Overview

Navigating the Complexities of GRC with a Centralized Platform

In today's dynamic business environment, organizations must navigate regulatory challenges, risk exposure, and governance requirements while maintaining operational efficiency. A Governance, Risk, and Compliance (GRC) platform is essential for businesses looking to mitigate risks, maintain compliance, and align IT strategies with business objectives.

1. Understanding the Role of a GRC Platform

A GRC platform is a software solution designed to help organizations manage risk, track compliance requirements, and enforce governance policies within a centralized framework. By integrating risk assessment, compliance tracking, policy management, and audit oversight, businesses gain a holistic view of their risk landscape and can implement proactive measures to ensure business continuity.

2. The Growing Need for a GRC Platform

Organizations across industries face increasing regulatory pressures, cybersecurity risks, and compliance obligations. A GRC platform provides automation, visibility, and control, enabling businesses to:

- Identify and mitigate potential risks before they escalate

- Streamline regulatory compliance processes

- Enhance governance through AI-driven policy enforcement

- Strengthen decision-making with real-time risk insight.

Key Features of a GRC Platform

A GRC platform provides an integrated suite of tools to enhance governance, risk management, and compliance functions.

1. Risk Assessment & Management

- Identifies, analyzes, and prioritizes risks across the organization

- Automates risk mitigation strategies to reduce business exposure

- Provides real-time risk scoring and predictive analytics

2. Compliance Management

- Tracks adherence to industry regulations such as NIST, ISO 27001, GDPR, and DORA

- Automates compliance documentation, reducing manual efforts

- Generates regulatory reports for audits and internal assessments

3. Policy Management

- Creates, distributes, and enforces company-wide policies

- AI-powered policy builder ensures regulatory alignment

- Automates policy synchronization across business units

4. Audit Management

- Streamlines internal and external audit processes

- Automates evidence collection and audit reporting

- Enhances transparency with AI-driven audit tracking

5. Incident & Case Management

- Tracks and responds to compliance violations and security incidents

- Automates incident resolution workflows

- Provides detailed forensic analysis for regulatory reporting

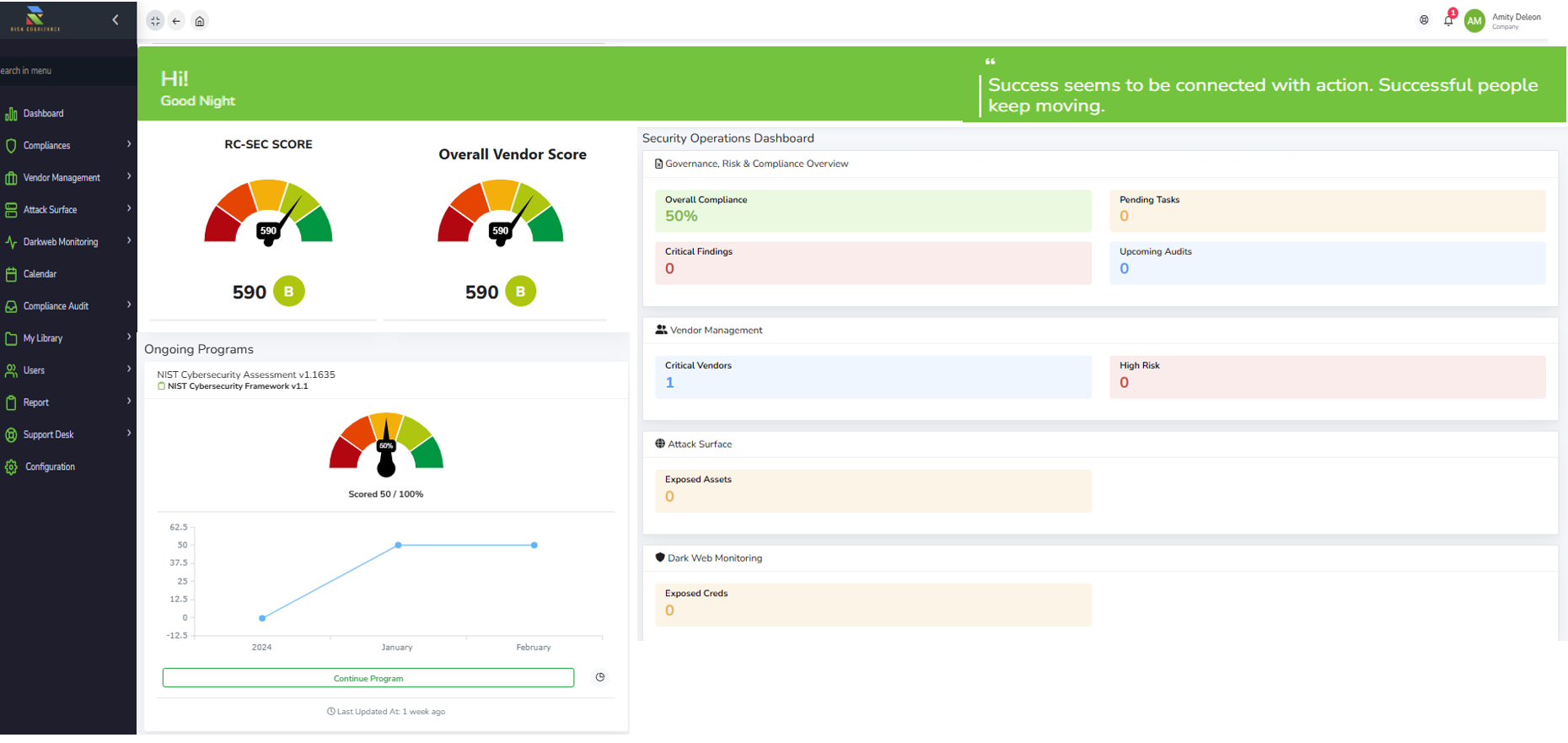

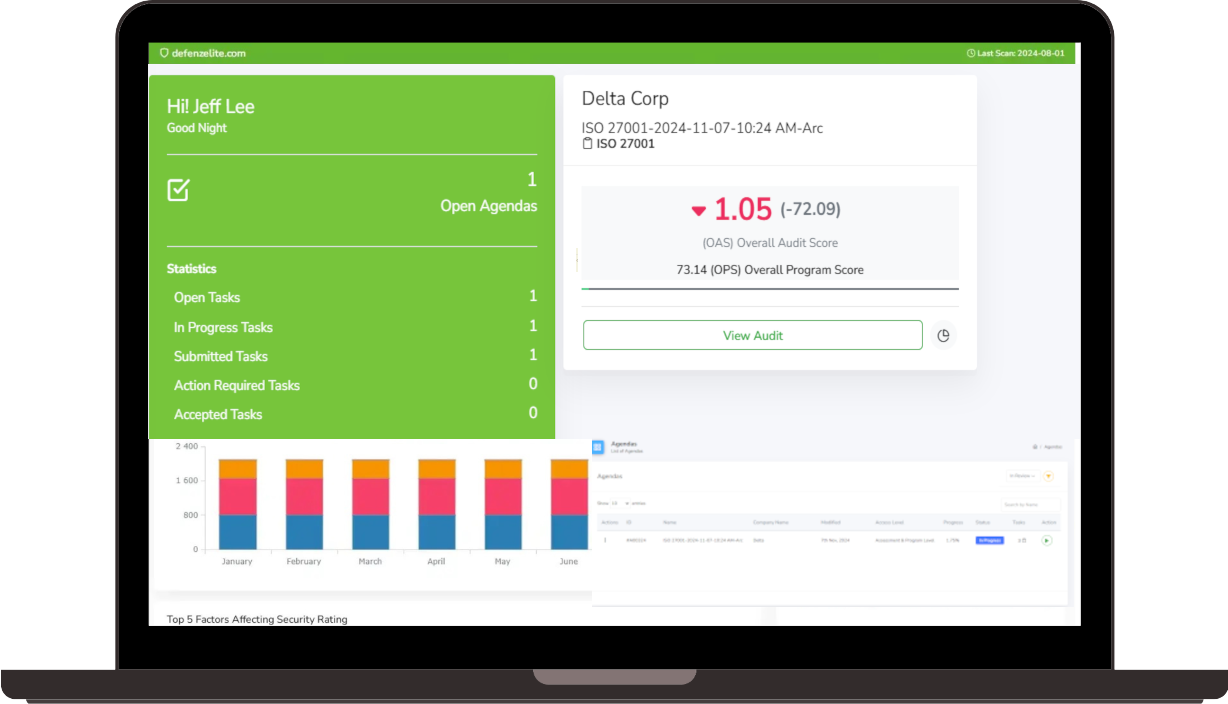

6. Reporting & Dashboards

- Real-time dashboards offering comprehensive GRC insights

- Automated report generation for boardroom decision-making

- Advanced analytics for trend analysis and predictive governance

Why Businesses Choose a GRC Platform

A GRC platform is not just a compliance tool—it is a strategic solution that enhances risk awareness, automates regulatory processes, and improves governance across the enterprise.

1. Improved Risk Mitigation

- Proactively identifies potential threats

- AI-driven risk intelligence for real-time decision-making

- Reduces financial, legal, and reputational risks

2. Enhanced Compliance

- Keeps organizations compliant with evolving regulatory requirements

- Automates compliance workflows to prevent human errors

- Ensures data protection, cybersecurity resilience, and privacy compliance

3. Streamlined Governance

- Ensures corporate policies align with business objectives

- Automates policy enforcement and governance workflows

- Increases visibility into operational risks and compliance gaps

4. Greater Efficiency Through Automation

- Reduces manual workload with AI-driven compliance management

- Eliminates redundant governance processes

- Enhances collaboration across compliance, legal, and risk teams

5. Increased Stakeholder Confidence

- Demonstrates strong risk management and governance practices

- Provides transparency for investors, regulators, and leadership

- Strengthens trust among clients, partners, and suppliers

- Scalable integration with enterprise compliance frameworks

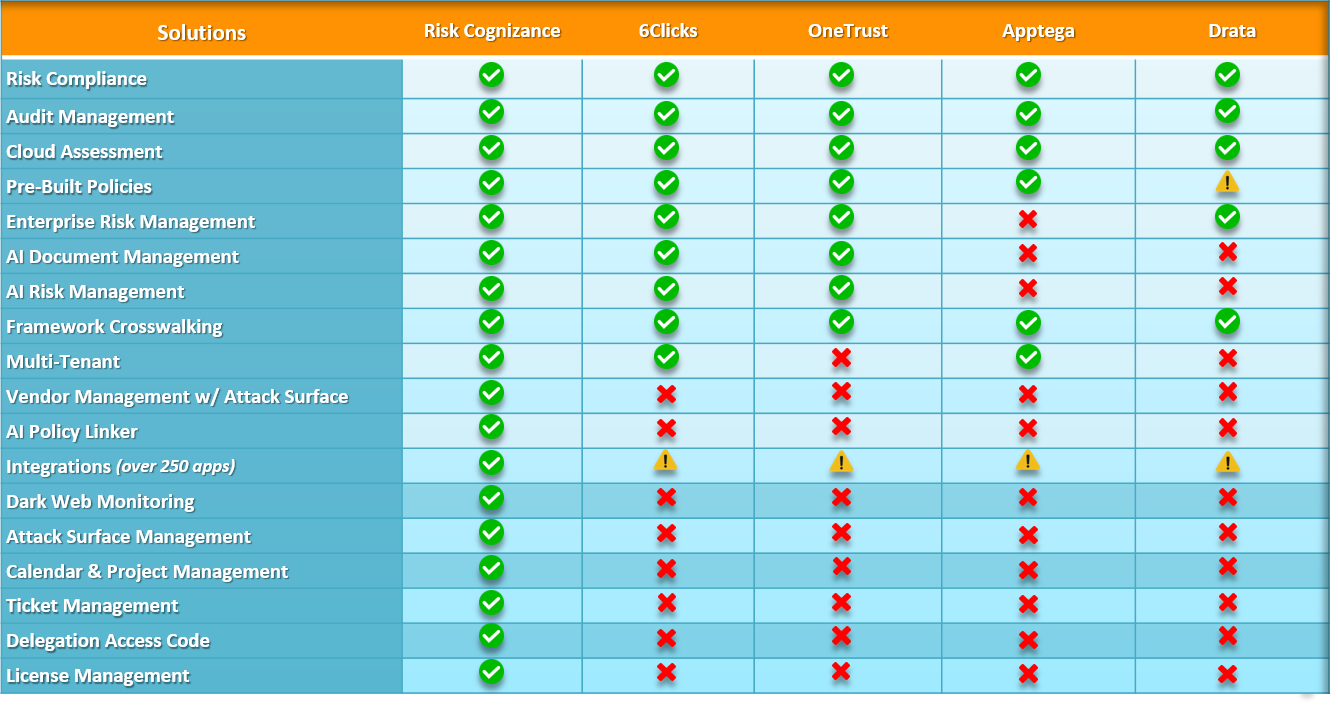

Risk Cognizance: The Most Advanced GRC Platform for Modern Businesses

While many GRC platforms exist, Risk Cognizance provides an AI-integrated, all-in-one solution designed for comprehensive risk and compliance management.

1. AI-Powered Risk Management

- Automated risk identification and scoring

- Predictive analytics for proactive risk mitigation

2. Advanced Third-Party Risk & Vendor Management

- Continuous monitoring of vendor compliance risks

- Automated third-party security assessments

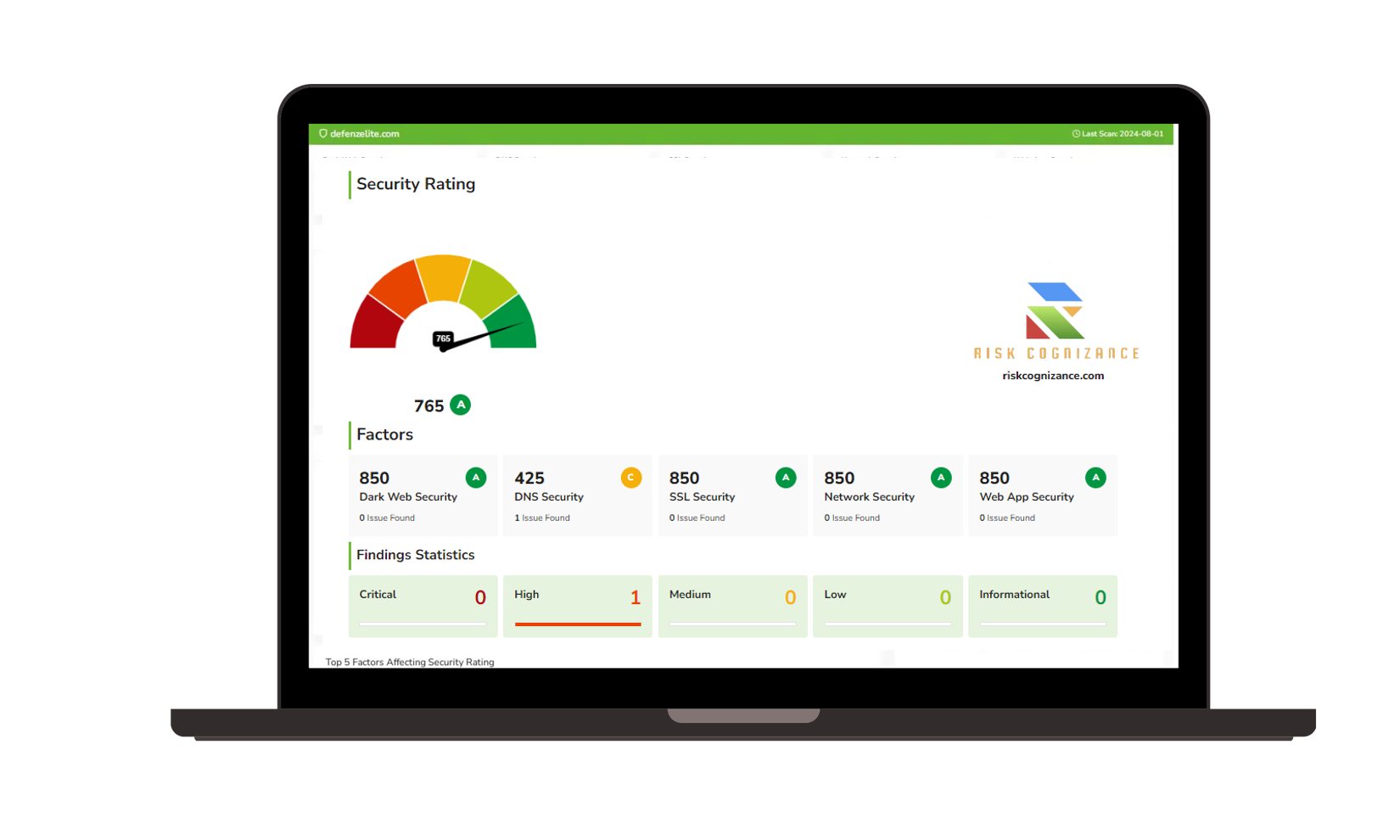

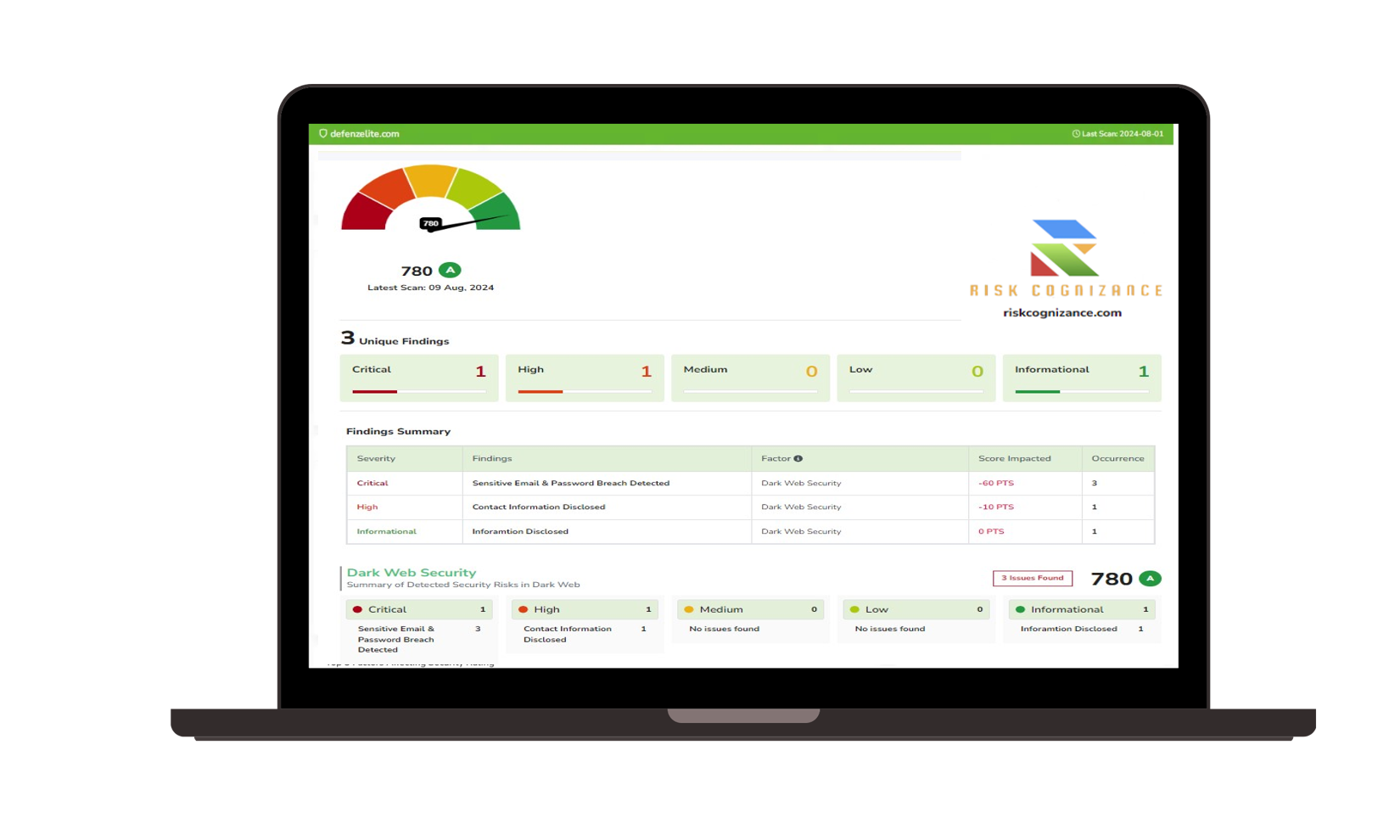

3. Attack Surface & Cyber Threat Intelligence

- Real-time monitoring of digital vulnerabilities

- Automated alerts on potential cyber threats

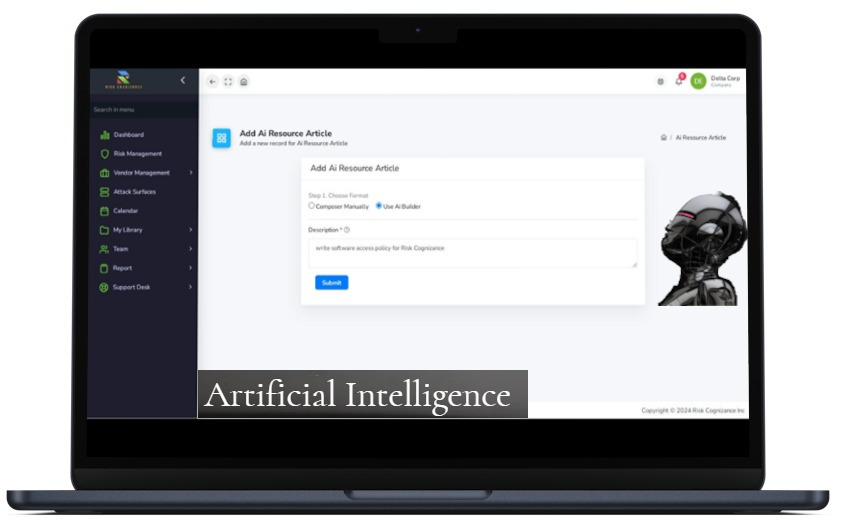

4. AI Policy Builder & AI Risk Syncer

- Automates creation, distribution, and enforcement of policies

- Ensures organization-wide compliance standardization

5. Dark Web Intelligence & Cybersecurity Resilience

- Detects and mitigates stolen credentials and cyber threats

- Provides real-time security insights and alerts

6. AI-Driven Ticket & Incident Management

- Tracks compliance violations and risk mitigation actions

- Automates issue resolution for regulatory adherence

7. AI-Powered Project Management for GRC

- Optimizes compliance and security initiatives

- Improves collaboration across risk, compliance, and IT teams

8. AI-Based Reporting & Governance Dashboards

- Automates compliance reporting for regulators and auditors

- Delivers real-time risk intelligence for business leaders

|  |

|  |

|  |

Why Businesses, Financial Firms, and Small Enterprises Choose Risk Cognizance GRC Platform

From large enterprises managing complex regulatory requirements to small businesses needing simplified risk solutions, Risk Cognizance adapts to all business sizes and industries.

1. AI-Driven Risk & Compliance for SMBs & Enterprises

- Affordable compliance automation for small businesses

- Scalable risk management solutions for global enterprises

2. Vendor Risk & Third-Party Compliance

- Monitors external cybersecurity risks in real time

- Provides automated risk assessment for vendors and suppliers

3. End-to-End Compliance Management

- Ensures businesses stay ahead of regulatory changes

- Automates compliance reporting to reduce audit fatigue

4. Centralized Cyber Governance for Business Continuity

- Provides a single source of truth for risk and compliance data

- Enhances organizational resilience against emerging threats

Risk Cognizance: The Ultimate GRC Solution for Risk, Compliance, and Governance

Businesses require more than just a basic compliance tool—they need an AI-driven, end-to-end GRC platform that delivers risk intelligence, governance automation, and regulatory compliance management.

Contact Risk Cognizance today to transform your risk, compliance, and governance strategy with AI-powered automation.

Request Callback