Overview

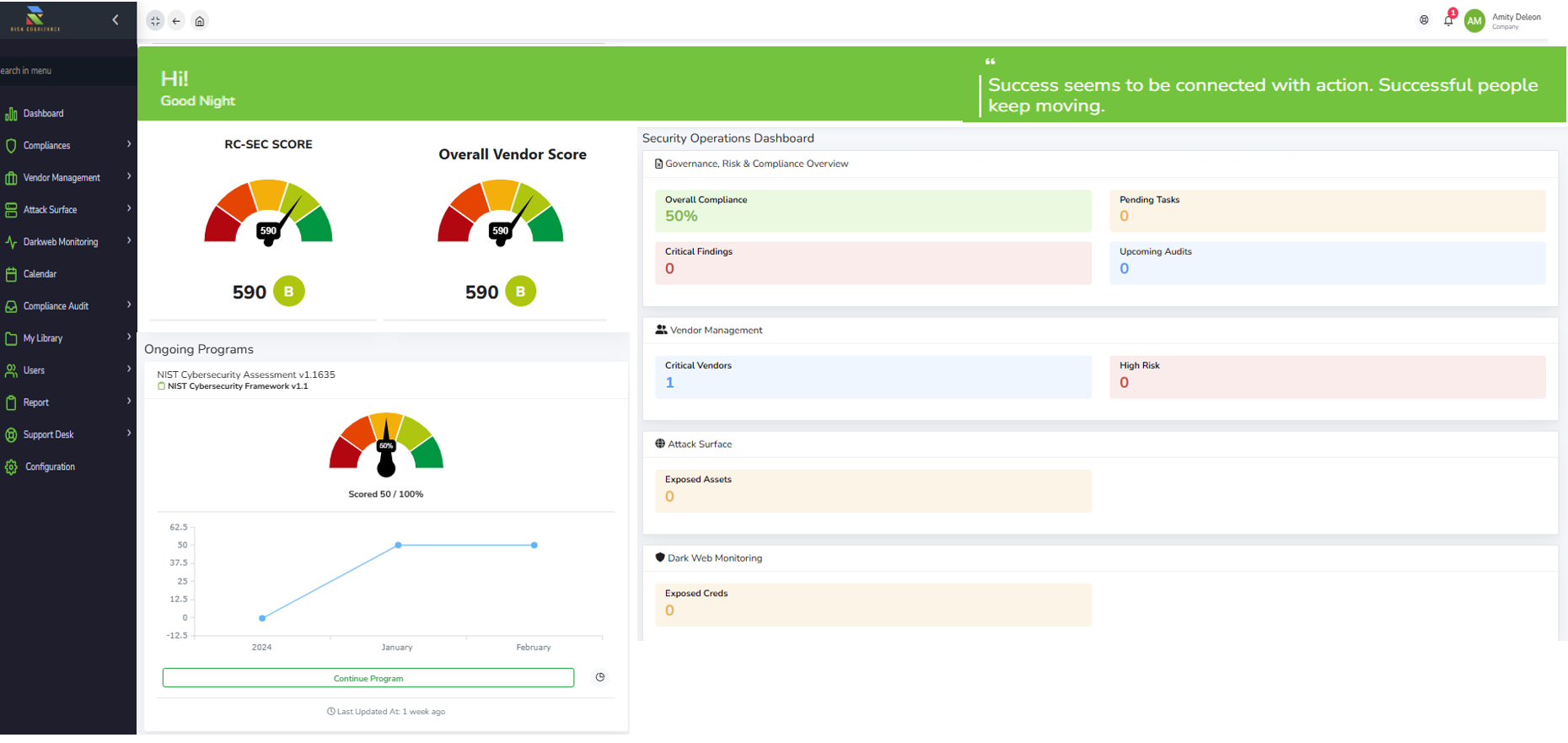

Assurance leaders require a robust, AI-powered GRC platform to manage governance, risk, and compliance seamlessly. Risk Cognizance delivers an integrated GRC software solution, empowering organizations with real-time risk intelligence, automated compliance workflows, and enterprise-wide governance oversight.

Why Assurance Leaders Need a Unified GRC Platform

✅ Automated Compliance & Risk Management

Risk Cognizance centralizes policy enforcement, regulatory tracking, and risk mitigation, ensuring a proactive compliance approach.

✅ AI-Powered Risk Intelligence

Advanced AI-driven analytics detect potential risks, ensuring assurance leaders can anticipate and address threats before they escalate.

✅ Seamless Audit & Incident Management

Automate audits, manage incidents, and track compliance status with real-time dashboards and automated reporting.

Key Features of Risk Cognizance’s GRC Platform

✅ Enterprise-Wide Compliance Automation

Ensure uniform adherence across business units with automated regulatory compliance monitoring and documentation management.

✅ Third-Party Risk & Vendor Management

Mitigate supply chain risks through continuous vendor assessments, due diligence, and compliance tracking.

✅ Customizable GRC Frameworks

Align with global standards like ISO, NIST, SOC 2, PCI-DSS, HIPAA, and GDPR, tailoring policies to specific industry needs.

✅ Real-Time Risk Analytics & Reporting

Interactive dashboards provide instant visibility into risk exposure, compliance status, and control effectiveness.

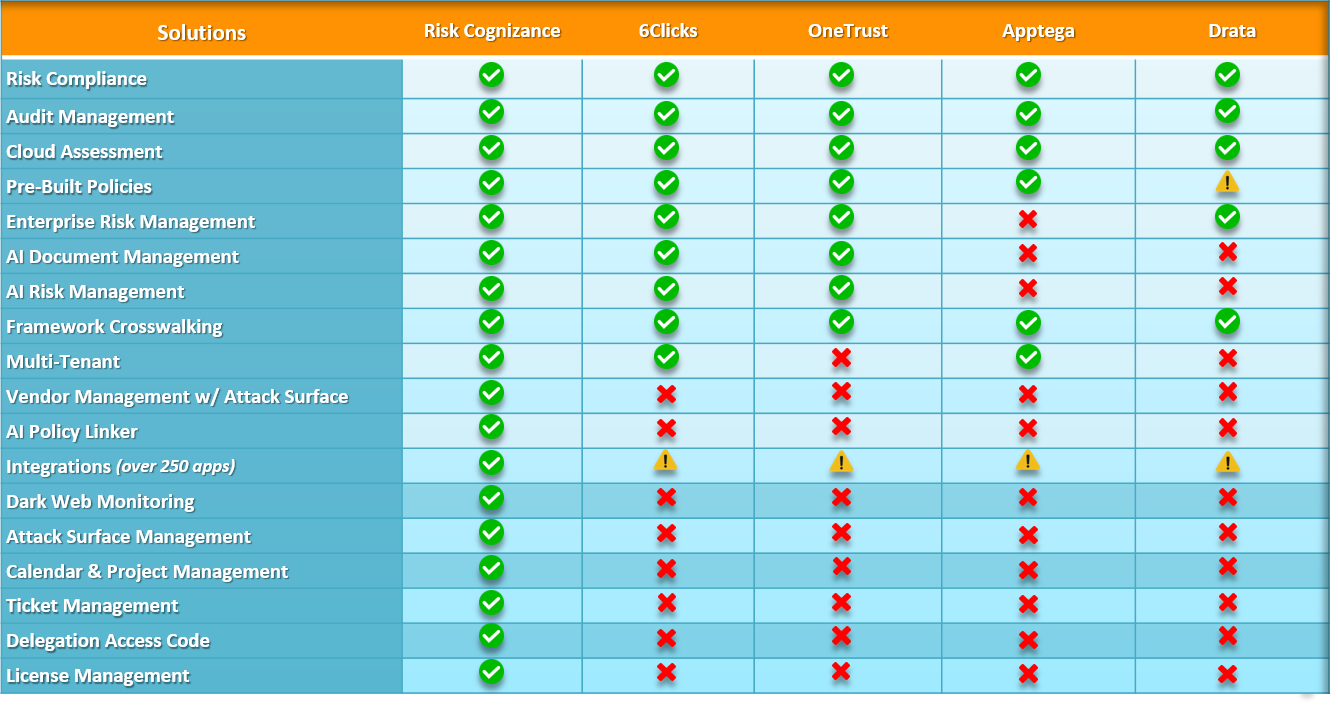

Why Choose Risk Cognizance’s GRC Software?

1️⃣ Enhanced Risk Visibility & Decision-Making

AI-powered insights empower assurance leaders with data-driven decision-making and proactive risk management.

2️⃣ Operational Efficiency & Cost Reduction

Automating compliance workflows minimizes manual effort, reducing compliance-related penalties and overhead costs.

3️⃣ Future-Ready Governance & Compliance

Adapt seamlessly to evolving regulations and emerging threats with a scalable, AI-driven GRC platform.

Empower Your Organization with Risk Cognizance

Risk Cognizance’s GRC platform for assurance leaders ensures seamless governance, risk mitigation, and compliance success. With AI-driven automation, real-time insights, and a unified risk management approach, enterprises can stay ahead in today’s fast-evolving compliance landscape.

Request Callback