GRC & Third Parties: Building a Holistic Approach to Managing Risk

Managing risk extends beyond internal operations to encompass third-party relationships. A solid Governance, Risk, and Compliance (GRC) strategy must address the challenges and complexities posed by external vendors, suppliers, and contractors. By adopting a holistic approach, organizations can ensure a comprehensive view of their risk landscape and enhance compliance efforts, ensuring both internal and external stakeholders remain protected.

At the core of building this holistic approach lies the power of AI and automation. With Risk Cognizance's user-friendly, AI-powered compliance solutions, businesses can integrate automated processes that simplify monitoring, auditing, and managing third-party risks with ease. Risk Cognizance’s platform is not just intuitive but also tailored to adapt to each organization’s unique risk management needs. Through real-time data processing and seamless integration, organizations can build stronger, more resilient compliance frameworks that extend across all levels of their operation.

Embracing AI in Risk Management

AI automation has transformed the way businesses approach risk management, making it more efficient, proactive, and data-driven. Risk Cognizance leverages cutting-edge AI technology to provide automated compliance monitoring, streamlining the process of identifying and mitigating risks. Through real-time data insights and predictive analytics, businesses gain a deeper understanding of potential risks and are empowered to take swift action, reducing vulnerabilities and ensuring ongoing compliance.

Whether assessing risk associated with new third-party relationships or ongoing vendor management, Risk Cognizance simplifies these processes with intelligent automation that continuously monitors and alerts stakeholders to any irregularities or emerging risks.

Frameworks Supporting Effective Third-Party Risk Management

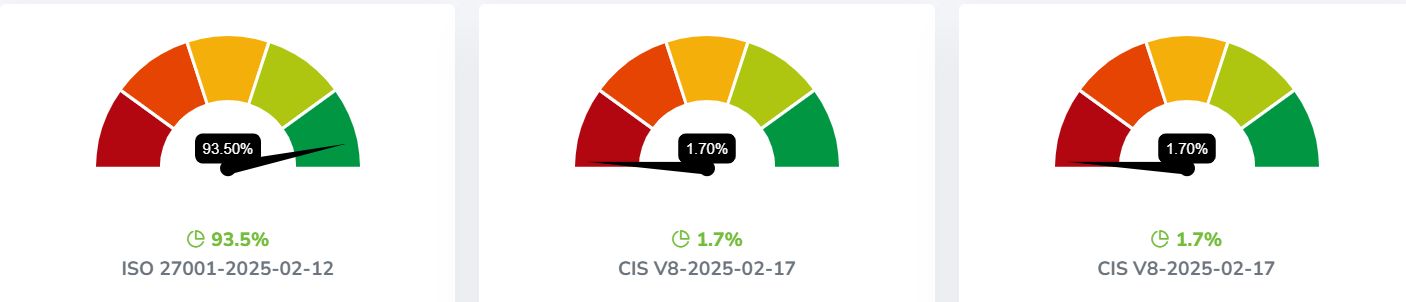

Risk Cognizance uses robust frameworks to support organizations in navigating the complexities of third-party risk management. The platform provides tools and techniques that adhere to internationally recognized compliance standards such as ISO 27001, NIST 800-53, and CIS L1. By aligning these frameworks with AI-driven solutions, businesses ensure that their GRC processes are both standardized and adaptable to evolving threats.

With Risk Cognizance, the power of automation integrates seamlessly with these frameworks, enabling organizations to manage and mitigate third-party risks without manual intervention. These frameworks not only enhance compliance but also provide peace of mind, ensuring that both internal and external parties adhere to the same stringent security protocols.

Use Cases for Third-Party Risk Management

1. Vendor Selection and Risk Assessment

When selecting a third-party vendor, organizations must assess not only the cost and benefits but also potential risks associated with that vendor. With Risk Cognizance’s automated solution, businesses can conduct thorough risk assessments using real-time data analysis and AI-powered risk detection. This ensures that vendors meet compliance requirements and pose minimal risks to operations.

Third-party risk doesn't stop at selection; continuous monitoring is essential to ensure vendors continue to comply with the organization's security standards. Risk Cognizance automates vendor monitoring processes, tracking compliance and identifying potential vulnerabilities as they arise. Organizations can stay ahead of risks without the need for constant manual oversight.

3. Incident Response and Compliance Alignment

In the event of a security breach or non-compliance incident involving a third party, Risk Cognizance's AI-powered compliance system offers a streamlined response. The platform provides organizations with immediate insights into the situation, identifying the root cause and offering steps for remediation in real-time. This ensures that businesses can swiftly mitigate any risk to their operations and maintain compliance with regulatory requirements.

Case Studies

Case Study 1: Large-Scale Healthcare Provider

A major healthcare provider with numerous third-party vendors turned to Risk Cognizance to manage its complex GRC requirements. The organization needed to ensure that all vendors adhered to strict compliance standards while minimizing risk exposure. With Risk Cognizance’s AI-powered platform, the healthcare provider automated its third-party risk assessment and ongoing monitoring processes. As a result, they were able to significantly reduce compliance breaches, enhance vendor management, and gain a comprehensive view of third-party risks in real-time.

Case Study 2: Global Financial Institution

A global financial institution required a robust GRC solution to manage its third-party relationships, which spanned multiple regions and involved a wide variety of risk factors. Risk Cognizance helped the institution build a centralized compliance framework that not only managed third-party risk but also ensured consistent security and regulatory compliance across all partners. The integration of AI automation enabled the institution to proactively identify risks, implement controls, and ensure compliance, thereby strengthening its security posture and reducing the risk of costly penalties.

The Future of GRC and Third-Party Risk Management

The future of GRC is automated, integrated, and intelligent. With the continued advancement of AI and machine learning, businesses can expect even more sophisticated tools for managing third-party risks. Risk Cognizance’s AI-driven platform is paving the way for organizations to build a more resilient and adaptive approach to third-party risk management, ensuring businesses can stay ahead of the curve in an ever-evolving risk landscape.

.jpeg)