Overview

Our Governance, Risk, and Compliance (GRC) Software Solution Platform is a cloud-based tool designed to assist FinTech companies with their GRC management. Risk Cognizance offers a powerful suite of tools to help businesses stay ahead of compliance requirements, manage risks effectively, and maintain stringent governance standards.

Why Risk Cognizance for FinTech?

Risk Cognizance provides a comprehensive GRC platform designed to empower FinTech companies to deliver proactive, scalable, and efficient risk management and compliance services. With a suite of tools that streamline risk management, automate compliance, and enhance governance, Risk Cognizance enables your business to meet the ever-evolving demands of the financial technology sector.

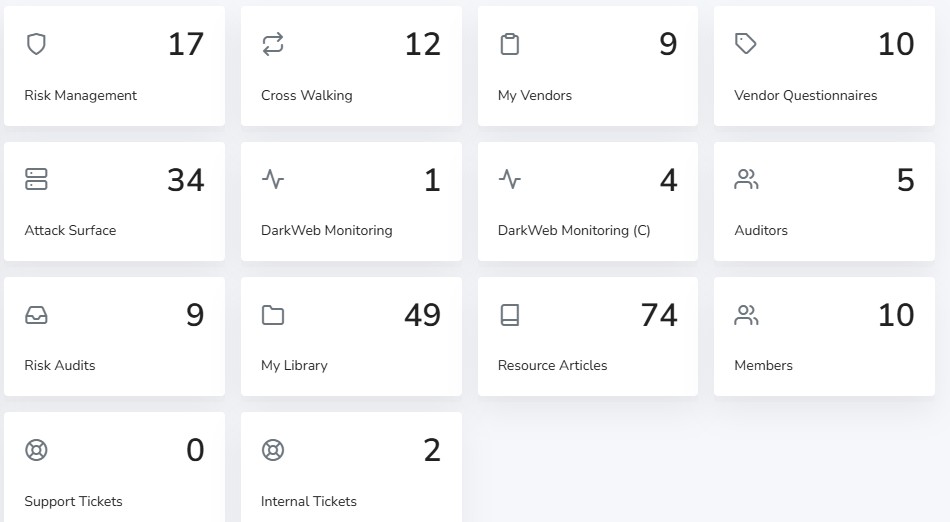

Compliance Risk Management Platform with 6 Tools

Designed around CISOs, CIOs, CTOs, and vCISOs compliance management programs, our solution enables the delivery of GRC-as-a-Service on top of the Risk Cognizance GRC and Incident Management Platform.

Integrated Risk Management Platform

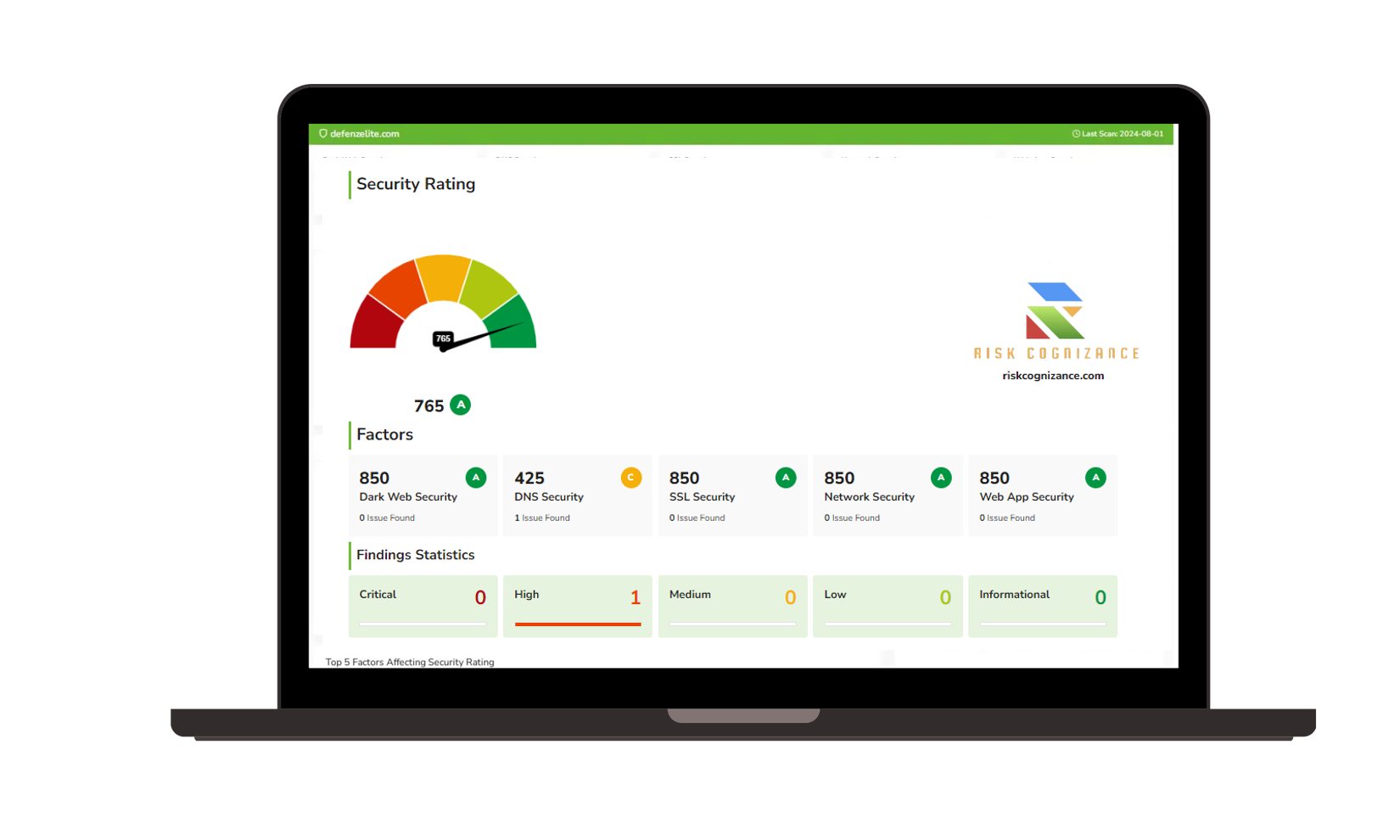

Gain comprehensive visibility into potential risks across your entire client base. Risk Cognizance GRC platform enables you to identify, assess, and prioritize risks with intuitive dashboards and real-time analytics, helping you deliver proactive risk management services.

Compliance Automation Platform

CISOs, CIOs, CTOs, and vCISOs can automate complex compliance tasks with our GRC platform, simplifying the process of adhering to standards like ISO 27001, NIST, GDPR, and others. With built-in compliance templates, you can easily manage client audits, track compliance status, and generate detailed reports.

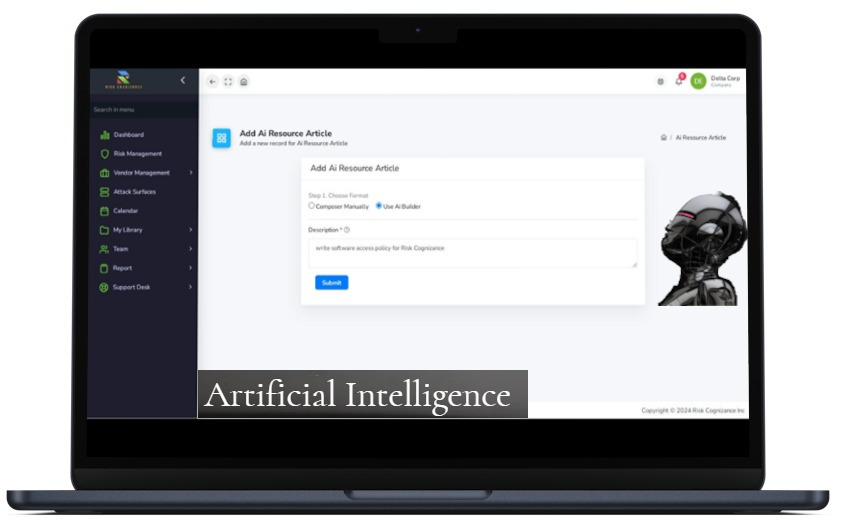

Centralize the creation, management, and distribution of security policies across all client environments. Risk Cognizance provides a user-friendly interface for drafting policies, obtaining approvals, and maintaining an up-to-date policy repository that supports governance needs.

|  |

|  |

| |

Key Features of Risk Cognizance GRC Software:

- Integrated Risk Management Platform

Gain comprehensive visibility across your organization and identify, assess, and prioritize risks. Real-time analytics and intuitive dashboards allow you to provide proactive risk management across all business functions. - Compliance Automation Platform

Automate complex compliance tasks and simplify adherence to industry standards such as ISO 27001, NIST, GDPR, PCI-DSS, and more. Manage audits, track compliance status, and generate detailed reports effortlessly. - Policy Management Software

Centralize the creation, management, and distribution of security policies. Maintain an up-to-date policy repository that supports the governance needs of your FinTech organization. - Third-Party Risk Management Platform

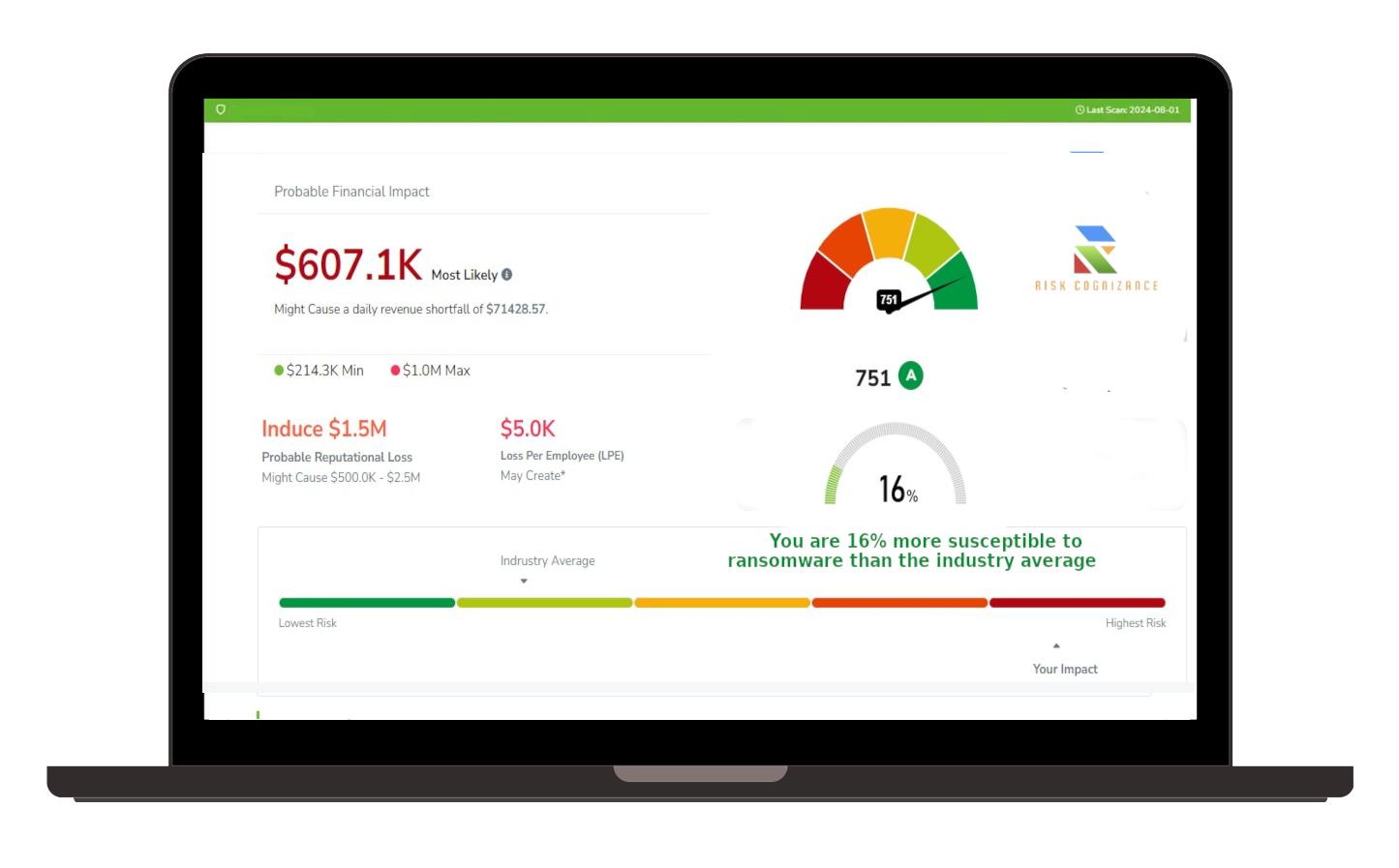

Manage third-party risks effectively by evaluating vendors, monitoring their compliance status, and ensuring that your partners’ operations align with your organization’s risk standards. - Ransomware Susceptibility Report

Assess your organization’s vulnerability to ransomware and implement strategic defenses based on real-time reports to mitigate threats. - Attack Surface Management Platform

Identify, assess, and mitigate potential vulnerabilities across your digital infrastructure to protect sensitive financial data and systems. - Artificial Intelligence (AI) Platform

Leverage AI-driven insights for real-time threat intelligence and risk analysis, enhancing your proactive risk mitigation strategies.

Benefits for FinTech Companies:

- Scalable Risk and Compliance Operations: The platform scales with your business, accommodating growth without compromising security or compliance.

- Enhanced Business Value: Deliver greater value through proactive risk management and streamlined compliance, improving client satisfaction and increasing trust in your financial services.

- Improved Incident Response: Real-time data enhances your ability to respond swiftly to security incidents, reducing the impact on client operations and financial data security.

Platform Features for FinTech Companies:

- Risk Assessment and Reporting: Conduct detailed risk assessments and generate reports that provide insights into vulnerabilities across your organization and business operations.

- Compliance Tracking and Reporting: Automated tracking and reporting keep you on top of regulatory requirements, making compliance easier and more efficient.

- Vendor Risk Management: Evaluate and manage third-party risks, ensuring that all partners align with your company’s security and compliance standards.

- Audit Management: Simplify your audit processes with tools for planning, execution, and reporting, ensuring continuous compliance across your organization.

- Incident Management: Streamline the detection, response, and resolution of security incidents with a structured workflow, enhancing overall security posture.

- Policy and Control Mapping: Map security policies to compliance controls and regulatory requirements, making governance management more efficient.

Why Choose Risk Cognizance?

Tailored for FinTech: Specifically designed to address the unique challenges FinTech companies face in managing risk, security, and compliance in a highly regulated and fast-evolving environment.

Comprehensive Compliance Management: Extensive support for a wide range of global standards and frameworks, ensuring that your company remains compliant as regulations evolve.

Seamless Integration: The platform integrates with your existing security stack, enhancing your GRC capabilities without disrupting your current systems and workflows.

Expert Support: Access the expertise of Risk Cognizance’s professionals, who provide guidance and support to help you navigate complex governance, risk, and compliance challenges.

Get Started with Risk Cognizance

Empower your FinTech company with Risk Cognizance’s advanced GRC software solution. Simplify compliance, strengthen risk management, and ensure superior security for your clients. Request a demo today and see how our platform can transform your operations.

Book a Demo