Overview

Cyber Liability Readiness Standard: Manage Compliance with Your Cyber Liability Insurance

In today’s digital-first world, managing cyber liability insurance compliance is essential for protecting your organization against the increasing frequency and sophistication of cyber threats. To ensure your business meets the requirements for cyber liability coverage and stays ahead of evolving regulations, a robust compliance strategy is crucial. Risk Cognizance offers comprehensive solutions that automate compliance tracking, streamline risk management, and enhance governance, helping businesses maintain cyber liability insurance compliance and mitigate cyber risks effectively.

What is Cyber Liability Insurance Compliance?

Cyber liability insurance is designed to protect organizations from the financial impact of data breaches, cyber-attacks, and other digital security threats. To maintain this protection, businesses must comply with specific insurance requirements and regulatory standards. Non-compliance can result in gaps in coverage, higher premiums, or even the loss of coverage altogether.

Key Aspects of Cyber Liability Compliance:

- Risk Management: Identifying and mitigating risks that may affect your organization’s cybersecurity posture.

- Regulatory Adherence: Aligning internal policies and cybersecurity protocols with industry regulations.

- Documentation and Reporting: Maintaining accurate records and generating reports to demonstrate compliance to insurers and regulators.

Key Solutions for Cyber Liability Insurance Compliance

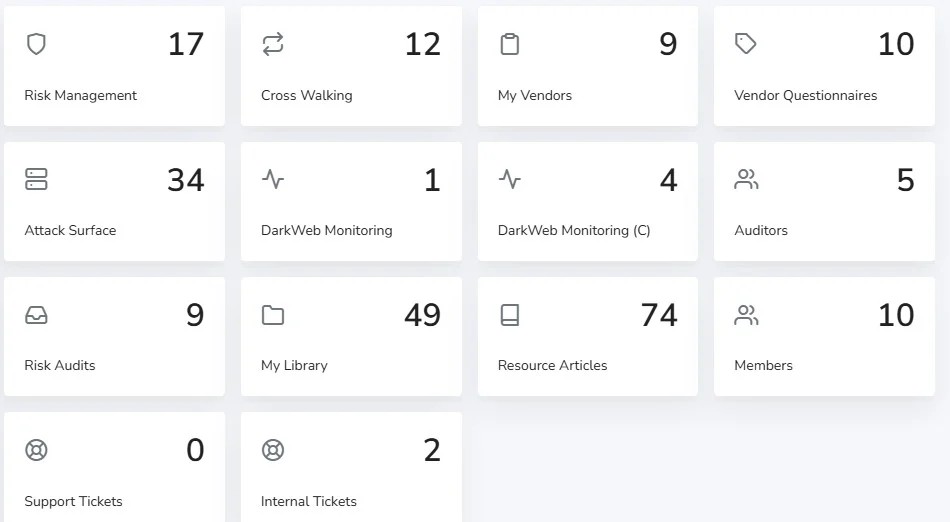

- Governance, Risk, and Compliance (GRC) Software

- Third-Party Risk Management Tools

- Dark Web Monitoring

- Incident Response Management Platform

- Audit and Compliance Management Software

- Artificial Intelligence for Risk Detection

Benefits of Risk Cognizance’s Cyber Liability Compliance Solutions

|  |

|  |

|  |

1. Automated Cyber Risk and Compliance Tracking

- Continuous Compliance Monitoring: Track and manage cyber liability requirements in real time to ensure full compliance with insurance standards and regulatory demands.

- Regulatory Mapping: Align internal cybersecurity protocols with industry regulations (e.g., GDPR, HIPAA, CCPA) and insurance policies to ensure a seamless compliance process.

- Automated Reporting: Automatically generate accurate and timely compliance reports for insurers, auditors, and regulators, reducing manual effort and ensuring timely submissions.

2. Streamlined Cyber Risk Management

- Standardized Risk Management Processes: Standardize your organization’s risk management activities to ensure consistency across departments and reduce the likelihood of compliance failures.

- Proactive Risk Identification: Detect potential cyber risks early, helping mitigate vulnerabilities before they lead to security breaches or insurance claims.

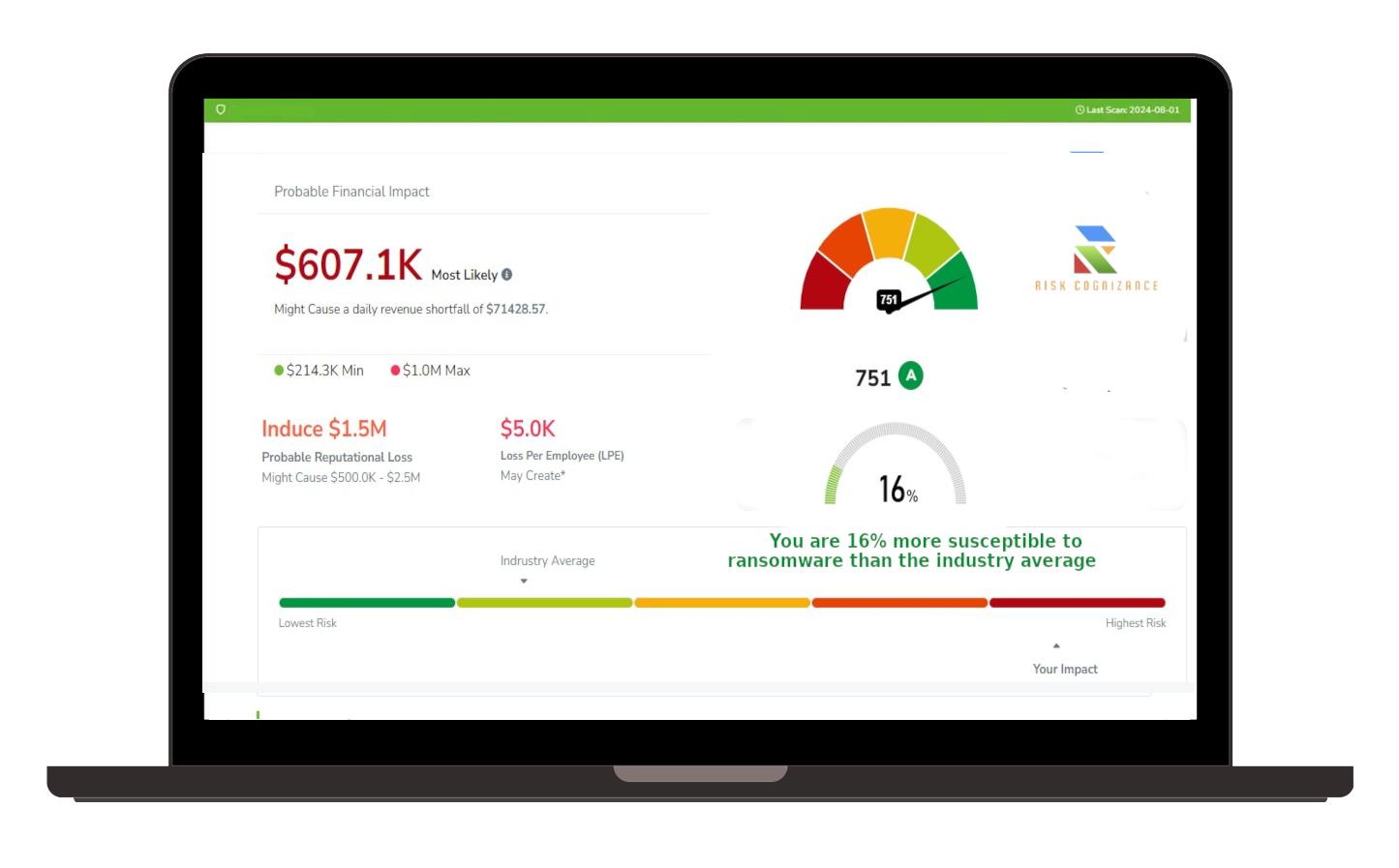

- Scenario-Based Risk Assessment: Simulate cyber incidents and evaluate their impact on your business to strengthen your risk management strategy and ensure compliance with insurance requirements.

3. Real-Time Alerts and Notifications

- Automated Compliance Alerts: Get notified in real time when cyber risk activities need attention—whether it’s updating policies, addressing new threats, or meeting reporting deadlines.

- Proactive Issue Resolution: Address compliance gaps and cybersecurity vulnerabilities quickly with actionable alerts that guide your team toward resolving issues efficiently.

4. Centralized Cyber Risk Documentation

- Centralized Documentation Management: Maintain all cyber liability-related documents, such as policies, audit reports, and incident response plans, in one secure, easily accessible location.

- Audit-Ready Records: Ensure your organization is always prepared for audits by keeping up-to-date, organized records that can be quickly accessed during regulatory reviews.

5. Integrated Governance, Risk, and Compliance (GRC) Framework

- Holistic Risk Assessment: Integrate cyber risk management with broader governance and compliance strategies to ensure a comprehensive, organization-wide approach to risk mitigation.

- Cross-Departmental Collaboration: Improve coordination and oversight across departments, ensuring that all business units adhere to cybersecurity and compliance requirements related to cyber liability insurance.

Explore Our Cyber Liability Compliance Technologies

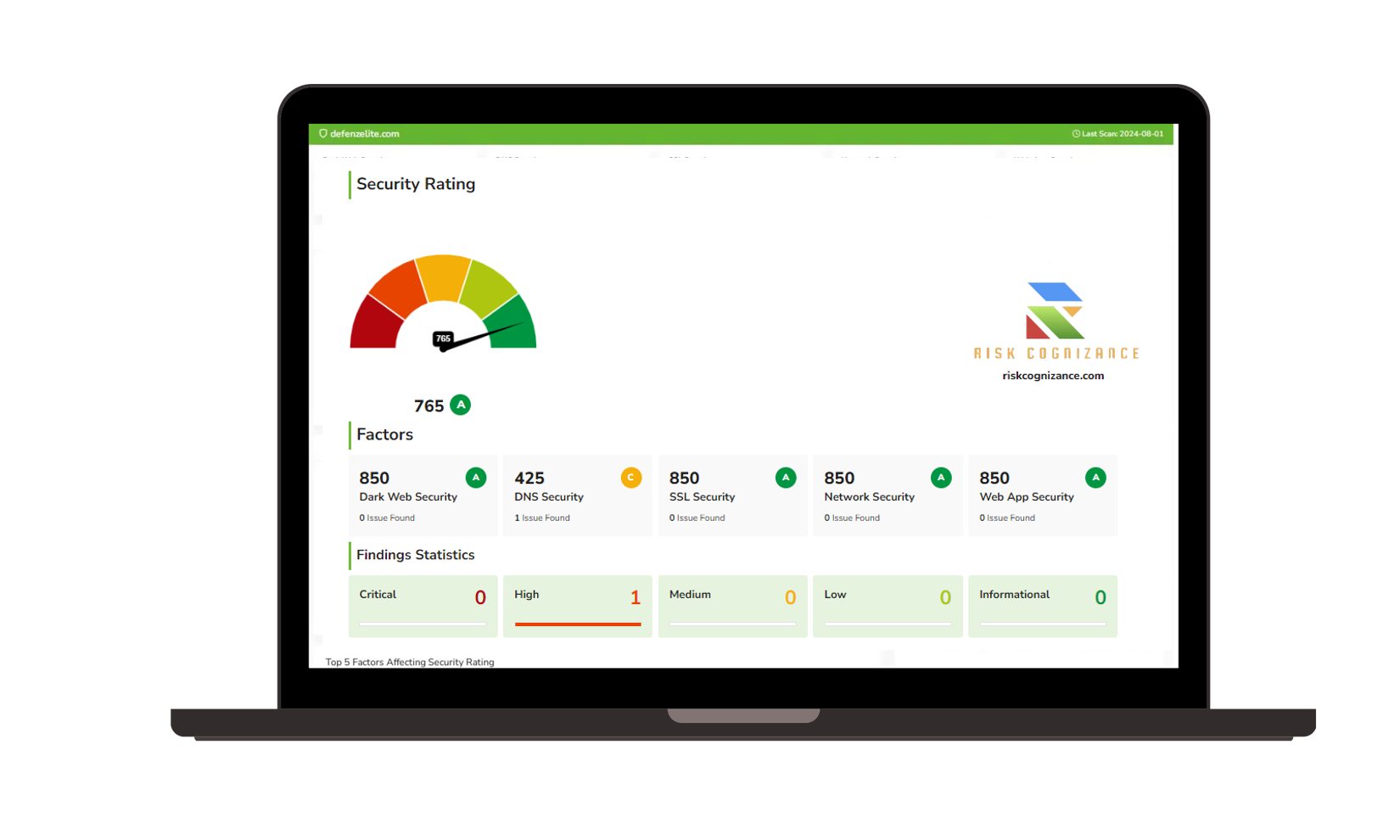

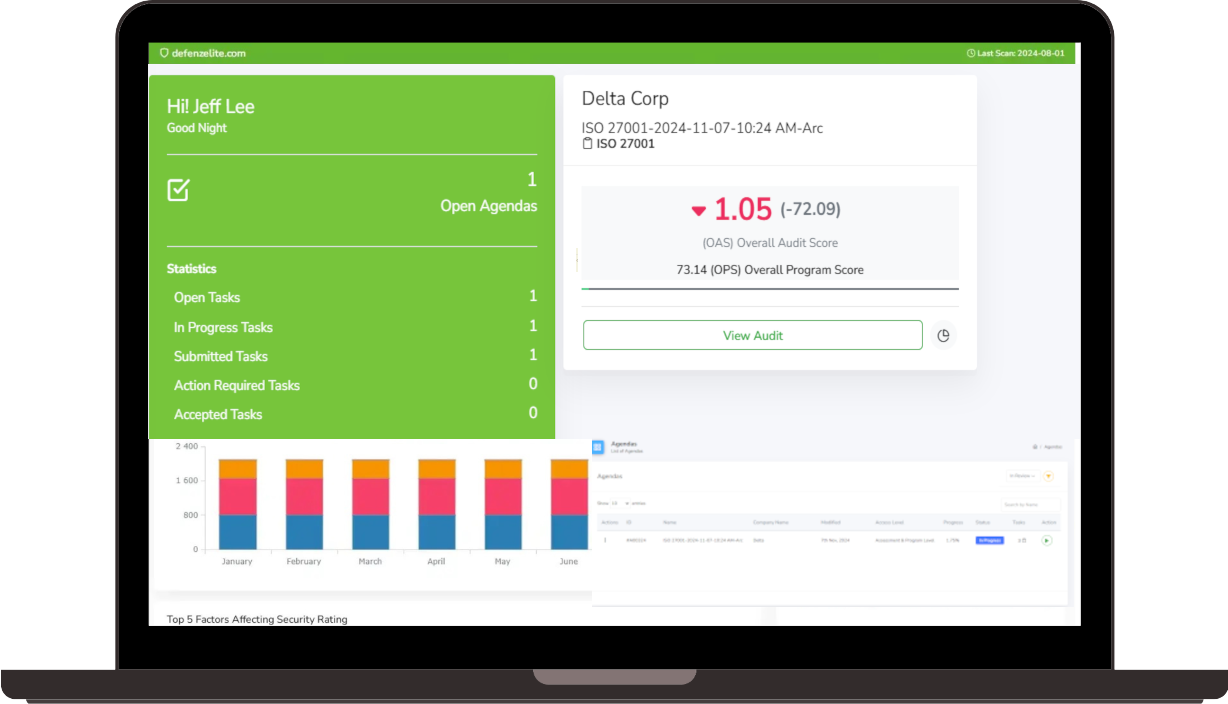

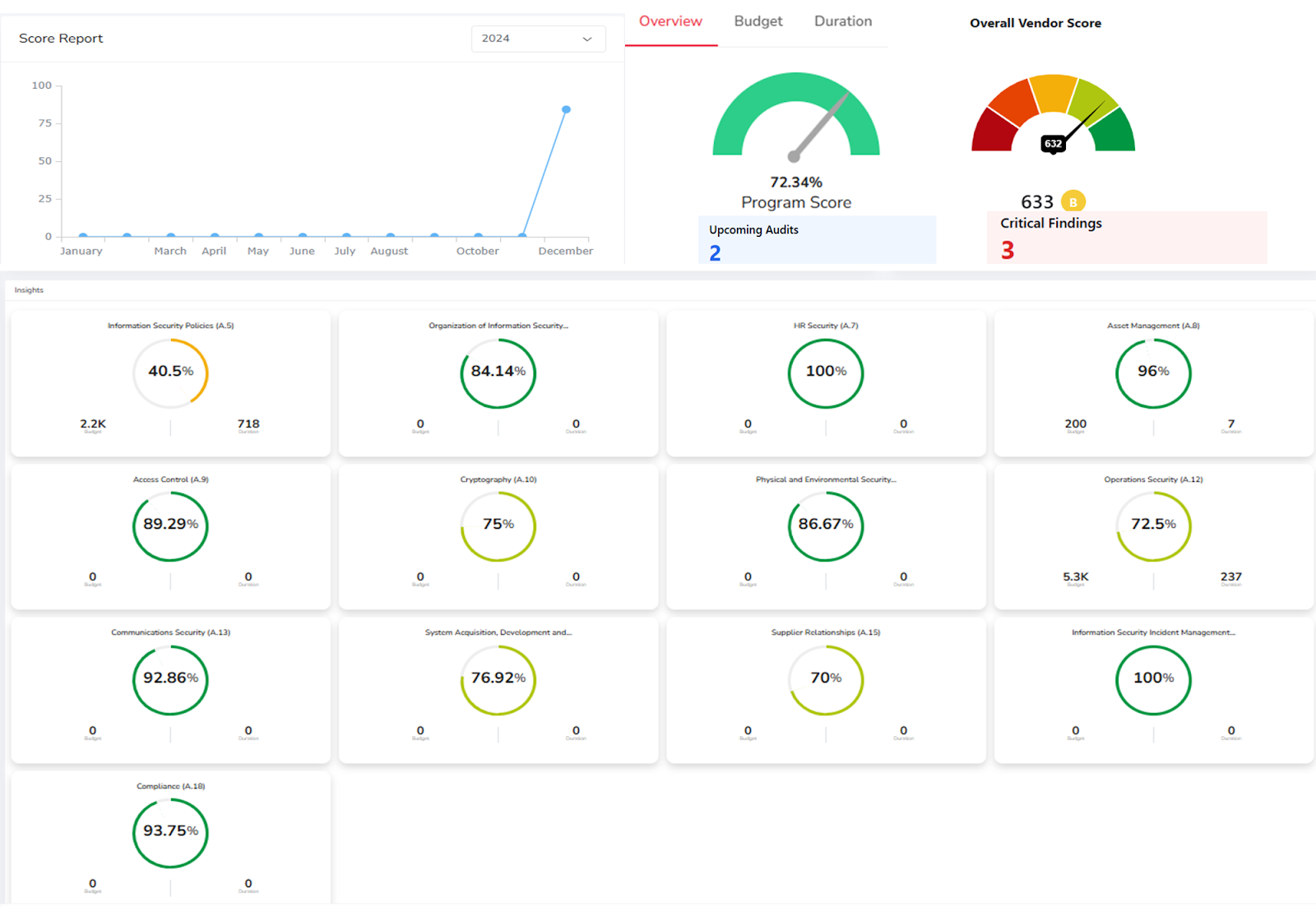

1. Cyber Risk and Compliance Dashboard

- Comprehensive Dashboards: View all cyber risk and compliance activities in a single, interactive interface.

- Real-Time Insights: Track your organization’s compliance status and cyber risk posture in real time, allowing for swift identification and resolution of issues.

- Customizable Views: Tailor the dashboard to your specific needs, focusing on the most relevant compliance metrics for your business.

2. Compliance Tracking and Automated Reporting

- Automated Reporting: Generate compliance reports based on real-time data, ensuring that all necessary reports are submitted on time and accurately.

- Audit Trail: Maintain an immutable audit trail of all compliance activities, making it easier to prepare for internal and external audits.

3. Risk Identification and Scenario-Based Mitigation

- Early Risk Detection: Use automated tools to identify potential cyber risks early, reducing the likelihood of cyber incidents that could jeopardize your insurance coverage.

- Risk Prioritization: Score and prioritize risks based on their potential impact and likelihood, helping you address the most critical vulnerabilities first.

- Scenario Modeling: Simulate potential cyber events to assess their impact and develop strategies to mitigate the risks and ensure compliance with your cyber liability insurance policy.

4. Vendor and Third-Party Risk Monitoring

- Third-Party Risk Management: Assess and monitor the cybersecurity posture of your third-party vendors to ensure they meet your compliance standards and do not introduce risks to your organization.

- Supply Chain Compliance: Monitor your entire supply chain to ensure that all external partners comply with your cyber liability insurance requirements and cybersecurity standards.

Why Choose Risk Cognizance for Cyber Liability Readiness?

Risk Cognizance offers a comprehensive, automated platform designed to simplify and streamline the process of managing cyber liability insurance compliance. With our solutions, businesses can:

- Automate Compliance Tracking: Stay ahead of ever-changing regulations and insurance requirements with real-time monitoring and automated reporting.

- Reduce Cyber Risk: Proactively identify, assess, and mitigate cyber risks to ensure your organization maintains compliance and reduces potential insurance claims.

- Ensure Documentation Accuracy: Maintain up-to-date, audit-ready documentation that demonstrates your commitment to cybersecurity and insurance compliance.

- Improve Cross-Departmental Collaboration: Foster a unified approach to risk management and compliance with integrated tools that streamline workflows across your organization.

Stay Ahead of Evolving Cyber Liability Requirements

By using Risk Cognizance’s Cyber Liability Readiness solutions, your organization can ensure it remains compliant with the latest regulations and cyber insurance requirements. With automated tracking, proactive risk management, and real-time reporting, you’ll be well-equipped to manage your cyber liability insurance and maintain a robust, comprehensive cybersecurity strategy.

Protect your business today—ensure compliance with your cyber liability insurance and strengthen your cyber resilience with Risk Cognizance.

Request Callback