Overview

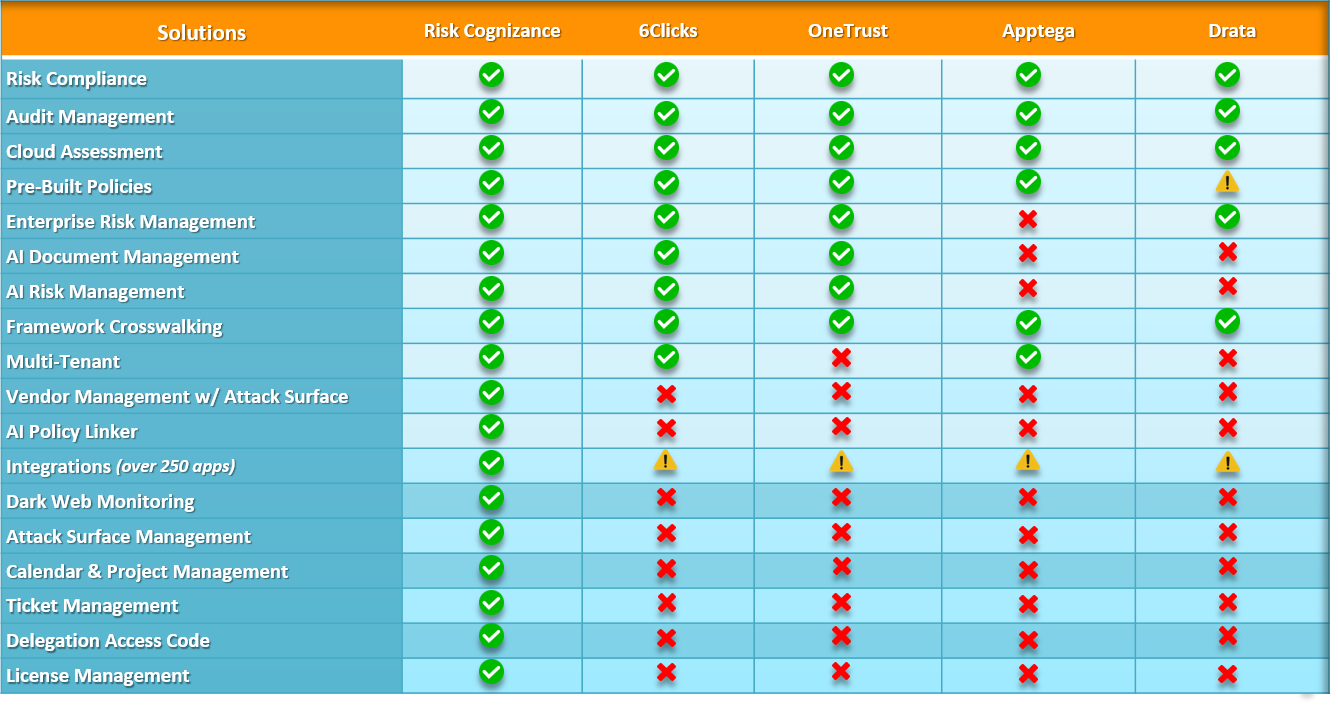

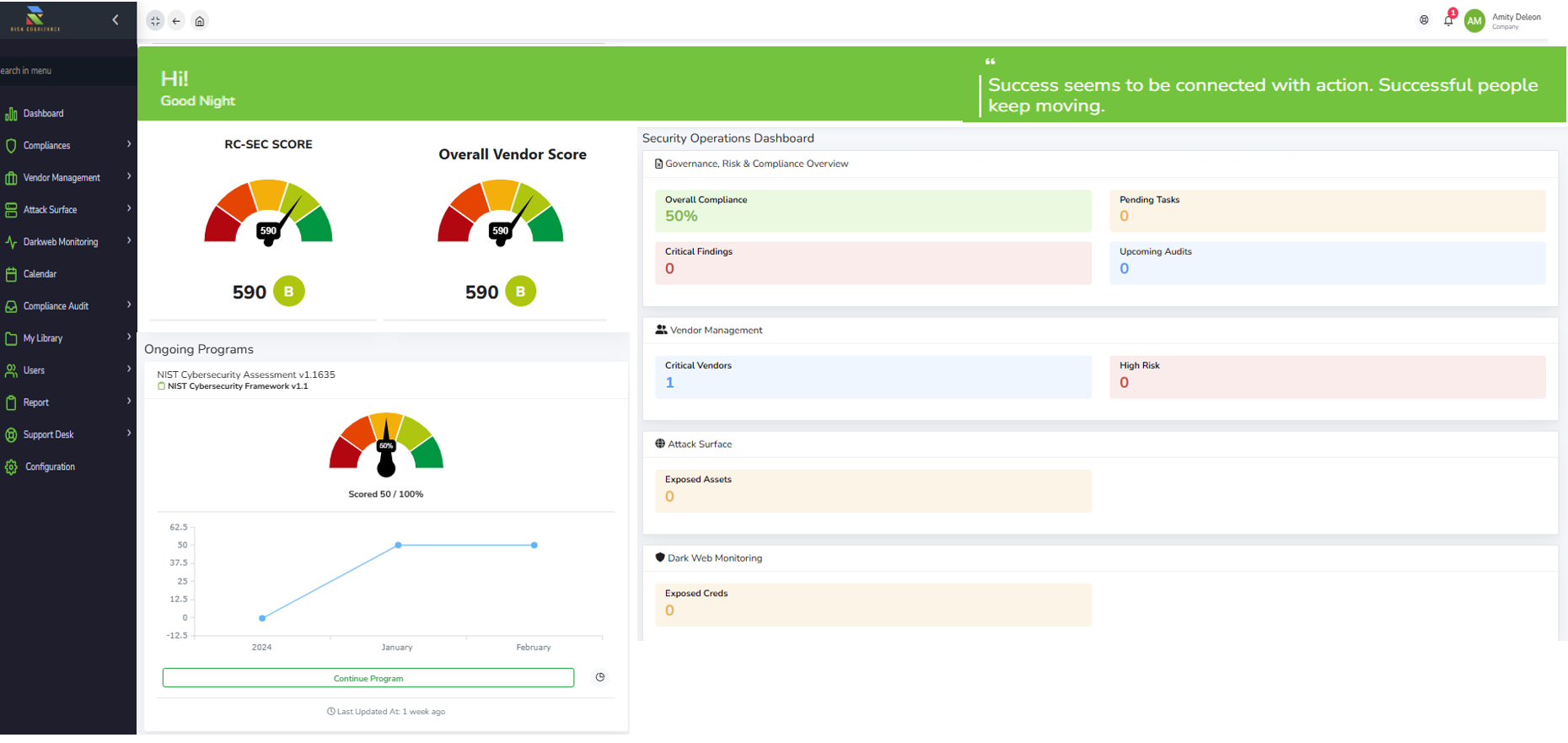

Compliance management is essential for businesses to ensure they meet regulatory requirements, mitigate risks, and maintain operational integrity. Risk Cognizance provides comprehensive compliance tools that help organizations automate compliance workflows, monitor regulatory changes, and streamline audits. These tools are designed to improve efficiency while reducing the complexity of managing compliance across multiple frameworks.

What Are Compliance Tools?

Compliance tools are software solutions that assist businesses in adhering to legal, regulatory, and industry standards. Risk Cognizance offers advanced compliance management solutions that help organizations track regulatory changes, conduct risk assessments, and generate audit-ready reports with ease.

Key Features of Risk Cognizance Compliance Tools

Risk Cognizance compliance tools provide a structured approach to managing compliance by integrating automation, reporting, and monitoring capabilities. These tools ensure businesses can proactively address compliance challenges and reduce non-compliance risks.

Automated Compliance Monitoring

By continuously monitoring compliance requirements, Risk Cognizance ensures businesses remain up to date with evolving regulations. Automated alerts and updates help organizations take immediate action to maintain compliance.

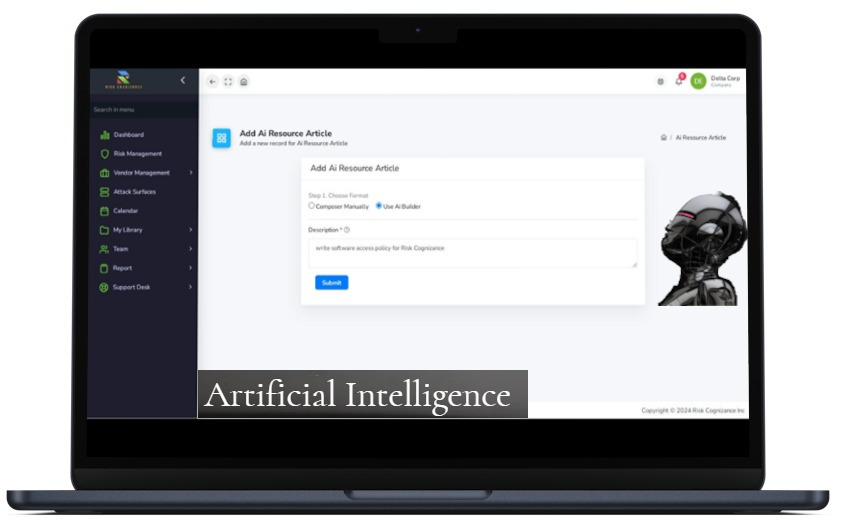

Policy and Documentation Management

Managing policies and regulatory documents is simplified with Risk Cognizance. The platform helps organizations create, distribute, and track compliance policies, ensuring employees stay informed and adhere to necessary guidelines.

Risk Assessment and Mitigation

Compliance tools within Risk Cognizance help businesses identify compliance risks, assess their impact, and implement mitigation strategies. Automated risk assessments streamline the identification and resolution of compliance gaps.

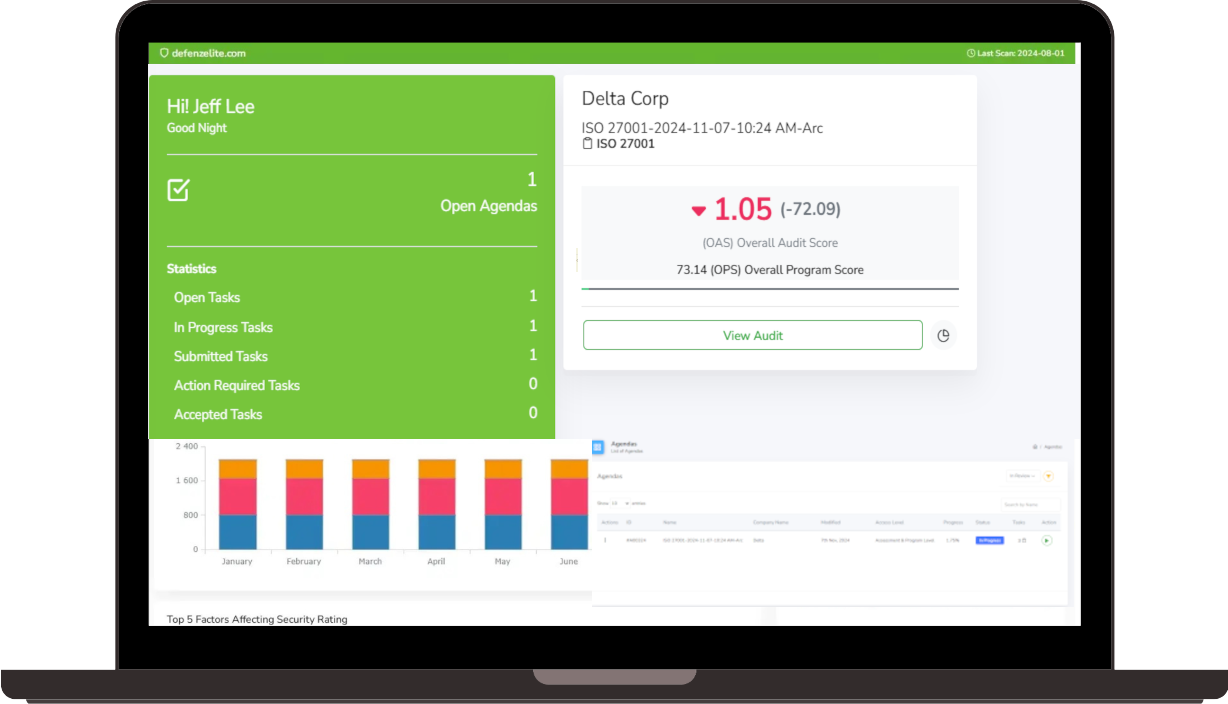

Streamlining Audits with Compliance Automation

One of the most significant benefits of Risk Cognizance compliance tools is the ability to automate audit processes. Businesses can generate audit-ready reports, maintain compliance records, and ensure smooth regulatory inspections.

Regulatory Change Management

With regulations constantly evolving, Risk Cognizance keeps businesses informed of new compliance requirements. Automated regulatory tracking ensures organizations adapt to changes without disrupting operations.

Workflow Automation for Compliance Tasks

Manual compliance management can be time-consuming and prone to errors. Risk Cognizance automates workflows related to compliance tracking, reporting, and remediation, reducing administrative burdens and improving efficiency.

Supported Security Compliance Frameworks

Risk Cognizance compliance tools support a wide range of global regulatory and industry compliance frameworks, ensuring businesses meet necessary standards:

- General Data Protection Regulation (GDPR) – Data privacy and protection for EU citizens.

- California Consumer Privacy Act (CCPA) – Data protection and consumer rights for California residents.

- Health Insurance Portability and Accountability Act (HIPAA) – Protection of healthcare information.

- Federal Risk and Authorization Management Program (FedRAMP) – Compliance for cloud service providers working with the U.S. government.

- Payment Card Industry Data Security Standard (PCI DSS) – Security standards for payment processing and cardholder data protection.

- International Organization for Standardization (ISO) 27001 – Information security management system (ISMS) framework.

- National Institute of Standards and Technology (NIST) 800-53 – Security controls framework for U.S. federal information systems.

- NIST Cybersecurity Framework (CSF) – Best practices for managing cybersecurity risks.

- Sarbanes-Oxley Act (SOX) – Financial reporting compliance for publicly traded companies.

- Control Objectives for Information and Related Technologies (COBIT) – IT governance and management framework.

- System and Organization Controls (SOC) 2 – Security, availability, and confidentiality controls for service organizations.

- North American Electric Reliability Corporation Critical Infrastructure Protection (NERC CIP) – Security standards for power and utility companies.

- Defense Federal Acquisition Regulation Supplement (DFARS) & Cybersecurity Maturity Model Certification (CMMC) – Compliance for U.S. Department of Defense contractors.

- Financial Industry Regulatory Authority (FINRA) – Compliance standards for financial services firms.

- Gramm-Leach-Bliley Act (GLBA) – Data privacy requirements for financial institutions.

- General Insurance Code of Practice (GICOP) – Compliance framework for the insurance sector.

- Federal Information Security Management Act (FISMA) – U.S. government cybersecurity compliance.

|  |

|  |

|  |

Integrated Compliance Solutions

Risk Cognizance offers a comprehensive suite of compliance tools tailored to specific regulatory requirements, including:

- Integrated Risk Management

- Third-Party Risk Management

- Business Continuity and Resilience

- Privacy and Data Protection Compliance

- Cyber Asset Attack Surface Management

Third-Party Risk Management Compliance

Ensuring vendor compliance is crucial for overall regulatory adherence. Risk Cognizance automates third-party risk management, helping businesses evaluate vendor compliance and mitigate associated risks.

Data Protection and Privacy Compliance

With stringent data protection laws such as GDPR and CCPA, businesses must ensure compliance with data privacy regulations. Risk Cognizance offers tools to manage data security, consent tracking, and compliance documentation.

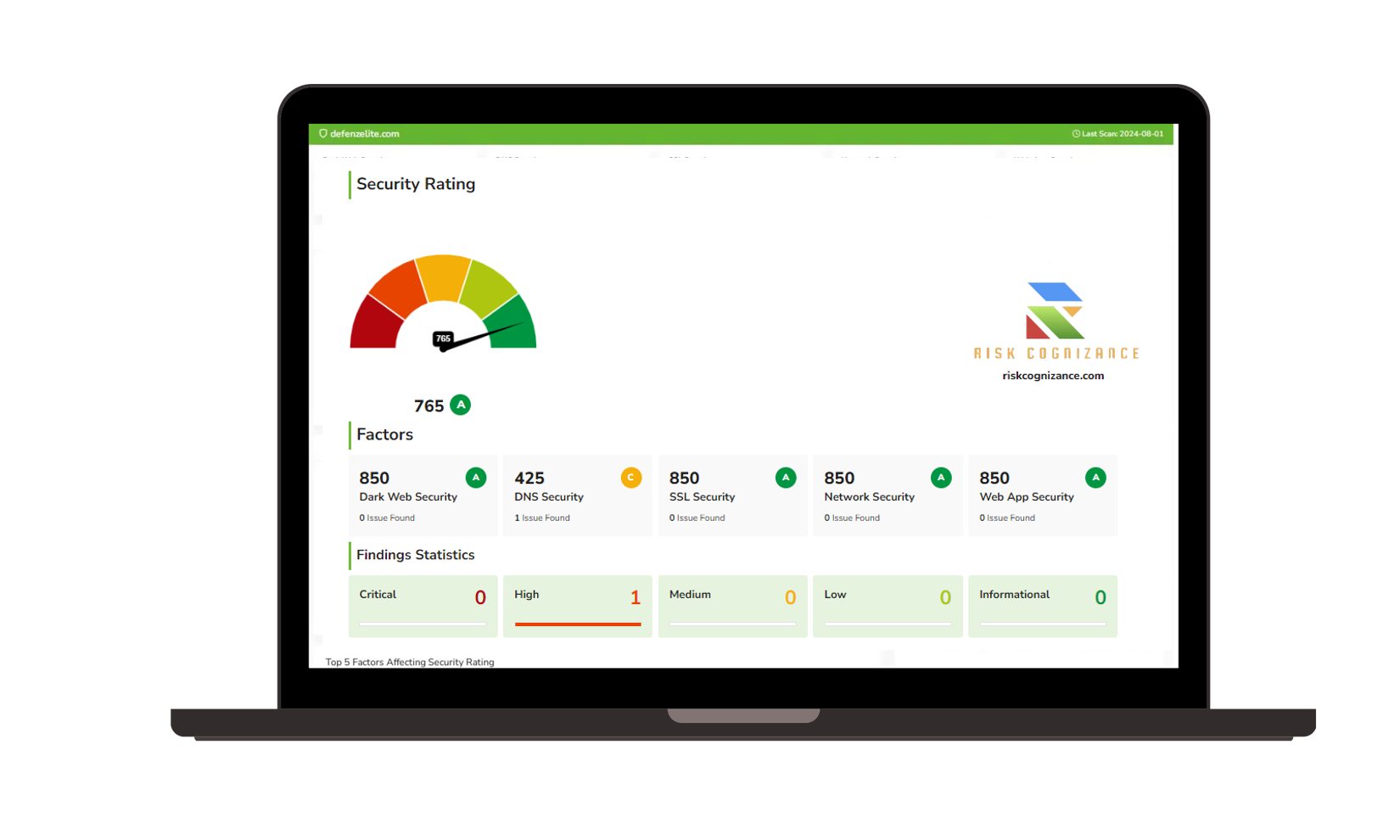

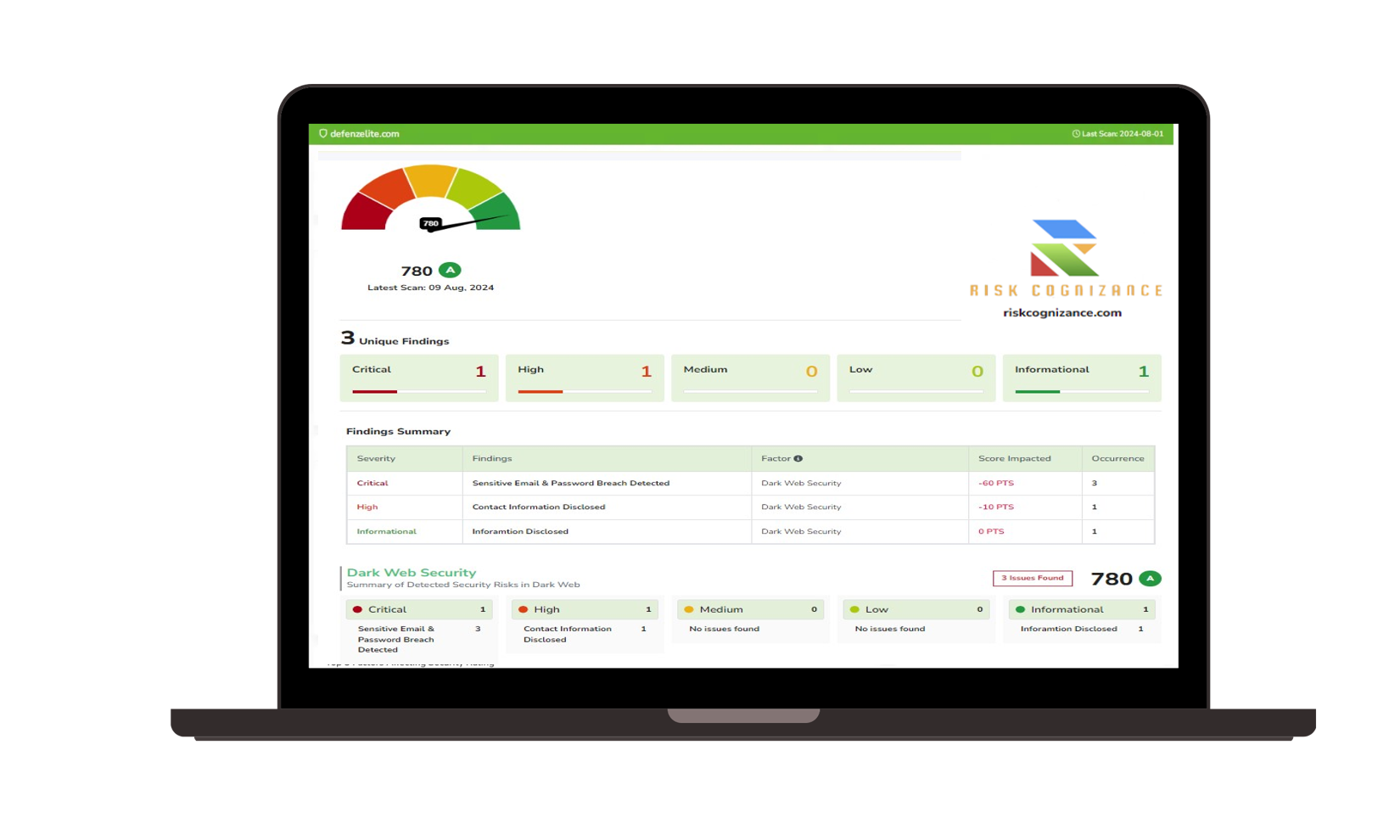

Strengthening Security Through Compliance

Compliance management is not just about meeting regulatory requirements—it also plays a critical role in cybersecurity. Risk Cognizance integrates security measures with compliance tools, providing real-time monitoring and risk detection to prevent potential breaches.

Continuous Compliance Monitoring

Real-time compliance monitoring ensures that businesses stay ahead of potential risks. Risk Cognizance provides visibility into compliance gaps, offering actionable insights to address them before they become regulatory violations.

Audit-Ready Reporting and Documentation

With automated reporting, businesses can generate compliance documentation required for audits, reducing preparation time and ensuring transparency with regulators.

Integrated Risk Management and Governance

Beyond compliance, Risk Cognizance provides governance and risk management solutions that enable organizations to proactively manage regulatory changes, security risks, and business continuity.

Identifying and Managing Risks

One of the primary functions of Risk Cognizance is to identify, assess, and mitigate risks across the organization. This proactive approach helps businesses stay ahead of potential threats, vulnerabilities, and non-compliance issues.

Cyber Asset Attack Surface Management (CAASM)

Effective risk management includes identifying vulnerabilities within an organization’s digital infrastructure. Risk Cognizance provides:

- Asset discovery: Identifies all digital assets, including servers, applications, and cloud services.

- Inventory and classification: Categorizes assets based on their type, criticality, and location for risk assessment.

- Vulnerability scanning: Detects weaknesses and potential exploits within identified assets.

- Risk prioritization: Assigns risk levels based on severity, impact, and exploitability.

- Continuous monitoring: Tracks changes in the attack surface over time.

- Remediation guidance: Provides actionable recommendations to address vulnerabilities and mitigate risks.

Conclusion: Why Choose Risk Cognizance for Compliance Management?

Risk Cognizance compliance tools simplify compliance management by integrating automation, monitoring, and reporting capabilities. By leveraging these tools, businesses can enhance their compliance posture, reduce regulatory risks, and improve operational efficiency. With features such as automated risk assessments, policy management, attack surface monitoring, and audit-ready reporting, Risk Cognizance ensures organizations remain compliant and secure in an ever-changing regulatory landscape.

Request Callback