automation, real-time monitoring, and seamless integrations.

✅ Key Features:

- AI-Powered Compliance Automation – Tracks regulatory changes and updates policies instantly.

- Risk Intelligence & Threat Monitoring – Detects cyber risks before they become security breaches.

- No-Code, User-Friendly Interface – Intuitive dashboard for non-technical users.

- Third-Party Risk Management – Evaluates vendors to reduce supply chain vulnerabilities.

- Seamless Integration – Connects with IT security tools, SIEMs, and cloud platforms.

Why It Stands Out:

Risk Cognizance is the most user-friendly, automated GRC solution, eliminating manual compliance burdens while ensuring organizations remain audit-ready.

2. LogicGate Risk Cloud – Best for Customizable Workflows

✅ Custom-built workflows

✅ Drag-and-drop automation

✅ API integrations for enterprise tools

3. OneTrust GRC – Best for Privacy & Data Governance

✅ GDPR, CCPA, HIPAA compliance automation

✅ Vendor and third-party risk management

✅ AI-powered privacy risk assessment

4. RSA Archer – Best for Enterprise Risk Management

✅ Advanced risk analytics

✅ Incident response automation

✅ Regulatory content library

5. IBM OpenPages – Best for AI-Driven Compliance & Risk Analytics

✅ AI-powered predictive risk insights

✅ Enterprise-wide risk and compliance tracking

✅ Advanced reporting capabilities

Virtual

6 Key Use Cases for Risk Cognizance

1. Cybersecurity & IT Risk Management

A financial institution uses Risk Cognizance to automate cyber risk assessments and prevent data breaches by continuously monitoring threats.

2. Vendor & Third-Party Risk Management

A healthcare company ensures that third-party vendors comply with HIPAA by leveraging automated assessments and risk scoring.

3. Regulatory Compliance & Audit Readiness

A global technology firm automates compliance with ISO 27001 and SOC 2, significantly reducing audit preparation time.

4. Business Continuity & Incident Management

A manufacturing enterprise deploys Risk Cognizance to minimize downtime and recover quickly from cyber incidents.

5. Financial Risk & Compliance Monitoring

A banking institution uses Risk Cognizance to automate regulatory reporting, fraud detection, and risk analysis.

6. AI-Powered Policy & Risk Documentation

A retail business leverages AI-driven policy automation to track and enforce compliance across multiple locations.

Case Studies: How Risk Cognizance is Transforming Compliance

Case Study 1: Automating Cybersecurity Compliance for a Fortune 500 Bank

The Challenge:

A global financial services company struggled with manual compliance processes, leading to delays, security gaps, and costly audits.

The Solution:

By implementing Risk Cognizance, the company automated compliance tracking, integrated real-time risk monitoring, and enhanced policy management.

The Outcome:

✅ 40% improvement in risk detection

✅ 30% reduction in compliance management costs

✅ 50% faster audit preparation

Case Study 2: Healthcare Compliance Automation

The Challenge:

A hospital network faced HIPAA compliance challenges due to outdated, manual reporting systems.

The Solution:

Risk Cognizance automated policy updates, third-party risk assessments, and compliance monitoring.

The Outcome:

✅ 100% compliance audit success

✅ Elimination of manual reporting errors

✅ Enhanced vendor risk management

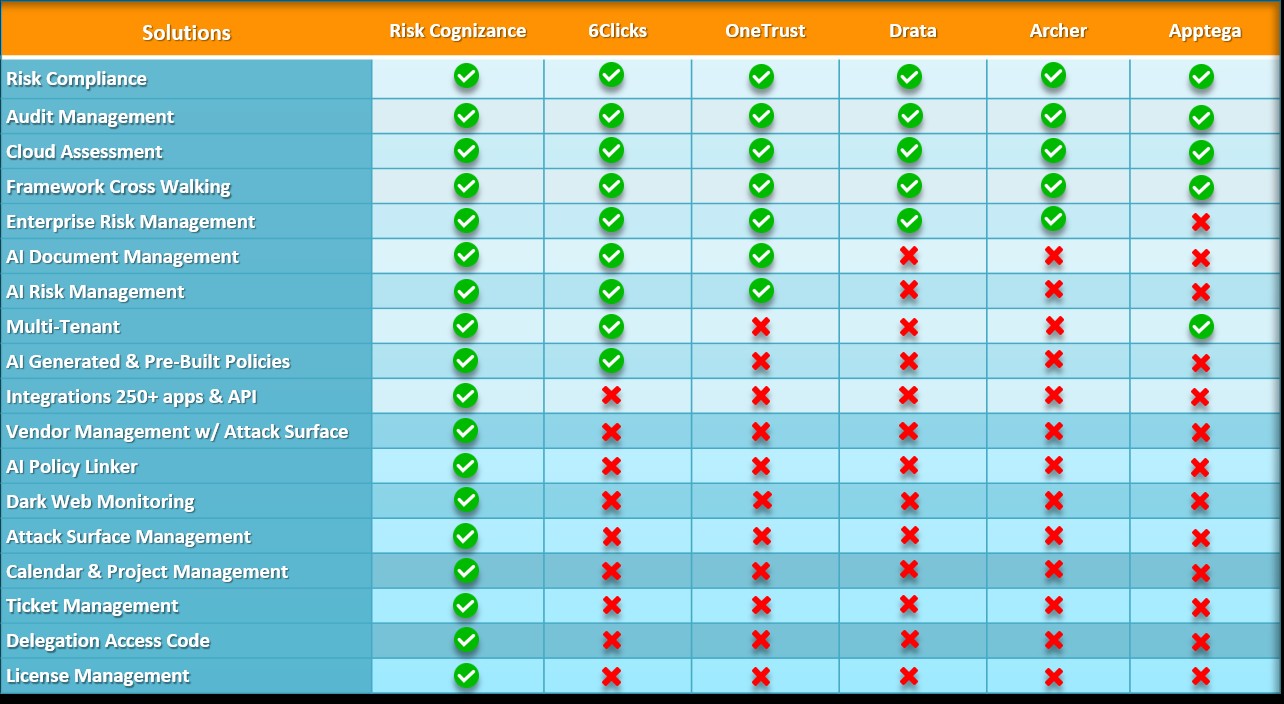

Risk Cognizance vs. Other GRC Tools: A Quick Comparison

Final Thoughts: Why Risk Cognizance is the Best GRC Tool for 2025

As compliance requirements grow more complex, businesses must move beyond manual processes and embrace automation.

Risk Cognizance is the most user-friendly, AI-powered GRC solution, providing effortless compliance, risk visibility, and real-time cybersecurity insights.

✅ Want to future-proof your compliance strategy? Try Risk Cognizance today!