Overview

Safeguard Your Business with Cyber Liability Protection

Our GRC Platform for Cyber Liability Protection offers a powerful solution for organizations looking to secure their operations against the increasing threat of cyber incidents. Cyber insurance has become a critical component in mitigating financial risks associated with data breaches, ransomware, and other digital threats. Our integrated GRC software enhances cyber insurance policies by providing a centralized platform for risk assessment, compliance tracking, and data protection.

With the Risk Cognizance GRC Platform, businesses can streamline their compliance efforts, demonstrate adherence to security standards, and proactively identify and manage potential vulnerabilities—all of which are key factors in qualifying for cyber insurance and reducing premiums. The platform’s AI-driven analytics help insurers assess the security posture of an organization, enabling more accurate underwriting and risk management.

Governance, Risk, and Compliance (GRC) |  Third-party Risk Management |

Ransomware Susceptibility |  GRC and Attack Surface |

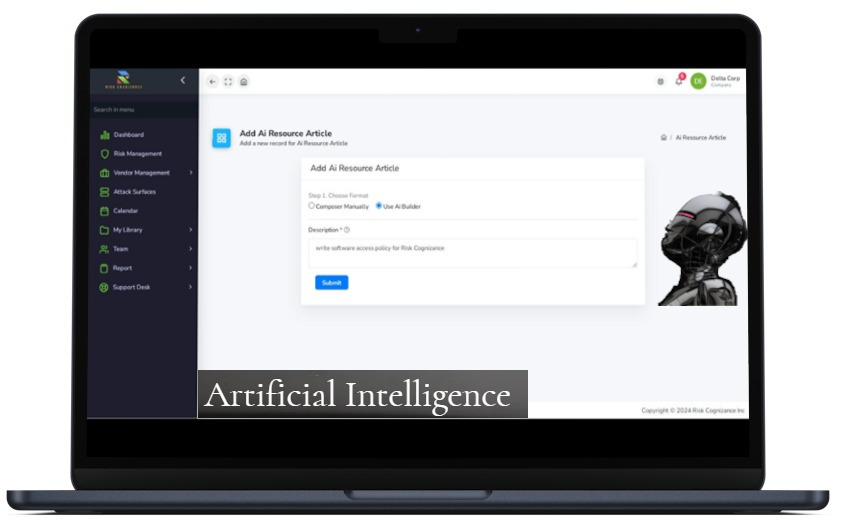

Artificial Intelligence | |

Key Features of Our GRC Platform for Cyber Liability Protection

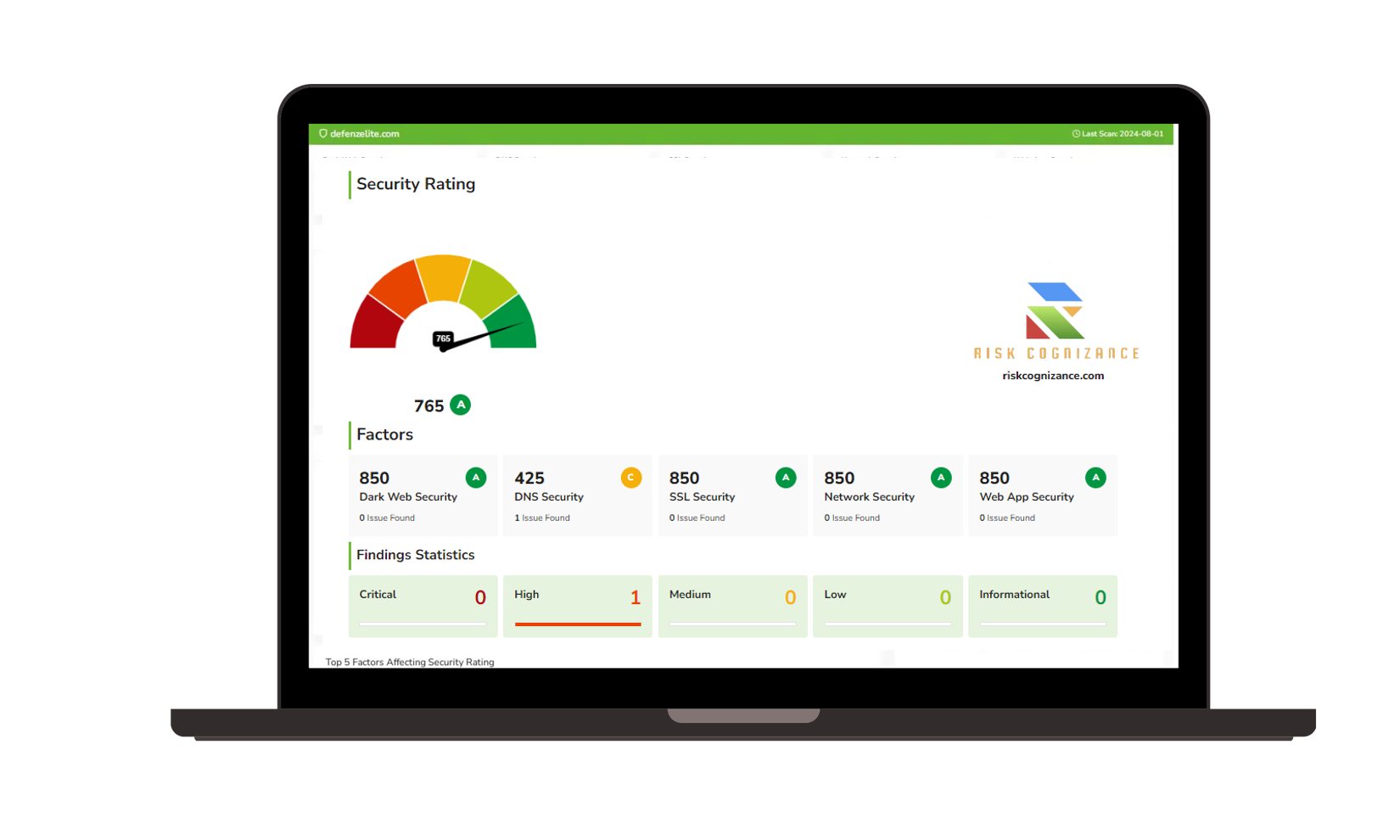

Comprehensive Risk Assessment and Reporting

Identify, prioritize, and mitigate cyber risks through automated risk assessments tailored to your business environment. Our platform delivers real-time insights into your organization’s security posture, providing clear documentation for cyber insurance applications.

Third-Party Cyber Risk Management

Assess and monitor the security posture of third-party vendors and partners. The platform helps identify potential vulnerabilities and dependencies, providing visibility into how third-party risks could impact your organization’s overall cyber insurance coverage.

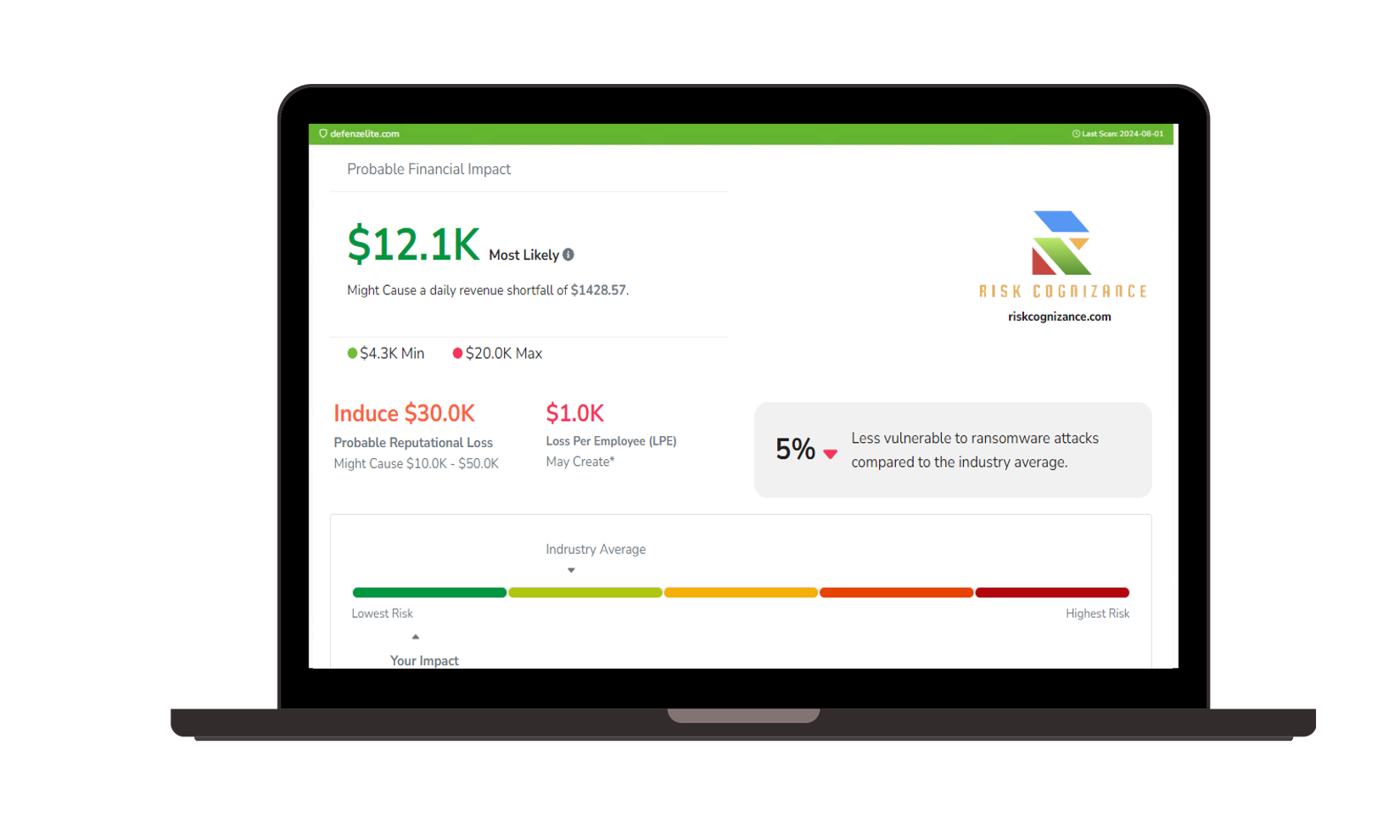

Ransomware Susceptibility Report

The platform includes a dedicated Ransomware Susceptibility Report that leverages data analysis techniques and common indicators, such as a third party’s location, industry, and annual revenue. By analyzing these factors, organizations can better understand their exposure to ransomware attacks and take proactive steps to mitigate potential risks.

Attack Surface Management

Gain a complete view of your organization's external attack surface, including exposed digital assets, misconfigurations, and vulnerabilities. Automated scanning and monitoring allow businesses to reduce their attack surface and demonstrate strong security controls to insurers.

Regulatory Compliance Management

Track and manage compliance with key regulations such as GDPR, CCPA, HIPAA, and PCI DSS. Automated workflows and reporting tools help ensure that your organization maintains compliance, reducing the risk of penalties and supporting a strong cyber insurance application.

Data Protection and Incident Management

Implement robust data protection policies and track incidents with real-time alerts and structured workflows. Our GRC platform allows organizations to quickly respond to security incidents, document response efforts, and showcase strong security controls to insurers.

Cyber Insurance Readiness Assessments

Use built-in tools to assess your organization’s readiness for cyber insurance. The platform helps identify areas that need improvement, provides recommendations, and tracks progress to ensure that you meet the stringent requirements set by insurers.

Policy and Procedure Management

Create, review, and update security policies and procedures to align with best practices and regulatory requirements. This feature helps organizations establish a consistent approach to cybersecurity, supporting risk management and compliance objectives.

Dynamic Risk Scoring and Analysis

Leverage AI-powered risk scoring to evaluate your organization’s vulnerability to cyber threats. The platform’s dynamic risk scoring model allows insurers to assess risk accurately, facilitating better policy terms and coverage.

Benefits of Our GRC Platform for Cyber Liability Protection

Reduced Cyber Insurance Premiums

By demonstrating strong risk management and compliance practices, organizations can potentially qualify for lower cyber insurance premiums and better coverage terms.

Streamlined Compliance and Risk Management

Automate complex compliance and risk management tasks, saving time and resources while ensuring that your organization remains aligned with evolving regulatory requirements.

Improved Incident Response and Reporting

Quickly respond to and document security incidents, providing insurers with detailed evidence of your organization’s preparedness and ability to handle cyber threats.

Enhanced Insurer Confidence

Provide insurers with transparent, real-time data on your organization’s security posture, making it easier to obtain cyber insurance coverage and reducing the time spent on manual documentation.

All-in-One Governance, Risk, and Compliance Solution

Manage your GRC and cybersecurity efforts from a single, integrated platform, reducing the need for multiple tools and ensuring a holistic approach to security and compliance.

Scalable for Any Size Organization

Whether you’re a small business or a large enterprise, our GRC platform scales to meet your needs, providing customizable features and tools to support your unique risk management and compliance objectives.

Why Choose Our GRC Platform for Cyber Liability Protection?

Risk Cognizance’s GRC Platform for Cyber Liability Protection is designed to help organizations of all sizes streamline their risk management and compliance activities, making it easier to qualify for cyber insurance and safeguard their operations. The platform’s AI-driven capabilities provide a complete view of your organization’s risk profile, enabling proactive management of vulnerabilities and compliance gaps.

With an emphasis on automation, dynamic risk scoring, and integrated policy management, our GRC solution supports a strong security posture and reduces the complexity of managing compliance and insurance requirements. By leveraging our platform, organizations can better protect themselves from the financial and operational impact of cyber incidents, while demonstrating to insurers that they have a mature and well-structured approach to cybersecurity.

Frequently Asked Questions (FAQ)

- Q: What is the GRC Platform Cyber Liability Protection?

A: The GRC Platform Cyber Liability Protection is a unified risk management and compliance solution designed to support organizations in meeting cyber insurance requirements. It provides tools for risk assessment, compliance tracking, and policy management to enhance cyber insurance readiness. - Q: How can this platform help reduce cyber insurance premiums?

A: By using the platform to demonstrate strong risk management, compliance practices, and incident response capabilities, organizations can potentially qualify for lower premiums and better coverage terms. - Q: Does the platform support specific regulatory compliance requirements?

A: Yes, the GRC platform is designed to support a wide range of compliance frameworks, including GDPR, HIPAA, CCPA, and PCI DSS. Automated workflows and templates make it easy to manage and document compliance efforts. - Q: What kind of reports does the platform generate for insurers?

A: The platform provides comprehensive reports on risk assessments, compliance status, incident response efforts, and policy management, making it easy for insurers to evaluate your organization’s security posture. - Q: Is the platform scalable for small and large organizations?

A: Absolutely. The platform is built to be scalable and customizable, providing features and tools that support the needs of both small businesses and large enterprises. - Q: How does the dynamic risk scoring work?

A: The platform uses AI-driven analytics to evaluate and score your organization’s risk based on various factors, such as the effectiveness of security controls, incident history, and compliance status. This scoring model helps insurers assess risk accurately and provides insights for improving security posture.

Request Callback