Overview

Comprehensive Compliance and Audit Management Solution

Risk Cognizance’s Compliance & Audit Program Manager is a robust solution designed to ensure your organization meets all regulatory requirements and exceeds regulatory expectations for managing compliance programs and audits. Tailored to address the complexities of today’s dynamic regulatory landscape, this solution helps credit unions and financial institutions streamline compliance efforts, maintain audit readiness, and reduce the risk of non-compliance.

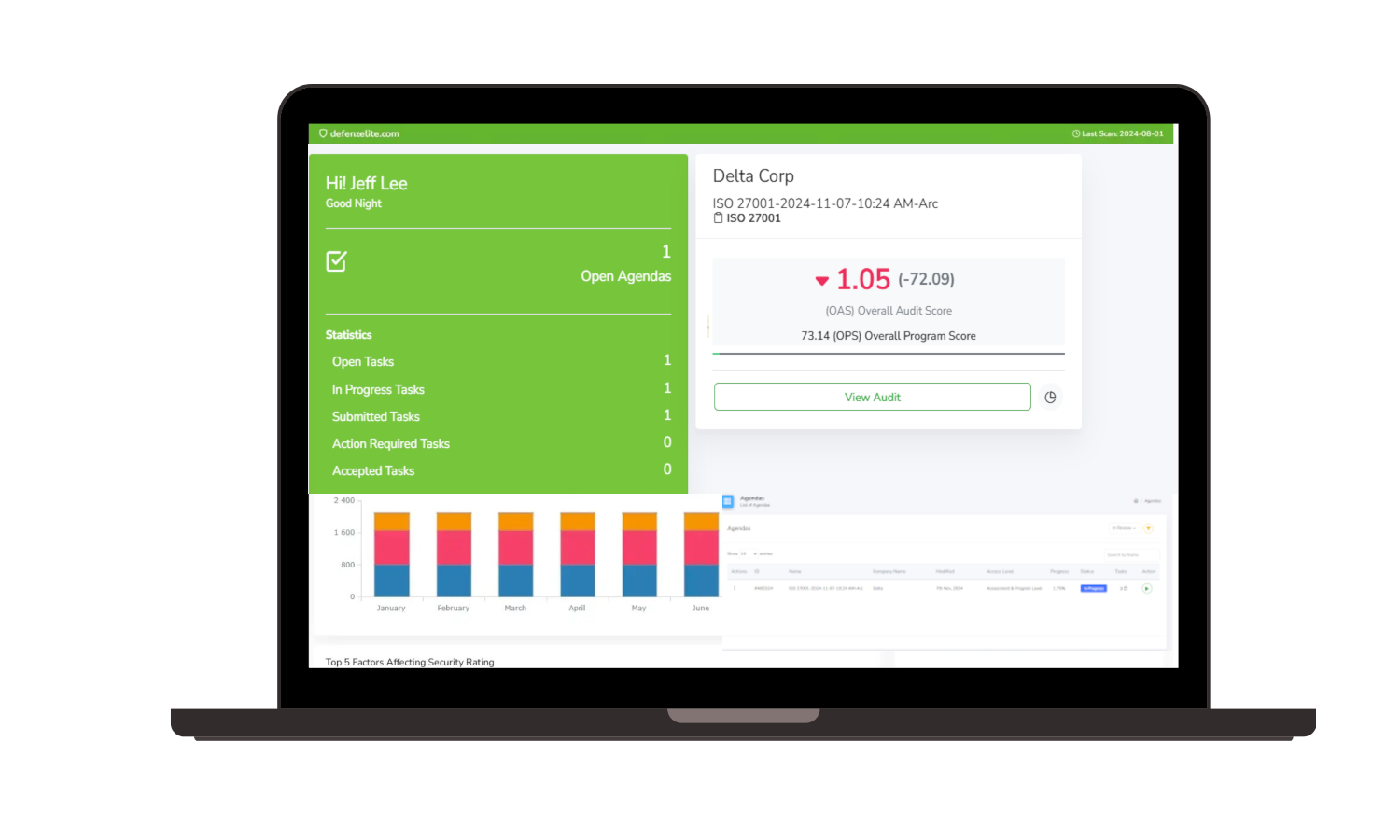

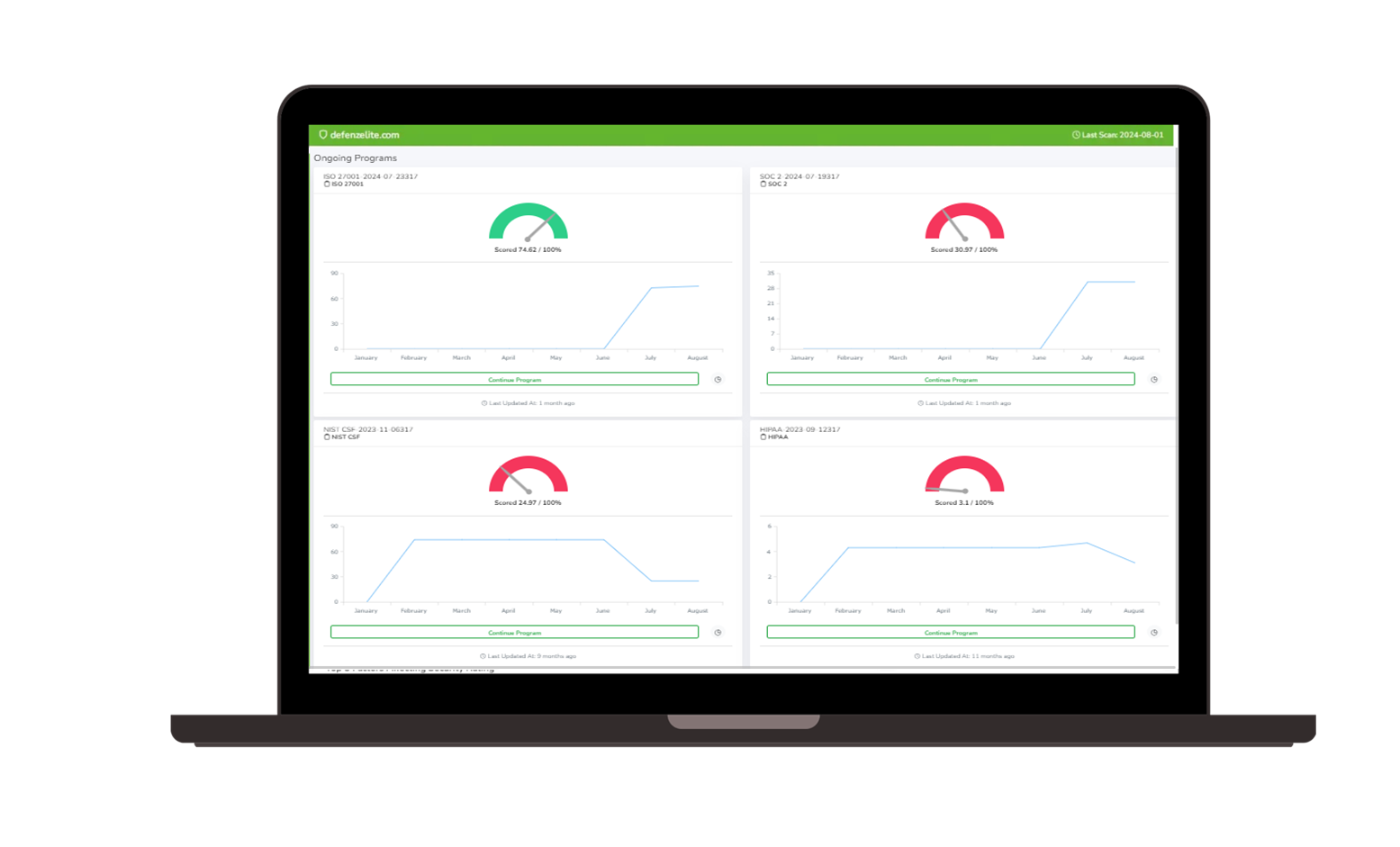

Our Compliance & Audit Program Manager integrates governance, risk, and compliance (GRC) functions in a single platform, providing visibility and control over your organization’s compliance initiatives. The solution centralizes compliance activities, automates routine tasks, and provides real-time insights to support proactive compliance management.

Audit Manager |  Third-party Risk Management |

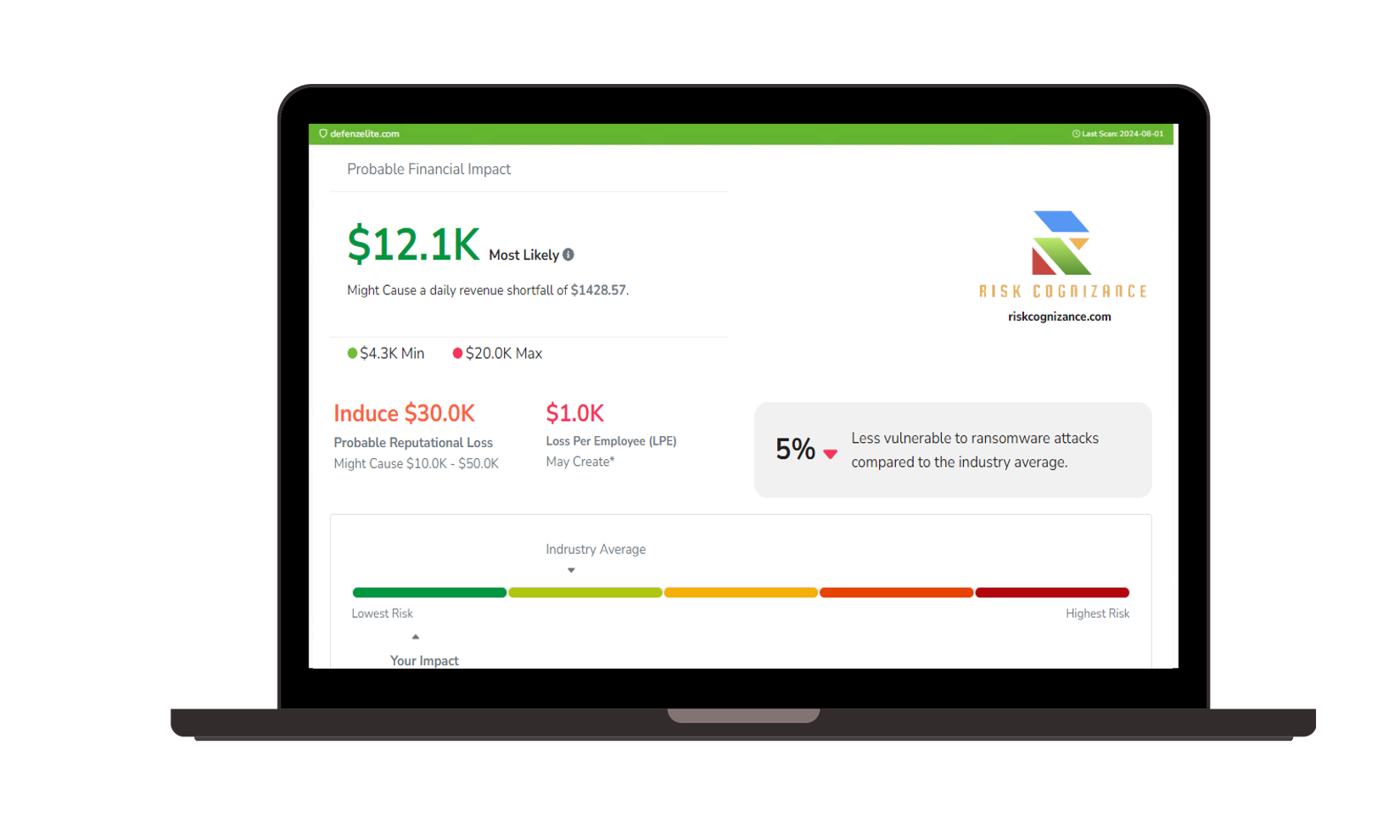

Ransomware Susceptibility |  Governance, Risk, and Compliance (GRC) |

| Compliance Made Easy for Compliance Managersr, CISO and Risk Managers | |

Core Capabilities of Compliance & Audit Program Manager

Comprehensive Compliance Management

Risk Cognizance’s platform enables you to track compliance requirements across multiple frameworks, such as NCUA, FFIEC, and SOX. Map controls, policies, and regulations to ensure all regulatory expectations are addressed efficiently.

Automated Audit Tracking

Manage internal and external audits with ease. Our solution provides pre-built templates, automated workflows, and centralized document management to simplify audit preparation and maintain a clear audit trail.

Policy and Procedure Management

Establish, distribute, and enforce compliance policies across your organization. Automate policy reminders, track employee acknowledgment, and ensure consistent adherence to regulatory standards.

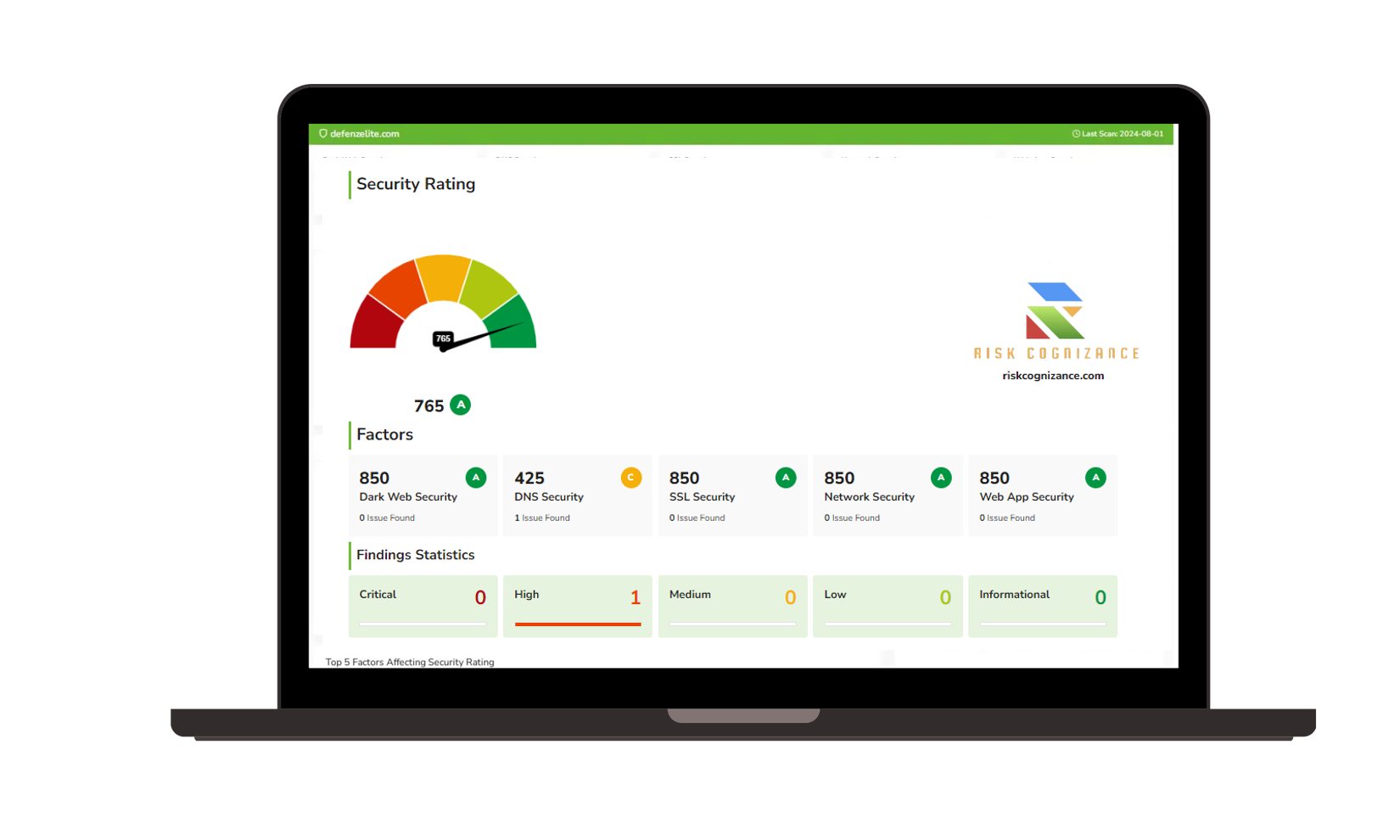

Risk Assessment and Management

Identify, evaluate, and prioritize compliance risks based on impact and likelihood. Leverage automated risk scoring and visual dashboards to enhance decision-making and resource allocation.

Incident Management and Reporting

Capture, track, and manage incidents from initial reporting to resolution. Maintain compliance by implementing automated workflows to ensure incidents are addressed promptly and documented thoroughly.

Key Benefits of the Compliance & Audit Program Manager

1. Proactive Compliance Monitoring

Stay ahead of evolving regulations with automated monitoring and alerts. The solution provides a centralized repository for all regulatory changes, ensuring that your compliance program is always up-to-date.

2. Real-Time Compliance Visibility

Gain comprehensive visibility into your compliance posture through real-time dashboards and reporting. Track the status of compliance initiatives, monitor risks, and generate detailed reports for regulators and stakeholders.

3. Enhanced Audit Readiness

Simplify audit preparation and reduce time spent on audit-related tasks. Our platform helps streamline the entire audit process, from initial scoping to evidence collection and reporting.

4. Automated Compliance Workflows

Eliminate manual processes and reduce administrative overhead with automated workflows. Automate routine compliance activities such as control testing, policy distribution, and compliance reporting.

5. Improved Collaboration and Accountability

Foster collaboration across compliance teams and departments with shared data, automated task assignments, and transparent reporting. The solution ensures that all stakeholders are aligned and accountable for compliance efforts.

Compliance Frameworks and Standards Supported

Risk Cognizance’s Compliance & Audit Program Manager supports a wide array of industry standards and frameworks, making it suitable for organizations operating in highly regulated sectors. Supported frameworks include:

- National Credit Union Administration (NCUA) Regulations

- Federal Financial Institutions Examination Council (FFIEC) Guidelines

- Sarbanes-Oxley Act (SOX)

- General Data Protection Regulation (GDPR)

- Health Insurance Portability and Accountability Act (HIPAA)

- Gramm-Leach-Bliley Act (GLBA)

- California Consumer Privacy Act (CCPA)

- Federal Risk and Authorization Management Program (FedRAMP)

Why Choose Risk Cognizance’s Compliance & Audit Program Manager?

Risk Cognizance’s Compliance & Audit Program Manager offers a comprehensive solution that goes beyond meeting regulatory requirements. It empowers organizations to transform compliance management from a reactive process into a proactive, strategic function that drives value and ensures regulatory peace of mind.

1. Proven Compliance Expertise

Our platform is trusted by leading financial institutions and organizations across industries for its reliability, scalability, and ability to adapt to complex regulatory environments.

2. Flexibility and Scalability

The solution is designed to grow with your organization. Whether you need to expand to support new regulatory frameworks or accommodate more users, Risk Cognizance provides the flexibility to meet your evolving compliance needs.

3. Centralized Compliance Operations

Manage all compliance, risk, and audit activities in one platform. This unified approach eliminates silos and ensures a consistent, organization-wide approach to compliance management.

Get Started with Risk Cognizance Today

Ready to streamline your compliance and audit management? Request a demo of the Risk Cognizance Compliance & Audit Program Manager to see how our solution can help your organization meet regulatory requirements, achieve audit readiness, and mitigate compliance risks efficiently.

Request a Demo Today and experience how our Compliance & Audit Program Manager can transform your compliance program into a streamlined, strategic advantage for your organization.

Book a Demo