Overview

Without an integrated GRC platform, organizations struggle with fragmented security policies, regulatory gaps, and inefficient risk management.

Risk Cognizance is a GRC platform designed to streamline governance, risk assessment, and compliance into a unified, automated, and scalable solution. By integrating advanced risk intelligence, real-time compliance tracking, and automated security governance, Risk Cognizance empowers businesses to mitigate risks proactively, ensure regulatory adherence, and maintain operational resilience.

Why a GRC Platform is Essential for Modern Businesses

As cyber threats grow and regulatory requirements become stricter, organizations must go beyond traditional compliance checklists. A GRC platform provides a structured framework to:

✔ Identify and assess risks before they impact business operations.

✔ Automate compliance processes to reduce manual effort and human error.

✔ Centralize security governance for real-time monitoring and reporting.

✔ Enhance operational resilience by proactively managing threats and vulnerabilities.

Without a GRC platform, businesses risk fines, reputational damage, and operational disruptions. Risk Cognizance ensures continuous compliance, risk intelligence, and security oversight to protect organizations from financial and legal risks.

|  |

|  |

|  |

How Risk Cognizance Revolutionizes GRC

Risk Cognizance GRC platform is built to address key governance, risk, and compliance challenges through:

1. Automated Risk Management

Risk is dynamic, and manual risk assessments often lead to gaps. Our GRC platform provides:

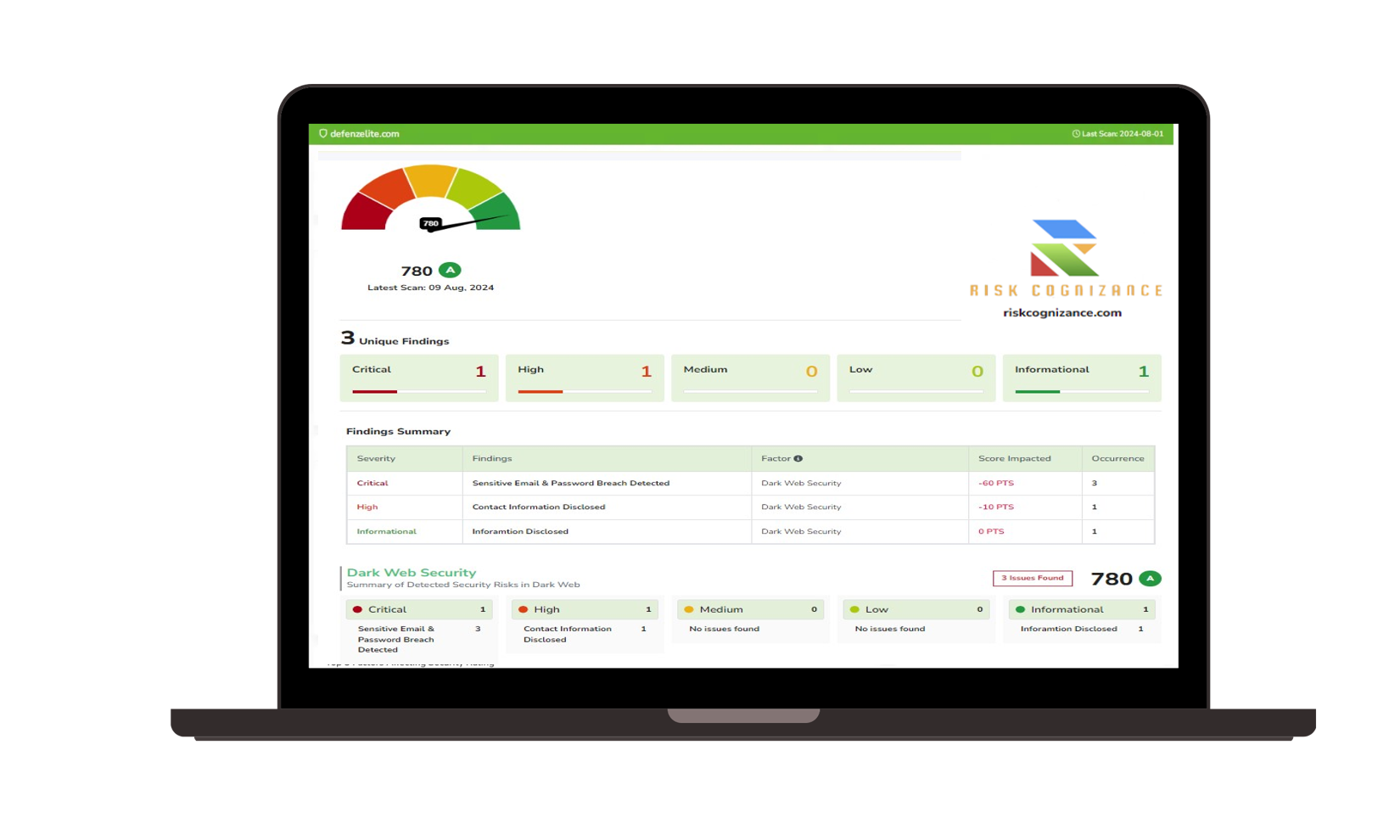

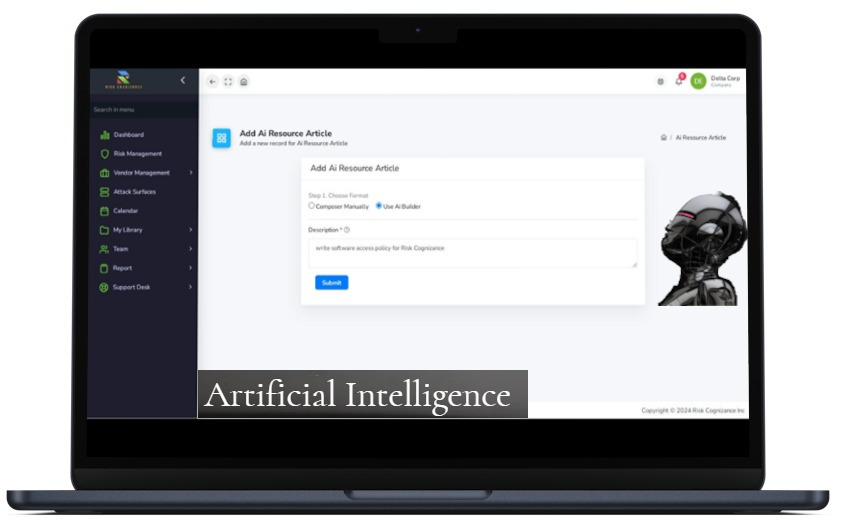

- AI-powered risk intelligence to detect, analyze, and mitigate threats.

- Continuous risk monitoring to prevent security incidents before they occur.

- Customizable risk scoring models to prioritize vulnerabilities based on severity.

2. Compliance Automation & Regulatory Adherence

Meeting industry standards like NIST, ISO 27001, HIPAA, SOC 2, and GDPR requires ongoing effort. Risk Cognizance simplifies compliance by:

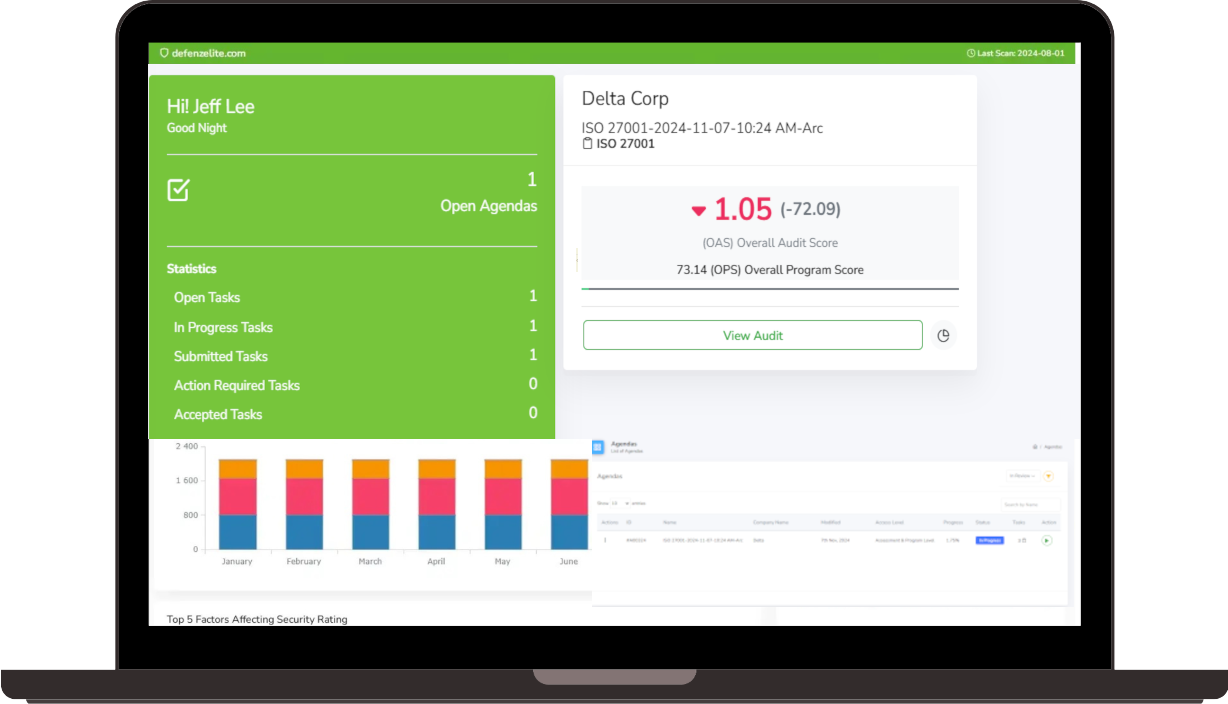

- Automating compliance checks to ensure real-time regulatory alignment.

- Generating audit-ready reports for effortless regulatory submissions.

- Providing policy templates tailored to industry-specific requirements.

3. Security Governance & Policy Enforcement

Managing security policies across departments is complex. Our GRC platform ensures:

- Role-based access controls to enforce security best practices.

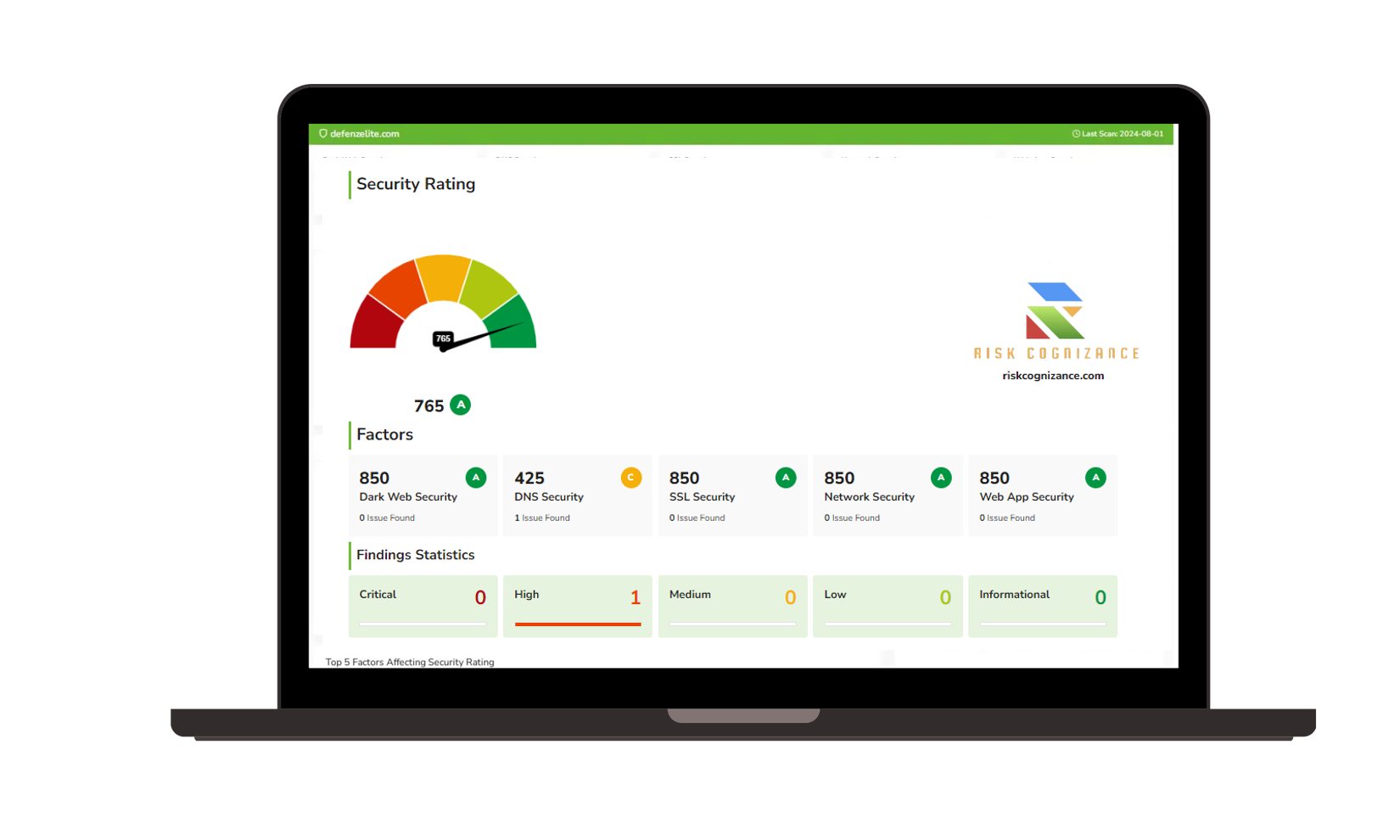

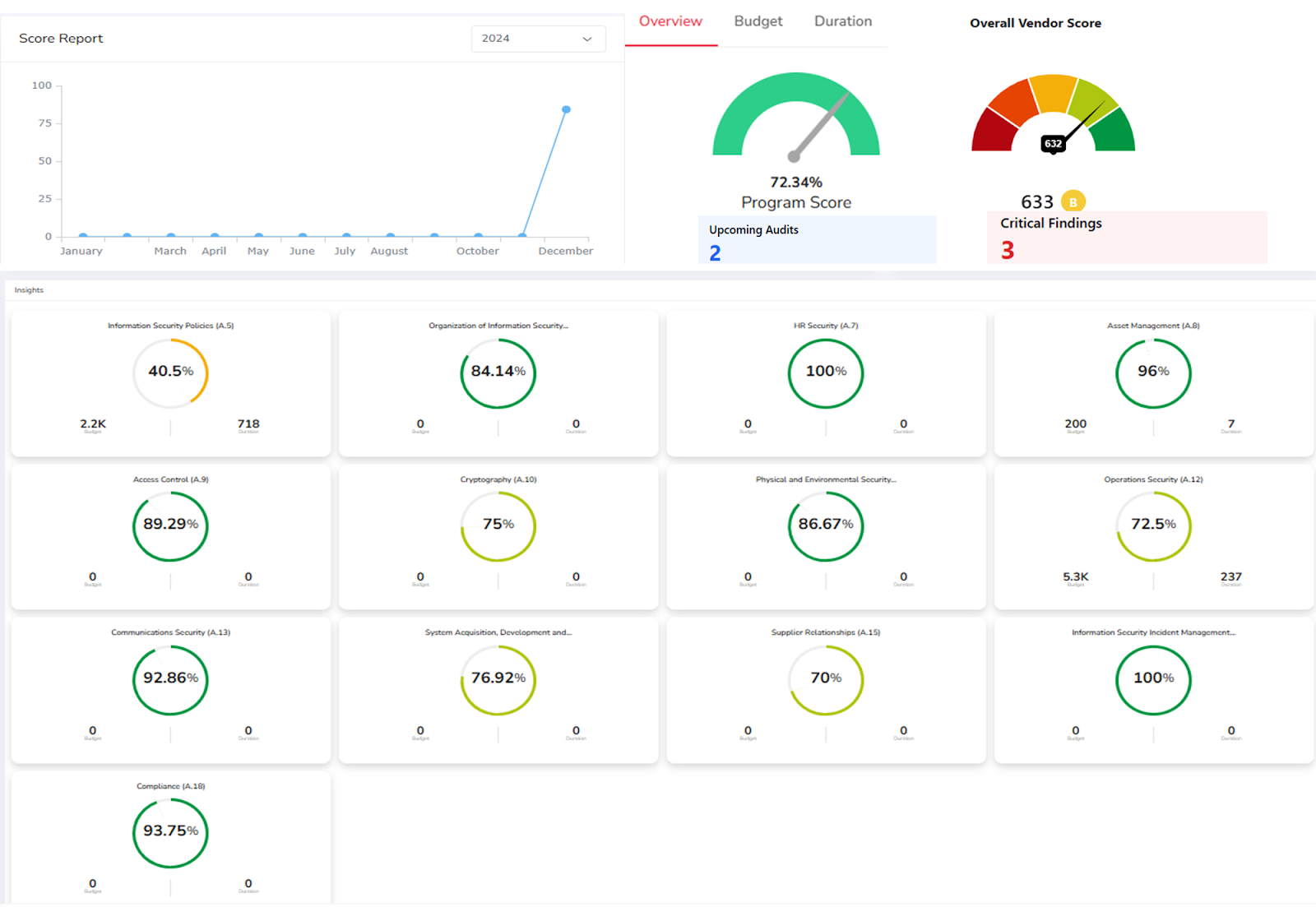

- Centralized governance dashboards for real-time visibility into compliance status.

- Policy lifecycle management for version control and enforcement tracking.

4. Vendor Risk & Third-Party Compliance

Third-party vendors pose cybersecurity and compliance risks. Our GRC platform includes:

- Automated vendor risk assessments to evaluate third-party security postures.

- Third-party compliance tracking for continuous risk oversight.

- Customizable risk questionnaires to ensure vendor accountability.

5. Incident Management & Business Continuity

A strong GRC platform must support rapid incident response and business continuity. Risk Cognizance offers:

- Automated incident response workflows to minimize downtime.

- Business continuity planning to ensure operational resilience.

- Threat intelligence integration for real-time risk mitigation.

Industries That Benefit from a GRC Platform

Risk Cognizance serves a wide range of industries, ensuring seamless GRC platform adoption for:

✅ Financial Services & Banking – Ensures regulatory compliance with SEC, FINRA, and PCI DSS.

✅ Healthcare & Life Sciences – Aligns with HIPAA and HITECH compliance frameworks.

✅ Technology & SaaS Providers – Helps meet ISO 27001 and SOC 2 certification requirements.

✅ Retail & E-Commerce – Ensures data security compliance with GDPR and CCPA.

✅ Manufacturing & Supply Chain – Reduces third-party risk and enforces cybersecurity best practices.

No matter the industry, Risk Cognizance provides a scalable and flexible GRC platform to meet evolving regulatory demands.

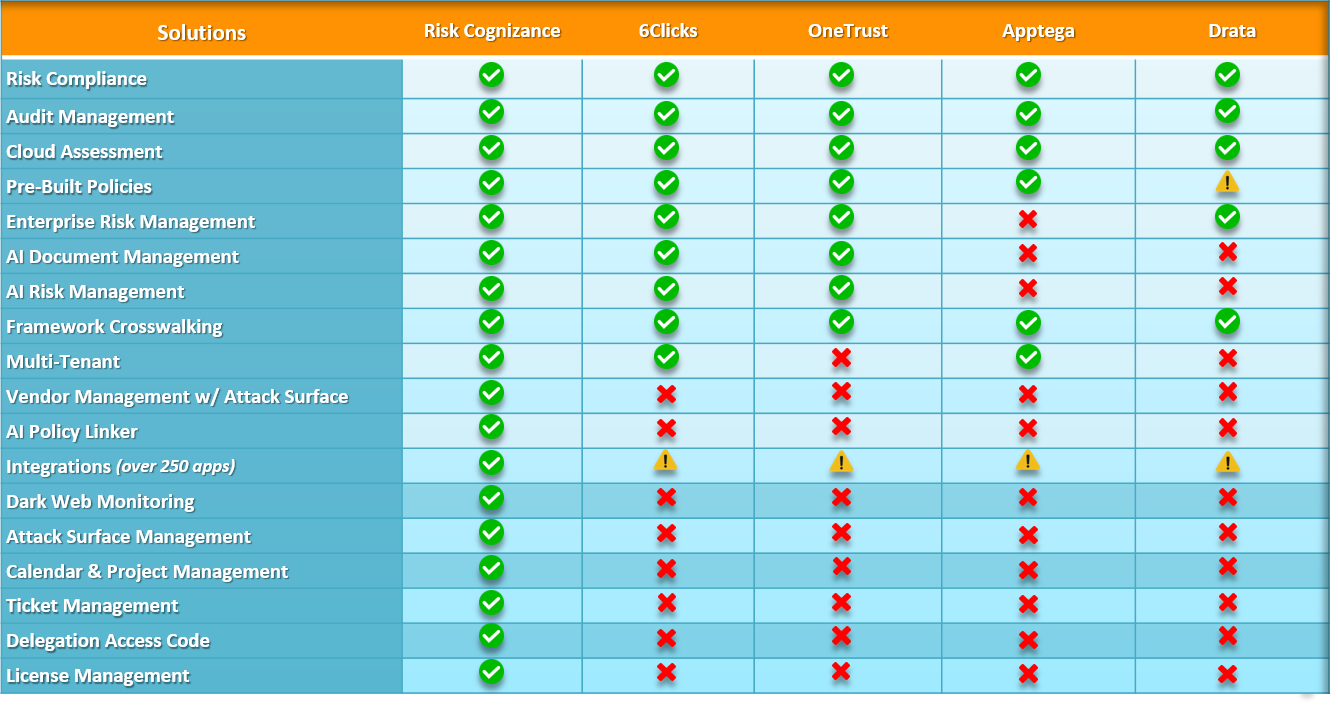

Why Choose Risk Cognizance as Your GRC Platform?

✔ End-to-End GRC Integration – Connects risk, compliance, and governance in a single platform.

✔ Real-Time Compliance Tracking – Automates reporting and regulatory adherence.

✔ AI-Driven Risk Intelligence – Enhances decision-making with advanced analytics.

✔ Customizable & Scalable – Adapts to businesses of all sizes and industries.

✔ User-Friendly Interface – Simplifies complex GRC processes with intuitive dashboards.

Future-Proof Your Business with a Powerful GRC Platform

Risk is inevitable, but mismanaging it is optional. With Risk Cognizance, businesses can shift from reactive risk management to proactive GRC strategies, ensuring compliance, reducing vulnerabilities, and strengthening resilience against cybersecurity threats.

Get Started with Risk Cognizance Today!

Ready to optimize governance, risk, and compliance for your business? Risk Cognizance’s GRC platform is your all-in-one solution for risk mitigation, security governance, and compliance automation.

Contact us today to schedule a demo and see how our GRC platform can transform your risk and compliance strategy!

Request Callback