Overview

As organizations face rapid digital transformation and increasing connectivity, the significance of effective governance, risk management, and compliance (GRC) practices has become more evident. With the emergence of new regulations and the growing threat of cyber risks, businesses must prioritize robust GRC frameworks to safeguard their operations and maintain compliance. In this context, Risk Cognizance stands out as a premier GRC solution, offering comprehensive features tailored to the unique needs of assurance leaders.

The Importance of GRC in Today’s Landscape

The modern business environment is characterized by constant change. Organizations are navigating a complex web of regulatory requirements, cybersecurity threats, and the need for operational efficiency. The consequences of inadequate GRC practices can be severe, including financial penalties, reputational damage, and operational disruptions. Therefore, identifying the right GRC software solution is crucial for businesses looking to streamline their processes and effectively manage risks.

Risk Cognizance emerges as a vital tool in this landscape, providing an integrated platform that not only meets compliance requirements but also enhances overall risk management capabilities.

Governance, Risk, and Compliance (GRC) |  Third-party Risk Management |

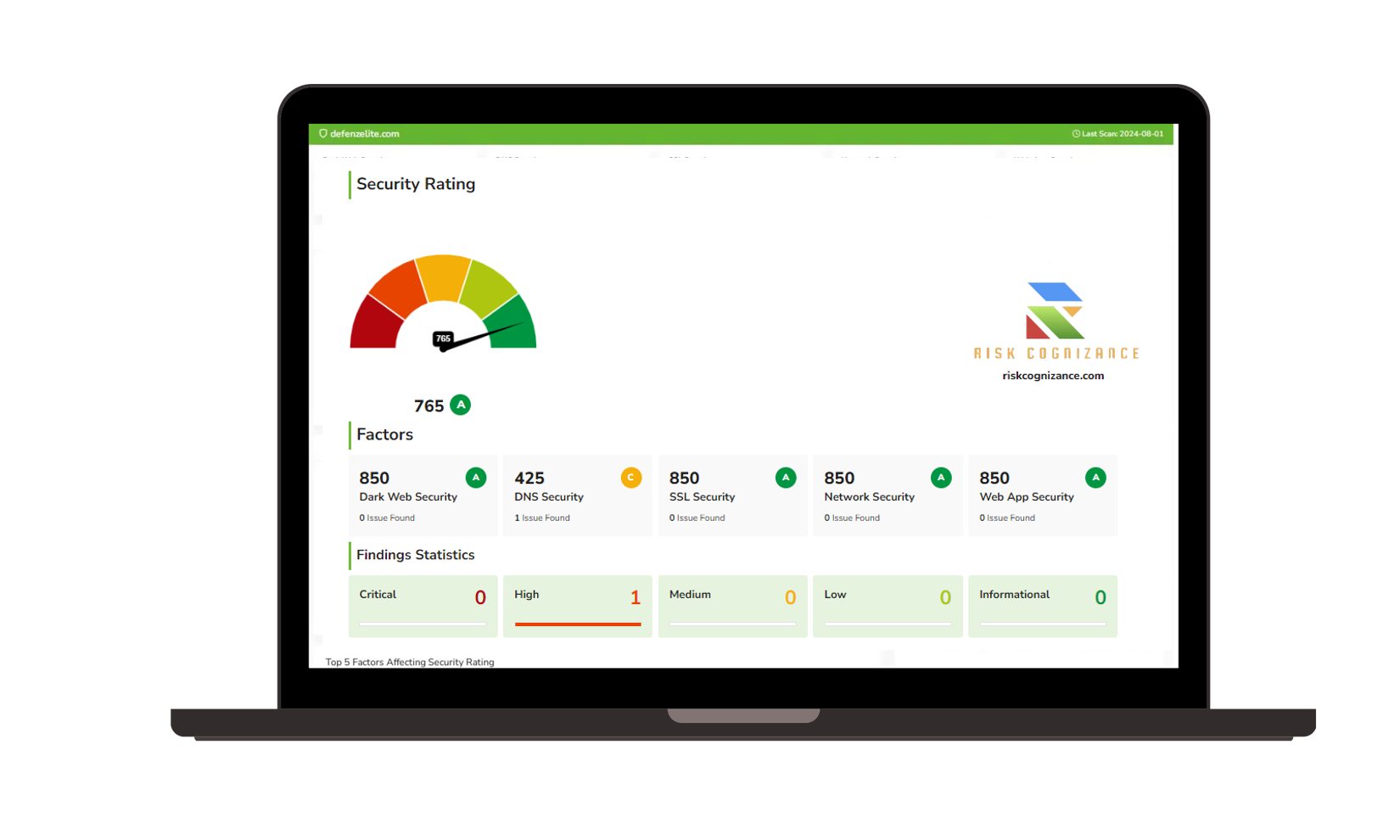

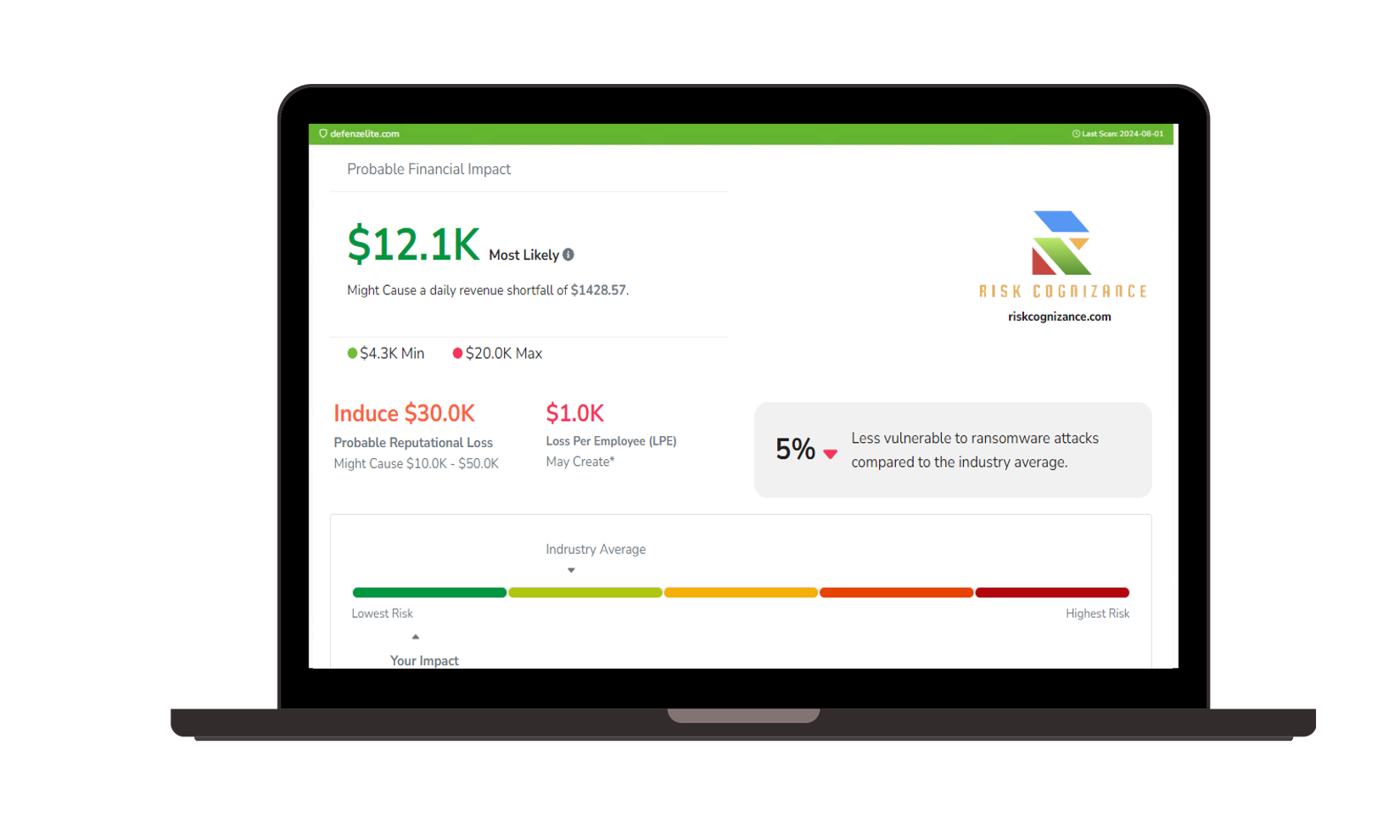

Ransomware Susceptibility |  GRC and Attack Surface |

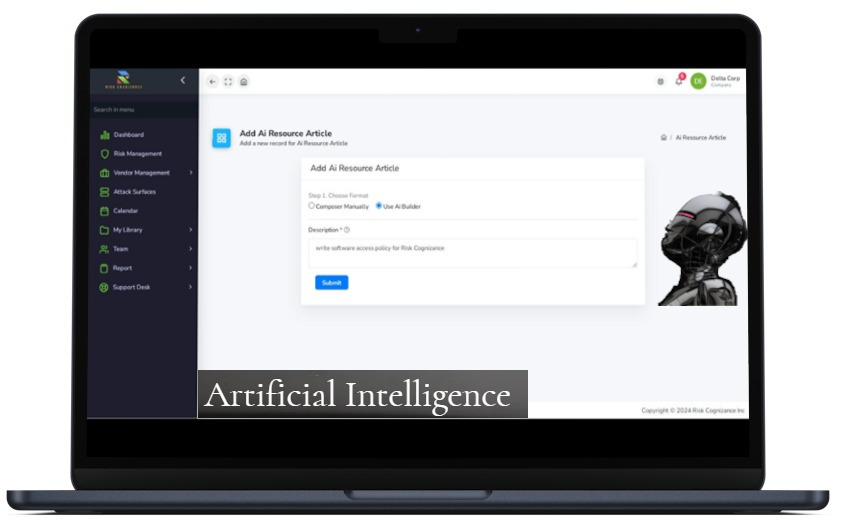

Artificial Intelligence | |

Key Features of Risk Cognizance

1. Comprehensive Risk Management

Risk Cognizance offers a holistic approach to risk management, enabling organizations to:

- Analyze and Evaluate Risks: Utilize real-time data analytics to identify, prioritize, and mitigate risks.

- Scenario Analysis: Simulate potential risk scenarios to prepare for unforeseen challenges.

- Risk Heat Maps: Visualize risk levels across the organization, facilitating informed decision-making.

2. Robust Compliance Management

Staying compliant in a dynamic regulatory environment is challenging. Risk Cognizance addresses this need by providing:

- Compliance Database: A centralized system to track compliance initiatives, ensuring all teams are informed and aligned.

- Automated Reporting: Effortlessly generate compliance reports to maintain transparency and accountability.

- Policy Management: Create and manage policies that adhere to regulations, streamlining the compliance process.

3. Audit Management Tools

Effective audit management is crucial for maintaining compliance and assessing operational effectiveness. Risk Cognizance includes:

- Audit Management: Tools for conducting financial, resource, or procedural audits efficiently.

- Automated Workflows: Simplify the audit process with integrated documentation and task management.

4. Advanced Reporting and Analytics

Risk Cognizance features customizable reporting and analytics tools, allowing organizations to:

- Monitor Key Performance Indicators (KPIs): Real-time dashboards provide visibility into compliance metrics and risk management performance.

- Predictive Analytics: Leverage machine learning algorithms to forecast potential risks and compliance issues.

5. User-Friendly Interface

Navigating complex GRC tools can be a challenge. Risk Cognizance overcomes this with:

- Intuitive Dashboard: A customizable dashboard that displays critical metrics at a glance, enhancing user experience.

- Mobile Accessibility: Access key features and data on-the-go, ensuring teams can stay connected and informed.

6. Collaboration Tools

Effective collaboration is essential for GRC success. Risk Cognizance fosters teamwork through:

- Integrated Communication Tools: Enhance collaboration with shared workspaces and task management features.

- Stakeholder Engagement: Keep stakeholders informed with automated notifications and updates.

7. Seamless Integration Capabilities

Risk Cognizance supports various integrations to enhance functionality and streamline workflows, including:

- API Access: Customize integrations tailored to organizational needs.

- Data Import/Export: Maintain consistency across platforms by easily importing and exporting data.

8. Training and Support

To ensure that organizations maximize the potential of Risk Cognizance, the platform offers:

- User Training Programs: Comprehensive training materials to equip teams with the necessary skills.

- Dedicated Support: 24/7 customer support from a knowledgeable team to address any issues or questions

Benefits of Implementing Risk Cognizance

Integrating Risk Cognizance into your organization can lead to numerous benefits:

- Enhanced Decision-Making: Leverage data-driven insights to make strategic decisions that minimize risk.

- Increased Efficiency: Automate routine tasks, allowing your team to focus on more strategic initiatives.

- Cost-Effective Solutions: Reduce the need for multiple tools by utilizing an all-in-one GRC platform, improving ROI.

Customer Testimonials

Organizations that have implemented Risk Cognizance report significant improvements in their GRC practices:

"Risk Cognizance has transformed our risk management process. We’re more efficient and proactive in addressing compliance issues."

— Sarah T., Compliance Officer

"The platform's user-friendly interface makes it easy for our team to stay on top of regulations and policies."

— James L., Assurance Leader

The GRC Landscape

The GRC software market is diverse, with various providers catering to distinct organizational needs. Key players include:

- Risk Comprehensive Guide to Risk Cognizance: Transforming Governance, Risk, and Compliance

- As organizations face rapid digital transformation and increasing connectivity, the significance of effective governance, risk management, and compliance (GRC) practices has become more evident. With the emergence of new regulations and the growing threat of cyber risks, businesses must prioritize robust GRC frameworks to safeguard their operations and maintain compliance. In this context, Risk Cognizance stands out as a premier GRC solution, offering comprehensive features tailored to the unique needs of assurance leaders.

- The Importance of GRC in Today’s Landscape

- The modern business environment is characterized by constant change. Organizations are navigating a complex web of regulatory requirements, cybersecurity threats, and the need for operational efficiency. The consequences of inadequate GRC practices can be severe, including financial penalties, reputational damage, and operational disruptions. Therefore, identifying the right GRC software solution is crucial for businesses looking to streamline their processes and effectively manage risks.

- Risk Cognizance emerges as a vital tool in this landscape, providing an integrated platform that not only meets compliance requirements but also enhances overall risk management capabilities.

- Key Features of Risk Cognizance

- 1. Comprehensive Risk Management

- Risk Cognizance offers a holistic approach to risk management, enabling organizations to:

- Analyze and Evaluate Risks: Utilize real-time data analytics to identify, prioritize, and mitigate risks.

- Scenario Analysis: Simulate potential risk scenarios to prepare for unforeseen challenges.

- Risk Heat Maps: Visualize risk levels across the organization, facilitating informed decision-making.

- 2. Robust Compliance Management

- Staying compliant in a dynamic regulatory environment is challenging. Risk Cognizance addresses this need by providing:

- Compliance Database: A centralized system to track compliance initiatives, ensuring all teams are informed and aligned.

- Automated Reporting: Effortlessly generate compliance reports to maintain transparency and accountability.

- Policy Management: Create and manage policies that adhere to regulations, streamlining the compliance process.

- 3. Audit Management Tools

- Effective audit management is crucial for maintaining compliance and assessing operational effectiveness. Risk Cognizance includes:

- Audit Management: Tools for conducting financial, resource, or procedural audits efficiently.

- Automated Workflows: Simplify the audit process with integrated documentation and task management.

- 4. Advanced Reporting and Analytics

- Risk Cognizance features customizable reporting and analytics tools, allowing organizations to:

- Monitor Key Performance Indicators (KPIs): Real-time dashboards provide visibility into compliance metrics and risk management performance.

- Predictive Analytics: Leverage machine learning algorithms to forecast potential risks and compliance issues.

- 5. User-Friendly Interface

- Navigating complex GRC tools can be a challenge. Risk Cognizance overcomes this with:

- Intuitive Dashboard: A customizable dashboard that displays critical metrics at a glance, enhancing user experience.

- Mobile Accessibility: Access key features and data on-the-go, ensuring teams can stay connected and informed.

- 6. Collaboration Tools

- Effective collaboration is essential for GRC success. Risk Cognizance fosters teamwork through:

- Integrated Communication Tools: Enhance collaboration with shared workspaces and task management features.

- Stakeholder Engagement: Keep stakeholders informed with automated notifications and updates.

- 7. Seamless Integration Capabilities

- Risk Cognizance supports various integrations to enhance functionality and streamline workflows, including:

- API Access: Customize integrations tailored to organizational needs.

- Data Import/Export: Maintain consistency across platforms by easily importing and exporting data.

- 8. Training and Support

- To ensure that organizations maximize the potential of Risk Cognizance, the platform offers:

- User Training Programs: Comprehensive training materials to equip teams with the necessary skills.

- Dedicated Support: 24/7 customer support from a knowledgeable team to address any issues or questions.

- Benefits of Implementing Risk Cognizance

- Integrating Risk Cognizance into your organization can lead to numerous benefits:

- Enhanced Decision-Making: Leverage data-driven insights to make strategic decisions that minimize risk.

- Increased Efficiency: Automate routine tasks, allowing your team to focus on more strategic initiatives.

- Cost-Effective Solutions: Reduce the need for multiple tools by utilizing an all-in-one GRC platform, improving ROI.

- Customer Testimonials

- Organizations that have implemented Risk Cognizance report significant improvements in their GRC practices:

- “Risk Cognizance has transformed our risk management process. We’re more efficient and proactive in addressing compliance issues.”

- — Sarah T., Compliance Officer

- “The platform's user-friendly interface makes it easy for our team to stay on top of regulations and policies.”

- — James L., Assurance Leader

- The European GRC Landscape

- The European GRC software market is diverse, with various providers catering to distinct organizational needs. Key players include:

- SAP GRC (Germany): Known for its seamless integration with other SAP applications and user-friendly interfaces.

- Swiss GRC (Switzerland): Offers a modular GRC suite that enhances risk management capabilities.

- NAVEX Global (United Kingdom): Focuses on ethics and compliance with a robust policy management platform.

- Corporater (Norway): Provides a comprehensive framework for managing GRC processes across industries.

- SAI Global (Netherlands): Known for its advanced risk intelligence and comprehensive compliance solutions.

- These providers, along with Risk Cognizance, showcase the promising growth potential and robust offerings in the European GRC market. Each solution presents unique strengths that cater to varying organizational needs.

- Conclusion

- The complexities of today’s regulatory environment and the increasing threat of cyber risks make it imperative for organizations to invest in effective GRC solutions. Risk Cognizance stands out as a powerful tool, equipped with comprehensive features designed to streamline governance, risk management, and compliance processes.

- By carefully evaluating their specific GRC requirements, organizations can leverage the capabilities of Risk Cognizance to navigate regulatory challenges, manage risks more effectively, and foster a culture of compliance and continuous improvement. As businesses continue to adapt to the evolving landscape, the right GRC software will be a critical component in their success.

- In summary, adopting Risk Cognizance is not just about compliance; it’s about empowering organizations to thrive in a complex and dynamic environment. By integrating advanced GRC capabilities, businesses can enhance their operational efficiency and safeguard their future in an ever-changing world.

The GRC Landscape

- Risk Cognizance GRC: Known for its ability to provide a comprehensive suite of tools today Risk Cognizance has a built-in attack surface management, dark web monitoring, ticket management, project management, vendor management, breach detection, artificial intelligence AI and threat intelligence.

- SAP GRC (Germany): Known for its seamless integration with other SAP applications and user-friendly interfaces.

- Swiss GRC (Switzerland): Offers a modular GRC suite that enhances risk management capabilities.

- NAVEX Global (United Kingdom): Focuses on ethics and compliance with a robust policy management platform.

- Corporater (Norway): Provides a comprehensive framework for managing GRC processes across industries.

- SAI Global (Netherlands): Known for its advanced risk intelligence and comprehensive compliance solutions.

These providers, along with Risk Cognizance, showcase the promising growth potential and robust offerings in the European GRC market. Each solution presents unique strengths that cater to varying organizational needs.

Conclusion

The complexities of today’s regulatory environment and the increasing threat of cyber risks make it imperative for organizations to invest in effective GRC solutions. Risk Cognizance stands out as a powerful tool, equipped with comprehensive features designed to streamline governance, risk management, and compliance processes.

By carefully evaluating their specific GRC requirements, organizations can leverage the capabilities of Risk Cognizance to navigate regulatory challenges, manage risks more effectively, and foster a culture of compliance and continuous improvement. As businesses continue to adapt to the evolving landscape, the right GRC software will be a critical component in their success.

In summary, adopting Risk Cognizance is not just about compliance; it’s about empowering organizations to thrive in a complex and dynamic environment. By integrating advanced GRC capabilities, businesses can enhance their operational efficiency and safeguard their future in an ever-changing world.

Request Callback