Overview

Enterprise Governance, Risk and Compliance (EGRC)

Risk Cognizance enterprise governance, risk, and compliance (EGRC) is a set tooltools, policies and procedures that organizations use to handle governance issues, manage risk, and ensure compliance in a unified way. Our enterprise governance, risk and compliance approach by identifying its main goals and developing a framework for managing governance, risk, and compliance in a way that advances those goals. This framework includes standardized policies and workflows.

What is EGRC?

Enterprise Governance, Risk, and Compliance (EGRC) refers to how an organization addresses governance, manages risk, and ensures compliance through policies, procedures, regulatory controls, risk assessments, monitoring, and internal controls. These frameworks are designed to ensure that every employee adheres to the company-wide standards and requirements for risk management and regulatory compliance..

Why are GRC and EGRC Important?

Both GRC and EGRC help organizations manage risks, safeguard against potential threats, and ensure regulatory compliance. Their importance lies in their ability to provide a structured and proactive approach to risk management that helps companies mitigate, monitor, and respond to risks efficiently.

- Risk Management: Anticipate, assess, and manage risks to ensure organizational resilience.

- Compliance Assurance: Ensure adherence to legal and regulatory standards, minimizing compliance risks.

- Integrated Risk Management: Streamlines processes and systems to assess risk across various functions like operational, financial, and cybersecurity.

.

Why Choose Risk Cognizance GRC Platform?

- Improve decision-making from risk management and reporting

- Align business goals with the most optimal IT investments

- Eliminate fragmentation among business departments that can cause inefficiencies and conflicts

- Reduce costs and risks of reputational damage due to non-compliance

- Allow for agility and scalability with consistency and stability in the IT environment

Without a rock-solid GRC strategy, your company is flirting with disaster—non-compliance, financial hits, and reputational damage. This article is your blueprint for mastering GRC, including the best GRC solutions for your business. Dive deep as we unravel GRC’s principles, explore certifications, weigh the benefits, and chart the course for establishing a robust GRC model. Master GRC best practices, and you’re not just avoiding pitfalls—you’re making better decisions, mitigating risks, and aligning with your business objectives.

Corporate Compliance Solutions MSSPs and MSPs

Robust Compliance Management: AI automated compliance checks for regulations such as SOC 2, PCI DSS, NIST, CMMC, ISO 27001, ISO 27002, ISO 27003, PCI DSS, NIST, CMMC, HIPAA, CCPA, GDPR and many others

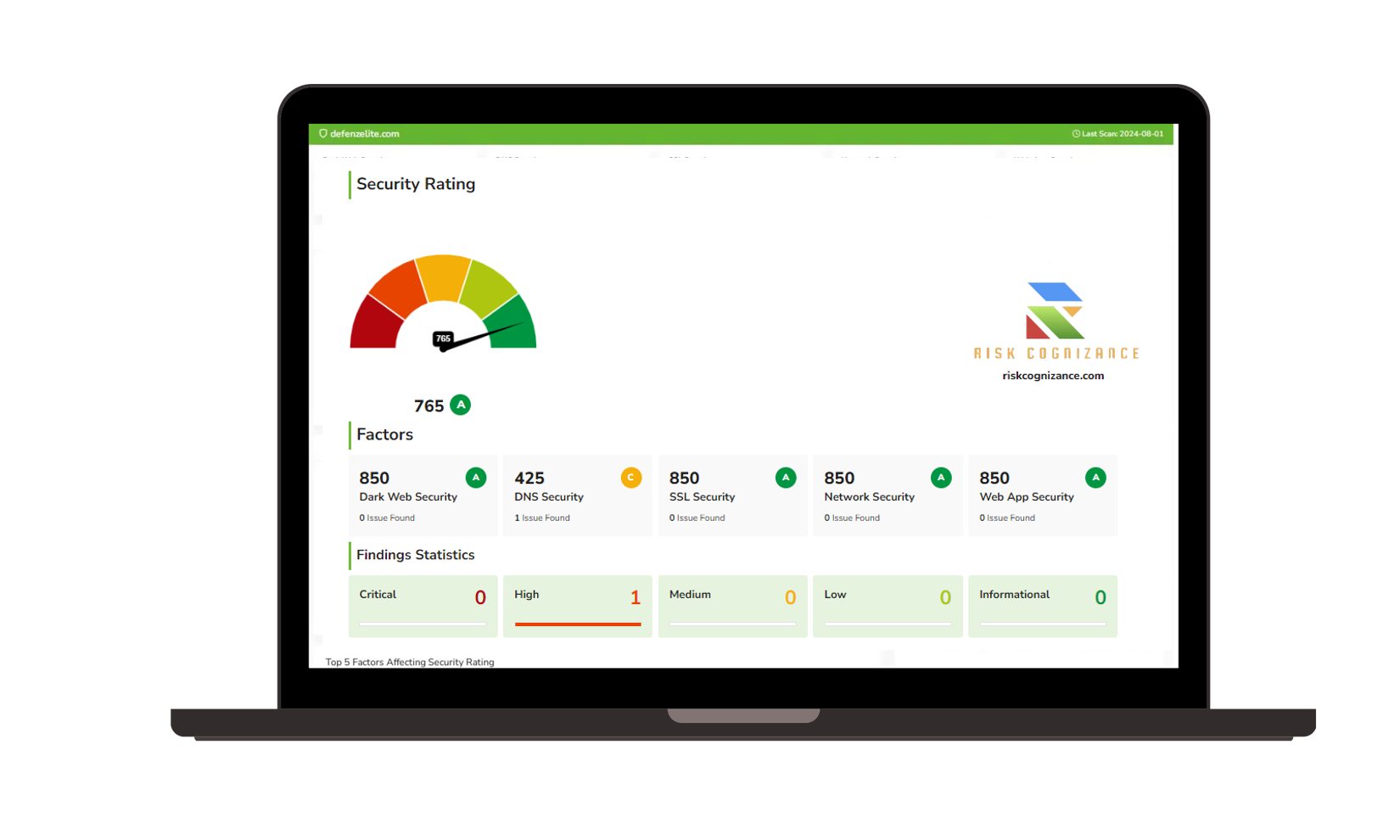

Attack Surface Management: Identify and analyze potential vulnerabilities across your digital landscape.

Cloud Assessment: Evaluate cloud environments for security and compliance risks..

Dark Web Monitoring: Monitor dark web activities to detect potential threats and data breaches.

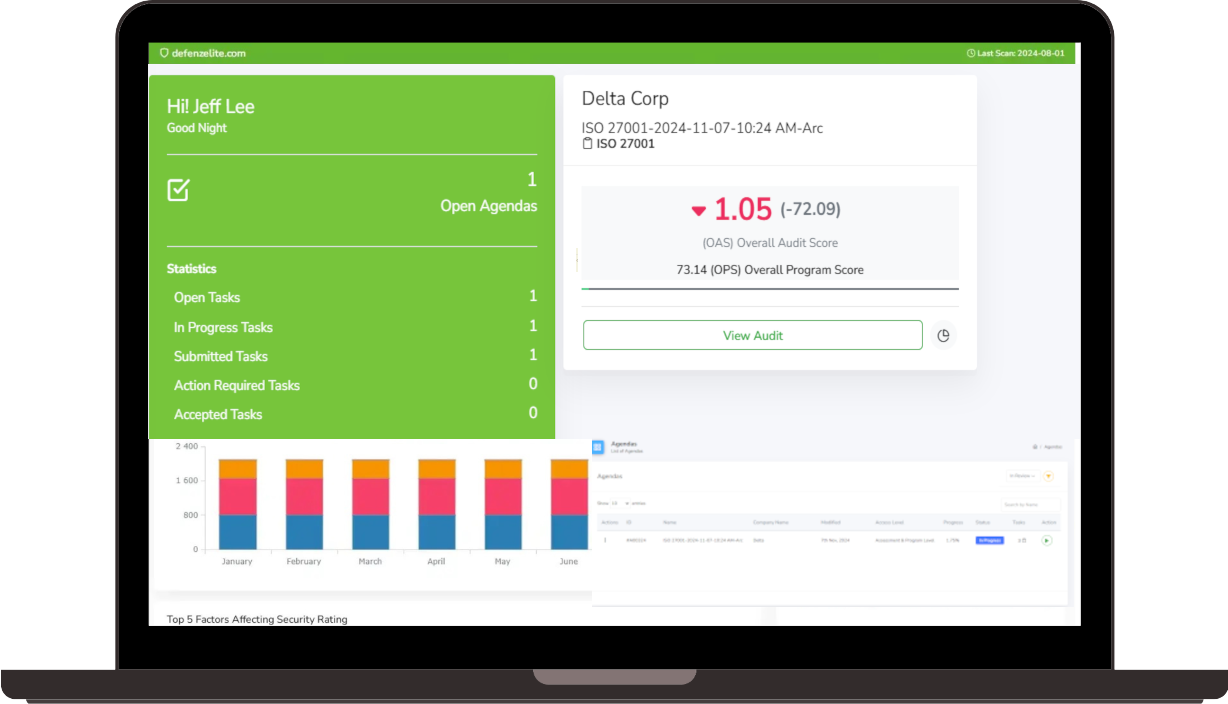

Audit Manager: Streamline the audit process with comprehensive audit management tools.

Third-Party Risk Management: Monitor and assess the risks associated with third-party vendors and partners.

White Label Solutions: Offers white label options for MSPs and MSSPs to provide GRC services under their own brand.

GRC solutions & programs - governance, risk & compliance

|  |

|  |

|  |

Key Features of EGRC

Integrated Risk Management

Ability to assess and manage risks across operational, financial, and cybersecurity domains. This comprehensive risk approach ensures that all potential threats are identified, assessed, and mitigated.

Compliance Monitoring

Real-time monitoring of compliance against regulations and industry standards. Automated alerts and reporting capabilities enable proactive risk management.

Workflow Automation

Improve operational efficiency through automated processes, including control testing, remediation assignments, and reporting. EGRC ensures that processes are streamlined and efficient.

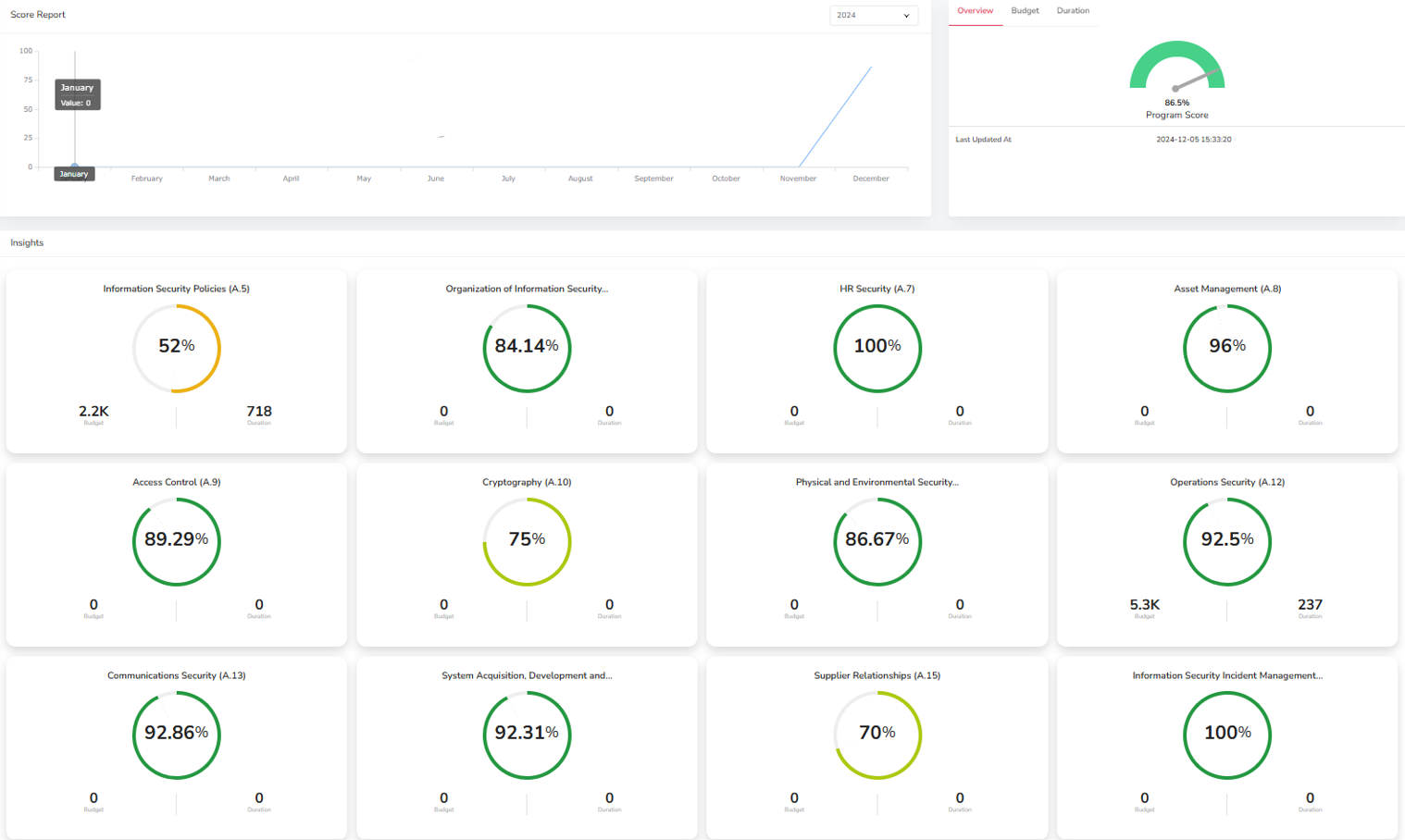

Detailed Reporting and Dashboards

Generate customized reports with insights into risk profiles, compliance status, and key performance indicators. EGRC systems ensure that leadership has access to actionable insights in real-time.

Third-Party Risk Management

Effectively assess and manage risks related to external partners, vendors, and contractors. This ensures that all third-party relationships meet organizational standards and do not expose the company to unnecessary risks.

EGRC Solutions for the Financial Services Industry

Streamline GRC management with an adaptable system designed for growth

Whether you're a bank, credit union, or another financial institution, EGRC solutions are purpose-built to help streamline your governance, risk, and compliance management efforts. From regulatory compliance to enterprise risk resilience, our platform scales as your organization grows.

Powerful GRC Solutions for Organizational Success

Quantivate GRC provides an integrated software-as-a-service (SaaS) platform that supports comprehensive governance, risk, and compliance needs. Our platform adapts to your organization's unique structure, allowing you to reduce risk, enhance performance, and empower smarter decision-making. With flexible data architecture and powerful risk management tools, Quantivate helps organizations across various industries achieve more resilient, compliant, and efficient operations.

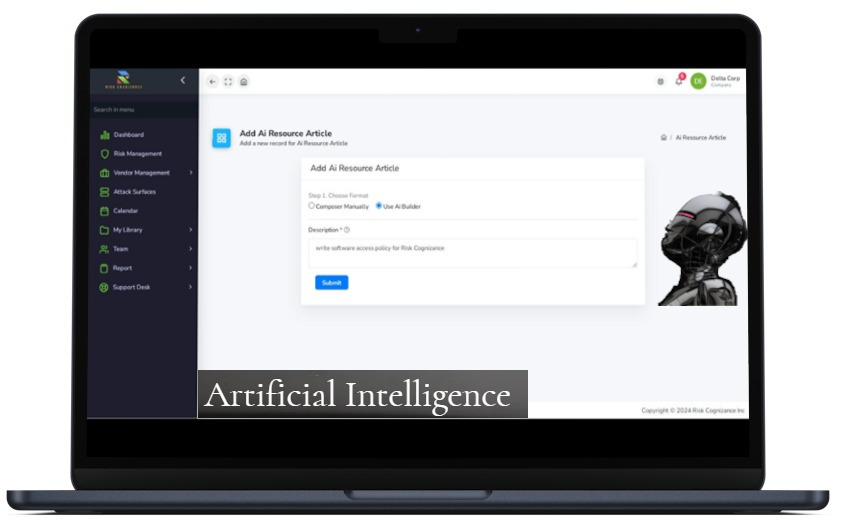

Risk Cognizance EGRC: Top Capabilities

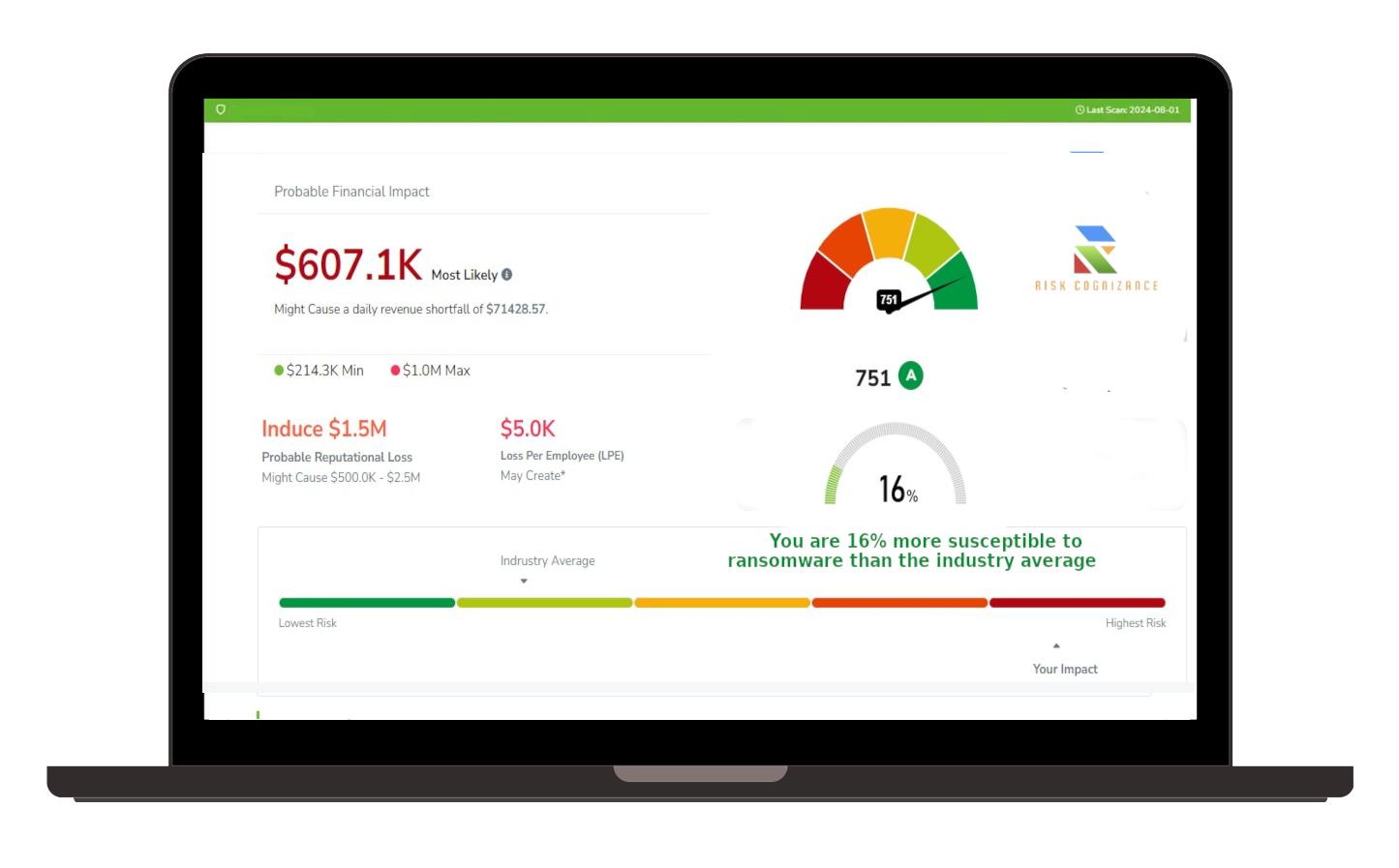

Risk Assessment and Quantification

Risk Cognizance helps organizations perform thorough risk assessments by identifying potential threats, evaluating the likelihood of their occurrence, and determining their impact. By quantifying risks, the platform enables informed decision-making to prioritize actions effectively.

Comprehensive Regulatory Compliance Management

The solution offers powerful tools for tracking and managing regulatory requirements. It provides continuous updates on regulatory changes, ensuring that your organization stays compliant with industry standards and minimizes the risk of violations.

Automated Incident and Event Management

With automated tracking and resolution processes, Risk Cognizance streamlines the management of incidents and risk events. This reduces response times and enhances an organization’s ability to respond to emerging risks quickly.

Advanced Analytics and Reporting

The platform utilizes advanced analytics to generate detailed insights and reports, helping organizations monitor risk trends, compliance status, and performance metrics. This real-time visibility enables executives to make proactive decisions based on accurate data.

Third-Party Risk Monitoring

Risk Cognizance provides a robust framework for assessing the risks associated with third-party vendors, contractors, and suppliers. This helps mitigate potential threats that could arise from external partners, ensuring that they align with your organization’s risk and compliance standards.

Scenario Analysis and Stress Testing

The platform allows for scenario analysis and stress testing, simulating various risk events to assess the resilience of your enterprise. This ensures that your organization is prepared for potential disruptions and can take preventive actions where needed.

Risk-Driven Internal Controls

Risk Cognizance enables the creation and management of internal controls based on identified risks. By implementing risk-driven controls, organizations can strengthen their internal processes and ensure consistent risk mitigation efforts across the enterprise.

Real-Time Alerts and Workflow Automation

The platform offers real-time alerts for risk and compliance breaches, enabling immediate action to mitigate any negative impacts. Workflow automation also ensures that necessary tasks, like remediation or control testing, are performed promptly and efficiently.

Data Security and Privacy Management

Given the growing importance of data privacy, Risk Cognizance helps organizations manage data security risks, ensuring compliance with privacy regulations such as GDPR, CCPA, and other industry-specific standards.

Our EGRC Solutions:

ERM Solution

Boost your organization's risk intelligence with our Enterprise Risk Management (ERM) tools.

Compliance Solution

Centralize and streamline compliance risk management for improved regulatory adherence.

Operational Resilience Solution

Ensure organizational resilience by supporting business continuity and fostering risk awareness.

IT Risk Solution

Manage IT risks and technology assets across your enterprise to safeguard against digital threats.

Procurement Solution

Make informed decisions about vendor sourcing and risk management for external partnerships.

Audit Solution

Manage the audit lifecycle with a risk-focused approach to ensure complete visibility and accountability.

Optimize Risk and Compliance with EGRC Software Suite

Make informed decisions around risk and compliance management with our GRC Software Suite. Empower your organization to navigate challenges, manage threats, and maintain compliance efficiently.

Request Callback