Overview

Risk Cognizance’s GRC (Governance, Risk, and Compliance) Software for banks and financial institutions is a comprehensive solution designed to streamline risk management, ensure regulatory compliance, and strengthen governance frameworks. Tailored specifically for the financial sector, our platform helps you navigate the complex regulatory landscape while enhancing your operational efficiency.

|  |

|  |

| |

Key Features:

Risk Management:

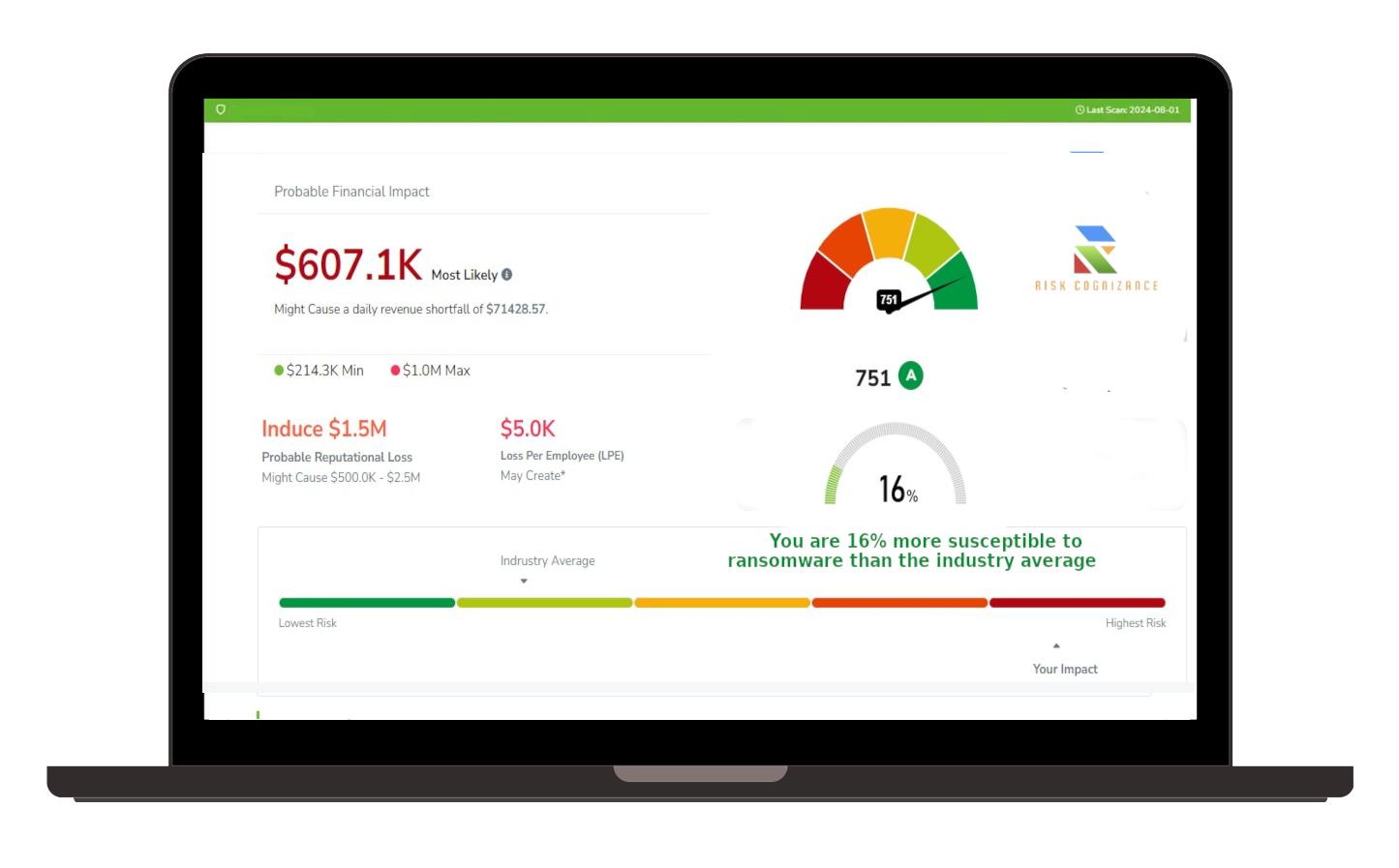

- Real-time risk monitoring and assessment tools

- Automated risk identification and reporting based on financial regulations like Basel III, SOX, and Dodd-Frank

- Integrated risk analytics to measure, mitigate, and monitor financial and operational risks

Compliance Management:

- Compliance tracking for financial regulations and standards (AML, KYC, GDPR, etc.)

- Automated audit trails and regulatory reporting

- Pre-built frameworks for industry standards, ensuring faster compliance with changing regulations

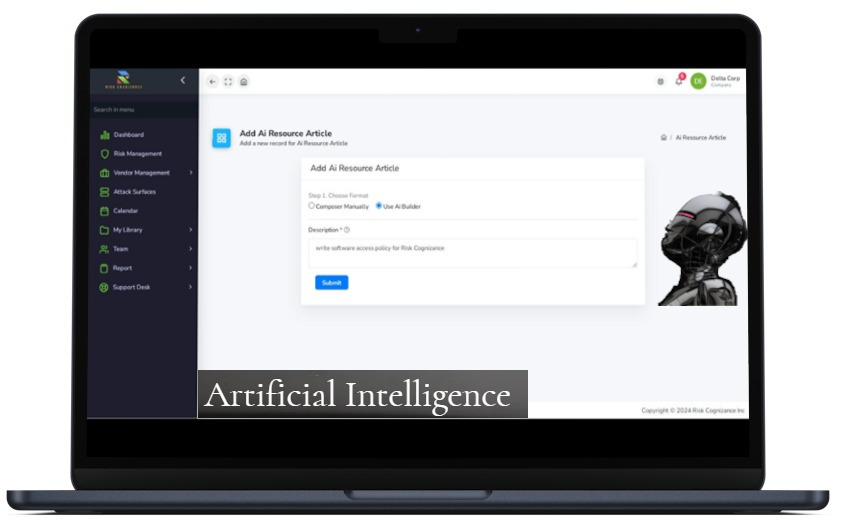

Policy and Procedure Management:

- Centralized policy creation, distribution, and tracking to ensure compliance across departments

- Automated policy updates with regulatory changes

- Employee training and attestation management to ensure adherence to compliance guidelines

Incident Management:

- Streamlined process for reporting, managing, and resolving incidents

- Integration with banking systems for quick resolution of fraud detection or data breaches

- Automated workflows for incident investigation and documentation

Audit Management:

- Simplified audit planning, scheduling, and execution

- Digital storage of audit records for seamless retrieval

- Role-based access controls for secure audit document management

Vendor Risk Management:

- Continuous monitoring of third-party vendors to mitigate potential risks

- Assessments to ensure compliance with cybersecurity and financial regulations

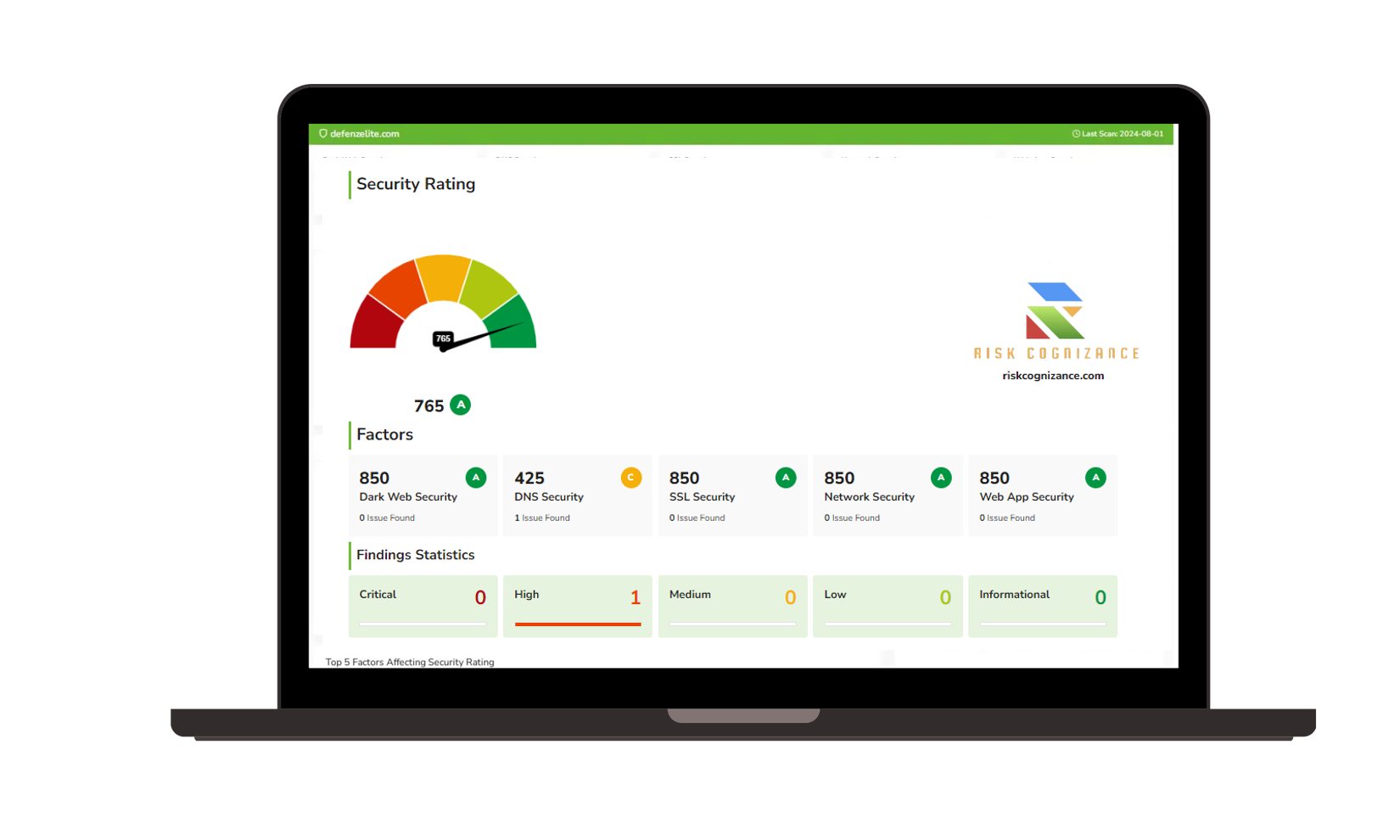

- Real-time risk scoring of vendor portfolios for actionable insights

Data Security & Privacy:

- End-to-end encryption and secure access controls to safeguard sensitive financial data

- Built-in compliance with data privacy regulations like GDPR, CCPA, and PCI DSS

- Dark web monitoring and threat intelligence integration for proactive risk mitigation

Dashboard and Reporting:

- Customizable dashboards with real-time insights into risk, compliance, and governance performance

- Regulatory reporting templates for easy submission to financial authorities

- Detailed reports on risk metrics, compliance statuses, and audit findings

Benefits:

- Efficient Compliance: Reduce the burden of regulatory compliance through automated updates and tracking.

- Improved Risk Visibility: Gain a clearer understanding of emerging risks and act on them proactively.

- Cost Savings: Reduce manual processes, improve response times, and lower the cost of compliance management.

- Strengthened Governance: Maintain higher standards of transparency and accountability within your organization.

Why Choose Risk Cognizance for Banks?

- Tailored specifically for the financial industry

- Built-in compliance with major banking regulations

- Scalable solution adaptable to both small financial firms and large banking institutions

Contact Us: To learn more about how Risk Cognizance’s GRC Software can transform your bank or financial firm, schedule a demo or speak with one of our experts today.

Request Callback