Overview

Automate compliance tasks and evidence collection. AI-powered workflows provide real-time insights and efficiency. Rule-based automation simplifies audit preparation. Get started now.

Revolutionizing Compliance Through Automation

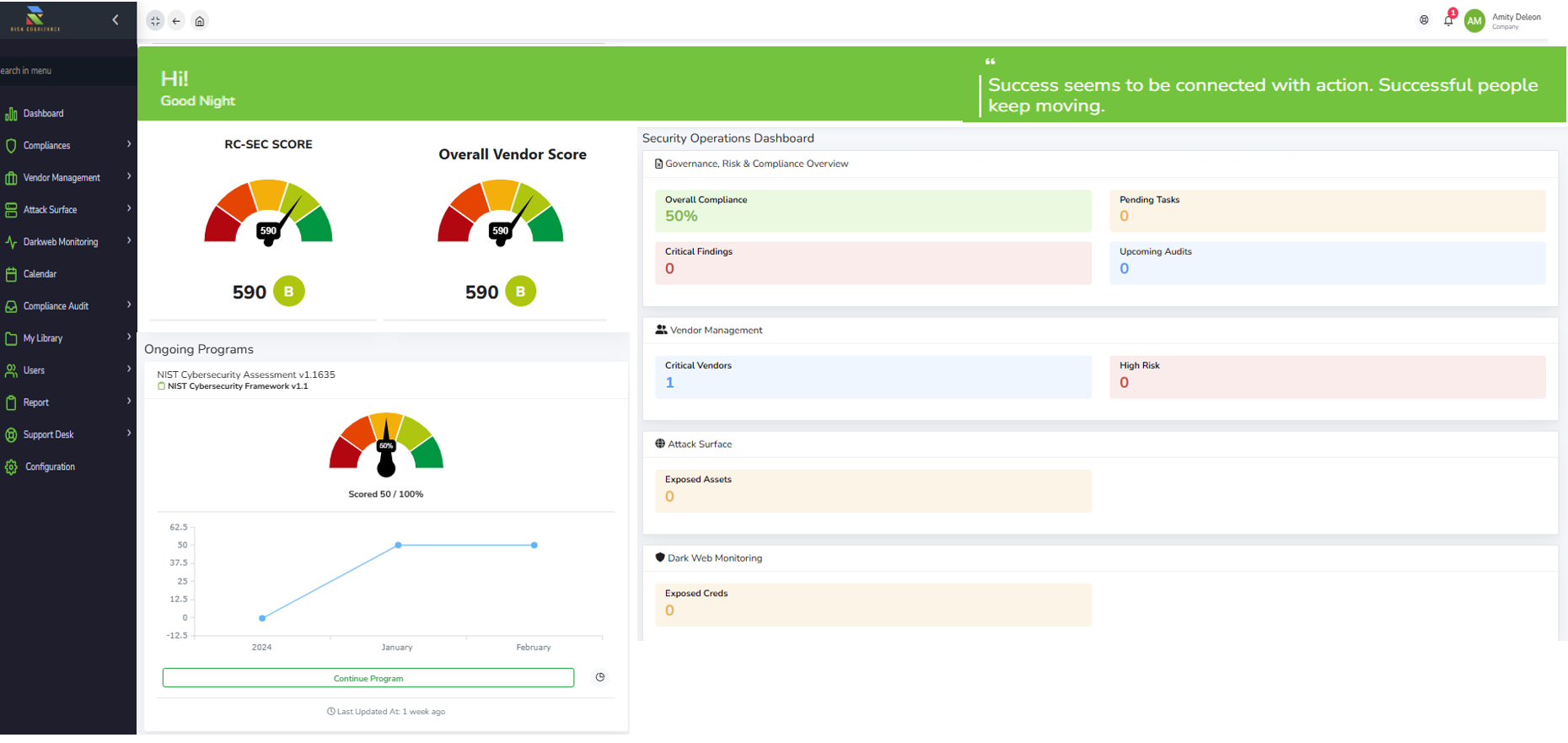

Regulatory requirements are rapidly evolving, organizations must ensure continuous compliance while reducing manual effort. Risk Cognizance empowers businesses with Automated Compliance & Evidence Collection, leveraging AI-driven integrations, risk syncing, and centralized monitoring to streamline audit readiness and compliance verification.

What is Automated Evidence Collection?

Automated Evidence Collection is a transformative approach to compliance that integrates with an organization's IT systems to automatically gather, organize, and manage documentation proving adherence to regulatory standards. Risk Cognizance enhances this process with Evidence Blend, an advanced tool that combines automated evidence collection with human insight, ensuring audit trust and efficiency.

Key Benefits of Automated Compliance & Evidence Collection

Struggling with compliance and audits? Automate evidence collection and streamline workflows with AI. Reduce prep time and improve efficiency.

- Reduced Manual Effort: Eliminates the need for time-consuming manual data collection and minimizes human error.

- Real-Time Visibility: Continuous monitoring of compliance status helps identify potential risks proactively.

- Improved Audit Readiness: Streamlined audit preparation with pre-collected, organized, and verifiable compliance evidence.

- Enhanced Accuracy: Standardized evidence collection processes ensure reliability and data integrity.

How Automated Evidence Collection Works

Risk Cognizance automates the compliance process through a seamless integration of technology and strategic risk management:

- Integrations: Connects with cloud providers like AWS, Azure, Google Cloud, and over 250 integrated applications.

- Automated Rules: AI-driven identification of compliance data points based on predefined regulatory requirements.

- Centralized Repository: Secure storage and easy access to compliance evidence for reporting and audit review.

Types of Evidence Automatically Collected

- System Configurations – Ensuring IT environments meet security and compliance standards.

- User Access Logs – Tracking who accessed systems and when.

- Policy Documents – Managing internal governance policies efficiently.

- Training Completion Certificates – Verifying staff compliance with mandatory training.

- Security Audit Reports – Capturing critical findings and remediation steps.

- Cloud Network Activity Logs – Monitoring activity across cloud environments for compliance adherence.

Automating Evidence Collection for Audit Success

Risk Cognizance accelerates compliance management by offering:

- Automated Testing & Monitoring: Run control tests on demand to detect and remediate compliance gaps.

- Project & Risk Management Tools: Track evidence collection and compliance tasks using built-in project management features.

- Risk Syncing & Remediation Nudging: Automatically align collected evidence with compliance requirements and trigger remediation workflows.

Compliance Automation to Accelerate Business Growth

With Risk Cognizance, organizations can achieve:

- 97% reduction in time spent on compliance tasks per month.

- 76% of teams reducing compliance workload by at least half.

- 60% decrease in compliance management effort, enabling businesses to focus on strategic growth.

- Support for 50+ pre-configured compliance frameworks, including SOC 2, ISO 27001, HIPAA, GDPR, and NIST.

Future-Proof Your Compliance Strategy with Risk Cognizance

Automated compliance and evidence collection is the key to reducing compliance burden, enhancing audit readiness, and ensuring regulatory adherence. By integrating cutting-edge AI and automation, Risk Cognizance enables organizations to save time, improve consistency, and move closer to real-time compliance results.

Stay ahead of regulatory changes and embrace a smarter, more efficient compliance strategy with Risk Cognizance’s Automated Compliance & Evidence Collection.

Request Callback