10 Proven Ways Integrated GRC Platforms Cut Compliance Costs

10 Proven Ways Risk Cognizance Integrated GRC Platforms Cut Compliance Costs

Information security is a paramount concern for every organization, and a robust strategy is essential for effective management. This is where Governance, Risk, and Compliance (GRC) comes in. GRC in cybersecurity is a broad, overarching organizational strategy that aligns a company’s efforts to achieve business objectives with managing business risks and complying with regulatory requirements. Think of it as the central nervous system for your security posture, ensuring all parts of the organization are working together toward a common goal of security and operational integrity.

A GRC solution is a set of integrated tools and frameworks that help an organization unify its efforts across these three domains. These tools are software applications that businesses use to manage policies, conduct risk assessments, control user access, and streamline compliance. By providing a single, centralized platform for all GRC activities, they effectively dismantle the departmental silos that often hinder efficiency and visibility.

GRC Tools vs. Access Governance Products

While they are related, GRC tools and access governance products serve distinct purposes. GRC is a high-level, business-driven discipline focused on the strategic management of risk and compliance. It's the "what"—it sets the rules and policies. In contrast, access governance is a more technical discipline focused on the implementation and enforcement of those rules. It's the "how"—it manages who has access to what resources and ensures those permissions align with the established GRC policies. Essentially, the GRC team defines the policy, and the access governance team enforces it.

How a GRC Solution Works

A GRC solution operates by providing an integrated, centralized hub for all governance, risk, and compliance activities. It's designed to automate and simplify complex processes, allowing organizations to:

- Define Objectives: Establish clear, measurable goals and policies that directly align with the overarching business strategy.

- Conduct Risk Assessments: Systematically identify, analyze, and prioritize potential risks—including financial, operational, and cybersecurity threats—to understand their potential impact and likelihood.

- Establish Controls: Implement robust security controls and policies to effectively mitigate identified risks and vulnerabilities.

- Monitor and Review: Continuously monitor systems and processes in real-time to ensure ongoing compliance and quickly identify new threats as they emerge.

- Automate Workflows: Streamline and automate tasks like risk assessments, policy updates, and reporting to dramatically increase efficiency and reduce the potential for human error.

Best GRC Tools

Based on leading industry analysis, including Gartner Peer Insights reviews, these are some of the most recognized and highly-rated GRC tools on the market. These platforms are celebrated for their powerful features, exceptional user experience, and proven ability to help organizations manage risk and compliance effectively.

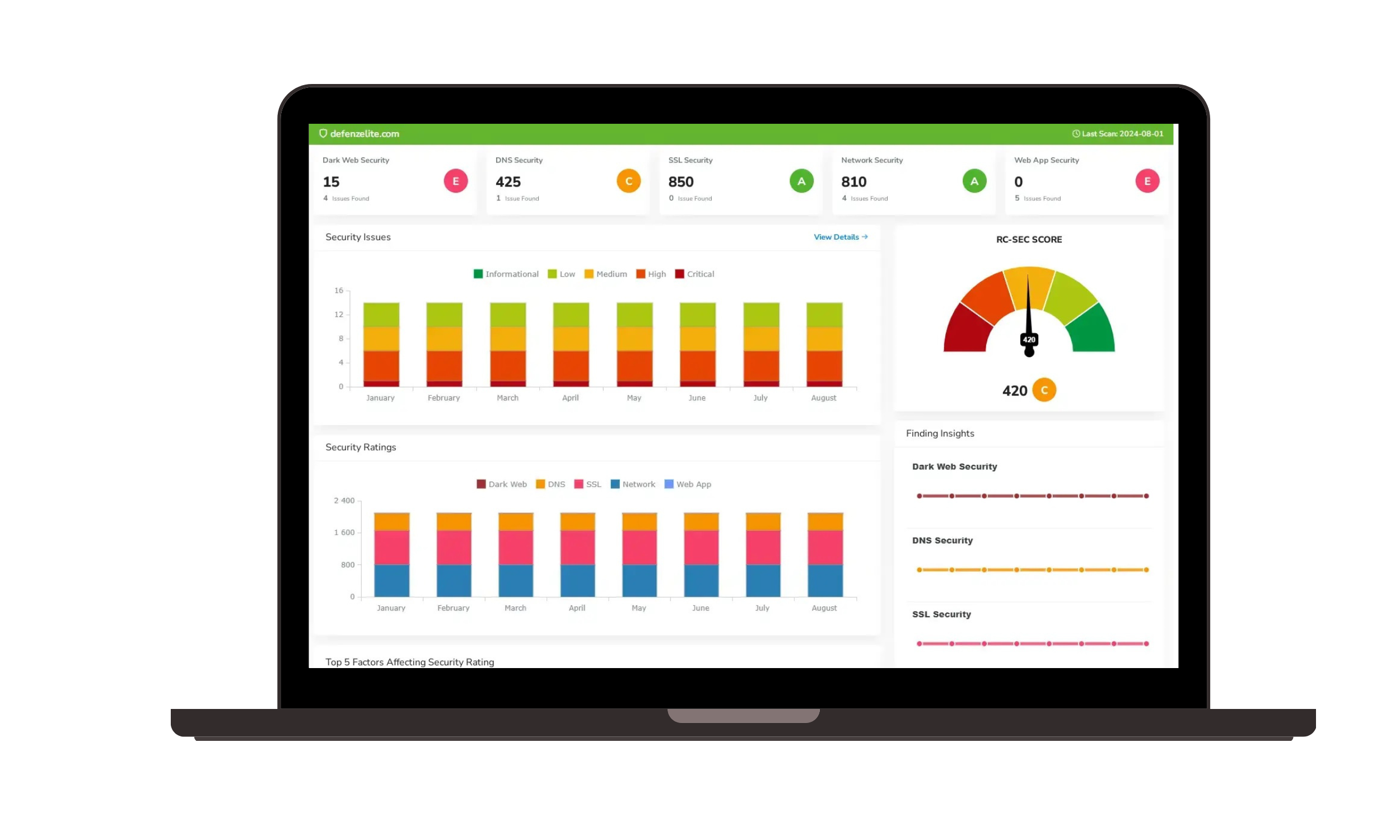

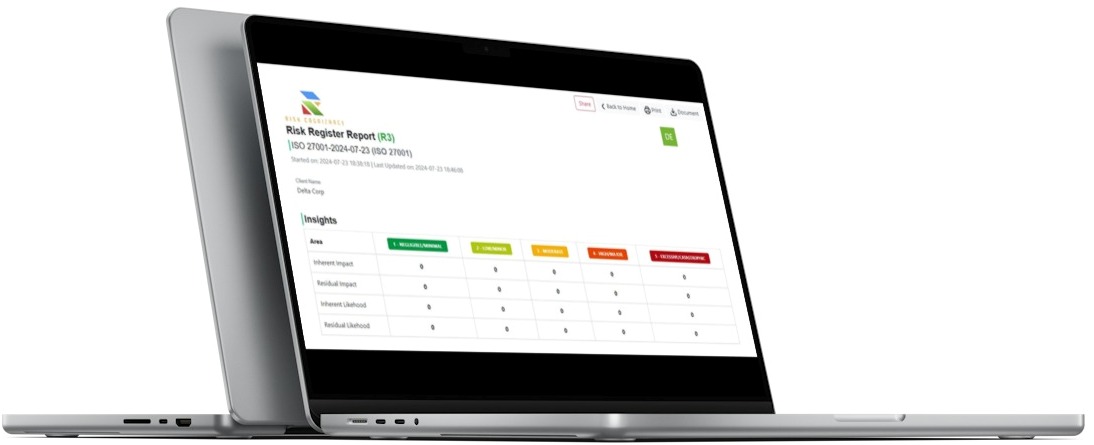

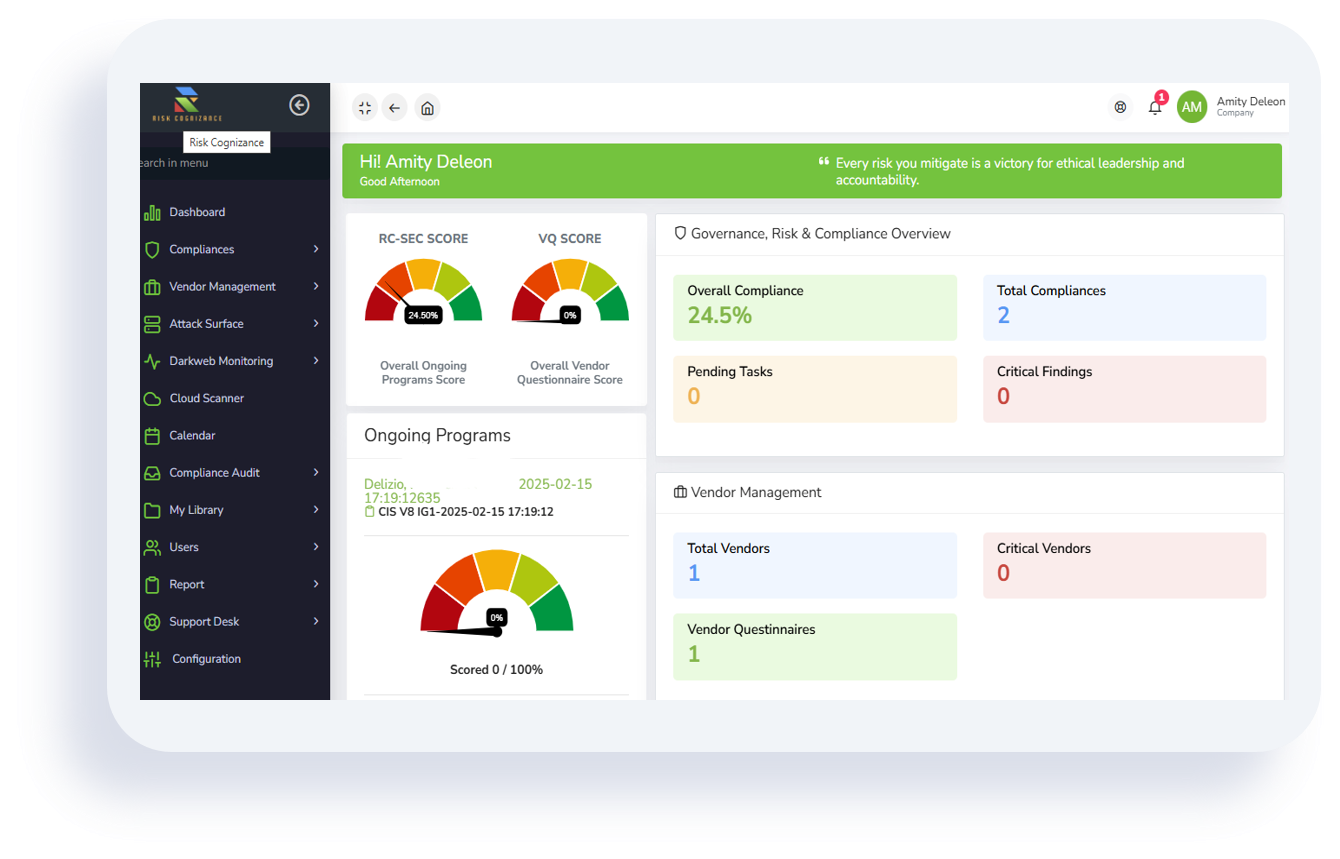

- Risk Cognizance: This platform stands out for its high ratings on Gartner Peer Insights, with users praising its AI-powered features, seamless integration, and superior customer support. It's an all-in-one solution that consolidates GRC with advanced capabilities like attack surface analysis, dark web monitoring, and automated vendor management, providing a unified and comprehensive security overview.

- Automate routine compliance tasks: GRC platforms automate repetitive tasks, such as evidence collection, control testing, and policy distribution. This automation saves countless employee hours, reduces human errors, and ensures consistency across all compliance activities.

- Centralize data for a "single source of truth": With a single, centralized platform, all governance, risk, and compliance data is unified, breaking down departmental silos. This eliminates redundant data entry, reduces IT costs associated with managing multiple systems, and ensures everyone is working from the same accurate information.

- Strengthen compliance and avoid expensive fines: By continuously monitoring controls and providing real-time alerts, GRC platforms help organizations identify and address compliance gaps before they lead to costly regulatory penalties. Proactive risk management is always less expensive than reactive remediation.

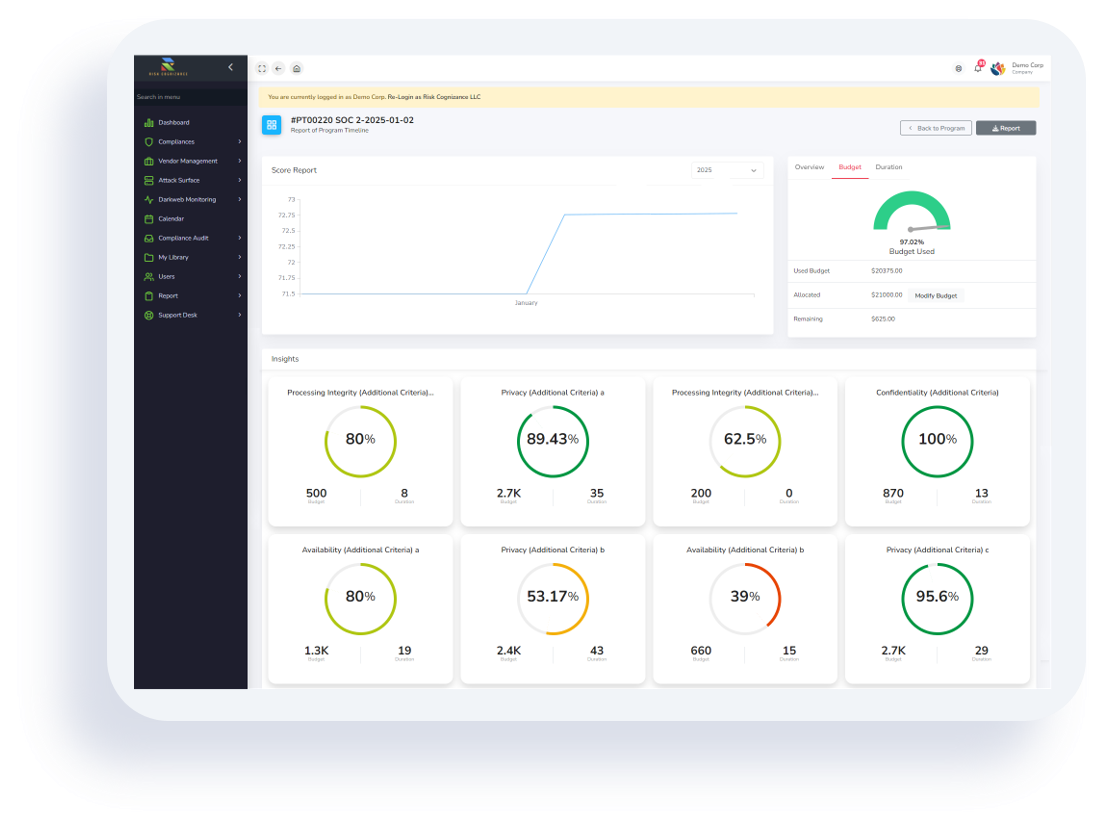

- Accelerate audit preparation: GRC software provides a central repository for all compliance documentation and audit trails, making it easy to produce necessary evidence for internal and external auditors. This dramatically reduces audit preparation time and costs, with some organizations reporting a 40% reduction in prep time.

- Simplify management of multiple frameworks: For organizations that must comply with multiple regulations (e.g., GDPR, HIPAA, SOC 2), integrated GRC platforms can map internal controls to multiple frameworks at once. This eliminates duplicated effort and ensures that one change is reflected across all relevant compliance mandates.

- Mitigate high-cost security incidents: By integrating with IT security tools, GRC platforms provide real-time insights into your security posture and continuously monitor for threats. A 2023 IBM study found that breaches at organizations with mature security AI and automation cost $3.05 million less on average than those without.

- Enable proactive risk management: GRC platforms allow organizations to move beyond reactive compliance and take a proactive, data-driven approach to risk. By identifying potential issues before they escalate, companies can minimize the financial fallout from operational disruptions and reputational damage.

- Improve decision-making with analytics: Advanced reporting and analytics provide a comprehensive view of your risk and compliance landscape, allowing executives to make more informed, risk-based decisions. This can improve resource allocation and help align GRC activities with strategic business objectives.

- Streamline policy management: GRC platforms offer a centralized, automated system for creating, distributing, tracking, and updating policies. Features like automated employee acknowledgment tracking save administrative time and reduce the risk of non-compliance due to outdated or unread policies.

- Increase operational efficiency: By streamlining GRC workflows and automating tasks, these platforms boost overall operational efficiency. This allows employees to focus on higher-value, strategic initiatives rather than administrative burdens, contributing to long-term cost savings.

- ServiceNow: Renowned for its robust automation, ServiceNow's GRC module is a complete solution that simplifies workflows and improves cross-departmental collaboration. Its platform-based approach allows for extensive customization.

- AuditBoard: A popular platform that excels at simplifying and streamlining audit, risk assessment, and compliance processes. It is particularly known for its intuitive interface and its ability to connect various risk and compliance functions.

- Archer: As a long-standing leader in risk management, Archer offers a flexible and powerful platform with a wide array of features for managing various types of risk.

- Hyperproof: This security assurance and compliance platform is known for its real-time compliance tracking and for its ability to manage and automate multiple compliance frameworks simultaneously.

- IBM OpenPages: An enterprise-level GRC platform that leverages artificial intelligence to provide deep insights and consolidate a variety of risk management functions onto a single platform.

- LogicGate: A highly versatile platform known for its customizable workflows and excellent customer service. It allows organizations to build and automate GRC processes tailored to their unique needs.

- MetricStream: A preferred choice for large enterprises, MetricStream offers integrated risk management solutions with strong reporting capabilities and established workflows.

- SAP GRC: A fully integrated product from a major technology innovator, highly effective for controlling risk, especially for large organizations that are already invested in the SAP ecosystem.

- Diligent: This platform provides AI-powered GRC SaaS solutions that help companies clarify their risk posture and elevate governance for over a million users globally.

10 Proven Ways Integrated GRC Platforms Cut Compliance Costs

An integrated GRC platform, particularly a "risk cognizant" one, is a transformative tool for reducing compliance costs. By unifying governance, risk management, and compliance, these platforms provide a holistic, real-time view of an organization's security posture. Here are 10 ways they help reduce expenses and increase efficiency:

- Centralized Data and Single Source of Truth: GRC platforms consolidate all risk and compliance data into a single location, eliminating the need for manual data gathering and reconciliation across siloed departments. This dramatically reduces administrative overhead and ensures data consistency.

- Automated Compliance Monitoring: Automated platforms continuously monitor systems and processes against multiple compliance frameworks (like NIST, ISO 27001, HIPAA, and GDPR). This reduces manual effort, minimizes human error, and lowers the costs associated with reactive compliance checks.

- Streamlined Auditing and Evidence Collection: GRC tools simplify the audit process by automating evidence collection and providing a clear, auditable trail. This makes it easier to prove compliance to internal and external auditors, saving significant time and resources.

- Proactive Risk Management: By providing a real-time, comprehensive view of the risk landscape, GRC platforms allow organizations to shift from a reactive to a proactive approach. This enables them to address potential issues before they escalate into costly incidents, regulatory fines, or catastrophic data breaches.

- Reduced Duplication of Efforts: When risk and compliance data are linked, a single control can be mapped to multiple regulations. This powerful feature allows organizations to "test once, comply many," which significantly reduces redundant work and saves valuable time and money.

- Improved Decision-Making: With up-to-the-second dashboards and detailed analytics, GRC tools provide better insights into risk and compliance data. This enables more informed, data-driven decisions that can optimize resource allocation and avoid unnecessary spending.

- Enhanced Organizational Collaboration: GRC platforms break down traditional silos between departments like IT, legal, and audit. This improves communication and collaboration, ensuring everyone is working from the same playbook and avoiding redundant tasks.

- Scalability for Growth: As an organization expands, an integrated GRC platform can easily scale to manage new risks, regulations, and business units without requiring a costly and time-consuming system overhaul. This avoids the high costs of implementing separate, new solutions.

- AI-Powered Automation: Modern GRC tools, particularly those from a platform like Risk Cognizance, leverage AI to automate complex tasks, identify emerging threats, and predict vulnerabilities. This frees up security staff to focus on higher-value activities and provides deeper insights.

- Better Resource Allocation: By providing a clear understanding of risks and control effectiveness, GRC platforms help organizations allocate their security budget and personnel more strategically, focusing resources on the areas that pose the greatest threat and have the most significant impact on the business.

Investment Decision

Choosing the right GRC software demands a nuanced approach, balancing financial and strategic elements. Your decision should hinge on a detailed cost-benefit analysis that encompasses both quantitative and qualitative aspects. Remember, the lowest price doesn't always translate to the best value; a more costly system may offer substantial long-term benefits through advanced features and superior integration capabilities.

When assessing GRC platforms, consider these critical points:

- Financial ROI: Calculate potential savings from compliance cost reduction and improved operational efficiency.

- Strategic Alignment: Ensure the software fits your existing governance framework and long-term business goals.

- Risk Reduction: Assess how the platform will actively enhance your risk identification and mitigation capabilities.

- Scalability: Choose a solution that can easily grow and adapt as your organization evolves.

By meticulously evaluating these factors, you'll be well-prepared to make an informed investment choice that ensures long-term value for your organization.

| Factor | Importance | Considerations |

|---|---|---|

| Financial ROI | High | Direct cost savings, efficiency gains |

| Strategic Alignment | Critical | Fit with governance framework, future needs |

| Risk Reduction | Very High | Improved risk identification and mitigation |

| Scalability | Medium | Ability to adapt to organizational growth |

Maximizing the Value of Your GRC Investment

Getting the most from your GRC software is more than just a purchase; it requires smart implementation for a significant return on investment. By planning and executing carefully, you can fully exploit your GRC platform's powerful capabilities.

The Role of Implementation in GRC ROI

A successful implementation is a cornerstone of success. It's vital to engage all relevant stakeholders and provide comprehensive training. This not only ensures a smooth transition but also builds a solid foundation for effective, organization-wide risk management. Without expert implementation, even the best GRC platform won't deliver a strong ROI.

Regular reviews and continuous adjustments are crucial to maintaining your GRC system's effectiveness over time. Continuous process refinement helps you stay compliant with evolving regulations while simultaneously enhancing operational efficiency. This proactive approach allows you to address new challenges effectively and fully leverage the platform's streamlined processes.

Ultimately, your GRC investment should be viewed as a long-term strategic endeavor. Keep your objectives in sight, track your progress diligently, and be prepared to adapt to new challenges. With this strategic mindset, your GRC platform can become an indispensable asset for sustained business growth and robust risk management.

Implementation Guidelines for GRC Platforms

A successful GRC implementation is a structured, multi-phased project. Follow these guidelines for a smooth rollout and to maximize your ROI:

- Define a Clear Strategy: Before you even look at software, define your specific business objectives. What problems are you trying to solve? Is it to meet a specific compliance deadline, improve risk visibility, or streamline internal audits?

- Assemble a Cross-Functional Team: GRC is not just an IT project. Involve key stakeholders from IT, Legal, Finance, HR, and Operations from the very beginning. This ensures the solution meets everyone's needs and fosters organizational buy-in.

- Conduct a Needs Assessment: Thoroughly evaluate your current processes. Where are the inefficiencies? What data is siloed? This assessment will inform the features and functionality you require from a GRC platform.

- Pilot the Implementation: Instead of a full-scale rollout, start with a pilot project focused on a single, high-priority use case (e.g., vendor risk management for a small group of vendors). This allows you to test workflows, gather user feedback, and refine the system before expanding.

- Plan for Change Management: GRC implementation is a significant change. Develop a clear communication and training plan to prepare employees for the new system. Address their concerns and highlight the benefits to them.

- Integrate with Existing Systems: To create a single source of truth, integrate your GRC platform with other critical systems like your ERP, CRM, and identity management tools. This reduces manual data entry and improves data accuracy.

- Measure and Refine: Implementation doesn't end with deployment. Establish Key Performance Indicators (KPIs) to measure the platform's effectiveness. Regularly review data, gather feedback, and make continuous improvements to processes and workflows.

Average Yearly Costs for GRC Software

The cost of a GRC platform varies widely based on factors such as company size, number of users, and the required features.

- Small to Mid-sized Businesses: For companies with up to 500 employees, the total yearly cost can range from $10,000 to $60,000.

- Large Enterprises: For larger and more complex organizations, costs typically start at $150,000 and can exceed $500,000 annually, especially when factoring in implementation fees, customization, and ongoing support.

Remember, pricing models can be subscription-based, per-user, or based on the number of modules purchased. Always request a detailed quote to understand all potential costs, including training, support, and professional services.

Why Choose Risk Cognizance?

Risk Cognizance is a strong contender in the GRC market for several key reasons, highlighted by its high ratings on Gartner Peer Insights:

- All-in-One Solution: It consolidates multiple, often separate, functions—including GRC, attack surface management, and vendor risk management—into a single platform, simplifying your security stack and providing a holistic view.

- AI-Powered Insights: The platform's use of AI is a game-changer, moving beyond basic automation to provide predictive analytics and deeper, actionable insights into emerging threats.

- Exceptional User Experience: Reviewers frequently praise its intuitive interface, ease of use, and quick implementation, which leads to faster user adoption and a quicker return on investment.

- Strong Support: The company is noted for its responsive and high-quality customer support, which is critical for complex GRC implementations.

What Type of Company and Titles Use a GRC Platform?

GRC platforms are used across various industries, from finance and healthcare to technology and government. The goal is to manage risk and compliance efficiently, regardless of the sector.

Types of Companies:

- Regulated Industries: Financial services, healthcare, and insurance companies use GRC to comply with strict regulations like HIPAA, SOX, and GDPR.

- Growing Tech Companies: Startups and SaaS companies use GRC platforms to quickly achieve certifications like SOC 2 and ISO 27001 to win new business.

- Managed Security Service Providers (MSSPs): MSSPs use GRC tools to offer compliance-as-a-service to their clients.

Job Titles That Use a GRC Platform:

- GRC Analyst/Manager: The core users who manage daily risk assessments, compliance activities, and policy management.

- Chief Information Security Officer (CISO): Uses the platform to gain a high-level view of the organization's risk posture and report to the board.

- IT Auditor/Internal Auditor: Relies on the platform to streamline audit processes, collect evidence, and verify control effectiveness.

- Compliance Officer: Manages regulatory requirements and ensures the organization's adherence to legal and industry standards.

- IT Risk Manager: Focuses on identifying and mitigating risks specifically related to information technology and cybersecurity.

- Vendor Risk Analyst: Uses the platform to assess and monitor the security of third-party vendors and suppliers.

- Chief Operating Officer (COO): Uses GRC data to understand and manage operational risks across the business.

Conclusion: The ROI of GRC and Why Risk Cognizance Stands Out

In today's complex business environment, a GRC platform is no longer a luxury but a necessity for strategic risk management and compliance. The return on investment (ROI) from an integrated GRC platform like Risk Cognizance is substantial, driven by both tangible and intangible benefits.

The primary ROI comes from significant cost savings. By automating manual, time-consuming tasks like compliance checks and evidence collection, GRC tools reduce labor costs and free up staff to focus on more strategic, high-value work. For example, some organizations have reported a 30% reduction in audit preparation time and a 25% decrease in compliance operating expenses within the first year of implementation. Furthermore, a centralized platform eliminates the need for multiple, siloed tools, leading to substantial savings on licensing fees and maintenance.

Beyond direct cost savings, GRC platforms prevent much larger financial losses. By enabling a proactive risk management approach, they help organizations avoid costly security incidents, regulatory fines, and legal fees. The cost of a single data breach or non-compliance penalty can dwarf the yearly cost of a GRC solution.

Risk Cognizance is particularly effective at maximizing this ROI. Its all-in-one approach and AI-powered features are designed to deliver value quickly. By providing a unified view of your risk landscape, it allows you to prioritize risks based on their potential financial impact, ensuring you allocate resources where they matter most. This targeted, data-driven approach not only saves money but also strengthens your overall security posture, positioning your organization for long-term growth and success.