Overview

Stay Ahead of Cyber Risks and Safeguard Your Insurance Coverage

Managing compliance with your cyber liability insurance policy is crucial for ensuring that you are covered in the event of a breach. Don’t risk a denied insurance payout due to non-compliance or a failed post-breach audit. Risk Cognizance offers a comprehensive solution to help you manage your cyber liability readiness while addressing all your IT security requirements effectively.

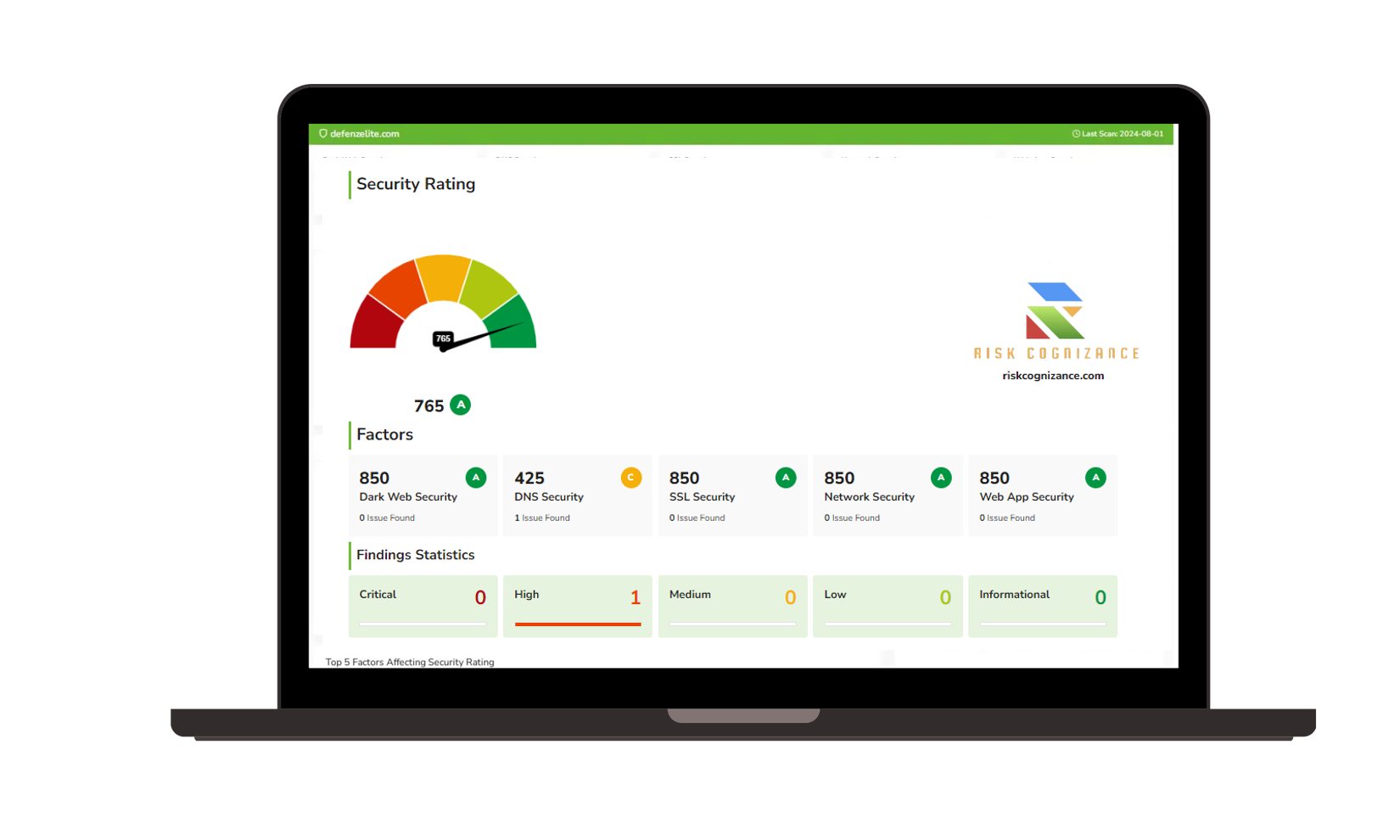

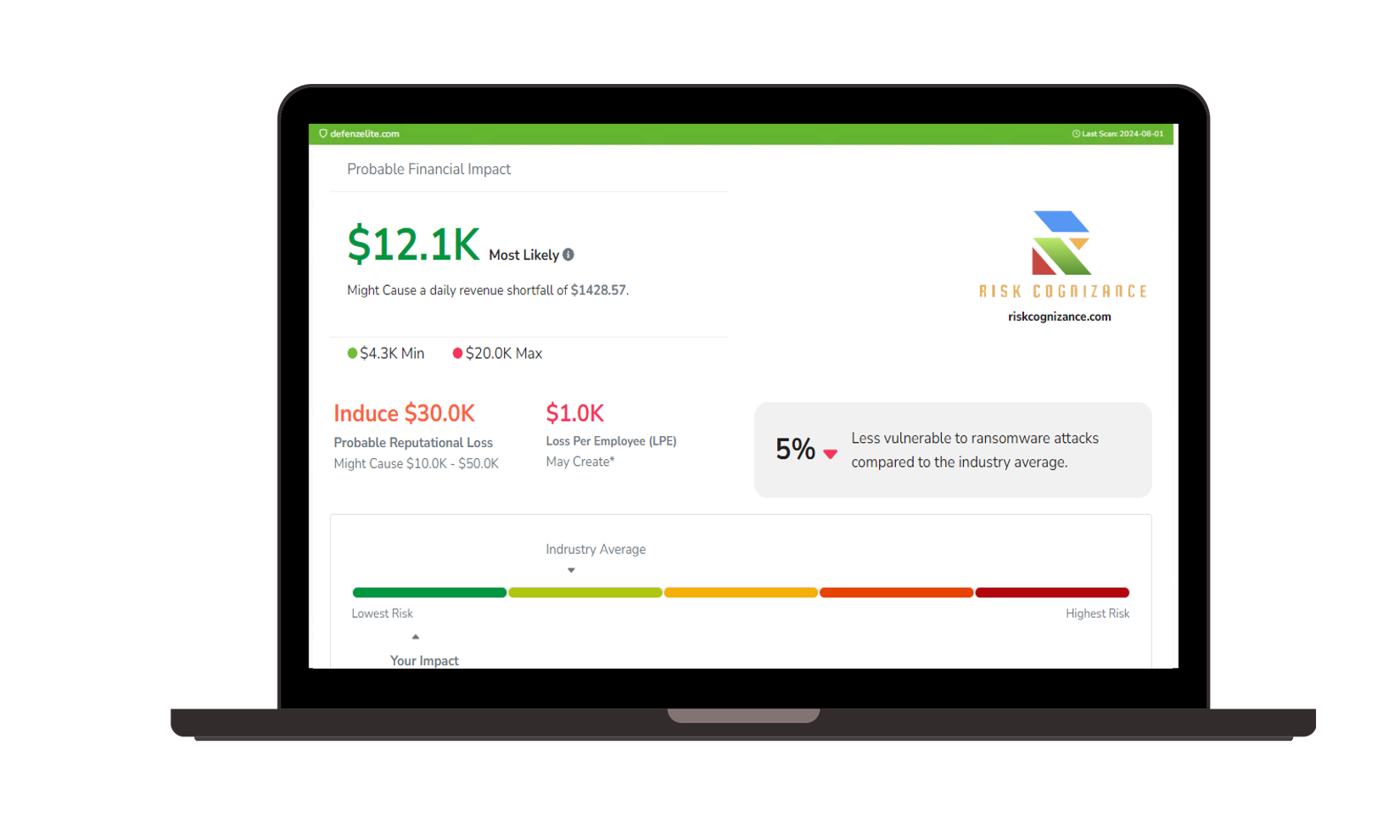

Governance, Risk, and Compliance (GRC) |  Third-party Risk Management |

Ransomware Susceptibility |  GRC and Attack Surface |

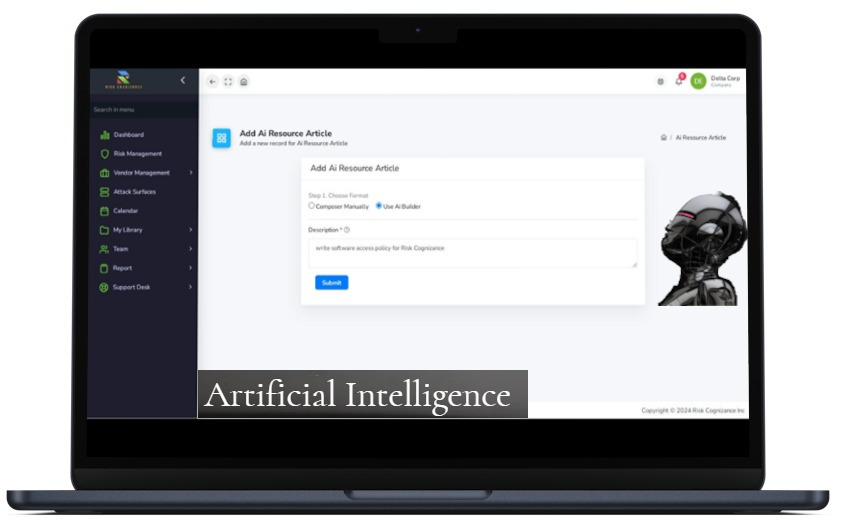

Artificial Intelligence | |

Why Risk Cognizance for Cyber Liability Readiness?

Risk Cognizance provides a robust platform designed to ensure that your organization meets the compliance standards required by your cyber liability insurance policy. Our solution helps you manage your cyber readiness efficiently and protects you from potential gaps that could jeopardize your coverage.

1. Comprehensive Compliance Management:

- Policy Alignment: Ensure your IT security practices align with the requirements set forth by your cyber liability insurance policy.

- Regulatory Compliance: Stay compliant with relevant regulations and standards to avoid issues during a post-breach audit.

- Documentation: Maintain thorough documentation of your compliance efforts and security measures.

2. Risk Assessment and Management:

- Risk Identification: Conduct detailed risk assessments to identify potential vulnerabilities and threats that could impact your insurance coverage.

- Control Implementation: Implement and manage cybersecurity controls to mitigate identified risks and ensure policy compliance.

- Continuous Monitoring: Monitor risk indicators in real-time to detect and address potential issues proactively.

3. Automated Reporting and Documentation:

- Compliance Reports: Generate detailed reports to demonstrate adherence to your cyber liability insurance policy and regulatory requirements.

- Audit Preparation: Streamline the audit process with tools for tracking, documenting, and resolving compliance issues.

- Automated Alerts: Receive alerts and notifications related to compliance status and security concerns.

4. Incident Management and Response:

- Response Plan: Develop and implement a comprehensive incident response plan to address and manage security incidents effectively.

- Incident Tracking: Track and manage incidents from detection through resolution to ensure compliance and support insurance claims.

- Post-Incident Review: Conduct thorough post-incident reviews to evaluate response effectiveness and improve future practices.

5. Data Protection and Privacy:

- Data Security: Ensure robust data protection measures are in place to safeguard sensitive information and meet policy requirements.

- Access Controls: Implement role-based access controls to secure critical data and systems.

- Privacy Compliance: Adhere to data privacy regulations and ensure secure handling of personal and financial information.

6. Security Program Oversight:

- Program Management: Oversee and manage your information security program to ensure ongoing compliance with insurance policy requirements.

- Control Optimization: Optimize security controls and practices based on real-time data and policy updates.

- Continuous Improvement: Benefit from continuous updates and improvements to stay ahead of evolving cybersecurity threats.

7. Training and Awareness:

- Employee Training: Conduct regular training sessions on cybersecurity best practices and compliance requirements for all employees.

- Awareness Campaigns: Implement awareness campaigns to educate staff on recognizing and responding to potential security threats.

8. Integration and Scalability:

- Seamless Integration: Integrate Risk Cognizance with your existing IT infrastructure and security systems.

- Scalable Solution: Adapt the platform to fit the needs of organizations of all sizes, from small businesses to large enterprises.

- Flexible Deployment: Choose from on-premises, cloud-based, or hybrid deployment options to suit your organization’s needs.

9. Advanced Analytics and Reporting:

- Real-Time Analytics: Utilize advanced analytics to gain actionable insights into your cybersecurity posture and compliance status.

- Interactive Dashboards: Access interactive dashboards for a comprehensive view of compliance metrics, risk indicators, and security performance.

10. Dedicated Support and Updates:

- Customer Support: Access dedicated customer support for assistance with implementation, training, and ongoing usage.

- Regular Updates: Stay up-to-date with the latest cybersecurity standards and insurance policy requirements through continuous platform updates.

Achieve Cyber Liability Readiness with Confidence

When managing compliance with your cyber liability insurance policy, organizations consider factors such as:

- Policy Alignment: Ensuring that IT security practices meet insurance policy requirements.

- Risk Management: Risk assessment, control implementation, and incident management effectiveness.

- Reporting and Documentation: Ability to generate compliance reports and manage regulatory documentation.

- Support and Updates: Quality of customer support and frequency of platform updates.

Explore how Risk Cognizance can help your organization achieve cyber liability readiness and protect your insurance coverage. Our platform offers comprehensive solutions to ensure compliance while enhancing your overall cybersecurity posture.

Ready to secure your cyber liability coverage? Contact Risk Cognizance today to discover how our advanced solutions can support your cyber readiness and safeguard your organization from potential risks.

Request Callback