Overview

PCI DSS Compliance Management Software

Achieving and maintaining Payment Card Industry Data Security Standard (PCI DSS) compliance is essential for organizations that handle credit card transactions. Risk Cognizance PCI DSS Compliance Automation Platform provides a comprehensive solution to streamline, automate, and simplify the process of meeting PCI DSS requirements. Designed for businesses of all sizes, this platform helps ensure that your organization adheres to PCI DSS standards, protecting payment card data and maintaining customer trust.

Complete Better PCI DSS Compliance with Risk Cognizance

Risk Cognizance offers an all-in-one platform tailored to manage every aspect of PCI DSS compliance. From implementing security controls and conducting risk assessments to continuous monitoring and audit preparation, our software enables you to efficiently meet PCI DSS requirements and safeguard sensitive payment information. Empower your team to enhance security, reduce vulnerabilities, and build customer confidence with our advanced compliance solution.

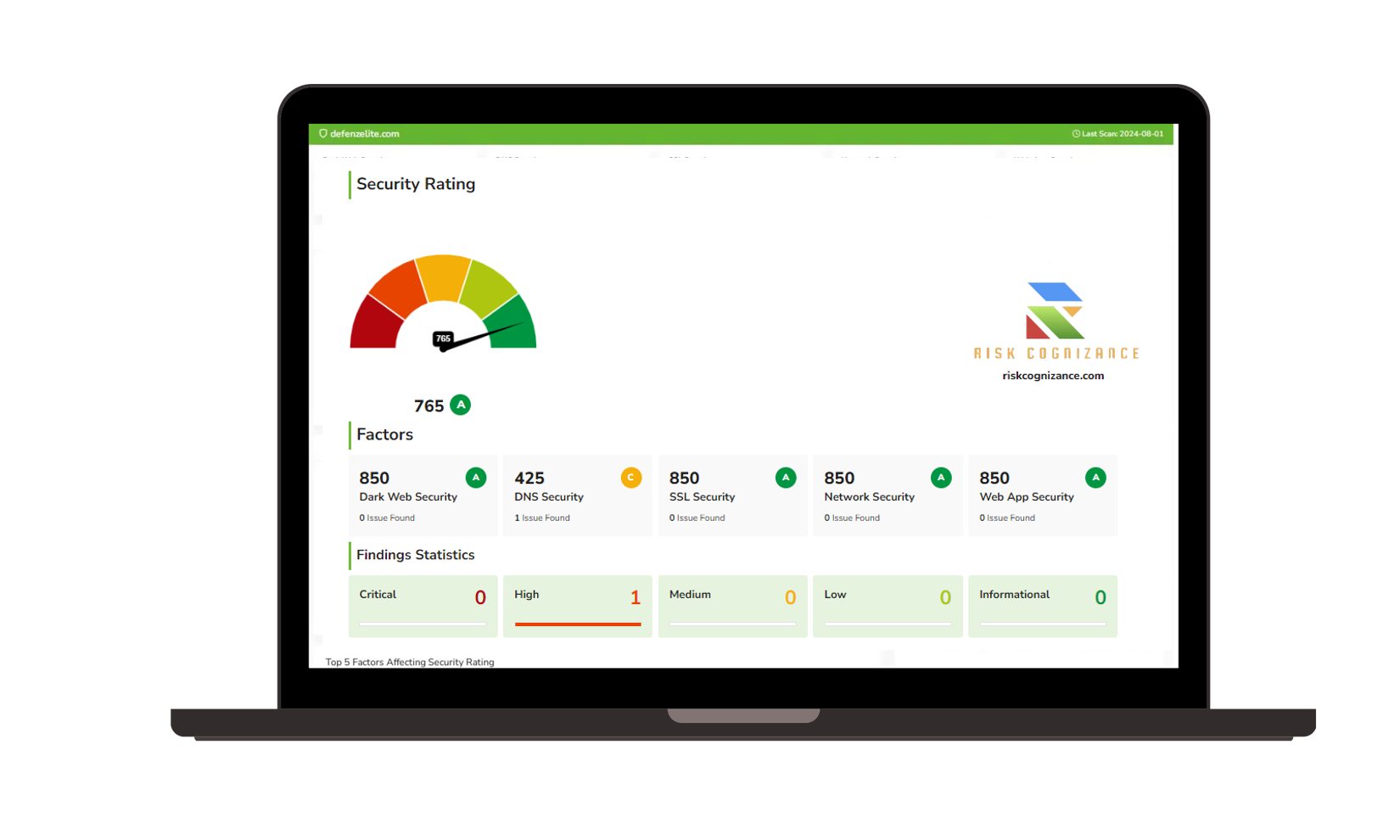

Governance, Risk, and Compliance (GRC) |  Third-party Risk Management |

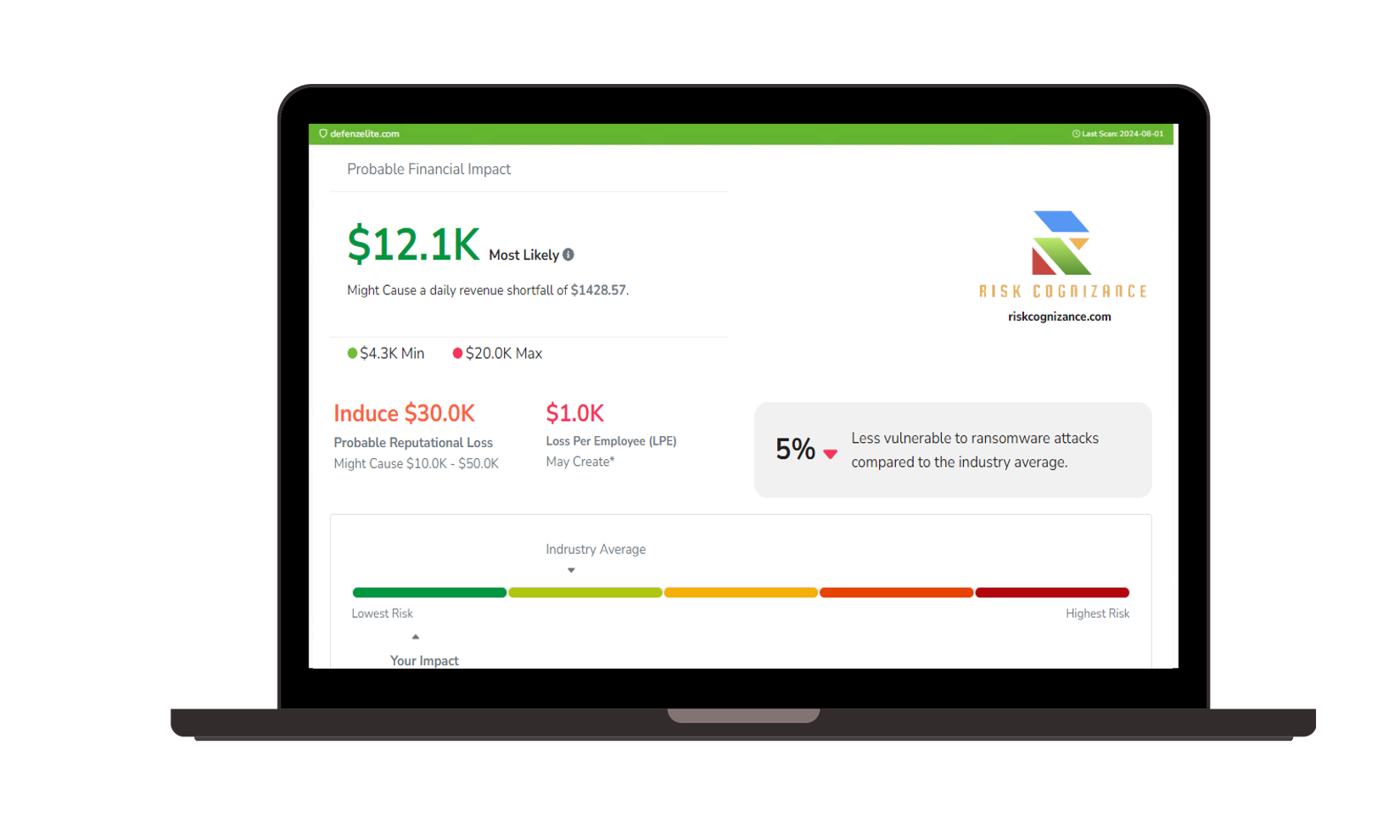

Ransomware Susceptibility |  GRC and Attack Surface |

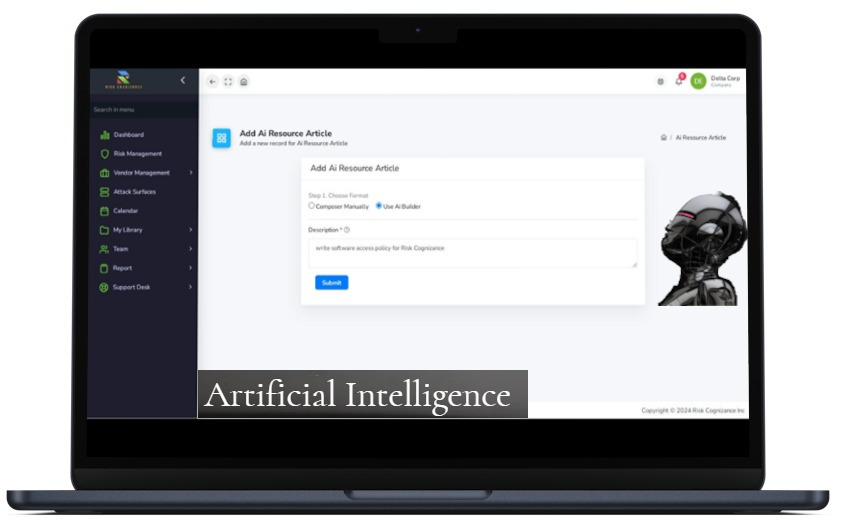

Artificial Intelligence | |

Key Features and Capabilities:

Automated Compliance Workflows:

- Streamline the implementation of PCI DSS controls across your organization.

- Automate routine compliance tasks to reduce manual effort and minimize errors.

- Ensure consistent and effective application of security controls to meet PCI DSS standards.

Comprehensive Control Coverage:

- Implement and manage all 12 PCI DSS requirements, from securing cardholder data to maintaining a vulnerability management program.

- Customize your compliance approach to address your organization's specific needs and payment processing environment.

- Document and manage controls effectively to align with PCI DSS requirements.

Gap Analysis and Readiness Assessments:

- Perform thorough gap analyses to identify areas needing improvement for PCI DSS compliance.

- Use readiness assessments to evaluate your current compliance status and prepare for audits.

- Develop targeted remediation plans to address identified gaps and improve security posture.

Centralized Documentation Management:

- Manage all PCI DSS-related documentation, including policies, procedures, and evidence, in one centralized repository.

- Maintain an organized, audit-ready documentation library for easy access and updates.

- Ensure documentation is consistently updated to reflect your compliance efforts and changes.

Continuous Monitoring and Control Testing:

- Implement continuous monitoring to assess the effectiveness of your PCI DSS controls.

- Automate control testing and generate audit-ready reports to demonstrate compliance.

- Gain real-time insights into your compliance status and proactively address potential issues.

Security Incident Management:

- Integrate incident response with your PCI DSS compliance framework.

- Automate the management and reporting of security incidents in line with PCI DSS requirements.

- Minimize the impact of incidents while ensuring ongoing compliance with PCI DSS standards.

Internal Audits and Continuous Improvement:

- Conduct internal audits to assess the effectiveness of your PCI DSS compliance efforts.

- Identify areas for improvement and implement corrective actions to enhance your compliance program.

- Foster a culture of continuous improvement to maintain a robust security posture.

Customizable Dashboards and Reporting:

- Access real-time dashboards for a comprehensive view of your PCI DSS compliance status.

- Generate detailed reports tailored for internal stakeholders, auditors, and regulators.

- Customize reporting to meet the specific requirements of your organization and compliance obligations.

Employee Training and Security Awareness:

- Develop and manage security awareness programs aligned with PCI DSS requirements.

- Track employee participation in training programs to ensure compliance.

- Promote a security-conscious culture across your organization.

Policy and Procedure Management:

- Create, distribute, and manage PCI DSS-compliant policies and procedures.

- Automate the distribution and acknowledgment tracking of policies within your organization.

- Ensure all policies are up-to-date and aligned with the latest PCI DSS standards.

Risk Assessment and Management:

- Conduct ongoing risk assessments to identify and mitigate potential threats to PCI DSS compliance.

- Automate risk management processes to ensure timely identification and remediation of risks.

- Integrate risk assessments with your overall security strategy.

Third-Party Vendor Management:

- Evaluate and monitor third-party vendors to ensure they adhere to PCI DSS standards.

- Automate the process of vendor risk assessments and compliance checks.

- Secure your supply chain by ensuring vendors meet PCI DSS requirements.

Change Management and Regulatory Updates:

- Stay informed about updates to PCI DSS and related regulatory requirements.

- Assess the impact of regulatory changes on your compliance efforts and update controls accordingly.

- Maintain compliance with the latest standards through proactive change management.

Task Automation and Workflow Management:

- Automate routine tasks related to PCI DSS compliance, freeing up resources for strategic initiatives.

- Use automated workflows to ensure timely completion of compliance-related activities.

- Focus on critical security functions while the platform manages compliance tasks.

Integration with Existing Systems:

- Seamlessly integrate Risk Cognizance with your existing IT infrastructure, including payment processing systems and security tools.

- Utilize API integrations for customized workflows and data sharing.

- Ensure a unified approach to security and compliance across all business systems.

User-Friendly Interface:

- Navigate the platform easily with an intuitive, user-friendly interface.

- Role-based access controls ensure that sensitive data is managed securely.

- Customize the platform to meet the specific needs of your organization.

Dedicated Support and Continuous Platform Updates:

- Access dedicated customer support to ensure smooth implementation and usage.

- Benefit from regular platform updates to keep up with the latest PCI DSS standards.

- Continuous improvements enhance the platform’s capabilities to meet evolving compliance needs.

Achieve PCI DSS Compliance with Confidence

The Risk Cognizance PCI DSS Compliance Automation Platform equips your organization with the tools needed to achieve and maintain compliance with PCI DSS requirements. Our platform simplifies the compliance process, from control implementation to audit readiness, ensuring that your organization can protect payment card data, reduce vulnerabilities, and build customer trust.

Ready to streamline your PCI DSS compliance journey? Contact Risk Cognizance today to discover how our platform can help you meet PCI DSS requirements and enhance your security posture.

Book a Demo