GRC Solutions: Revenue Growth, Risk Cognizance, and Benefits

Governance, risk, and compliance (GRC) software is becoming increasingly vital for organizations seeking to navigate a complex regulatory landscape and mitigate risks effectively. As GRC landscape continues to evolve, organizations must prioritize effective governance, risk management, and compliance strategies to thrive in an increasingly complex environment.

GRC Solutions Revenue Projections

The GRC market has demonstrated robust growth in recent years, with a year-over-year increase of 8.2%. This growth is largely attributed to organizations' rising need for comprehensive GRC solutions that can streamline processes and enhance compliance efforts. As businesses face mounting pressures to adhere to regulations and manage various risks, investments in GRC technology are expected to surge.

IDC forecasts that global GRC revenues will increase from $11.3 billion in 2020 to nearly $15.2 billion by 2025. This trend reflects the ongoing transformation within the GRC landscape, where companies are increasingly prioritizing risk management and compliance as part of their core strategies.

Market Dynamics

The need for effective GRC strategies is more pressing than ever as organizations navigate a myriad of challenges, including evolving regulatory requirements, increased scrutiny from stakeholders, and a rapidly changing risk environment. Corporate boards are also feeling the heat, as investors and consumers demand greater accountability regarding environmental, social, and governance (ESG) issues.

Organizations must therefore develop integrated GRC frameworks that not only address compliance and risk management but also align with broader business goals. This approach enables companies to respond swiftly to changes in the regulatory landscape and internal risk factors, ultimately supporting long-term sustainability.

Why Risk Cognizance Matters

Risk cognizance refers to the awareness and understanding of the risks that an organization faces. It involves recognizing potential threats, assessing their impact, and formulating strategies to mitigate them. This proactive approach is essential for effective governance and compliance.

Enhanced Decision-Making: When organizations have a clear understanding of their risk profile, they can make informed decisions that align with their risk appetite and business objectives.

Strategic Planning: Risk cognizance enables organizations to plan strategically, allowing them to allocate resources effectively and anticipate potential challenges before they arise.

Crisis Management: Organizations that prioritize risk cognizance are better equipped to respond to crises, minimizing the impact on operations and reputation.

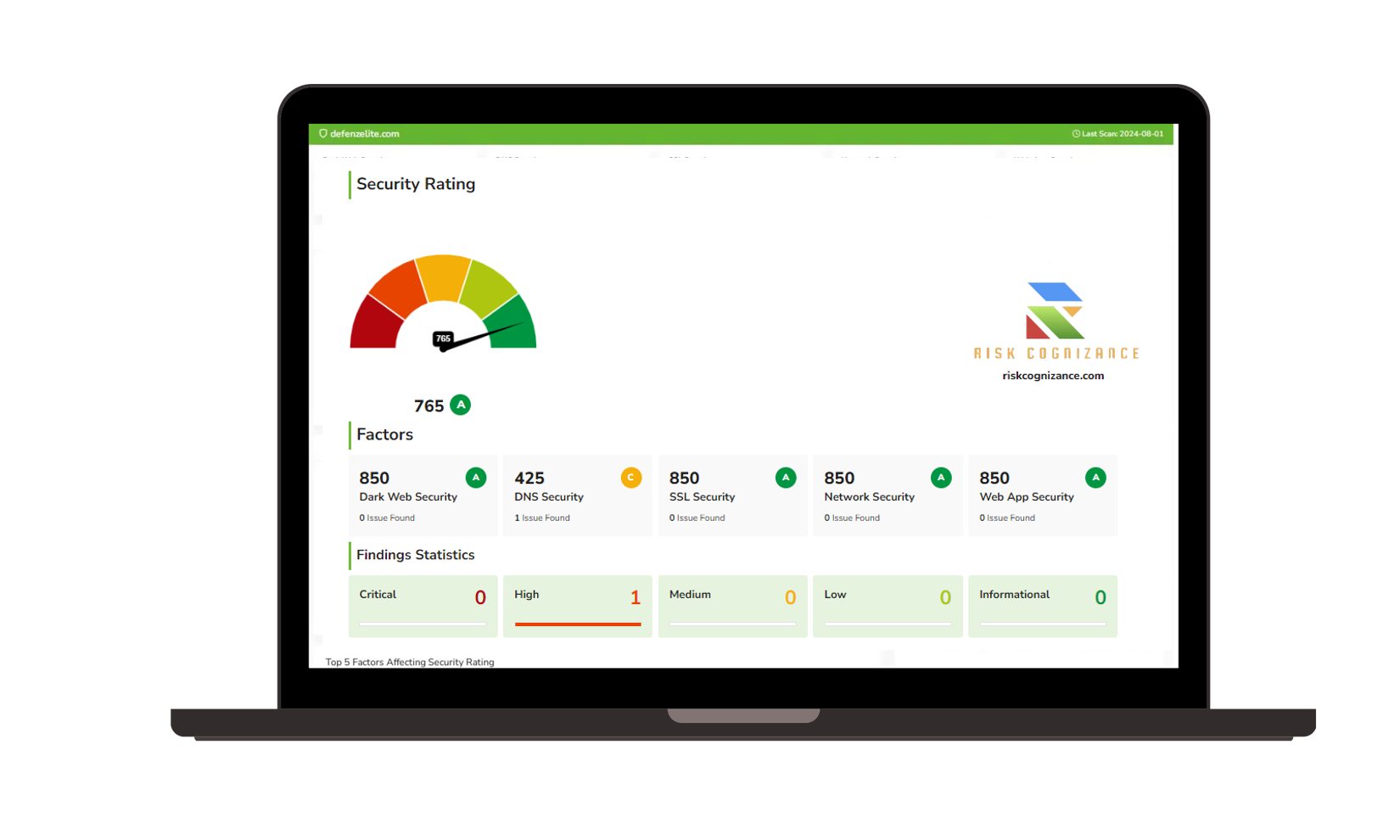

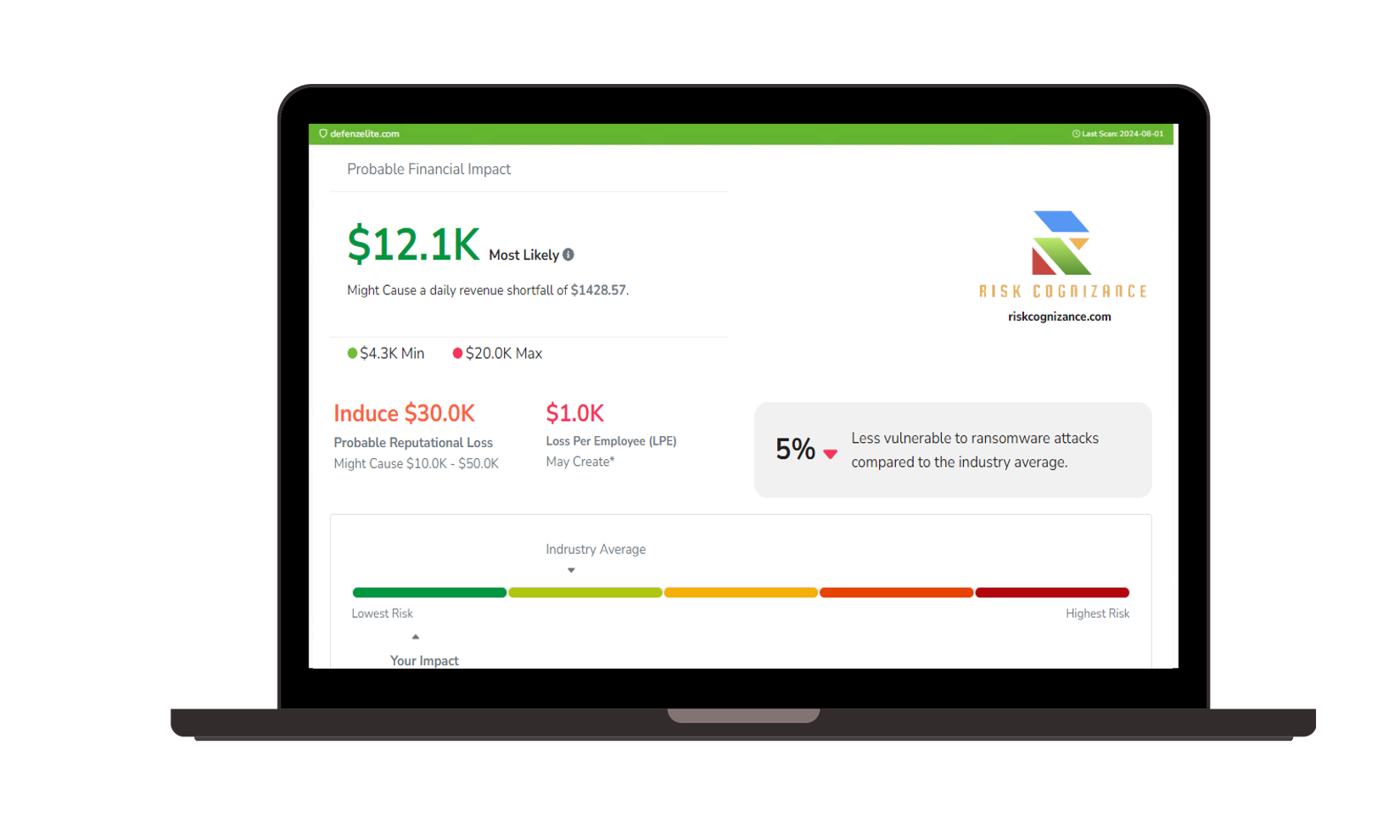

Governance, Risk, and Compliance (GRC) |  Third-party Risk Management |

Ransomware Susceptibility |  GRC and Attack Surface |

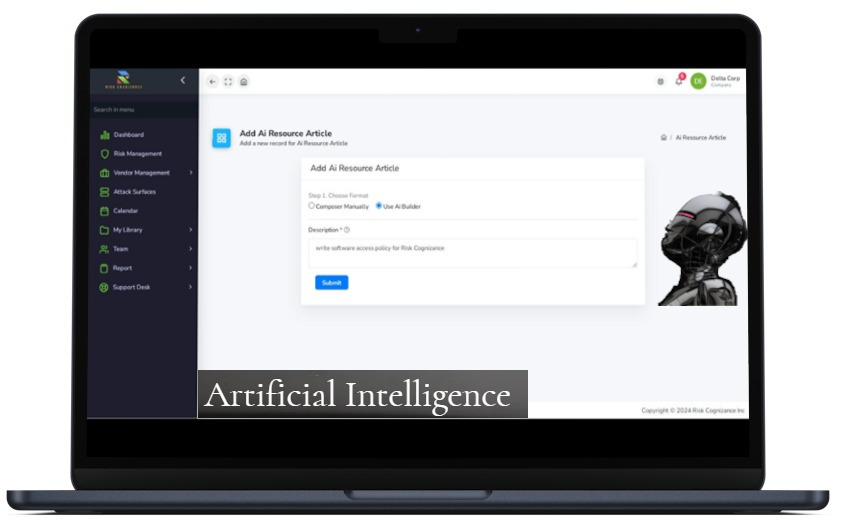

Artificial Intelligence | |

Benefits of Risk Cognizance

Informed Decision-Making: Organizations that are aware of their risks can make strategic decisions that align with their risk appetite and business objectives.

Enhanced Compliance: Understanding regulatory requirements helps organizations stay compliant, reducing the likelihood of legal issues and penalties.

Improved Resilience: With a solid grasp of potential risks, organizations can implement measures that enhance their resilience and ability to recover from disruptions.

Increased Stakeholder Trust: Demonstrating a commitment to risk management fosters trust among stakeholders, including investors, customers, and employees.

Revenue Growth Across GRC Categories

All categories of GRC solutions are expected to see revenue increases, with particularly strong growth anticipated in business continuity and ESG sectors. The demand for compliance and risk management solutions is also on the rise, along with emerging areas such as privacy, third-party risk management, and environmental health and safety.

Companies are increasingly recognizing that effective GRC solutions not only help with compliance but also serve as a competitive advantage in today’s market. As organizations seek to automate and streamline their governance, risk, and compliance functions, GRC providers are likely to see significant demand for their services.

Survey Insights

A recent survey of GRC users revealed that nearly two-thirds of organizations utilize multiple GRC solutions, with some employing five or more. However, organizations with a higher number of solutions often face integration challenges. This indicates that substantial investments in GRC may not always translate into efficient implementation.

Key Findings

- IT and Security Risk Management: This remains the most widely adopted GRC solution, followed by data privacy management and corporate social responsibility tools.

- Increased Spending: Many organizations plan to increase GRC spending in the coming years, with IT and security risk management identified as the top area for future investment.

- Integration Challenges: There is a strong desire among companies for more integrated GRC solutions, but opinions are divided regarding the preference for custom versus standardized offerings. Siloed solutions are generally viewed as unfavorable.

- Deployment Preferences: Approximately one-third of respondents still require on-premises GRC deployments, while half expect a rise in cloud-based solutions in the near future.

Frequently Asked Questions (FAQ)

- Q: What is GRC?

A: GRC stands for governance, risk, and compliance. It refers to the integrated approach organizations take to align their governance frameworks, manage risks, and adhere to regulatory requirements. - Q: Why is risk cognizance important?

A: Risk cognizance helps organizations identify potential threats, assess their impacts, and develop strategies to mitigate them, leading to better decision-making and increased resilience. - Q: What are the main benefits of implementing GRC solutions?

A: Key benefits include enhanced compliance, improved risk management, better decision-making, increased operational efficiency, and greater stakeholder trust. - Q: How can organizations improve their GRC integration?

A: Organizations can enhance GRC integration by standardizing processes, leveraging technology for better data sharing, and fostering a culture of collaboration among departments. - Q: What trends are driving growth in the GRC market?

A: Key trends include increasing regulatory pressures, a focus on ESG practices, the rise of data privacy concerns, and the need for robust risk management strategies in a complex business environment.

Conclusion

As the GRC landscape continues to evolve, organizations must prioritize effective governance, risk management, and compliance strategies to thrive in an increasingly complex environment. By fostering risk cognizance and investing in comprehensive GRC solutions, businesses can not only meet regulatory demands but also enhance their overall resilience and strategic agility. The future of GRC is bright, and organizations that adapt to these changes will be well-positioned for success.