Overview

Risk Cogniance's Enterprise Risk Management (ERM) Solutions

Effective Enterprise Risk Management (ERM) is crucial for navigating the complexities of today's business landscape. Risk Cognizance provides comprehensive ERM solutions designed to help organizations of all sizes identify, assess, respond to, and monitor risks across the entire enterprise. Our platform empowers you to make informed strategic decisions, protect organizational value, and achieve your business objectives.

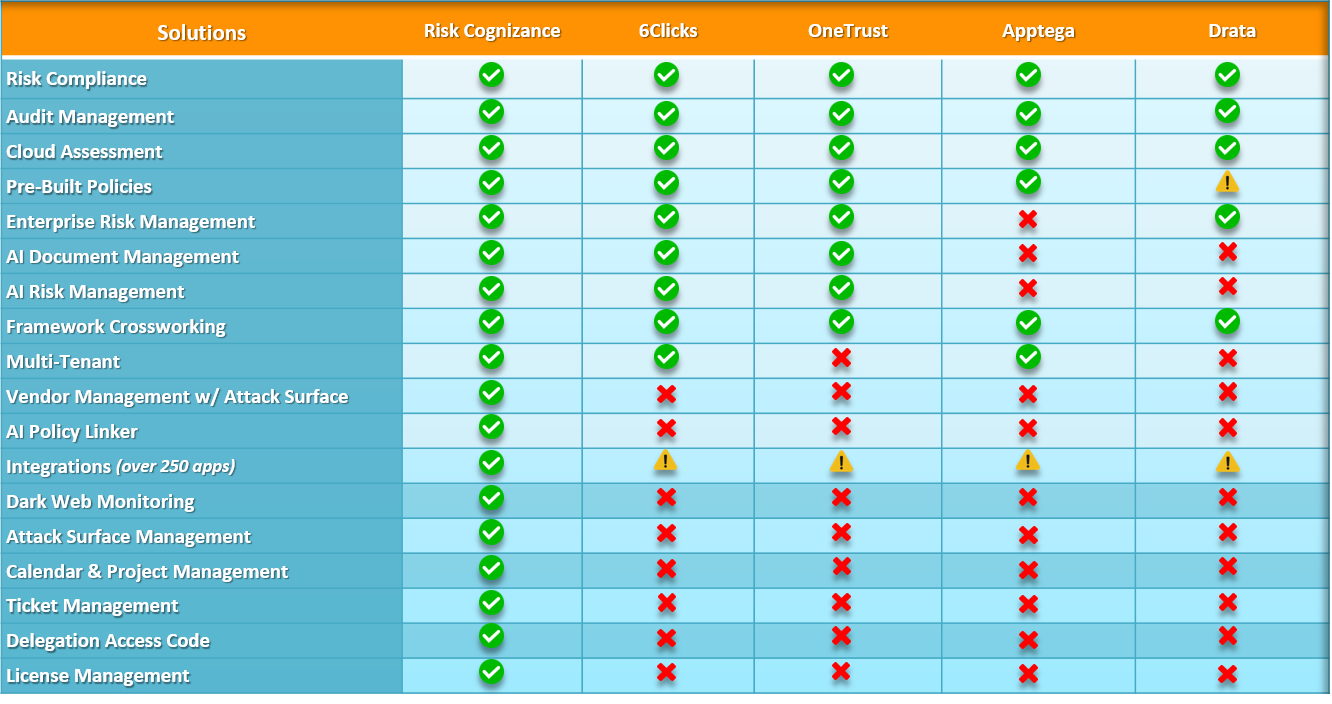

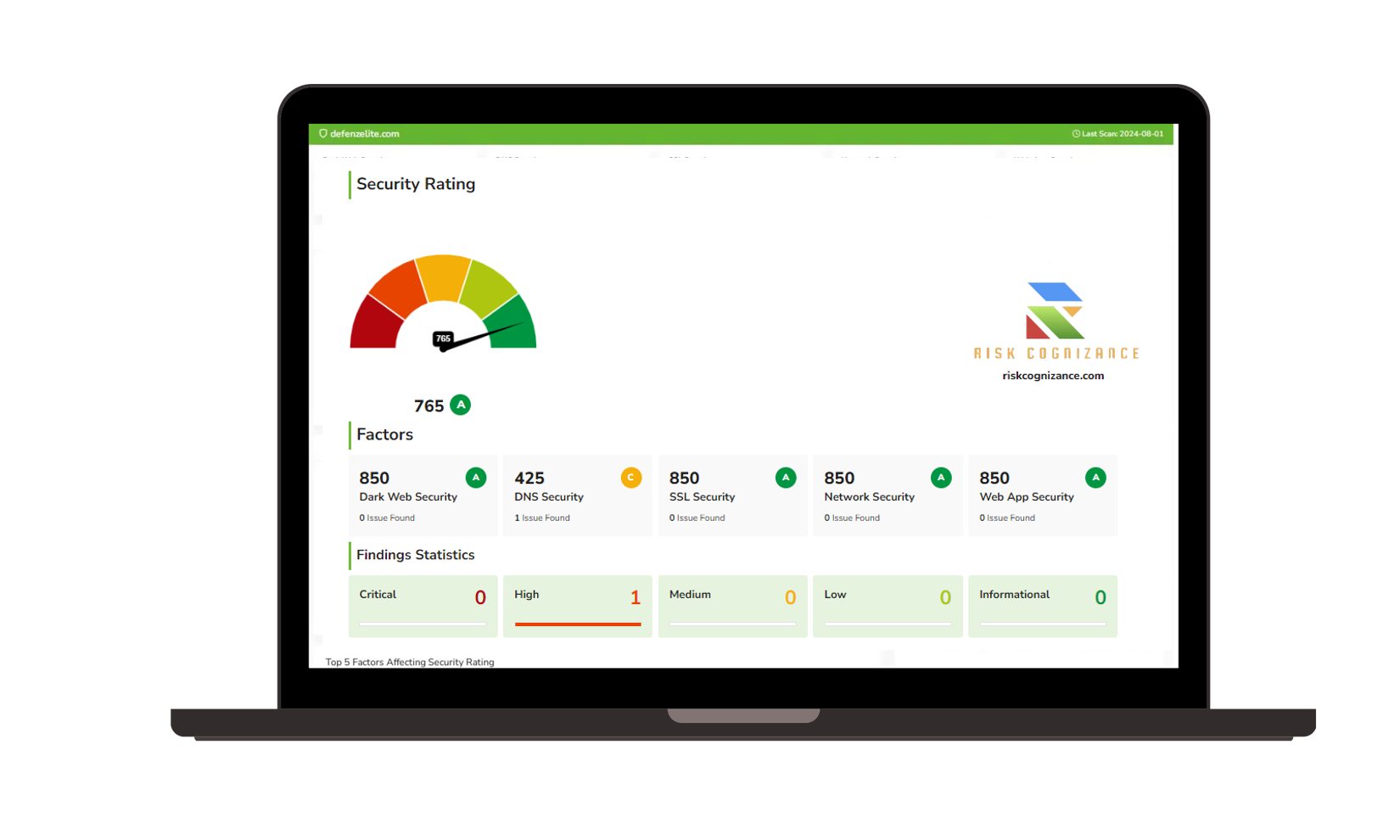

Comprehensive ERM for Strategic Advantage

Risk Cognizance's ERM solutions offer a holistic and integrated approach to risk management, moving beyond siloed approaches to provide a complete view of your organization's risk profile. We help you embed risk management into your strategic planning and decision-making processes.

How Risk Cognizance Features Support Effective ERM:

Risk Cognizance offers a robust suite of features designed to facilitate comprehensive ERM:

- Risk Identification and Assessment:

- Top-Down and Bottom-Up Risk Identification: Facilitate risk identification from both high-level strategic objectives and operational processes.

- Qualitative and Quantitative Risk Assessment: Employ various assessment methodologies to evaluate the likelihood and impact of identified risks.

- Risk Appetite and Tolerance Definition: Establish clear risk appetite and tolerance levels to guide risk-taking decisions. This ensures alignment between risk management and business strategy.

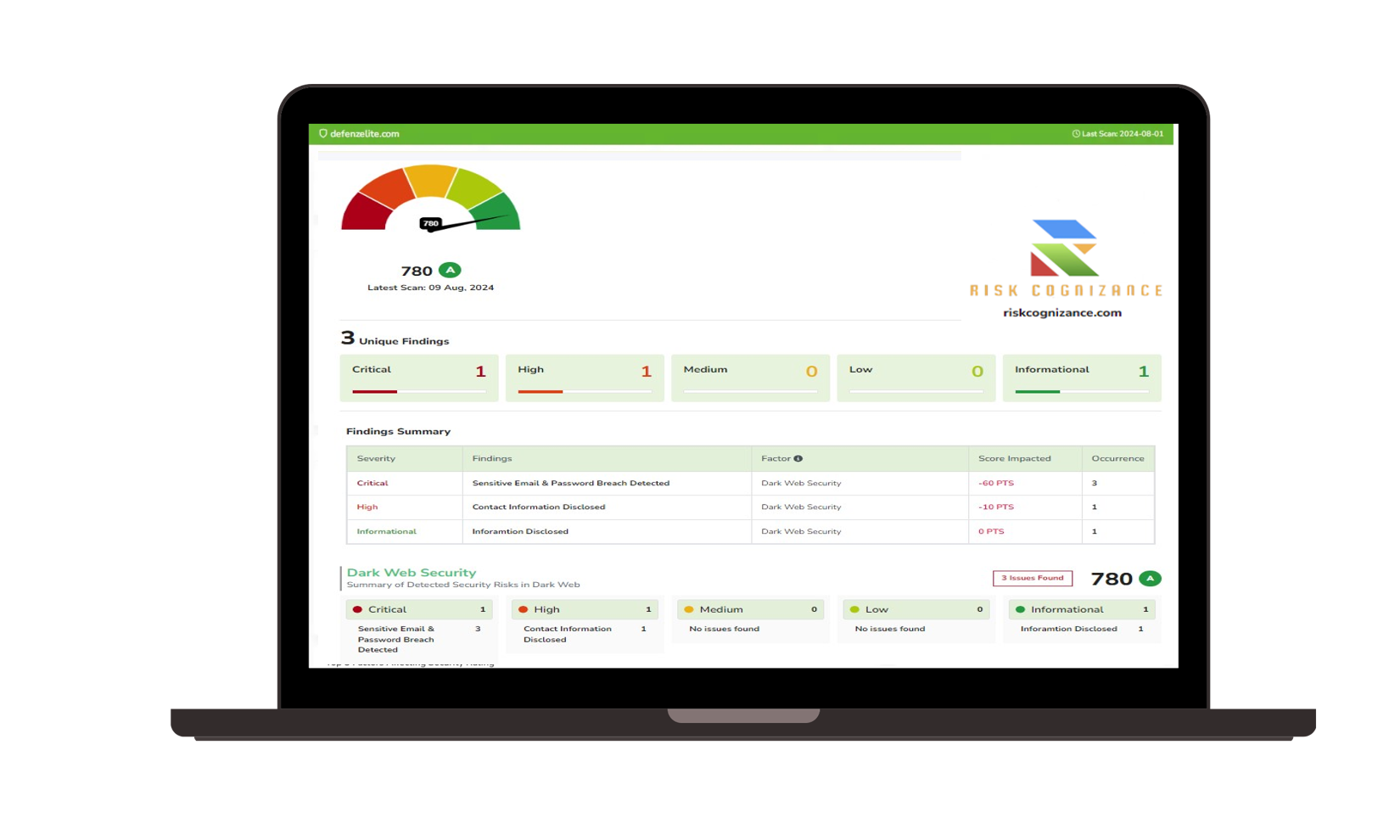

- Risk Register and Tracking:

- Centralized Risk Repository: Maintain a comprehensive and up-to-date risk register, providing a single source of truth for all risk information.

- Risk Tracking and Monitoring: Track mitigation efforts, monitor key risk indicators (KRIs), and report on changes in risk levels. This provides continuous oversight of the risk landscape.

- Risk Response and Mitigation:

- Risk Response Strategies: Implement appropriate risk response strategies, including avoidance, mitigation, transfer, and acceptance.

- Mitigation Plan Development and Tracking: Develop and track mitigation plans to reduce the likelihood and/or impact of identified risks.

- Control Management: Implement and monitor controls to support mitigation efforts and ensure their effectiveness. This ensures that risk responses are implemented effectively and efficiently.

- Scenario Analysis and Modeling:

- What-If Analysis: Model different risk scenarios to understand their potential impact on business objectives.

- Stress Testing: Simulate extreme events to assess the organization's resilience. This helps prepare for unexpected events and minimize their impact.

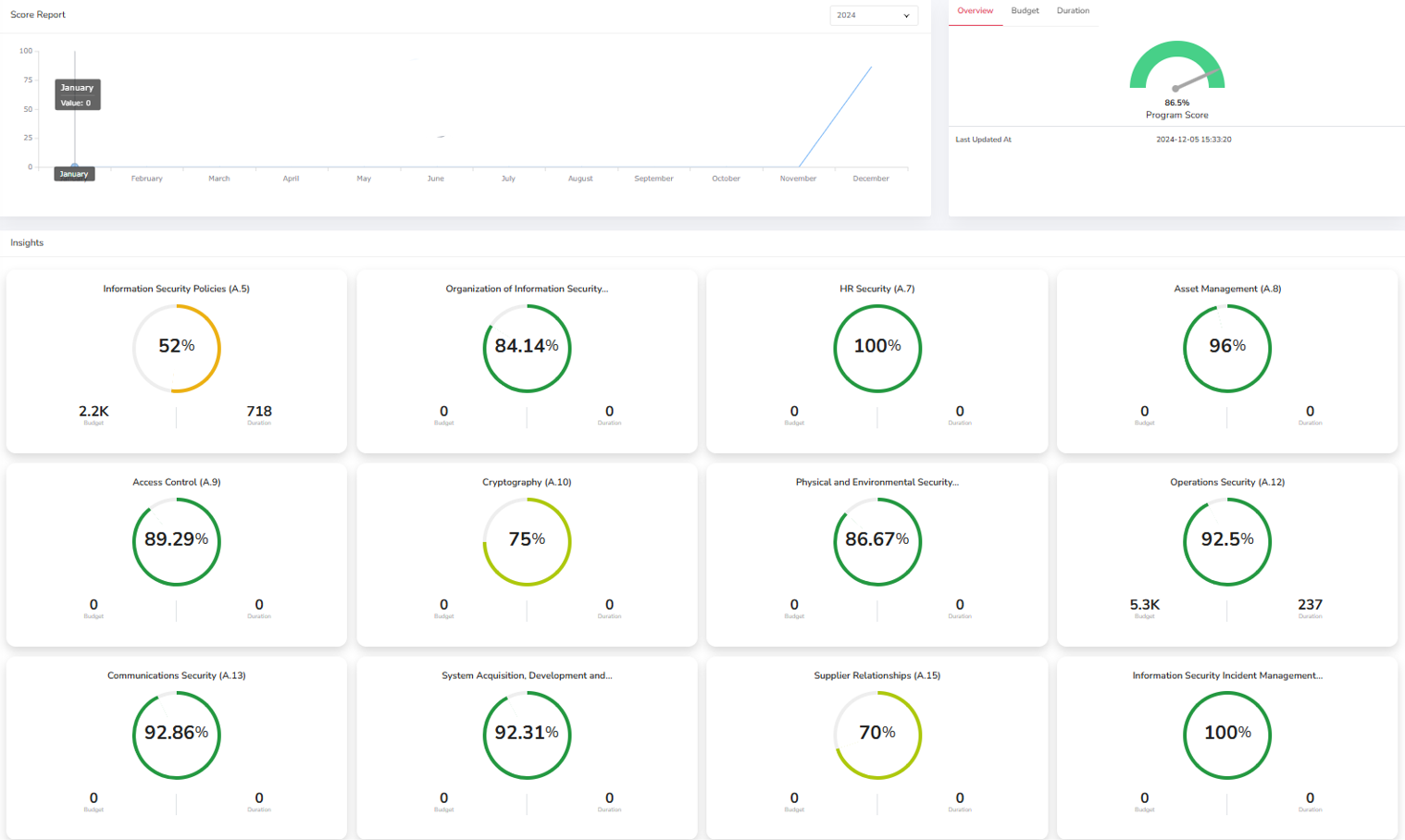

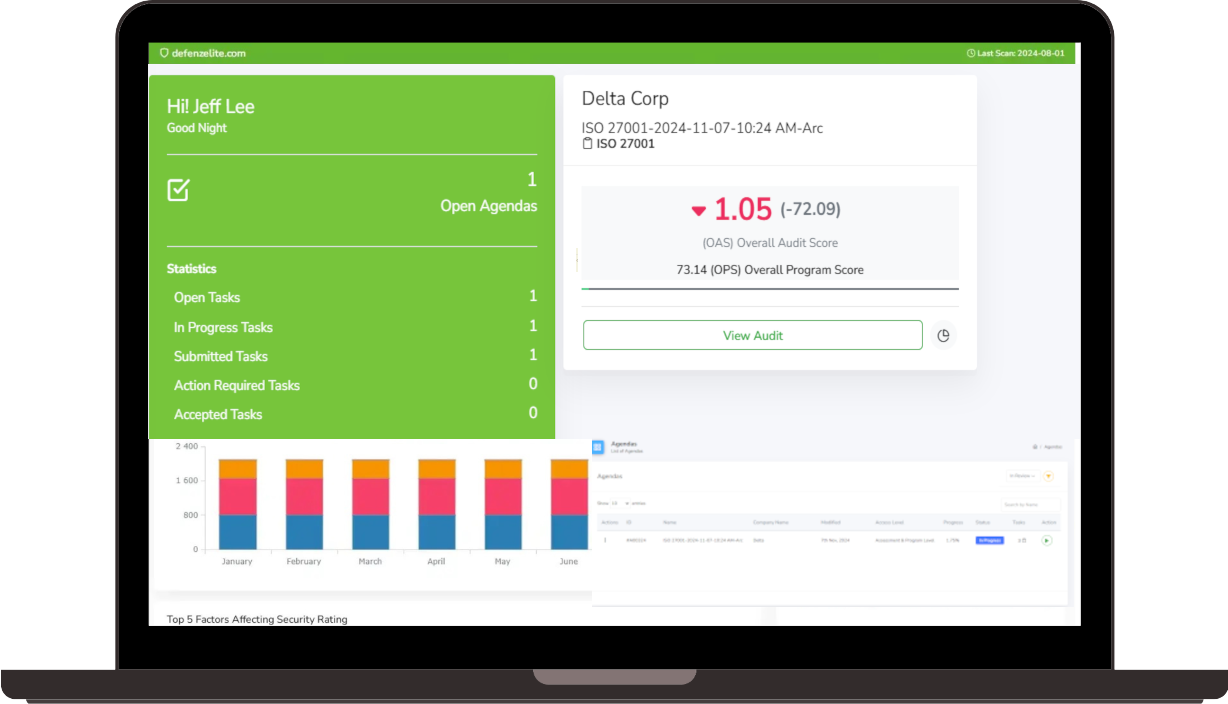

- Reporting and Dashboards:

- Customizable Reports: Generate reports tailored to different stakeholders, including the board of directors, management, and regulators.

- Real-Time Dashboards: Provide a consolidated view of the organization's risk profile with interactive dashboards and key risk metrics. This improves communication and facilitates data-driven decision-making.

- Integration with Other GRC Functions:

- Compliance Management Integration: Connect risk management with compliance activities to ensure holistic governance.

- Audit Management Integration: Integrate risk information into audit planning and execution. This ensures that risk management is aligned with other key business functions.

Benefits of Using Risk Cognizance for ERM:

- Improved Strategic Decision-Making: Make informed strategic decisions based on a comprehensive understanding of risks and opportunities.

- Enhanced Risk Awareness and Culture: Foster a risk-aware culture throughout the organization.

- Increased Organizational Resilience: Improve the organization's ability to withstand and recover from adverse events.

- Reduced Losses and Volatility: Minimize financial losses, operational disruptions, and reputational damage.

- Improved Stakeholder Confidence: Demonstrate a commitment to effective risk management, building trust with investors, customers, and regulators.

- Optimized Resource Allocation: Allocate resources effectively to address the most critical risks.

|  |

|  |

|  |

Who Can Benefit from Risk Cognizance ERM Solutions?

Risk Cognizance is suitable for organizations of all sizes and across all industries that are looking to implement or enhance their ERM programs.

Choose Risk Cognizance for Your ERM Needs

Risk Cognizance is the ideal ERM solution for organizations seeking to proactively manage risk, protect organizational value, and achieve their strategic objectives. Contact us today to learn more and request a demo.

Request Callback