Overview

Why Use a Risk Cognizance GRC for Your Managed Security Service Provider (MSSP)?

According to the Cybersecurity Trends Report by Cybersecurity Insiders many organizations rely on a mix of in-house and outsourced IT security to handle the increasing complexity of modern cybersecurity challenges. Managed Security Service Providers (MSSPs) help alleviate pressures such as addressing evolving cyber threats, protecting against data theft, and overcoming skills shortages by providing specialized expertise.

Risk Cognizance GRC framework can significantly enhance the effectiveness of an MSSP by providing comprehensive governance, risk, and compliance management. It helps organizations proactively manage and mitigate risks while ensuring they stay compliant with industry regulations.

By using a Risk Cognizance GRC for your MSSP, you gain:

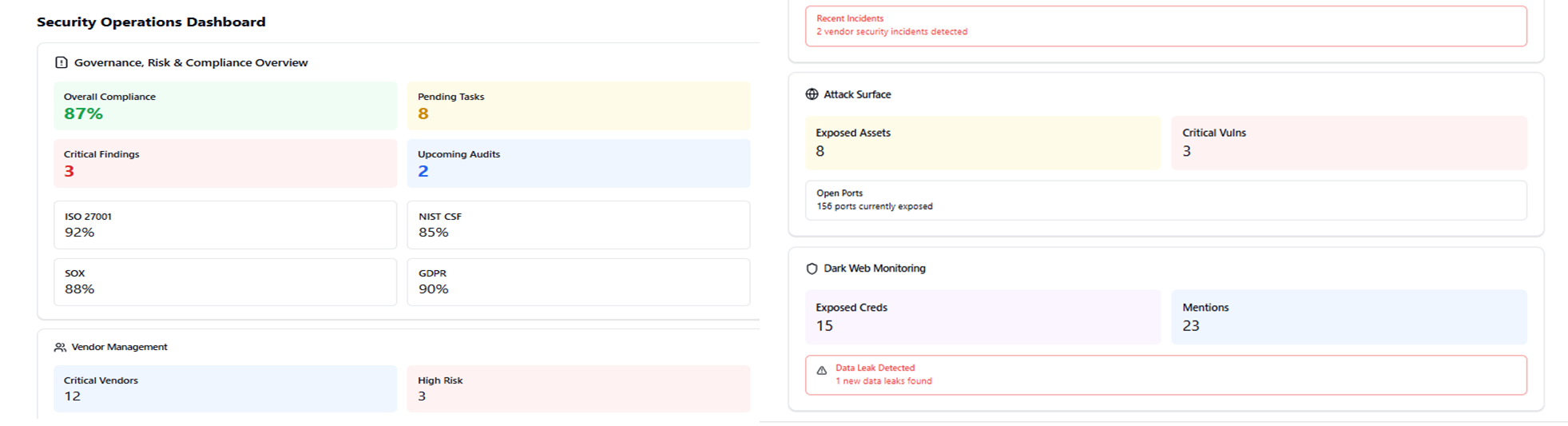

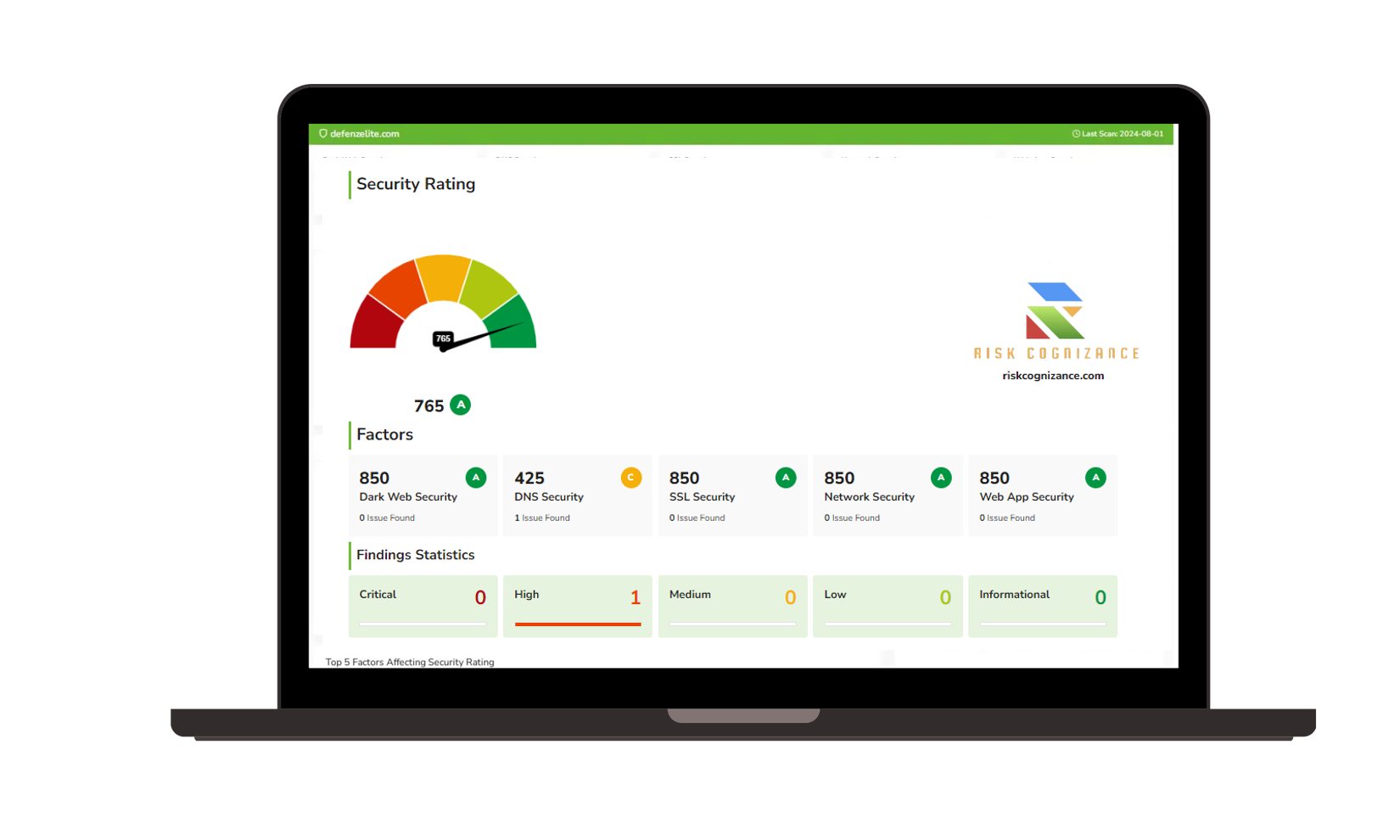

Streamlined Risk Management: Easily track and manage cybersecurity risks, ensuring your MSSP is consistently aligned with your organization's risk appetite. This includes monitoring your entire attack surface—identifying and mitigating vulnerabilities across your network, endpoints, and cloud infrastructure.

Improved Compliance: Ensure your MSSP meets industry standards and regulatory requirements, helping you avoid costly penalties for non-compliance. GRC tools help automate compliance checks in real-time, ensuring your organization's security policies are consistently followed.

Vendor Management: MSSPs often involve third-party vendors for various services. A Risk Cognizance GRC framework provides tools to assess and monitor the security posture of these vendors, ensuring that they meet the necessary security standards and do not pose additional risks to your organization.

Continuous Monitoring: With 24/7 monitoring from the MSSP, GRC tools can help automate compliance checks and risk assessments in real-time, providing better visibility and faster response to potential threats.

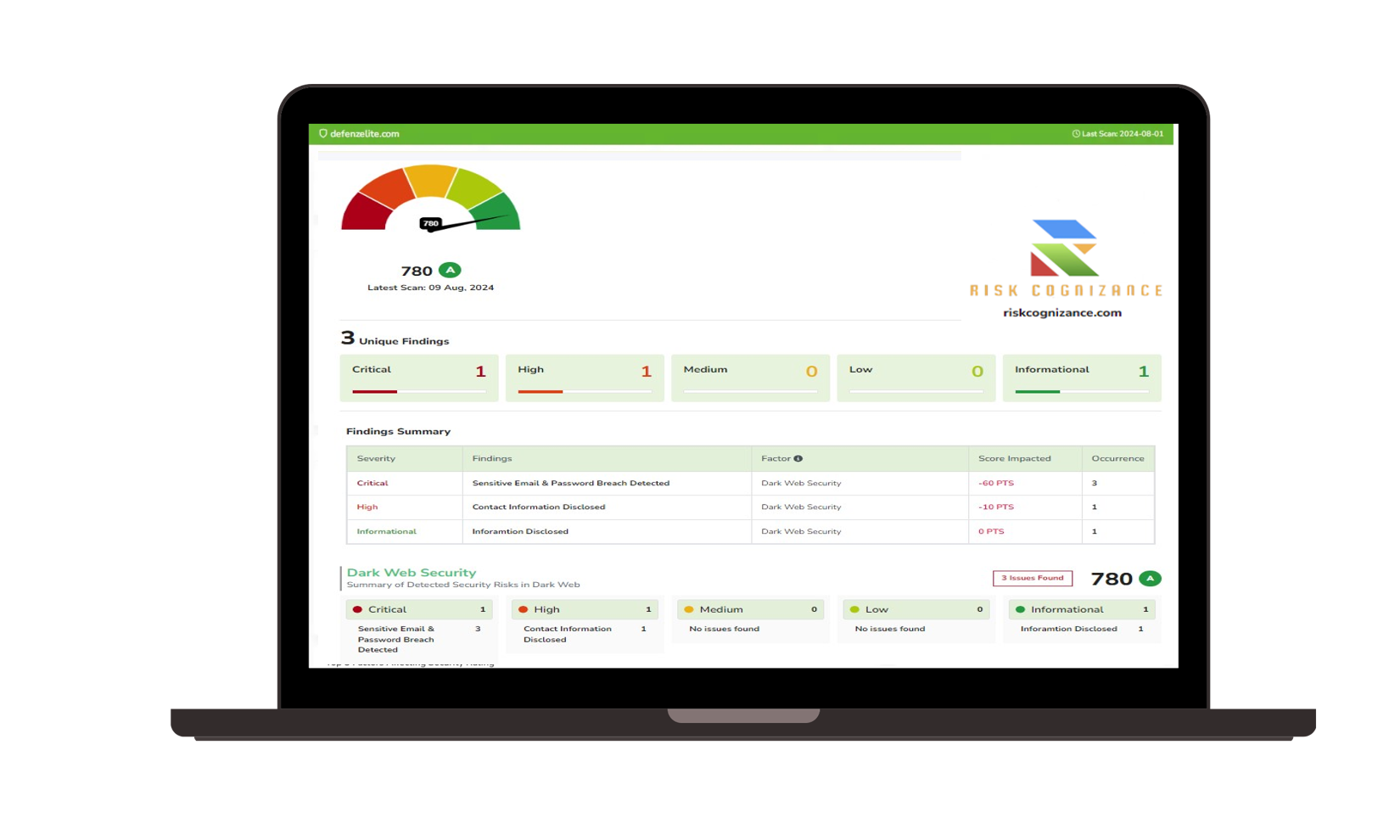

Dark Web Monitoring: Many MSSPs include dark web monitoring to detect if your organization’s sensitive data or credentials are being sold or shared on dark web marketplaces. A GRC framework helps assess and manage risks related to data exposure on these platforms, enabling a proactive approach to mitigating potential security breaches.

Resource Optimization: Fill resource gaps by combining the skills of an MSSP with the strategic oversight and automation offered by a GRC framework, improving operational efficiency.

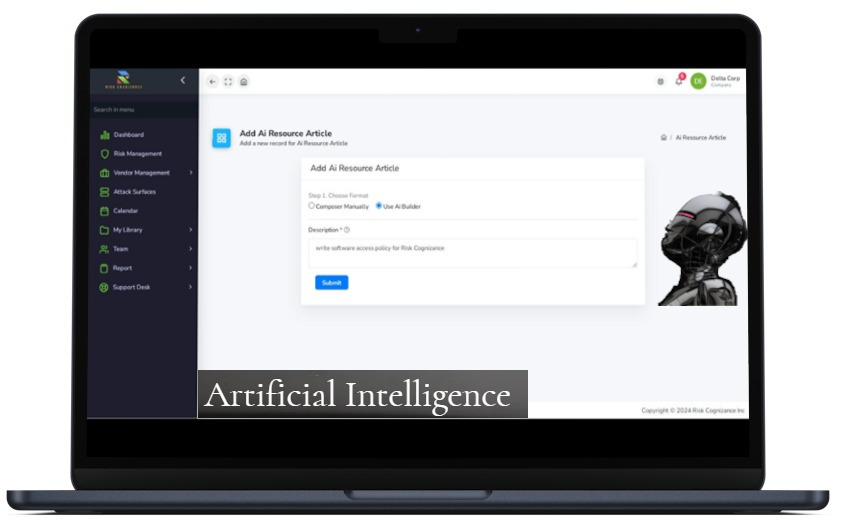

AI & Machine Learning: Transforming Regulatory Compliance

The Risk Cognizance Regulatory Compliance Management Suite combines advanced regulatory change management technology, real-time regulatory intelligence, and comprehensive repositories of critical regulatory data to help enhance and streamline your organization’s compliance framework. The suite’s tools, plugins, and repositories can be used independently for regulatory compliance or seamlessly integrated.

With its unique mapping capabilities and Artificial Intelligence (AI) powered by Natural Language Processing (NLP) technology, Risk Cognizance streamlines the process of regulatory change management (RCM) with enhanced regulatory knowledge, impact assessments, and change management workflows.

How AI and Machine Learning Enhance Regulatory Compliance

Regulatory compliance is essential for businesses, particularly in industries like finance, healthcare, and insurance, where strict regulations safeguard consumer data, ensure transparency, and uphold ethical standards. Failure to comply can result in heavy penalties, reputational damage, and operational setbacks. AI and machine learning are increasingly becoming key tools in enhancing regulatory compliance by automating tasks, improving accuracy, and offering real-time insights. This section examines how these technologies are transforming compliance management.

AI Enable Faster Compliance Management and Detection

The integration of artificial intelligence (AI) into compliance audits has revolutionized the process, offering unparalleled speed and accuracy in data analysis. AI-driven algorithms can quickly sift through vast amounts of data, identifying trends, spotting anomalies, and immediately flagging potential compliance violations. By automating routine tasks and data analysis, AI allows auditors to focus on higher-level risk assessments and strategic decision-making.

One of the key advantages of AI in compliance assessments is its ability to learn from data, continuously improving performance while reducing false positives. Machine learning algorithms can detect subtle changes in regulatory requirements, helping organizations stay ahead of compliance issues. Additionally, AI-powered insights provide actionable intelligence, enabling businesses to manage risks more effectively and address compliance challenges proactively.

AI is transforming Governance, Risk, and Compliance (GRC) by making processes more efficient, proactive, and data-driven. Here's how AI enhances GRC:

Automation: AI automates repetitive tasks like data entry, monitoring, and reporting, freeing up human resources for more strategic activities.

Risk Prediction: AI analyzes data to identify and predict risks (e.g., fraud, cybersecurity threats) before they occur, helping organizations take preventive actions.

Better Decision-Making: AI provides data-driven insights that improve decision-making, helping leaders choose the best risk mitigation or compliance strategies.

Continuous Compliance Monitoring: AI helps monitor regulatory changes in real-time, ensuring organizations stay compliant with evolving laws.

Advanced Analytics & Reporting: AI processes large data sets to spot trends, detect risks, and generate detailed reports for better governance.

Fraud Detection: AI detects suspicious activities like fraudulent transactions, allowing for quick intervention.

Ongoing Audits: AI enables continuous monitoring and alerts for compliance violations, reducing the need for periodic audits.

Enhanced Cybersecurity: AI helps detect and prevent cyber threats by analyzing patterns in network behavior, protecting sensitive data.

External Data Integration: AI gathers and analyzes external data (e.g., market trends, news) for a more comprehensive risk view.

Personalized Risk Management: AI tailors risk management strategies to an organization’s specific needs, enhancing their effectiveness.

In summary, AI streamlines GRC processes, improves risk management, ensures compliance, and helps organizations stay ahead of challenges.

GRC Automation of Compliance Processes

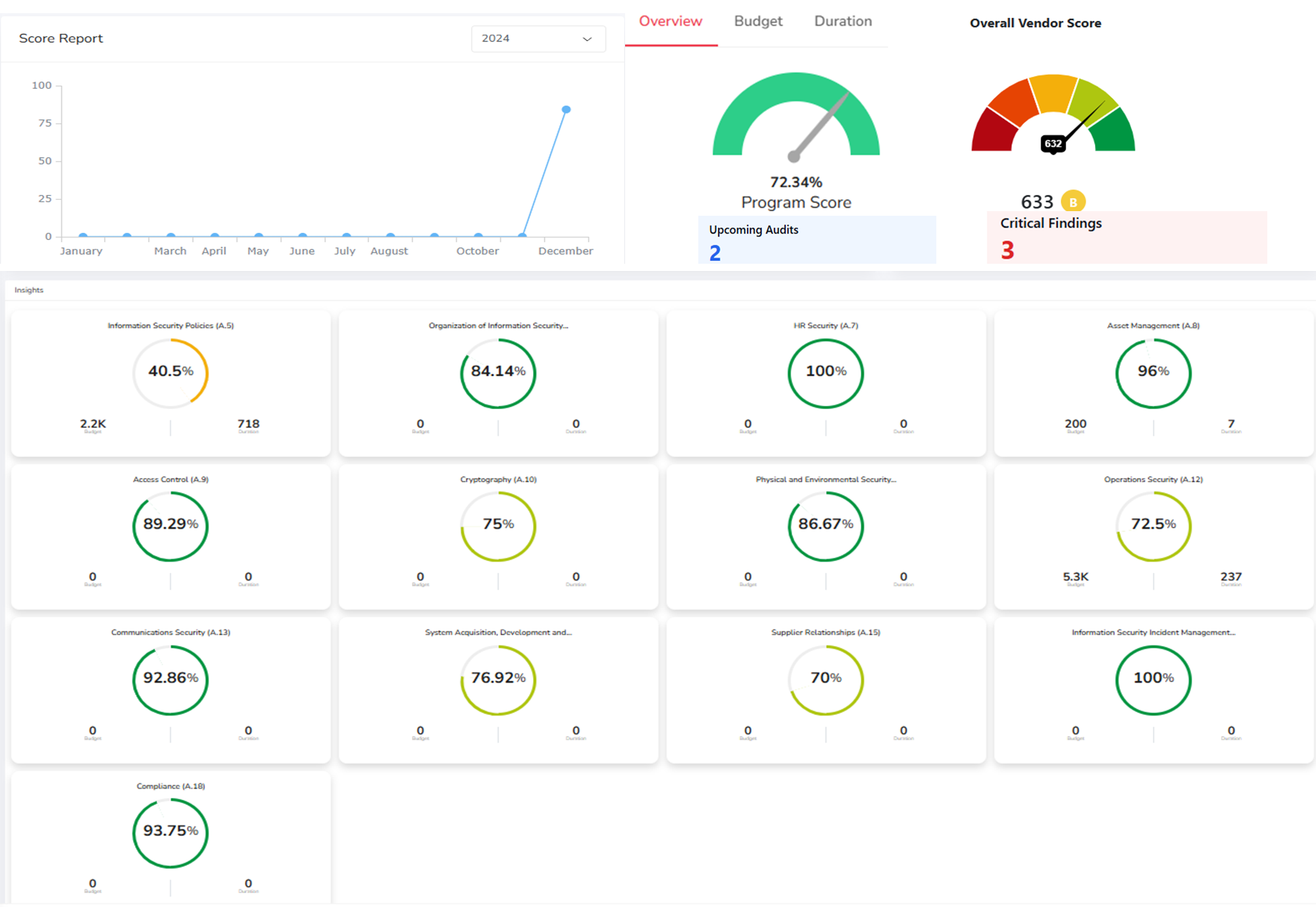

Our platform automates evidence collection, continuous monitoring, and policy management, ensuring compliance with a wide range of frameworks, including SOC 1, SOC 2, HIPAA, GDPR, PCI DSS, ISO 27001, ISO 27701, ISO 27017, ISO 27018, ISO 9001, ISO 13485, NIST CSF, NIST 800-53, NIST 800-171, FedRAMP, CCPA, CMMC, SOX ITGC, Australian ISM, and ACSC’s Essential Eight, among others.

Risk Cognizance offers a comprehensive suite that includes Risk Management using FAIR and NIST-based qualitative methods, Vulnerability Assessments, Pen Testing, Trust Center, and an AI-based Automated Questionnaire Response product to streamline security processes and reduce costs. Our team provides tailored guidance throughout the compliance journey, while Risk Cognizance Academy offers concise video courses on key security and compliance topics for fast-growing companies.

Our solution delivers significant time and cost savings, including discounted audit fees, enabling organizations to achieve compliance quickly and affordably. As businesses grow, they can continuously maintain compliance and become certified under multiple frameworks, all through a single automated platform.

Simplify compliance with a built-in framework crosswalking feature that maps requirements from multiple standards (such as NIST, ISO, and GDPR) to ensure comprehensive coverage.

Interconnected Compliance & Risk - GRC AI Risk Management

AI-powered GRC (Governance, Risk, and Compliance) tools with multitenancy capability offer a scalable solution that allows multiple organizations to manage their compliance needs within a single platform. By leveraging AI automation, these tools streamline risk assessments, regulatory reporting, and compliance management across diverse business units, enabling real-time monitoring, automated workflows, and actionable insights. The multitenancy architecture ensures that each tenant has its own secure, isolated environment while benefiting from shared platform resources, making it an efficient, cost-effective solution for enterprises managing multiple clients or subsidiaries with varying compliance requirements.

GRC Compliance and Cybersecurity Oversight

While a GRC platform provides a framework for comprehensive risk and compliance management, an MSSP enhances cybersecurity by actively managing and mitigating threats.

|  |

|  |

|  |

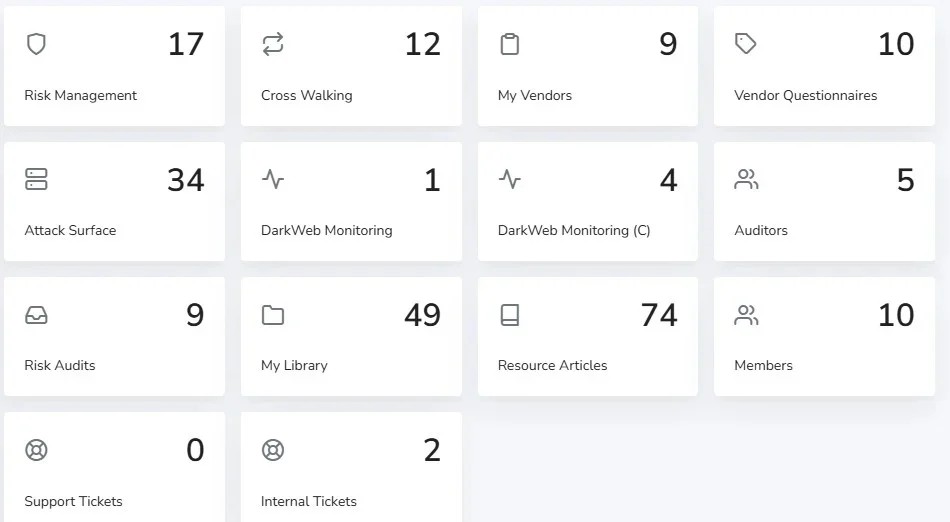

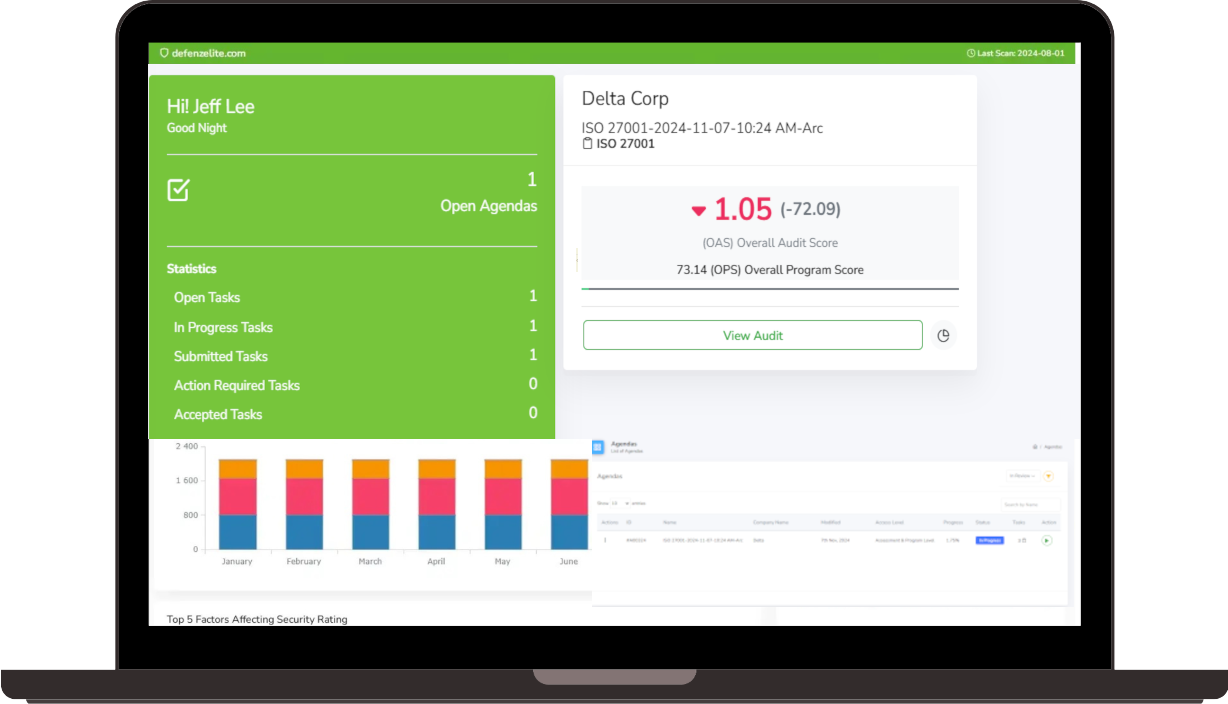

MSSP Partner Regulatory Compliance Dashboard

Our Managed Service Provider Partnership Program offers a comprehensive compliance solution and white-label support services are purpose-built for MSPs to streamline the compliance process and drive revenue

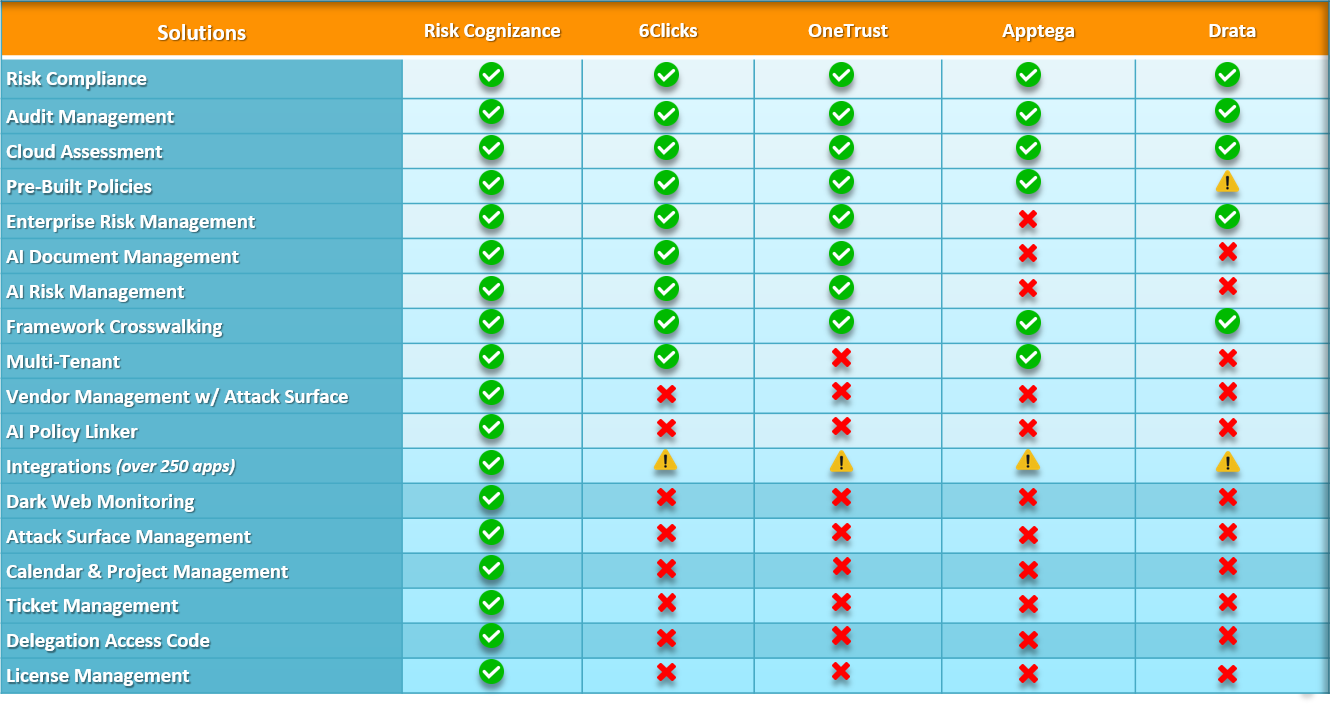

Why Choose Risk Cognizance?

Risk Cognizance GRC Platform: AI-Powered Governance, Risk, and Compliance Solutions

The Risk Cognizance GRC Platform is an advanced, AI-powered tool designed to support consultants and service providers in delivering state-of-the-art Governance, Risk, and Compliance (GRC) solutions to their clients. By harnessing the power of artificial intelligence, the platform enhances decision-making, streamlines compliance processes, and fosters a proactive approach to risk management and mitigation. With AI integration, it ensures businesses stay agile and compliant, even in the face of evolving regulatory landscapes.

AI-Powered Risk Management

The Risk Cognizance platform utilizes AI to automate and optimize the entire risk management process. By leveraging AI-driven analytics, consultants can conduct comprehensive risk assessments, identify vulnerabilities, and create precise, targeted mitigation strategies. The platform’s real-time monitoring feature keeps users informed of emerging threats, empowering them to make proactive, data-driven decisions that reduce risk exposure and enhance organizational resilience.

AI-Driven Compliance Tracking

With Risk Cognizance, compliance management becomes more efficient through AI-powered tracking tools that automate the monitoring of compliance statuses. The platform flags potential non-compliance risks, generates automated reports, and ensures that all regulatory requirements are consistently met. This AI-driven automation reduces manual effort, improves accuracy, and allows consultants to deliver faster, more effective services to their clients, ensuring continuous compliance with changing regulations.

Regulatory Intelligence

The regulatory landscape is constantly evolving, with new frameworks and updates emerging across the globe. For example, the introduction of the European Union’s GDPR set a new standard for data privacy, prompting countries worldwide to adopt similar laws. To navigate this complex environment, organizations need to stay informed about the latest regulatory developments across various jurisdictions.

Risk Cognizance’s AI-driven regulatory intelligence tools continuously track and analyze changes in regulations, providing real-time insights into new legal requirements and their potential impact. By using these tools, businesses can stay ahead of regulatory shifts, avoid penalties, and ensure compliance in a fast-paced, ever-changing legal environment. This proactive approach helps organizations mitigate risks before they become compliance challenges.

- Comprehensive: A fully integrated platform covering everything from compliance management to AI-powered risk analysis.

- Scalable: Ideal for organizations of any size, with multi-tenant capabilities to support MSSPs and large enterprises.

- AI-Driven: Leverage artificial intelligence to automate processes, identify risks, and make real-time decisions.

- Secure: Built with cutting-edge security features like dark web monitoring and attack surface management to protect against evolving cyber threats.

- Efficient: Streamline risk management, compliance reporting, and audit processes with powerful automation and integration capabilities.

Ready to Simplify Risk & Compliance Management?

Transform how your organization approaches compliance and risk management with Risk Cognizance. Schedule a demo today and see how our platform can help you navigate the complexities of modern risk management.

Request Callback