Overview

Streamlining PCI DSS Compliance with Automated GRC Management

Risk Cognizance is a robust Governance, Risk, and Compliance (GRC) software platform designed to simplify and automate your organization’s compliance with PCI DSS (Payment Card Industry Data Security Standard) regulations. Whether you're a retailer, financial institution, or payment processor, Risk Cognizance empowers you to manage payment data security, ensure ongoing compliance, and reduce the complexity of maintaining PCI DSS standards. With Risk Cognizance, you can centralize your compliance efforts, proactively address risks, and protect sensitive cardholder data.

Key Features

Automated PCI DSS Compliance Management: Risk Cognizance automates key processes for PCI DSS compliance, including risk assessments, control implementation, and audits. Stay compliant with evolving PCI DSS regulations while minimizing manual effort.

Tailored Risk Management for Payment Security: Customize your risk management strategy to meet PCI DSS’s unique requirements. Establish effective security controls to protect cardholder data, and develop a risk management plan aligned with PCI DSS standards.

Centralized Compliance Tracking: Keep all PCI DSS compliance activities in one centralized platform. Risk Cognizance provides real-time tracking and reporting for risk management, assessments, audits, and control effectiveness, ensuring full visibility and consistency.

Continuous Control Monitoring: Automate the continuous monitoring of PCI DSS security controls to identify any potential gaps in compliance. Risk Cognizance offers real-time alerts and reporting to ensure that your security measures are always up to date and in line with PCI DSS standards.

Seamless Integration with GRC Activities: Integrate PCI DSS compliance efforts seamlessly into your broader GRC initiatives. Risk Cognizance ensures that your information security, risk management, and compliance activities work together for maximum efficiency and alignment.

.

What Is Cloud-Based GRC Software?

Governance, Risk, and Compliance (GRC) software is now more powerful and accessible through the cloud. By leveraging cloud technology, organizations can:

- Centralize risk management processes.

- Access real-time compliance tracking from anywhere.

- Reduce infrastructure costs.

Key benefits of our GRC solution include:

- Enhanced visibility into organizational risks.

- Streamlined workflows for compliance activities.

- Real-time reporting and analytics.

|  |

|  |

| |

Key benefits of our GRC solution include:

- Enhanced visibility into organizational risks.

- Streamlined workflows for compliance activities.

- Real-time reporting and analytics.

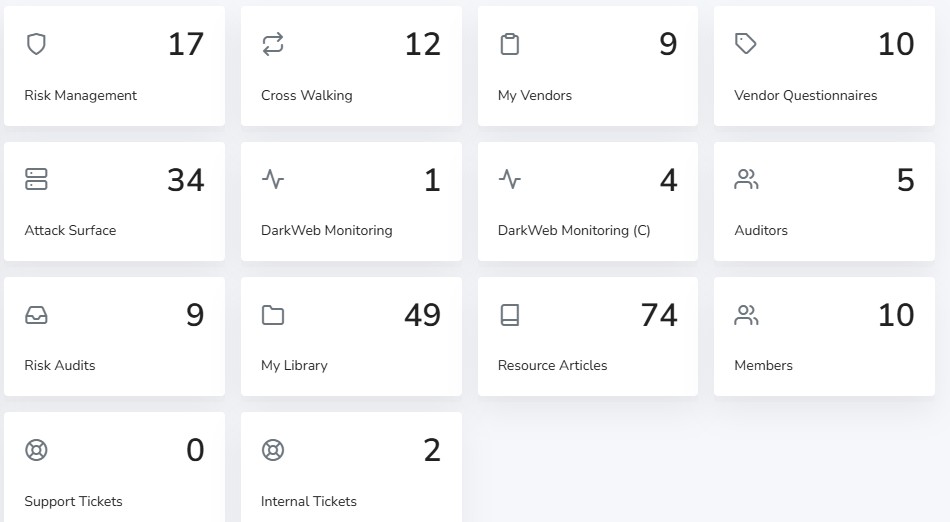

Governance, Risk, and Compliance (GRC) Software

- Third-party Risk Management Platform

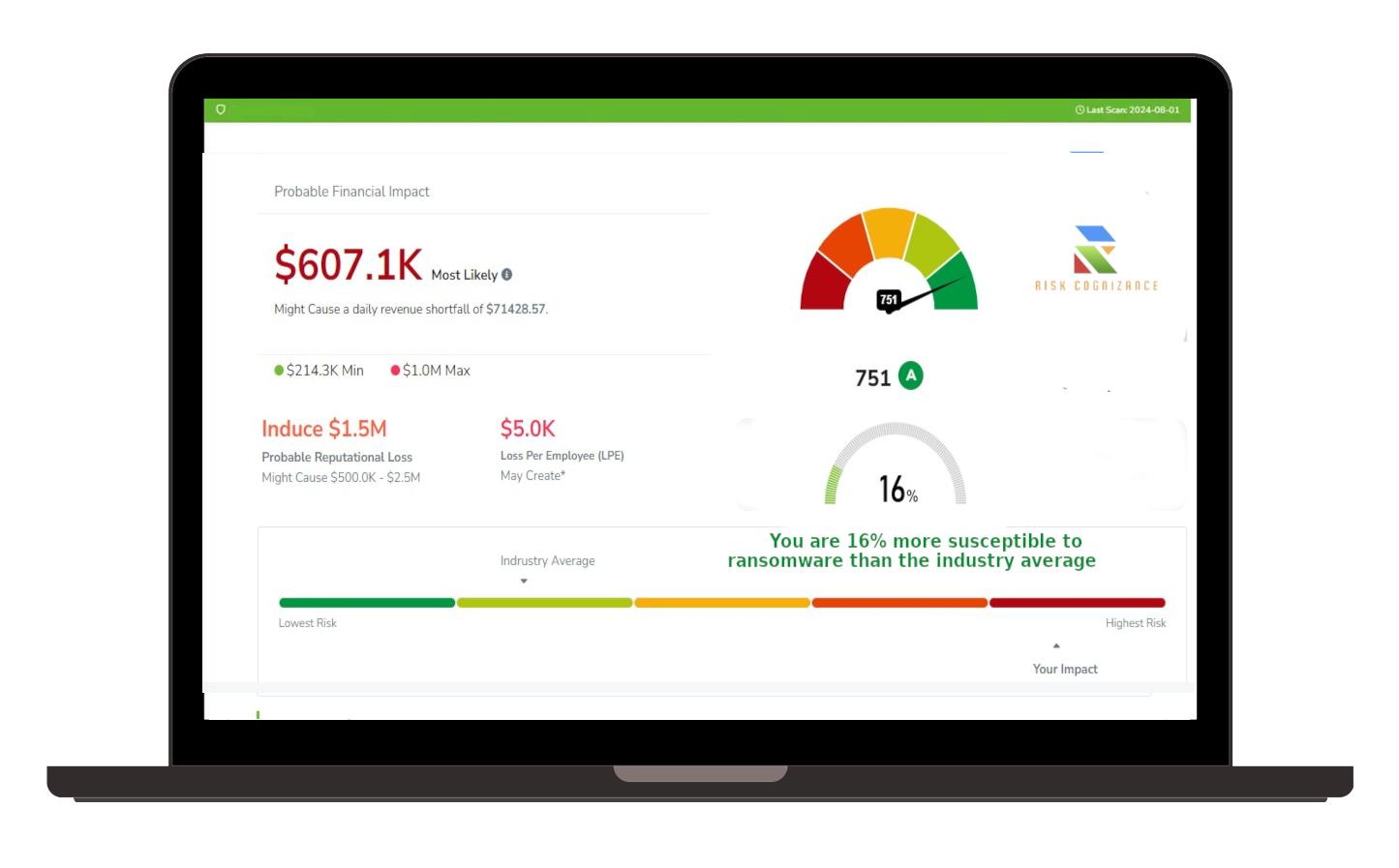

- Ransomware Susceptibility Report

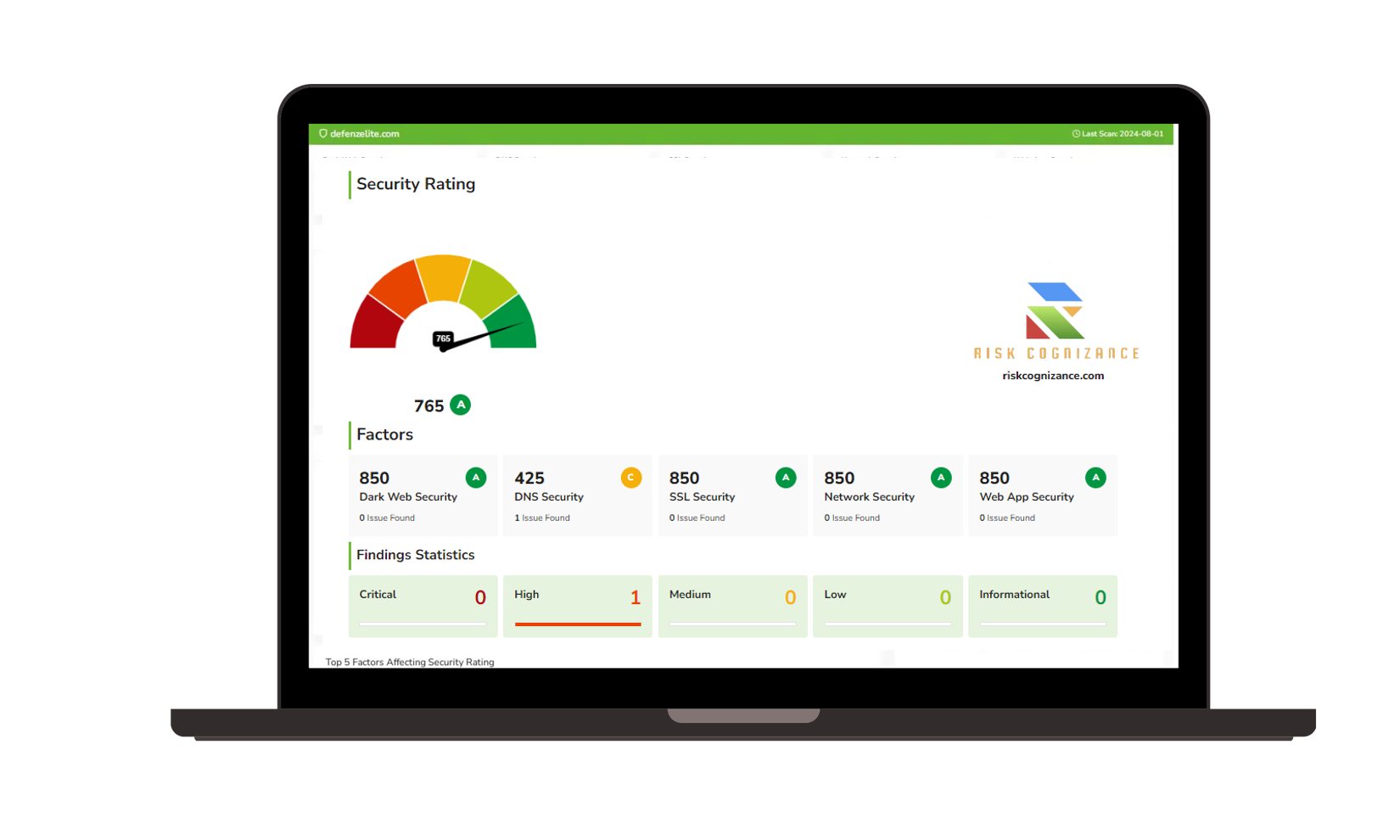

- Attack Surface Management Platform

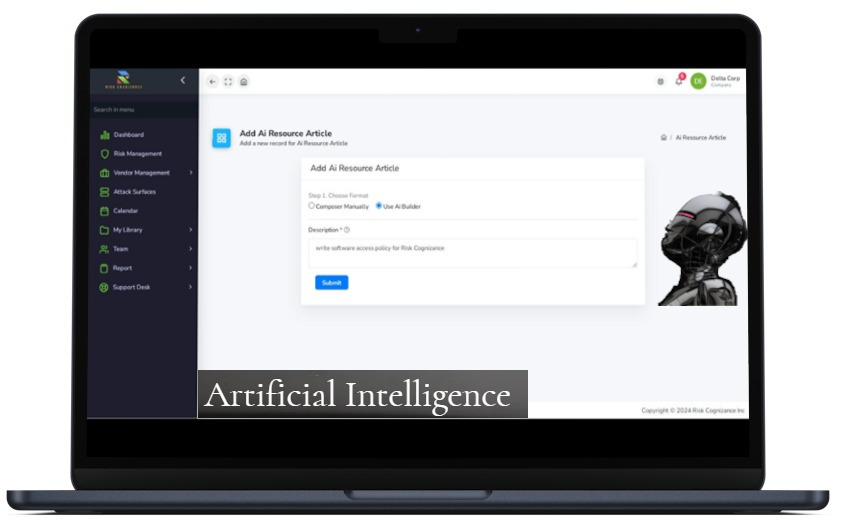

- Artificial Intelligence Platform

Key Benefits

Simplified PCI DSS Compliance: Risk Cognizance simplifies PCI DSS compliance by automating tasks such as risk assessments, control implementation, and audits. This saves time and resources, helping you stay compliant without overwhelming your team.

Strengthened Data Security: With continuous monitoring and proactive risk management, Risk Cognizance helps you safeguard sensitive cardholder data. By identifying vulnerabilities and gaps in compliance early, the platform ensures that your organization can address risks before they become serious threats.

Proactive Risk Mitigation: Risk Cognizance allows your team to take a proactive approach to risk management. Quickly assess potential risks to cardholder data, mitigate vulnerabilities, and maintain a secure environment for sensitive payment information.

Audit-Ready Compliance: Stay prepared for audits with automated reporting and audit trails. Risk Cognizance ensures that your team can quickly generate comprehensive reports and demonstrate full compliance with PCI DSS during internal or external audits.

How Risk Cognizance Supports PCI DSS Compliance

Automated Risk Assessments: Risk Cognizance automates PCI DSS risk assessments, helping you evaluate the threats and vulnerabilities to cardholder data in real time. By automating this process, the platform makes it easy to identify and address risks before they escalate.

Continuous Monitoring of Security Controls: Continuously monitor your PCI DSS security controls to ensure that they are effective and up-to-date. Risk Cognizance automates this monitoring and generates real-time alerts when gaps or deficiencies are identified.

Integrated Compliance Workflow: Risk Cognizance seamlessly integrates PCI DSS compliance into your broader GRC strategy. This integration ensures that all security, risk management, and compliance efforts are aligned across your organization, improving overall efficiency and effectiveness.

Comprehensive Reporting and Auditing: Keep track of every compliance activity and decision with Risk Cognizance’s automated audit trail. Generate detailed reports and access comprehensive logs for PCI DSS audits, demonstrating your organization's commitment to safeguarding cardholder data.

Why Choose Risk Cognizance for PCI DSS Compliance?

Effortless Compliance Implementation: Risk Cognizance simplifies PCI DSS compliance by automating key tasks like risk assessments, control management, and audit preparation. This allows your team to focus on core business operations while staying compliant.

Comprehensive GRC Platform: Beyond PCI DSS compliance, Risk Cognizance is a complete GRC solution, providing robust risk management, governance, and compliance capabilities across your organization. It ensures that all your compliance initiatives are well-integrated and aligned.

Centralized Compliance Management: With Risk Cognizance, PCI DSS compliance management is streamlined and centralized. Easily track, monitor, and manage compliance activities from a single platform, ensuring full oversight and transparency.

Get Started with Risk Cognizance Today

Ready to simplify your journey to PCI DSS compliance? Risk Cognizance is your go-to platform for automating GRC processes, managing payment security risks, and strengthening your data security. Schedule a demo today to see how Risk Cognizance can help your organization maintain PCI DSS compliance while safeguarding sensitive cardholder data.

Request Callback