Overview

AI-Powered GRC (Governance, Risk, and Compliance) Risk Management

AI-powered GRC risk management leverages artificial intelligence (AI) to streamline and optimize processes, making it easier to manage compliance, identify risks, and improve operational efficiency. By analyzing vast datasets, AI can uncover hidden patterns, predict risks, and automate routine tasks, leading to smarter decision-making and enhanced regulatory adherence within organizations.

Key Features of AI-Powered GRC Risk Management

Data Analysis

AI algorithms process massive volumes of data from various sources to uncover hidden trends and patterns, allowing for proactive risk identification.

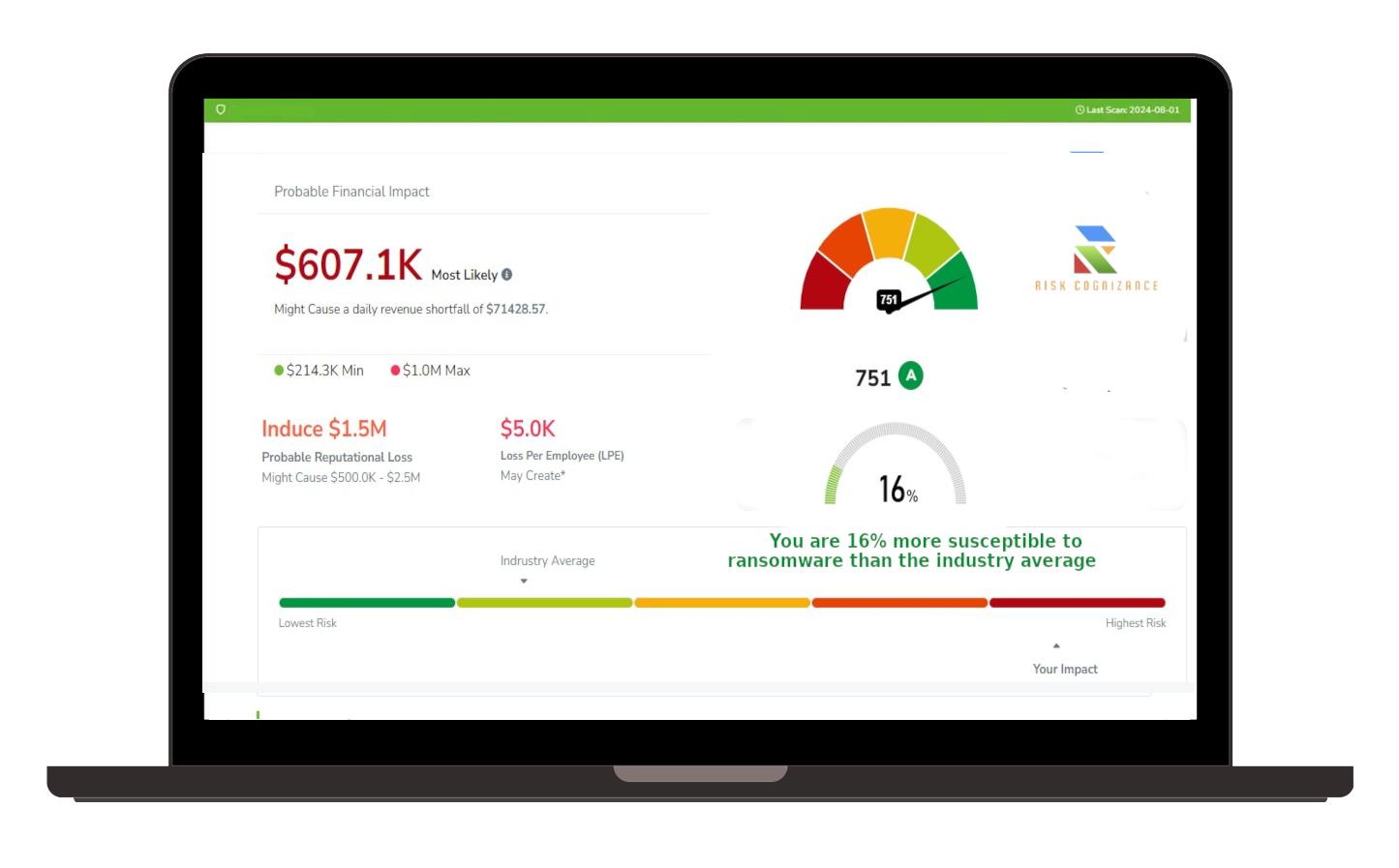

Predictive Analytics

By examining historical data, AI predicts potential risks and areas of non-compliance, enabling organizations to take preventive measures before problems arise.

Real-Time Monitoring

AI-powered tools monitor compliance against evolving regulations continuously, offering real-time alerts for emerging issues and facilitating quick corrective actions.

Automated Compliance Checks

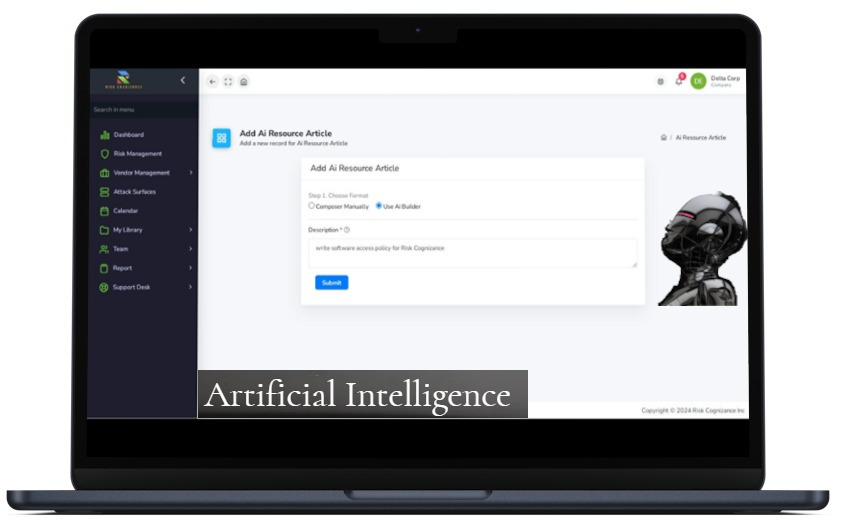

Routine compliance tasks, such as data validation and document review, are automated, freeing up resources for more complex issues.

Enhanced Decision-Making

AI provides data-driven insights to support informed decisions about risk management strategies.

How AI is Used in GRC

- Risk Assessment: Identifying and prioritizing risks based on historical data and current trends.

- Compliance Monitoring: Continuously checking for regulatory adherence across systems and processes.

- Audit Preparation: Automating data collection and analysis to simplify the audit process.

- Third-Party Risk Management: Assessing the compliance status of vendors and partners.

Benefits of AI-Powered GRC

- Reduced Costs: Automating tasks and improving efficiency lowers operational expenses.

- Improved Accuracy: AI minimizes human errors in data analysis and compliance assessments.

- Proactive Risk Management: Identifying and addressing risks before they materialize.

- Enhanced Agility: Rapidly adapting to regulatory changes and shifting business needs.

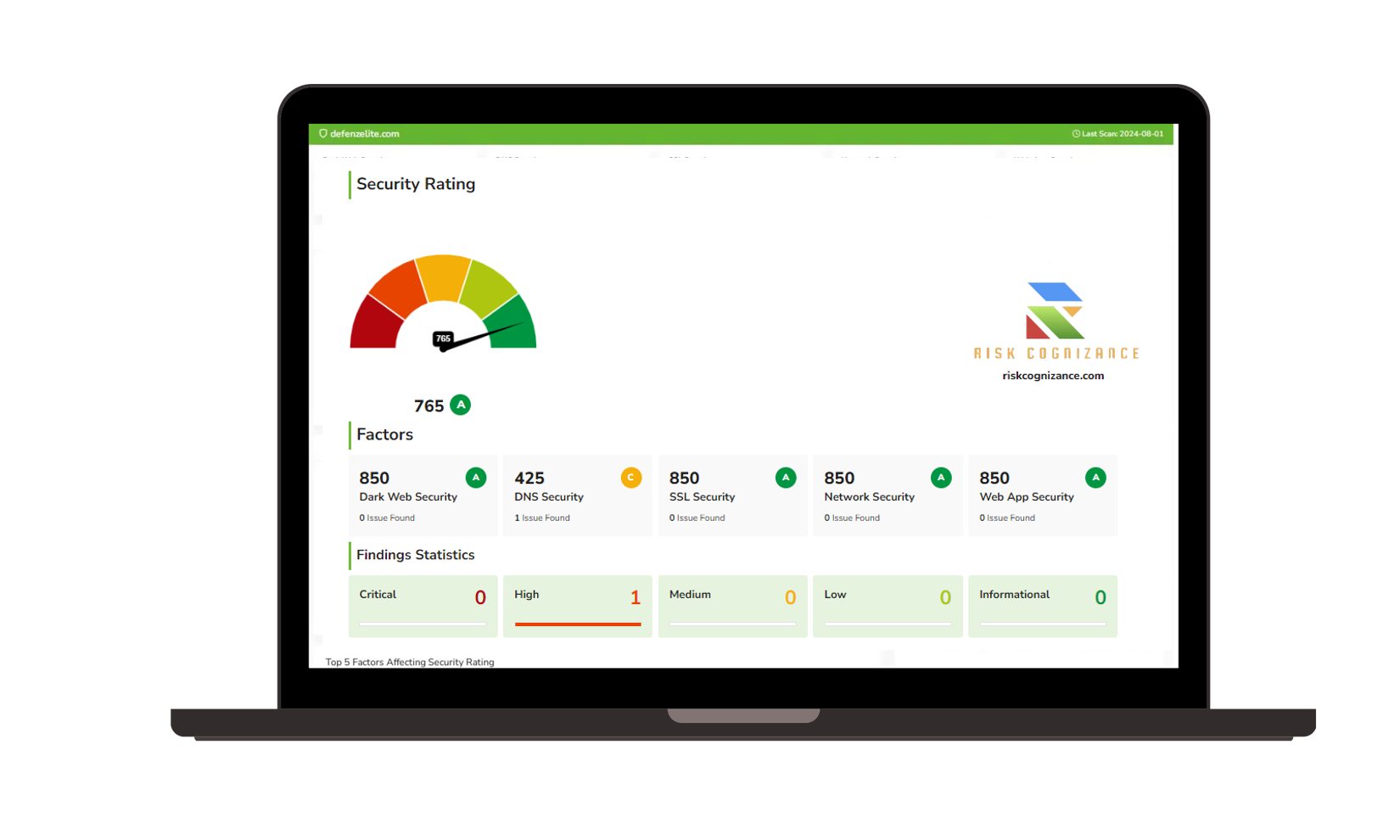

Comprehensive Risk Coverage

Address internal and external risks, including data breaches, supply chain vulnerabilities, and operational disruptions, with a unified approach to cybersecurity risk management.

Advanced AI-Powered Insights

Harness the power of artificial intelligence to identify, prioritize, and mitigate risks faster. Gain actionable insights through data analytics and predictive modeling to enhance decision-making.

Streamlined Compliance

Support for 30+ compliance frameworks, including ISO 27001, NIST CSF, PCI DSS, and GDPR, enables seamless integration with your organization's policies. Crosswalk frameworks effortlessly to ensure compliance continuity.

Scalable for Businesses of All Sizes

Whether you're a startup or a global enterprise, our platform adapts to your needs. Managed Service Providers (MSPs) can easily manage multiple clients, while enterprises benefit from robust scalability.

|  |

|  |

|  |

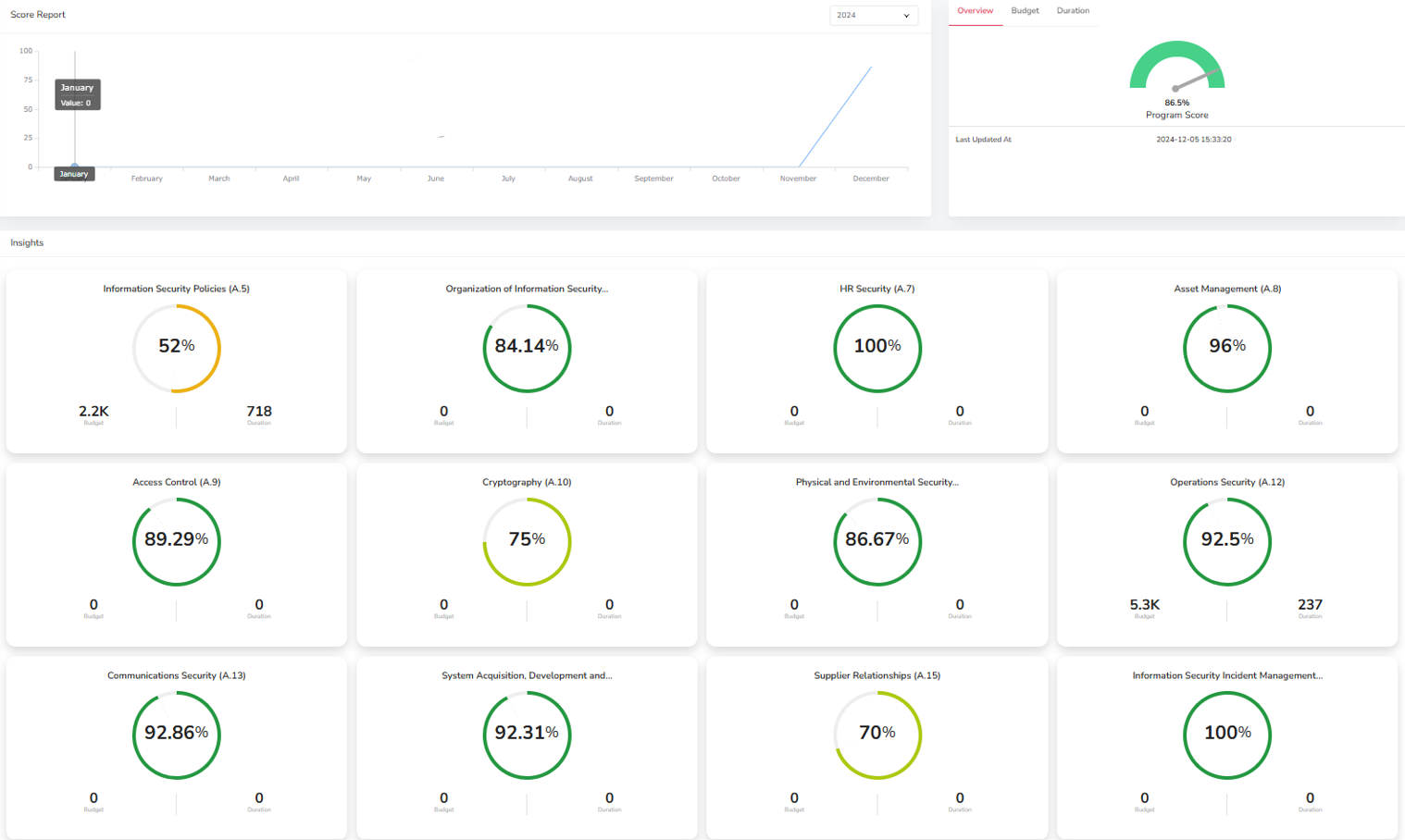

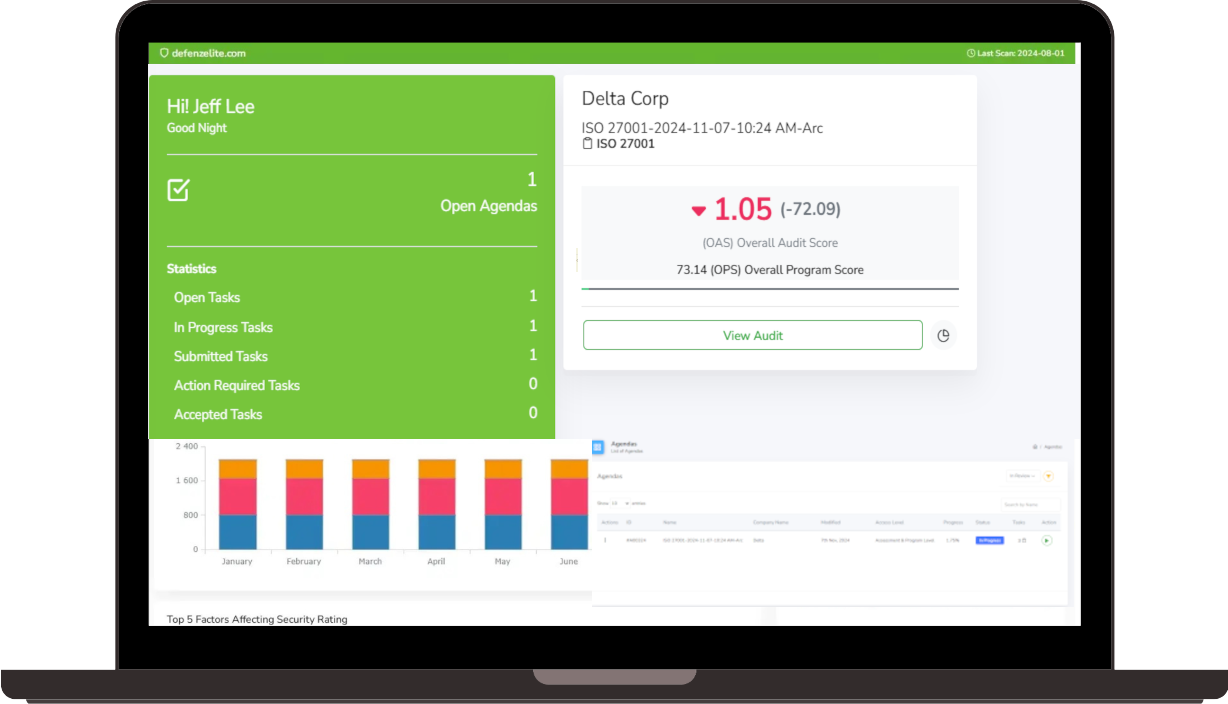

Risk Management Platform Core Features

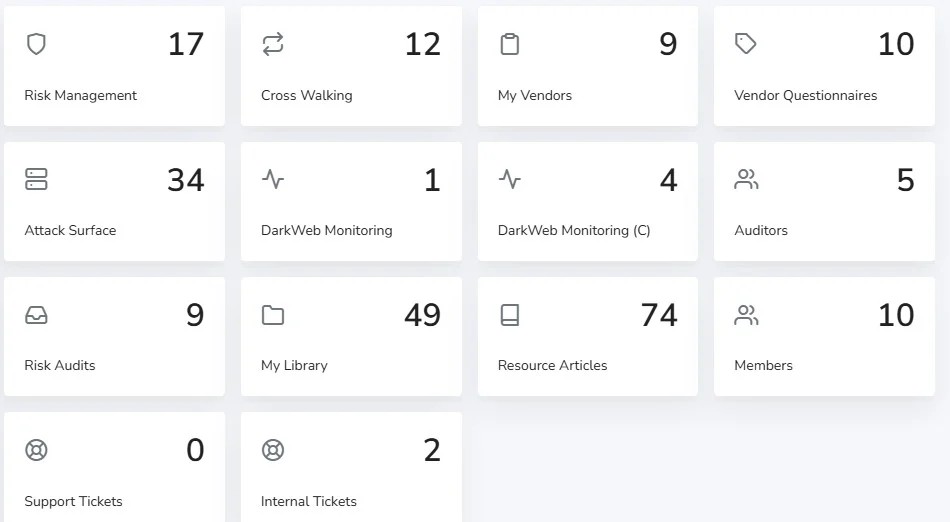

Integrated Risk Management

Centralize risk assessments, mitigation plans, and status tracking in one platform. Achieve full visibility into your organization's risk landscape.

Continuous Monitoring

Automated tools provide real-time updates on emerging threats and vulnerabilities, ensuring you're always prepared.

Vendor Risk Assessments

Simplify third-party risk management with dynamic assessment capabilities and integration into a unified risk register.

Framework Crosswalking

Map controls across multiple compliance frameworks to streamline audits and enhance efficiency.

Dark Web Monitoring

Continuously scan for potential data exposures or credential compromises on the dark web, protecting your organization's reputation and assets.

Customizable Dashboards

Create personalized views to monitor critical metrics, compliance gaps, and risk trends in real time.

Cybersecurity Strategy Key Benefits

Enhanced Decision-Making

Leverage detailed reports and visualizations to support leadership alignment and strategy development.

Cost-Effective Risk Mitigation

Minimize financial losses with a proactive approach to identifying and addressing cyber risks.

Audit and Compliance Readiness

Simplify audit preparations with centralized documentation and automated compliance checks.

Operational Resilience

Ensure business continuity by addressing risks that could disrupt operations or impact customer trust.

Risk, Compliance & Privacy Frameworks

Risk Cognizance's enables cyber risk teams to easily create and define frameworks to fit their specific needs or choose from over a hundred pre-populated integrated risk and compliance frameworks. By mapping shared controls across frameworks, Risk Cognizance allows for a quicker, automated compliance process.

Challenges of AI in GRC

- Data Quality: The accuracy of AI insights is dependent on the quality of the data used to train models.

- Algorithm Bias: Ensuring AI models produce fair, unbiased outcomes.

- Integration Complexity: Difficulty integrating AI-powered tools with existing GRC systems.

AI-driven GRC tools provide significant advantages, but they must be carefully managed to address challenges like data quality and integration. Nonetheless, they hold the potential to revolutionize risk management and compliance in organizations.

Request Callback