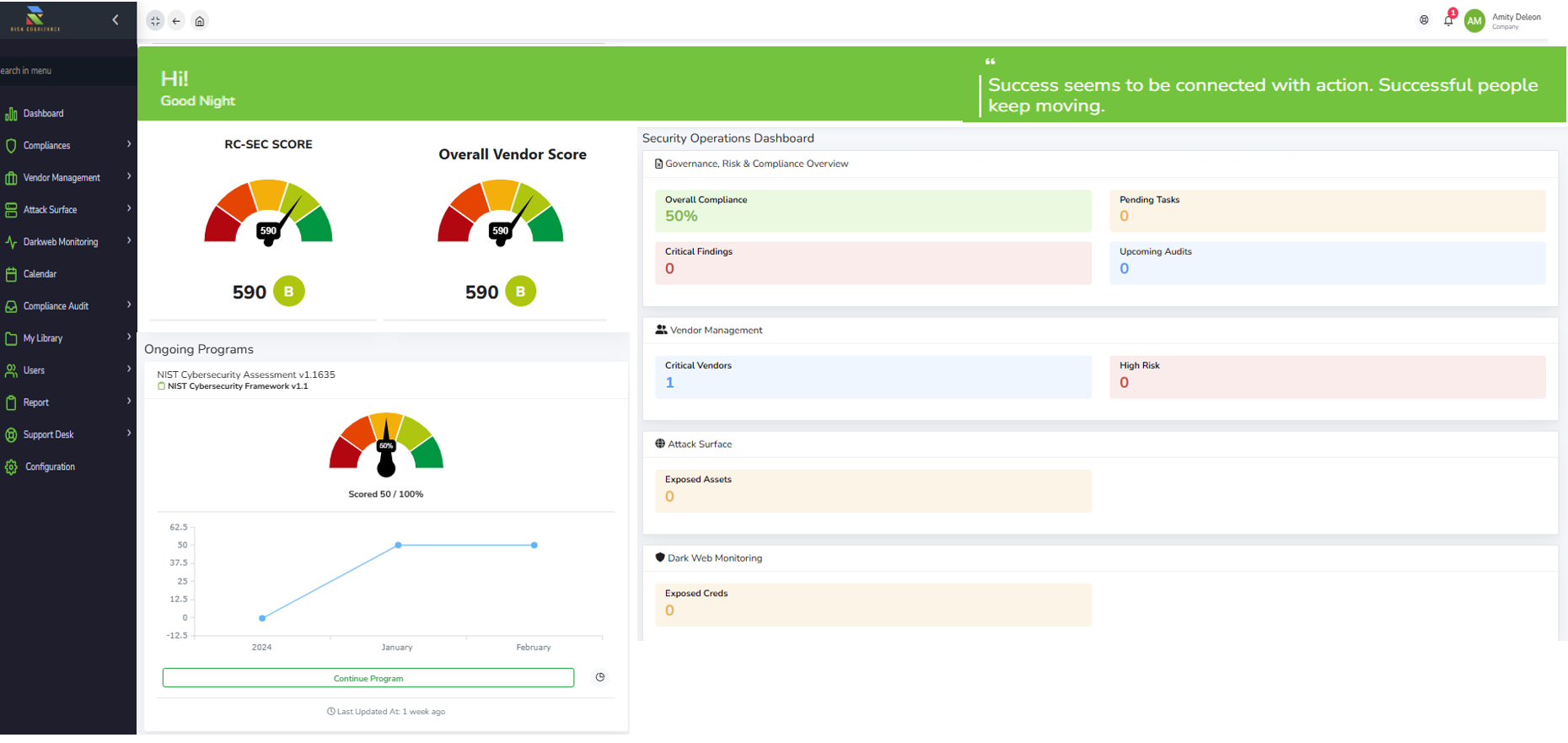

Overview

Automation, Analytics, and AI for Risk & Compliance

Organizations use Risk Cognizance to managmanage risk and ensuring compliance knowning that the are essential components of success. With Risk Cognizance Automation, Analytics, and AI for Risk & Compliance, organizations can tackle the growing complexities of governance and regulatory requirements more efficiently. These technologies bring powerful capabilities that streamline processes, identify risks, and improve decision-making. By integrating automation into risk management, businesses can achieve a proactive and strategic approach to compliance.

The Role of Risk Cognizance Automation in Risk and Compliance

Risk Cognizance Automation plays a pivotal role in simplifying the management of risk and compliance tasks. It involves the use of specialized tools to perform routine processes, such as audits, reporting, and risk assessments, without human intervention. Through automated workflows, organizations can speed up processes, reduce errors, and enhance the consistency of compliance activities. By utilizing automation in risk management, companies can stay ahead of regulatory changes and ensure continuous compliance across multiple departments.

Leveraging Risk Cognizance Analytics to Strengthen Risk Management

Risk Cognizance GRC Analytics is a game-changer when it comes to understanding and mitigating risks. By using advanced data analytics, organizations can gain deep insights into their risk landscape. These insights help in identifying potential threats early, enabling businesses to make informed decisions and take proactive actions. With analytics integrated into risk management processes, companies can better understand risk patterns and forecast potential compliance challenges.

Through predictive analytics, businesses can anticipate future compliance risks and take corrective measures before they escalate into costly issues. The use of analytics not only improves operational efficiency but also strengthens the overall risk management framework by enabling data-driven decision-making.

AI in Risk and Compliance: A New Era of Precision

Risk Cognizance Artificial Intelligence (AI) is revolutionizing the way organizations approach risk and compliance management. AI-powered solutions can analyze vast amounts of data, detect patterns, and identify compliance violations more accurately than traditional methods. With AI’s ability to continuously learn and adapt, organizations can benefit from advanced threat detection, anomaly detection, and real-time monitoring.

Risk Cognizance integration of AI allows businesses to automatically flag potential risks, ensuring timely responses to compliance challenges. AI algorithms can also assess risk severity and recommend the best course of action to mitigate potential impacts. By adopting AI-driven tools, organizations enhance their ability to manage risk and compliance with unparalleled precision and agility.

The Synergy Between Automation, Analytics, and AI

When combined, Automation, Analytics, and AI create a powerful synergy that enhances risk and compliance strategies. By automating repetitive tasks, companies can free up valuable resources to focus on more strategic decision-making. Analytics provides the data and insights needed to understand risk trends, while AI refines these insights and delivers predictive capabilities that help organizations stay one step ahead of potential compliance challenges.

This synergy not only streamlines compliance workflows but also enables more informed decision-making. The integration of AI into automated compliance systems ensures that businesses are always in a position to meet regulatory requirements and mitigate risks effectively.

Real-Time Monitoring and Reporting with Automation and AI

One of the significant advantages of Automation, Analytics, and AI for Risk & Compliance is the ability to offer real-time monitoring and reporting. With AI-powered analytics, organizations can track risks and compliance statuses in real-time, providing instant insights into potential issues. This enables quicker responses to emerging risks and ensures that compliance gaps are addressed promptly.

By automating the generation of compliance reports, businesses can reduce the time spent on manual tasks and ensure that they are always prepared for audits. Automation and AI allow companies to maintain accurate records and provide up-to-date information to regulatory authorities whenever required.

Risk Cognizance Enhancing Decision-Making with Data-Driven Insights

With Risk Cognizance Analytics and AI, decision-makers can leverage data-driven insights to make more informed and accurate decisions. Instead of relying on gut feelings or outdated information, organizations can trust the power of data to guide their risk management and compliance strategies. Automation ensures that this information is readily available, removing bottlenecks and enabling a faster response to changing conditions.

By incorporating analytics into risk management processes, businesses can continuously improve their compliance strategies, making better decisions that not only ensure regulatory adherence but also contribute to long-term success.

Cost Savings and Efficiency Gains through Automation and AI

The integration of automation and AI into risk and compliance processes can result in significant cost savings. By automating routine tasks, companies can reduce operational costs and minimize the need for manual labor. Additionally, the ability of AI to detect anomalies and risks early helps organizations avoid costly compliance violations and fines.

The efficiency gained through automation and AI ensures that resources are allocated more effectively, allowing businesses to focus on higher-value tasks. This leads to improved productivity and reduced costs across the organization.

Conclusion: The Future of Risk & Compliance with Automation, Analytics, and AI

The future of Risk & Compliance management lies in Risk Cognizance integration of Automation, Analytics, and AI. By harnessing the power of these technologies, organizations can not only streamline their processes but also make better decisions, reduce risks, and ensure continuous compliance. As regulations become more complex and businesses face increasing challenges, automation and AI provide the tools needed to stay ahead, ultimately transforming how companies approach risk management and compliance.

Request Callback