Overview

Risk Cognizance offers a robust platform designed to streamline Governance, Risk, and Compliance (GRC) across complex organizations with multiple entities. Whether you manage subsidiaries, business units, or operate across different regions, Risk Cognizance provides a centralized solution to ensure effective GRC management, reducing risks and maintaining compliance across all levels of your organization.

Key Features

Centralized GRC Management

Manage governance, risk, and compliance initiatives across multiple entities from a single platform. Gain complete visibility into the risks, controls, and compliance status of each entity, while maintaining a global view of your organization's overall risk posture.

- Entity-Level Risk Profiles: Customize risk profiles and assessments for individual entities based on their unique operational environments.

- Unified Control Frameworks: Standardize controls across entities while allowing for customization to meet local regulatory requirements.

- Multi-Entity Reporting: Generate detailed reports for individual entities or consolidate data for enterprise-wide insights.

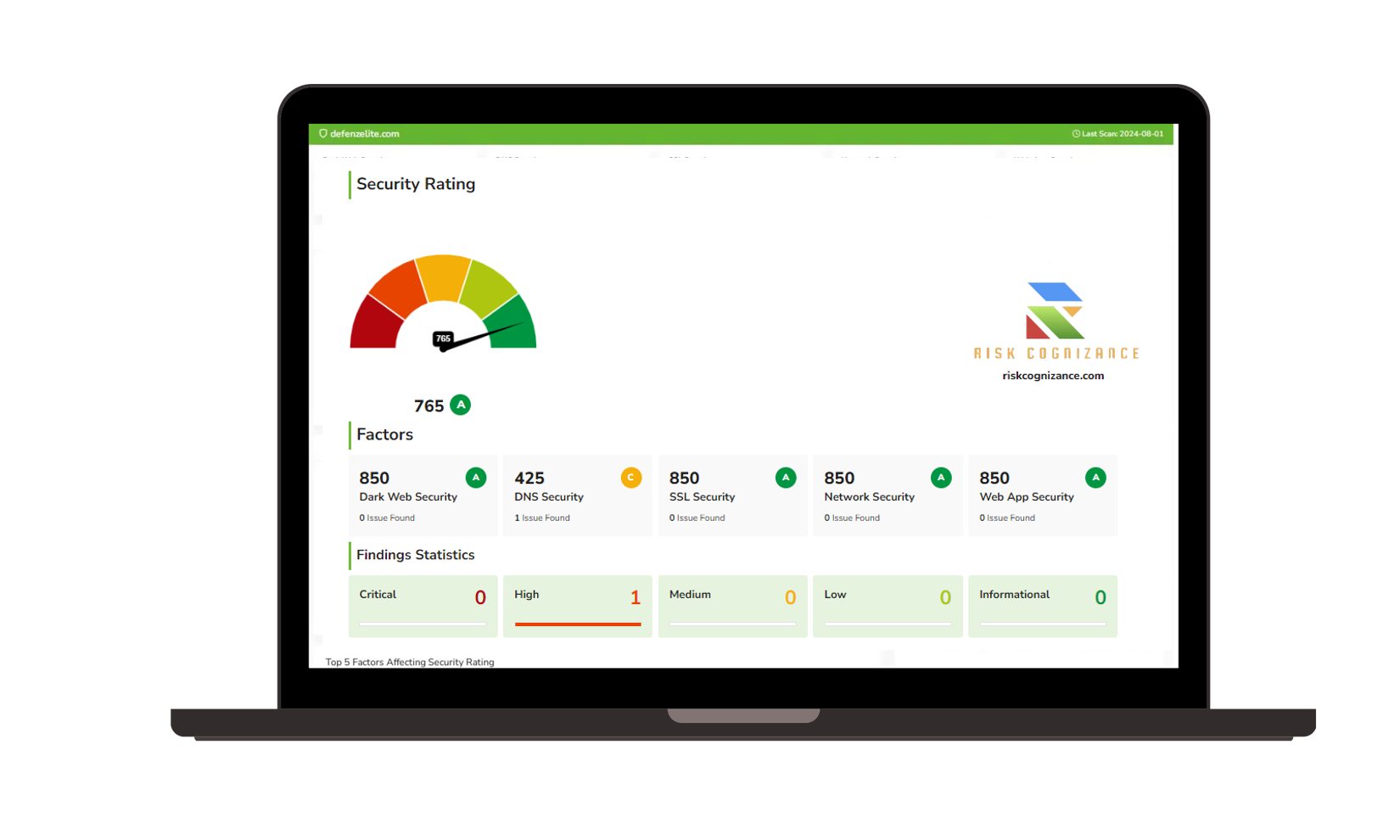

Governance, Risk, and Compliance (GRC) |  Third-party Risk Management |

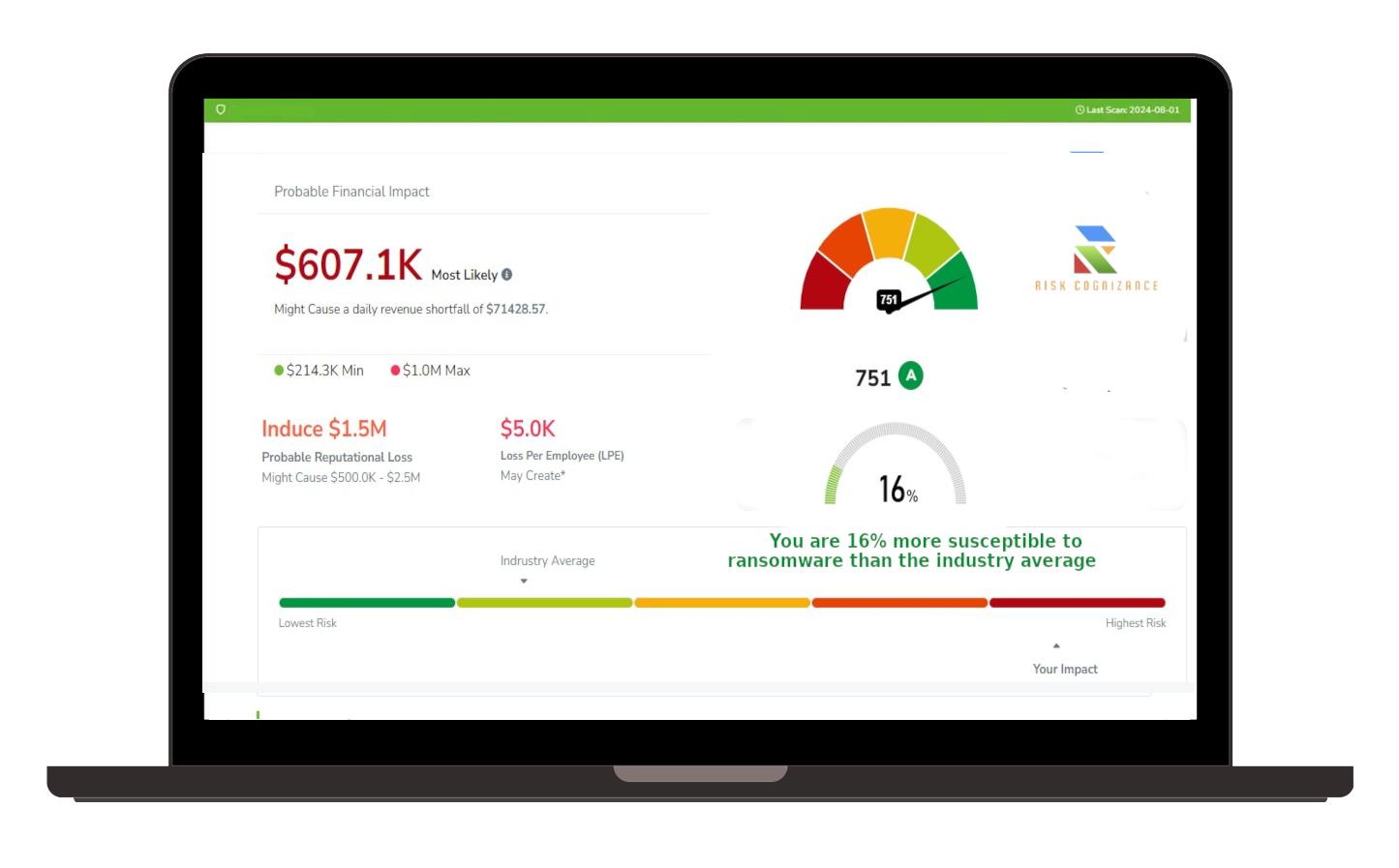

Ransomware Susceptibility |  GRC and Attack Surface |

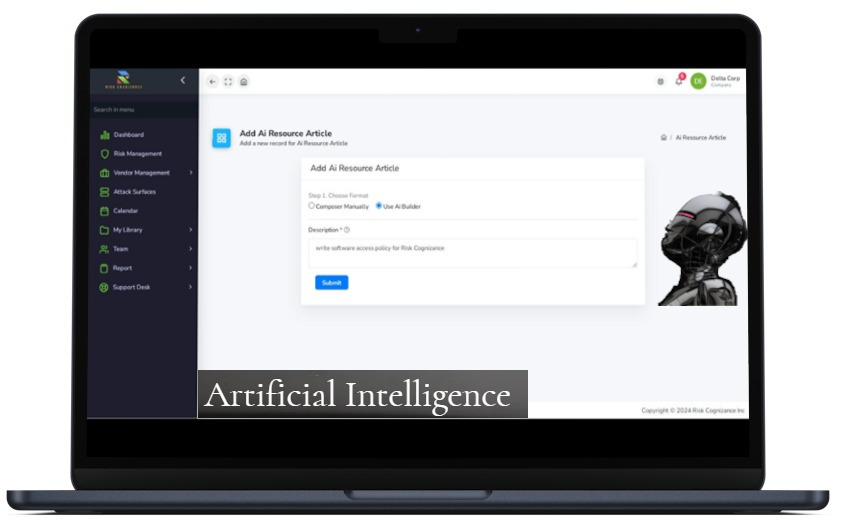

Artificial Intelligence | |

Automated Compliance Tracking

Ensure each entity adheres to both local and global regulatory standards with Risk Cognizance’s automated compliance tracking. Stay on top of changing regulations and streamline the audit process.

- Regulatory Updates by Entity: Stay compliant with local laws and regulations across multiple regions.

- Audit-Ready Documentation: Automatically compile and store compliance evidence for each entity.

- Policy Management: Create and distribute policies that reflect the specific needs of each entity, ensuring compliance at all levels.

Integrated Risk Assessment and Monitoring

With Risk Cognizance, risk management becomes seamless, enabling you to assess and monitor risks at both the entity and enterprise levels.

- Tailored Risk Assessments: Conduct risk assessments tailored to each entity's operational risks, regulatory requirements, and unique challenges.

- Real-Time Risk Monitoring: Stay informed with real-time monitoring of risk exposure across all entities, enabling proactive mitigation strategies.

- Risk Aggregation: Aggregate risk data across multiple entities to understand your organization's total risk exposure.

Scalable Architecture for Global Operations

Risk Cognizance’s flexible architecture scales with your organization, accommodating growth, and expansion into new markets or sectors.

- Entity Creation & Management: Easily add new entities as your organization expands, with the ability to scale GRC processes across all units.

- Cross-Entity Collaboration: Collaborate seamlessly across business units, departments, or regions, ensuring alignment in governance, risk, and compliance strategies.

Vendor and Third-Party Risk Management

Manage vendor and third-party risks across multiple entities. Ensure your entire supply chain adheres to your organization’s standards, regardless of entity location.

- Centralized Vendor Management: Maintain a comprehensive view of vendor risks and performance across all entities.

- Third-Party Compliance: Ensure vendors and partners comply with local regulations for each entity while upholding your enterprise-wide standards.

Customizable Dashboards & Reporting

Risk Cognizance offers advanced reporting and dashboards that can be customized by entity, business unit, or region, providing tailored insights into your organization's GRC performance.

- Entity-Specific Dashboards: Create dashboards that provide granular insights into each entity’s risk and compliance metrics.

- Consolidated Reporting: Generate high-level reports to evaluate GRC performance across all entities, helping leadership make informed decisions.

Benefits of Using Risk Cognizance for Multi-Entity GRC Management

- Holistic Visibility: Gain full oversight of risk and compliance across all entities from a single platform.

- Improved Efficiency: Reduce administrative burden with automation and standardized processes across multiple entities.

- Regulatory Confidence: Stay ahead of compliance obligations across different regions and sectors with automated tracking and updates.

- Scalability: Accommodate organizational growth with a platform that scales to manage new entities, units, or regions.

- Enhanced Risk Mitigation: Proactively manage risks by having real-time insights and a structured approach to risk assessment and mitigation across your organization.

Why Choose Risk Cognizance?

Risk Cognizance empowers organizations to efficiently manage the complexities of multi-entity governance, risk, and compliance. Our platform is designed for flexibility, scalability, and ease of use, allowing you to maintain control and oversight across all your business entities while staying compliant with regulatory demands.

Ready to Simplify Your Multi-Entity GRC Management?

Start managing your GRC processes more effectively across multiple entities. Contact us today for a demo and see how Risk Cognizance can help your organization streamline governance, reduce risk, and ensure compliance.

Request Callback